Written by: kkk

On August 28, the U.S. Commodity Futures Trading Commission (CFTC) announced a significant announcement: the Foreign Exchange Trading Committee (FBOT) consultation provides necessary regulatory clarity for legitimate onshore trading activities. This means that overseas exchanges, long blocked from the U.S. market, now have a legal path to return.

Over the past few years, giants like Binance and Bybit have been forced to restrict US users or even withdraw from the market due to regulatory pressure. Countless US traders have been trapped on local platforms with limited product availability or resorted to risky overseas trading platforms. Now, the CFTC has clarified that by registering with the FBOT, these platforms can now serve Americans without becoming a Direct Commercial Commercial Exchange (DCM).

Acting Chairwoman Caroline D. Pham even stated in a statement that this was intended to "bring back trading activities that have been driven out of the United States." Against the backdrop of the Trump administration's "Crypto Sprint," this document serves as a clarion call, signaling a radical shift in US regulatory direction.

Why now?

Over the past few years, the US's approach to the crypto industry has been largely law enforcement-driven. During the Biden administration, former SEC Chairman Gary Gensler championed the "regulate and punish" policy, targeting everyone from Binance to numerous other projects. In 2023, Binance was fined $4.3 billion and forced to withdraw from the US market, a development that resonated deeply with the entire industry.

