Not only are star projects leading the market, but more structural compensatory gains are spreading across sectors, forming a "multi-point blossoming" market.

Written by BitpushNews

Over the past week, the crypto market's "heat map" has been quietly redrawn. Amidst Bitcoin's price volatility, capital has quietly accelerated into altcoins—from mainstream narratives to niche sectors, multiple sectors have seen unexpected gains. Data shows that not only are star projects leading the gains, but more structural compensatory gains are spreading across sectors, creating a multi-faceted market.

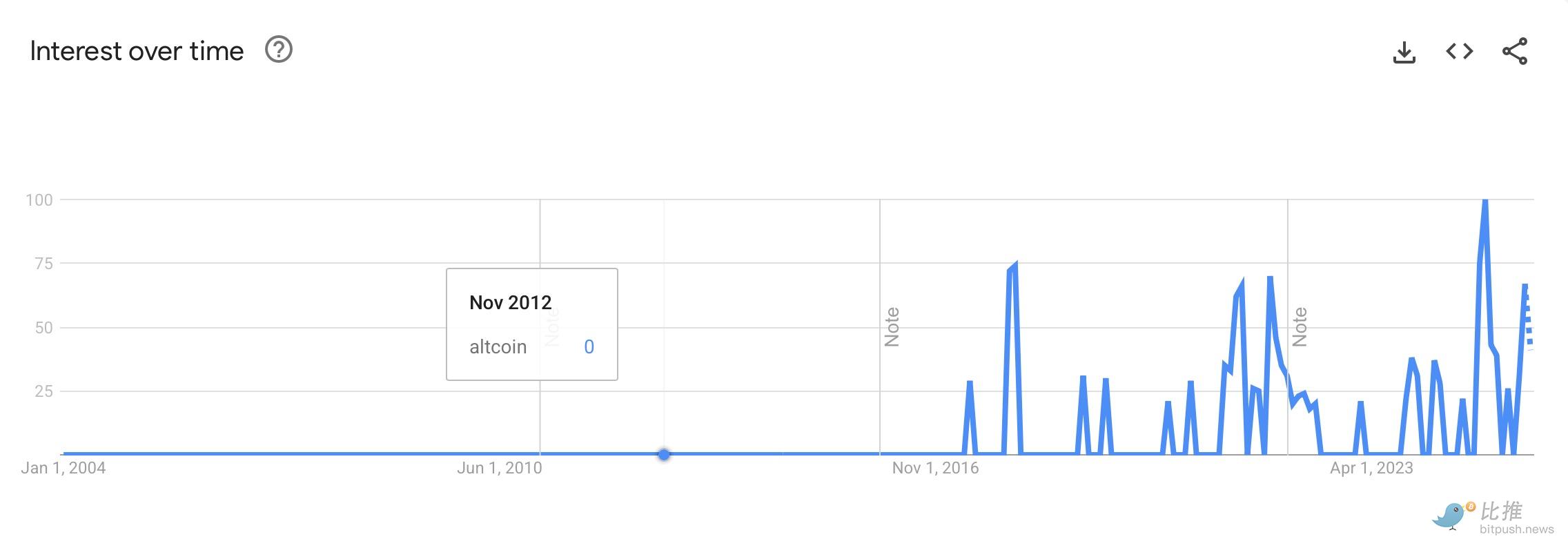

Google Trends data shows that the search popularity of "Altcoin" has hit a five-year high, and the search volume of "Ethereum" has reached a two-year peak.

