Coinbase acquires Echo: Unlocking the future of onchain capital formation

Original Article by Shan Aggarwal and Aklil Ibssa

Compiled by: Peggy, BlockBeats

Editor's Note: As on-chain financing becomes a new trend in the crypto industry, Coinbase is accelerating the development of its capital markets infrastructure. On October 20, 2025, the US crypto trading platform Coinbase announced the completion of its acquisition of Echo, an on-chain financing platform. This acquisition represents not only a fusion of technology and concepts but also a key step for Coinbase towards an on-chain primary market. This article, compiled from the official Coinbase blog, aims to help readers understand the strategic logic and industry significance behind this transaction.

The following is the original content:

Enabling more people to participate in early-stage investment in next-generation innovation

Coinbase has officially acquired Echo, an on-chain platform dedicated to enabling community co-investment and providing entrepreneurs with more options for managing equity structures. Echo shares our philosophy of democratizing early-stage investing, empowering more people to support the next generation of groundbreaking, innovative companies.

Echo was founded by Cobie, a crypto OG and long-time advocate of community-driven investing. For years, Echo has been creating tools that make financing more inclusive, transparent, and efficient, driving innovation in on-chain fundraising.

Why do this? The answer is simple: we want to build a more open, efficient, and transparent capital market. However, entrepreneurs still face difficulties in raising funds, and ordinary investors are almost unable to participate in private token issuance.

Echo changes this. It enables projects to raise funds directly from their communities—whether through private placements or self-hosted public token sales using the Sonar platform. By integrating Echo's tools into the Coinbase ecosystem, we will enable even more communities to directly participate in fundraising, seamlessly connecting projects and capital on-chain.

We are currently starting with crypto token sales based on Sonar, but plan to expand into tokenized securities and real-world assets in the future, leveraging Echo’s infrastructure capabilities.

Since its launch, Echo has made significant inroads into the private markets – helping projects raise over $200 million across approximately 300 transactions.

Its latest self-hosted public token issuance product, Sonar, has also achieved initial success, providing technical support for Plasma's XPL token sale.

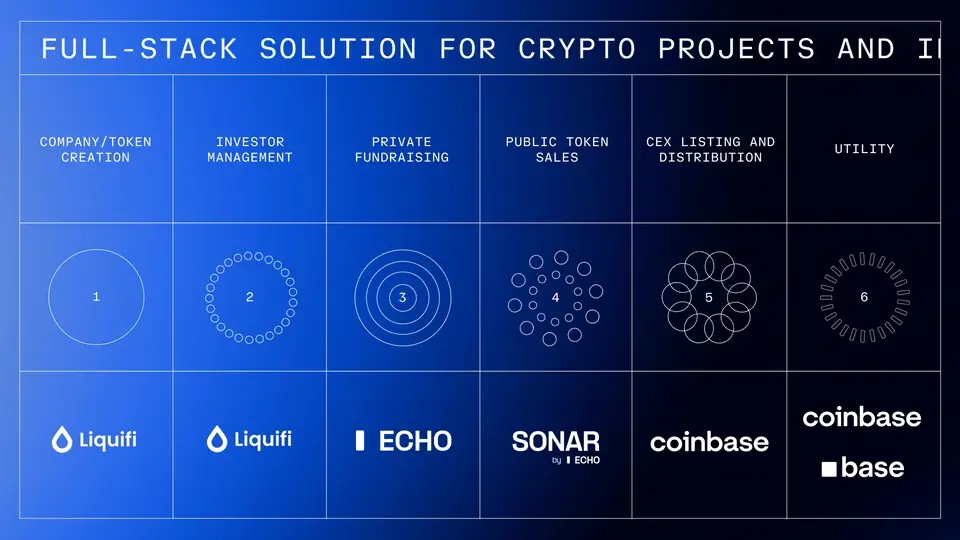

Through this acquisition, Coinbase is building a full-stack solution for crypto projects and investors, covering the entire cycle from project launch, fundraising to secondary market trading.

- For Builders: Easier access to capital and access to fundraising tools aligned with community interests — like Echo’s private investment platform and Sonar’s self-hosted public token sale solution.

- For investors: Access new and diversified investment opportunities that were previously unavailable through trusted platforms like Echo or through Sonar’s direct distribution channels.

- For the Onchain Economy: Build a more efficient, transparent, and globally accessible capital market to further promote innovation and growth.

Echo complements our recent acquisition, Liquifi. Liquifi enables early-stage teams to more efficiently create tokens and manage equity, while Echo extends our support from the startup phase to the fundraising phase.

Combining our existing strengths in exchange listing, custody, staking, trading, and financing, Coinbase now has the ability to serve the entire life cycle of token issuers and investors - from project inception and financing to secondary market circulation, all within a single system.

Coinbase has always been the intersection of users, liquidity, and trust. Our entry into fundraising is designed to further eliminate ecosystem barriers, empower builders and investors, and jointly drive the continued growth of the entire crypto ecosystem.