Author: Will Awang

On June 9, 2025, at a roundtable meeting on the theme of "DeFi and the American Spirit", the new chairman of the U.S. Securities and Exchange Commission (SEC), Paul S. Atkins, gave a very positive speech on decentralized finance (DeFi), laying the groundwork for the SEC's subsequent friendly regulation of DeFi.

Adams, the founder of Uniswap, who was devastated by the previous SEC Chairman Gary Genseler’s lawsuit and regulation, tweeted that happiness came too suddenly:

It's incredible how fast DeFi has grown 🤯. It felt like the real beginning of the DeFi movement back in 2018 with the launch of MakerDAO + Compound + Uniswap. Before that, the term "DeFi" didn't even exist. Now, 7 years later, government agencies are openly acknowledging it as a national priority!

(https://x.com/haydenzadams/status/1932298054343733664)

Similarly, the crypto market has also given a positive answer. The value of old DeFi such as Aave, Uni, Mkr, Comp, etc. has soared. Since these old DeFi are built on ETH, ETH has also risen accordingly. For these old, relatively decentralized DeFi protocols, on the one hand, the value is returning, and on the other hand, the most important thing is that they can land.

Therefore, this article first compiles the content of the DeFi speech, then takes a glimpse into the prototype of US crypto regulation (not just DeFi), and finally looks at the future crypto trend - On-Chain Financial Markets.

1. DeFi and the American Spirit

Paul S. Atkins: Because the decentralized finance (DeFi) movement itself embodies American values such as economic freedom, private property rights, and innovation.

1.1 What is a blockchain network?

Blockchain technology is a highly creative and potentially revolutionary innovation that makes us rethink ownership and the transfer of intellectual property and economic property rights. Blockchains are shared databases that enable users to own digital assets (i.e. crypto assets) without relying on intermediaries or central institutions. Instead, these peer-to-peer networks use an economic mechanism to incentivize participants to verify and maintain the database according to the network's rules. These are free market systems where users need to pay fees to network participants on demand to have their transactions included in a "data block" with limited storage capacity.

1.2 Blockchain Network Node Participants

The previous U.S. administration used lawsuits, speeches, regulation, and threats of regulatory action to prevent Americans from participating in these market-based systems by claiming that participants and Staking-as-a-Service Providers may be engaging in securities transactions.

I am very grateful to the Division of Corporation Finance staff for clarifying their view that voluntary participation in Proof of Work (PoW) or Proof of Stake (PoS) networks as "miners", "validators", or "staking as a service" providers is not within the scope of the federal securities laws. While I am pleased with this move, it is not a formally enacted rule with the force of law, so we cannot stop there.

The SEC must write a regulation to provide clarity, based on the authority Congress has given us.

1.3 Asset Self-custody

Another core feature of blockchain technology is the ability for individuals to self-custody their crypto assets in their personal digital wallets. The right to self-custody over one’s own private property is a fundamental American value that should not disappear when people log on to the Internet.

I support giving market participants greater flexibility to self-custody crypto assets, particularly when intermediaries add unnecessary transaction costs or restrict the ability to participate in staking and other on-chain activities.

The previous presidential administration undermined innovation in self-custodial digital wallets and other on-chain technologies by asserting through regulatory actions that developers of such software may be engaging in brokerage activities. Engineers should not be subject to federal securities laws simply for publishing such software code. As one court put it:

“It is unreasonable to hold the developer of a self-driving car liable because a third party used the car to violate traffic rules or rob a bank. In such cases, people would not sue the car company for enabling the wrongdoing; they would sue the individual who perpetrated the wrongdoing.”

1.4 Self-Executing Software Code

Many entrepreneurs are developing software applications designed to run without any operator management. The idea of self-executing software code that is accessible to everyone but controlled by no one, enabling private peer-to-peer transactions, may sound like science fiction. However, blockchain technology makes possible a whole new category of software that can perform these functions without an intermediary.

I do not believe that we should allow century-old regulatory frameworks to stifle technological innovations that could disrupt, and most importantly improve and advance, our current traditional intermediation models. We should not automatically be fearful of the future.

These on-chain self-executing software systems have proven resilient in the face of crisis. While centralized platforms have faltered and failed under pressure in recent years, many on-chain systems continue to operate as designed in open source code.

1.5 Innovative regulatory rules

Most current securities rules and regulations are based on the regulation of issuers and intermediaries, such as brokers, advisors, exchanges, and clearing organizations. The drafters of these rules and regulations may not have contemplated that self-executing software code could replace these issuers and intermediaries. I have asked Commission staff to explore whether further guidance or rulemaking is needed to help registrants transact with these software systems while complying with applicable law.

I am also excited about issuers and intermediaries using on-chain software systems to eliminate economic friction, improve capital efficiency, launch new financial products, and enhance liquidity. Existing securities regulations already contemplate the possibility of issuers and intermediaries using new technologies, but I have asked staff to consider whether the Commission's rules and regulations need to be revised to better provide the necessary convenience for issuers and intermediaries seeking to manage on-chain financial systems.

As the Commission and its staff work to develop appropriate rules for on-chain financial markets, I have directed the staff to consider a Conditional Exemptive Relief Framework, or “Innovation Exemption,” to enable registrants and non-registrants to quickly bring on-chain products and services to market.

The innovation exemption helps realize President Trump’s vision of making the United States the “cryptocurrency capital of the world” by encouraging developers, entrepreneurs, and other companies willing to comply with certain conditions to innovate on-chain technology in the United States.