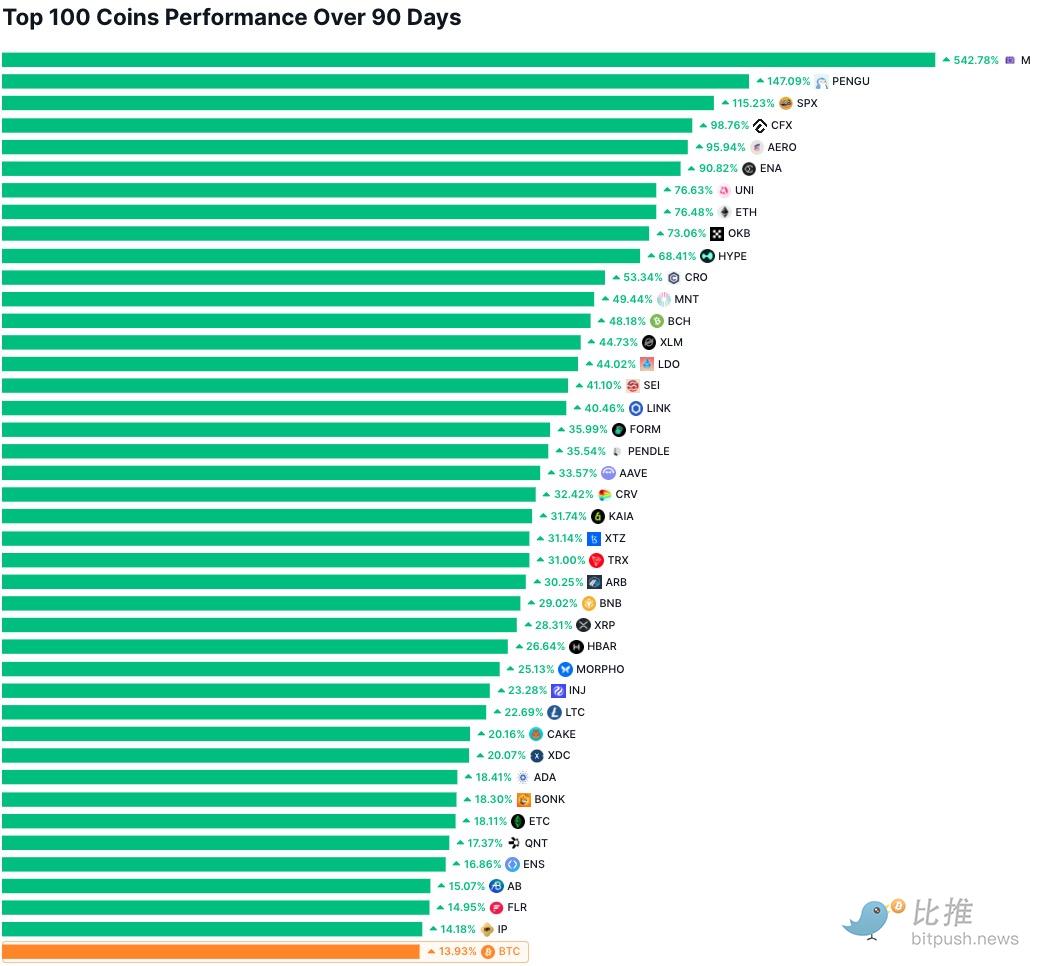

At the same time, the total market capitalization of global cryptocurrencies has increased to $4 trillion, with the altcoin sector performing significantly better than Bitcoin (the data in the figure below is as of the close of the U.S. stock market on August 14, Eastern Time):

- Ethereum has risen 79% in the past 90 days, while Bitcoin has only risen 14% in the same period.

- The Altcoin Season Index rose to 40 from 29 a month ago.

- The United States has received 31 applications for altcoin spot ETFs in the first half of the year, covering mainstream public chains and ecological tokens such as SUI, SOL, XRP, LTC, DOGE, ADA, DOT, HBAR, and AVAX.

On the funding side, ETFs and corporate treasuries are changing the supply and demand structure:

- Ethereum spot ETFs alone recorded a net inflow of $2.3 billion in three days, equivalent to 500,000 ETH.

- Corporate treasuries are diversifying their allocations, with Ethereum, Solana, and Chainlink all being held in large amounts and staked for returns.

- DeFi's locked-in value (TVL) returned to US$96.9 billion, approaching its historical high in 2021.

This pattern of capital + narrative resonance provides a solid foundation for the full rotation of altcoins.

Meme track: Emotional explosion driven by PENGU and SPX

In this structural rotation, the growth of PENGU, SPX and AERO is the most prominent, representing the three main lines of the current copycat market: Meme narrative, technical form trading and platform entry bonus.

Pengu: From Meme to Financial Product

PENGU, which emerged out of nowhere, is essentially still a meme coin with the image of a penguin as its cultural core, but this time it has gained legitimacy at the financial level.

In March, Canary Capital submitted an ETF application that included PENGU spot trading, planning to allocate over 80% of its funds to the token itself, with the remainder held in Pudgy Penguins NFTs. This marked the first time that NFT IP and crypto tokens were packaged in an ETF product. The ETF narrative directly increased PENGU's visibility among institutional investors.

Both offline and online exposure fueled buzz. In early August, PENGU trading volume on the South Korean exchange Upbit surpassed Dogecoin. Coinbase changed its official social media profile to the Pudgy Penguins NFT, and Robinhood also listed the coin.

Technically, PENGU has broken through its downward trend channel and experienced significant volume growth, providing an entry signal for short-term investors. This combination of "cultural IP × ETF expectations × technological breakthrough" has given PENGU significant upward potential.

SPX6900: Meme-style capital rotation guided by technical factors

While Penguin is more sentiment-driven, the SPX's rise is more rationally supported by strategic trading. Its name, known as a parody of the S&P 500, is a bit of a financial allusion.

The classic "cup with handle" pattern has formed on the daily chart, with the neckline at $1.74. Once it breaks upward, the technical target will be $2.28-2.88. This pattern is highly attractive to technical traders.