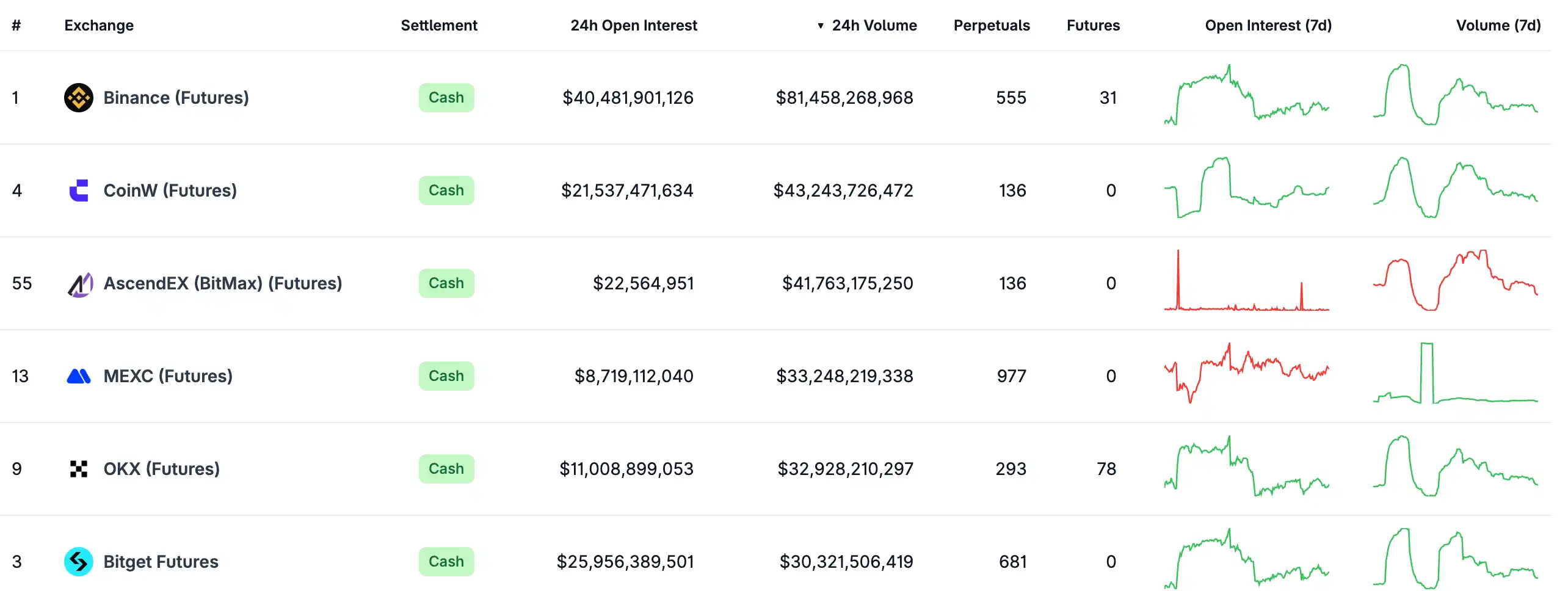

The US lost not just a few exchanges but an entire market: local users were forced to flee overseas, and with them, capital. While overseas platforms firmly held the top spot in the derivatives market, with Binance, OKX, and Bitget boasting daily trading volumes exceeding tens of billions, US exchanges were relegated to a secondary position. Coinbase's daily derivatives trading volume was a mere $6 billion. This lag was driven by the former SEC's restrictions on perpetual futures trading, staking, and leverage. Meanwhile, Singapore, Hong Kong, and the European Union were rapidly introducing more flexible frameworks, eroding the US's original "regulatory advantage."

It's for this reason that the CFTC's move is particularly timely. In early August, the CFTC had just launched its "Crypto Sprint" initiative and publicly solicited feedback on whether spot crypto assets could be listed on registered exchanges (DCMs). Within a few weeks, the regulator received a flood of inquiries regarding how foreign exchanges could return to the US. Pressure from public opinion and industry feedback forced the CFTC to provide a clear answer.

The acceptance of overseas exchanges represents both a correction to the "overregulation" of the past few years and a starting point for the United States to regain global market share. Against the backdrop of the "crypto sprint," this guidance is more than just a procedural clarification; it serves as an invitation: American traders deserve to be in the same pool as global users, enjoying the deepest liquidity and the most diverse product offerings.

The new landscape of compliance: return, expansion, and competition

The most direct significance of the CFTC's FBOT advisory is that it draws American traders back into the core pool of global markets. In the past, domestic exchanges, constrained by regulatory constraints, had limited product offerings and liquidity, forcing many users to either accept a mediocre experience or risk navigating overseas platforms. Now, with a clearer path to compliance, American traders can finally enjoy the same deepest liquidity and broadest product offerings as their Asian and European counterparts. This not only improves market efficiency but also signifies that the United States is once again integrated into the global financial arena. Some even predict that this could boost liquidity for Bitcoin and Ethereum in the coming months.

For overseas exchanges long barred from the market, this is a long-awaited "pass." Giants like Binance, Bybit, and OKX, which previously cut off US users due to compliance pressure, now have a legitimate path back. The US market's vast user base and voracious trading demand have long been coveted by these platforms, and the FBOT registration framework undoubtedly provides them with the key to legal expansion. For them, this represents new growth opportunities; for users, it means more competitors entering the market, leading to lower fees, better products, and services.

The significance of this consultation also lies in creating a more level playing field for domestic exchanges. For the past few years, the US crypto market has been largely dominated by a few domestic platforms. Now, with the opening of the FBOT registration path, overseas giants finally have a legal and compliant way to return. This means that the market is no longer the preserve of a few domestic exchanges, but has entered a stage of true multi-party competition. The entry of more competitors will bring more intense price competition, faster product iterations, and higher service standards. For US investors, this is a rare benefit: they no longer have to endure "passive selection" and can now enjoy the liquidity and innovation provided by top global platforms in a more open and fair market.

Summarize

This guidance not only clarifies procedures but also repairs the image of US regulation. Over the past few years, the US has left the market with a reputation for being "rigid and punitive," with vague policies and frequent enforcement, forcing a wave of capital and project owners to flee. Now, the CFTC has demonstrated its willingness to listen to feedback and promptly correct course. This not only corrects excessive regulation but also signals to the global market that the US is transitioning to an era of transparent, open, and rule-based regulation. Once this signal is received by the market, it will undoubtedly rebuild investor and developer confidence and attract capital and innovation back to the US. This is the true essence of the "Crypto Sprint"—not just slogans, but concrete institutional action.