II. SEC Regulatory Thinking in the New Era

2.1 SEC Regulatory Thinking during Gary Genseler’s Period

Simply put, the SEC, previously led by Gary Genseler, had regulatory authority over DeFi, or the regulatory controversy, which was:

- The token assets of the project party constitute "securities". A typical case is: Ripple's XRP case. Reference article: Interpretation of the SEC v. Ripple case, further clearing the regulatory fog

- Staking-as-a-Service Providers have built an interest-bearing asset that falls into the category of "securities". A typical case is the SEC's lawsuit against Karken's staking products; Reference article: In-depth analysis: Ethereum and ETH staking (Solo Staking) are not securities, but Kraken's ETH staking products are securities

If the assets traded on the platform involve "securities", then the platform will be deemed to be involved in unregistered securities sales and brokerage business. A typical case is the SEC's lawsuit against the self-custodial wallet Metamask, which believes that some of its services, such as pledge and brokerage transactions, are classified as "securities" transactions.

Under such a regulatory logic, a very strict "securities" identification is required, which is not only a challenge to the US Securities Act of 1933, but also a challenge to the existing judicial legislative process. Therefore, due to the lack of a clear characterization and regulatory framework for crypto assets, the SEC adopted a more law enforcement-style regulatory approach at the time, provoking a war against crypto project parties such as Coinbase, Metamask, and Uniswap.

2.2 SEC Regulatory Thinking during the Paul S. Atkins Period

So this Trump administration, led by Paul S. Atkins, has a fundamental change in its goal: “It is a new day at the SEC.”

Whether in this speech or in the last speech on May 12 on "Assets on the Chain - The Intersection of Traditional Finance and Decentralized Finance", a signal was released:

Achieve President Trump’s vision of making the United States the “global cryptocurrency capital” by encouraging developers, entrepreneurs, and other companies willing to comply with certain conditions to innovate on-chain technologies in the United States, making the United States the best place for global participation in the crypto asset market.

Therefore, through Paul S. Atkins' two speeches, the SEC was given a regulatory idea:

For real-world asset on-chain (RWA Tokenization):

- Develop a reasonable regulatory framework for the crypto-asset market;

- Issuance: adopt a more flexible approach to issuing crypto assets rather than strictly following traditional securities issuance methods;

- Custody: Support providing more autonomy for registries in custody of crypto assets;

- Trading: Support the launch of more types of trading products based on market demand, breaking the previous SEC restrictions on such trading activities.

Create more flexible conditional exemption measures to promote the return of blockchain innovation to the United States, MAGA.

For Decentralized Finance (DeFi):

- Redefine the blockchain network node operation Staking business, promote the healthy development of the blockchain network, and strive for nodes;

- Providing flexibility for self-custody of assets, in line with the American spirit;

- The responsibility for self-executing software code is clear;

- Provide clear regulatory guidance for DeFi to build on-chain financial markets;

- Build a conditional exemption framework & innovative exemption framework to encourage innovation.

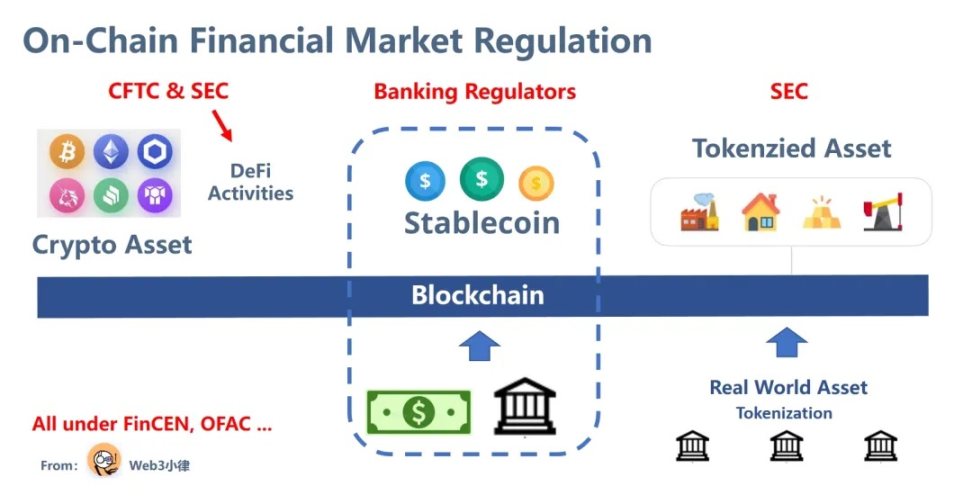

2.3 The U.S. crypto regulatory framework is emerging

As a result, the following crypto regulation prototype has been basically formed:

- The Genuis Act, which regulates “payment stablecoins”, is led by banking regulators;

- The CFTC regulates crypto assets;

- SEC regulates DeFi activities;

- The SEC regulates tokenized assets.

- FinCEN, OFAC, etc. have KYC/AML/CTF and economic sanctions.

3. What will happen in the future?

After understanding the regulatory framework of the United States, we can get a glimpse of future trends:

The old DeFi has remained stable after experiencing ups and downs, and can now be officially launched.

Innovative DeFi can also develop rapidly in the United States under the background of "innovation exemption", especially those financial products of yield-bearing stablecoins. These are mainly different from the "payment stablecoins" defined in the Genuis Act. Although they are called stablecoins, they are actually financial products built through stablecoins.

The composability brought by this relatively decentralized DeFi can be combined into more diversified financial products as more and more stablecoins and tokenized assets are put on the chain.

More and more Web2 traditional fintech companies will combine innovations with Web3 DeFi.

Then came: On-Chain Financial Markets.

This market is globalized, democratized, has low barriers to entry, low costs, global reach, and is supported by global liquidity. It is an Internet-based market. The important thing is that the Internet has a network effect.

But based on the regulatory framework, all underlying elements are US dollar stablecoins, US dollars, and US Treasury bonds.