Author: Zuo Ye

A specter, the specter of super-liquidity, roams the blockchain. To carry out a holy siege against this specter, all CEX forces—offshore and onshore, Perp DEX and FTX fragments, Solana radicals and L2 upstarts—have united.

The US dollar is the anchor of liquidity, and Hyperliquid is equivalent to Crypto liquidity. Trading is increasingly concentrated on mainstream currencies such as BTC and ETH. People intentionally or deliberately forget that Hyperliquid seized the opportunity to grow and develop, and inadvertently grew into a towering tree.

People are talking about the possibility of Hyperliquid flipping Binance, and it seems that Aster's attack is just the beginning of a long offensive. But in fact, the 20x leverage limit in 2021 did not end the competitive situation between FTX and Binance, and today's Aster 1001x will not hinder Hyperliquid's pace.

Mystery is the source of charm. The Hyperliquid ecosystem is too complex. This article only focuses on how Hyperliquid survived the CEX siege and turned the tables. As for the pedigree of HyperEVM and its DeFi ecosystem, as well as the capital operation stories such as $HYPE's flywheel, $USDH's closed loop, ETF and DAT, they will be narrated in subsequent articles.

The price of time

Don't hate your enemies, it will make you lose your judgment.

The history of arbitrage is as long as the history of finance.

From November 2, 2022, when Coindesk exposed the secrets of FTX, to November 11, 2022, when FTX filed for bankruptcy, the strategies were to attack the security of $FTT as FTX's reserve and the market maker Alameda's misappropriation of FTX user assets. CZ then expressed his willingness to acquire FTX and then refused, disrupting SBF's fundraising and self-rescue rhythm.

When SBF was raising funds in the Middle East, he clearly expressed his resentment towards CZ. Emotions are the enemy of business, and ultimately SBF failed to save FTX.

Looking at it today, whether it is the prediction market, AI investment, the Solana chain itself, the gradual progress of FTX asset liquidation, or even the collaboration between perpetual contract exchanges and market makers, we will find that SBF’s ideas are correct, but it’s a pity that he is unstable.

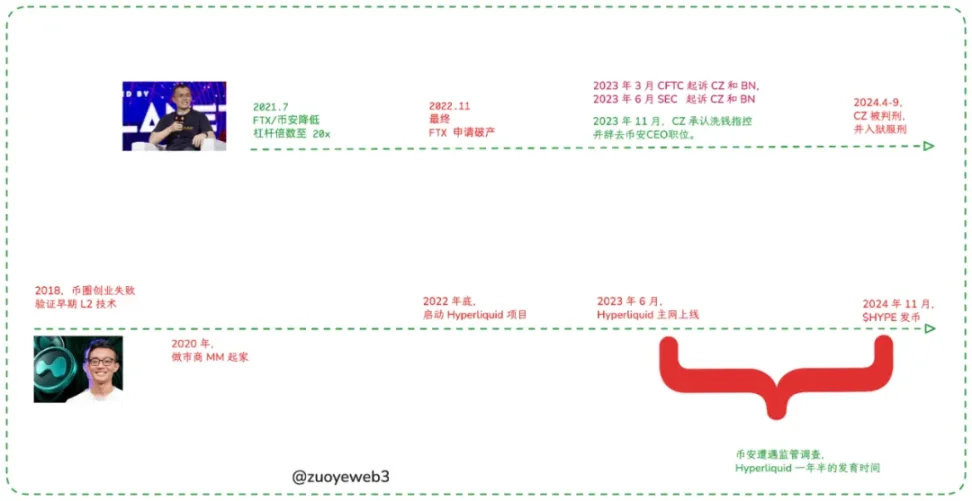

Image caption: Hyperliquid's early development history, Image source: @zuoyeweb3

After the collapse of FTX, CZ began to negotiate with the US judicial system to pay the ticket. The price of getting on the bus first and paying the ticket later was 4.2 billion US dollars, but unfortunately, the high price did not restore Binance's solid position. The seeds of Hyperliquid had already been planted.

The United States defines a challenger as one whose GDP reaches approximately 60% of its own. This is also the case for the Soviet Union and Japan. Binance's warning line for challengers is 10%. As long as it is below this safety line, whether it is dYdX on the chain or the centralized FTX, they are all negotiable objects. Binance's main site and ApolloX of the BNB ecosystem can cooperate in defense.

Hyperliquid is developing almost at the same pace as Binance, with its launch in June 2023 and coin issuance in November 2024. Who still remembers that CZ happened to hold a public event to talk about Bio Protocol and educate Giggle at this time? As for Hyperliquid, it is just another Perp project with coin issuance as its main focus.

Image caption: Hyperliquid OI market share, Image source: @0xhypeflows

Unfortunately, Hyperliquid’s growth flywheel didn’t stall after the epic 31% airdrop of $HYPE, but trading volume actually started to rise.

Counterintuitively, GMX also experienced a surge in trading volume, exchanging trading volume for tokens, and after the tokens were issued, the price and trading volume returned to zero. It can be predicted that whether it is Aster, Avantis, Lighter, Backpack, edgeX, StandX, Drift or BULK, they will follow this path. This does not mean that they are not good projects, nor does it mean that tokens cannot be involved.

We are simply emphasizing that the fact that Hyperliquid can survive after issuing its token is itself an anomaly, and that is why we are examining whether it can survive the cycle and become a mainstay of the crypto industry.

The remaining similar projects will lose their appeal after issuing coins. Sushiswap can absorb Uniswap's trading volume, GMX can absorb dYdX's trading volume, and Blur can absorb OpenSea's trading volume.

Binance offshore takes advantage of Coinbase onshore, SBF uses FTX to take advantage of Binance's regulation, and Hyperliquid takes advantage of CEX.