At the same time, the SPX community is highly active and capital rotation is extremely efficient. After making a profit, holders quickly allocate funds to the next round of pre-sale projects such as Pepe Dollar, forming a high-frequency capital transmission and interception.

The outbreak of SPX is not only the result of technical graphics, but also a reflection of the synergistic fermentation of Meme × trading momentum × community activity.

AERO: Platform entrance becomes capital accelerator

AERO's upward momentum is driven by practical reasons. As the core decentralized exchange (DEX) token on the Base chain, it received significant positive news in early August: integration with the Coinbase app, enabling one-click buying and selling without requiring a web browser. This provided millions of traders with direct access to the on-chain liquidity pool. Within a week, AERO's trading volume surpassed a six-month high, and its price surged by over 43%. Meanwhile, Ethereum's TVL rebounded to approximately $96.9 billion, and Base chain trading activity surged, with Aerodrome becoming a hub for capital.

This wave of increase shows that the "platform entrance" has the ability to be effectively converted into on-chain buying and selling behavior, and is the central node that drives price diffusion and explosion.

Other sectors also stand out in the structural rebound

Other sectors have also seen structural market trends, with funds gradually penetrating into more sectors:

L2 / Capacity Expansion Track

Representative projects such as MNT (+49.06%) and ARB (+30.52%) have benefited from the resurgence of Ethereum's ecosystem activity and the increase in on-chain transaction volume, revitalizing the valuation logic of layer-2 networks. As user demand for low fees and high throughput continues to intensify, layer-2 is not only a performance optimization solution but also a launching pad for various new protocols. Some investors believe that these foundational sectors possess the characteristics of a "slow bull market." While they may not have the short-term resilience of memes, they offer advantages in terms of a robust ecosystem and long-term narrative.

DeFi Protocol Track

Uniswap (+76.37%) continues to maintain its core position in decentralized liquidity, with cross-chain aggregation and increased proportion of transaction fee income being the main reasons.

FORM (+35%) leverages "portfolio strategy management" to lower the barrier to entry for retail investors, while PENDLE (+34.89%)'s "revenue splitting" product bridges fixed income and derivatives, meeting the diverse needs of institutional and advanced traders. This suggests that current investment is not blindly chasing high prices, but rather tends to invest in DeFi protocols with unique mechanisms and moats.

Infrastructure track

LINK (+40.46%), KAIA (+31.93%), and XDC (+20.19%) represent the three needs of "oracle", "cross-chain infrastructure" and "enterprise chain" respectively.

LINK's monopoly in the oracle space has made it an essential underlying component in the DeFi and RWA narratives. KAIA, as a cross-chain hub, has benefited from the growing demand for interoperability. XDC, with its integration into traditional enterprise supply chains and trade finance scenarios, has garnered attention from investors seeking long-term, stable capital allocations. The common thread among these assets is that their use cases consistently generate rigid demand, regardless of market fluctuations.

Platform coin track

The strong performance of platform-denominated coins like OKB (+72.98%), CRO (+52.95%), and BNB (+29.12%) is driven both by platform revenue growth driven by a rebound in trading volume and by the long-term prospects for a buyback and burn mechanism. For investors, platform-denominated coins are more like equity-like assets, and their intrinsic value is expected to steadily increase as the exchange ecosystem expands.

Payment chain track

BCH (+48.27%), XLM (+44.49%), and TRX (+31.18%) are experiencing a recovery amidst the resurgence of cross-border payments and stablecoin transfers. BCH remains a staple in offline payments and over-the-counter (OTC) transactions in some emerging markets; XLM is gaining momentum through partnerships with international clearing and remittance services; and TRX maintains its attractiveness to investors thanks to its stablecoin issuance and on-chain activity. These assets are relatively resilient to market fluctuations and are more likely to attract medium- and long-term investors.

Special Narrative/Derivative Track

While the strength of SPX has been mentioned above, projects like HBAR and INJ are also finding opportunities for revaluation thanks to their differentiated narratives (e.g., DAG architecture and deep derivatives trading). Especially at this stage, projects that offer an additional risk-return profile outside the mainstream narrative often receive unexpected funding at the end of the market.

Judging from the overall performance, the rebound in these sectors confirms a trend: funds are migrating from main assets to targets with greater flexibility and sector depth, trying to find new sources of alpha.

Summarize

The current market rotation makes the entire market more like a multi-layered chess game: the main track continues to attract attention, but other squares on the board are also quietly lighting up. Whether it is long-term stable infrastructure or short-term explosive concept coins, they are providing investors with different risk preferences.

Going forward, the market may see even more divergence—some assets will continue to rise thanks to narratives, funding, and fundamentals, while others will quickly retreat in the absence of sustained momentum. For investors, the real challenge isn't finding a rising coin, but determining how long it can continue to rise and when to exit.

After all, this market is never short of surprises, but it is also never short of accidents.