The time window is just a passive blank. Only by actively keeping up with the situation can we have the present moment.

The centralization of BTC/ETH transactions mirrors the Meme craze. It is precisely because large funds and ETFs dominate the price trends of mainstream currencies that the on-chain market initiated by PumpFun has emerged. Desperate retail investors will face sanctions such as disconnection of their network connections through GameStop, but Meme has no restrictions on this point.

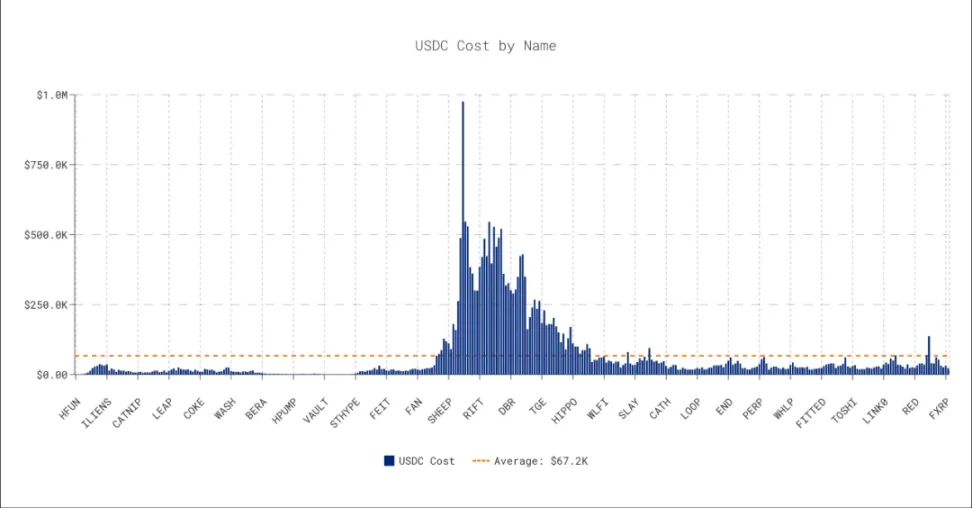

In mid-2024, Hyperliquid launched the Dutch auction model for listing coins. In addition to innovating the opaque CEX listing model, more importantly, Hyperliquid gradually entered a dual-track model of spot and contract listings.

However, apart from $GOD reaching $100,000 at the end of 2024, the remaining bidding prices have been hovering at low levels, and the currencies launched throughout 2024 are basically "non-mainstream" Meme coins, which is incomparable to the current BTC spot trading volume approaching Binance.

Image caption: Hyperliquid Netherlands auction data, image source: @asxn_r

To be more precise, Hyperliquid's development started from Perp DEX, focusing on conventional processes such as low latency, token incentives, and permissionlessness, but following the Meme wave, it launched an auction mechanism, from then on truly entering the spot market and the minds of "retail investors", and then cultivating a complete trading ecosystem.

Tip: Enter the current mainstream ecosystem at the right time, make yourself synonymous with it, use liquidity to drive traffic, complete the empowerment of $HYPE, and build a system.

The same is true for $USDH and the beginning of HyperEVM. System Thinker is the nature of Hyperliquid founder Jeff. You will reuse this set of methodologies at every stage of Hyperliquid's development.

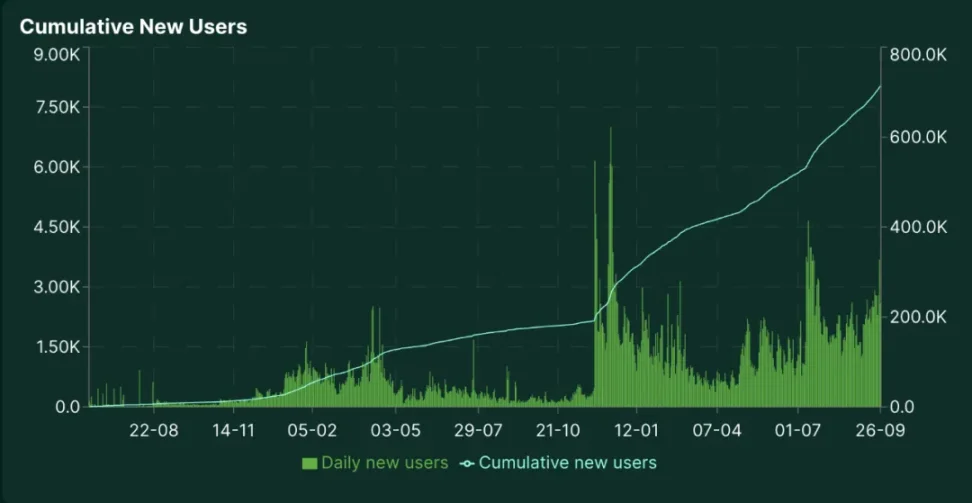

Image caption: Hyperliquid user growth, Image source: @Hyperliquidx

From the perspective of intuitive user growth, the first 10,000 users were accumulated during the internal test in October 2023, but in the S1 season from November 2023 to May 2024, Hyperliquid's user base grew to 120,000.

Among them, the spot model created a second small peak in April and May in the Netherlands, and when Meme was hottest at the end of 2024, $GOD was auctioned and launched, and $Solv also entered the Hyperliquid spot market, becoming the first mainstream ecological BTCFi project token.

Of course, I cannot quantify the causal role of the spot market in the growth of Hyperliquid users and trading volume, but the two are highly correlated over time.

Hyperliquid did not simply rely on high leverage and No KYC to gain market position. We must change the stereotype of Hyperliquid. From the beginning, Hyperliquid has been an all-round exchange, but it entered the market with the Perp product.

The price of liquidity

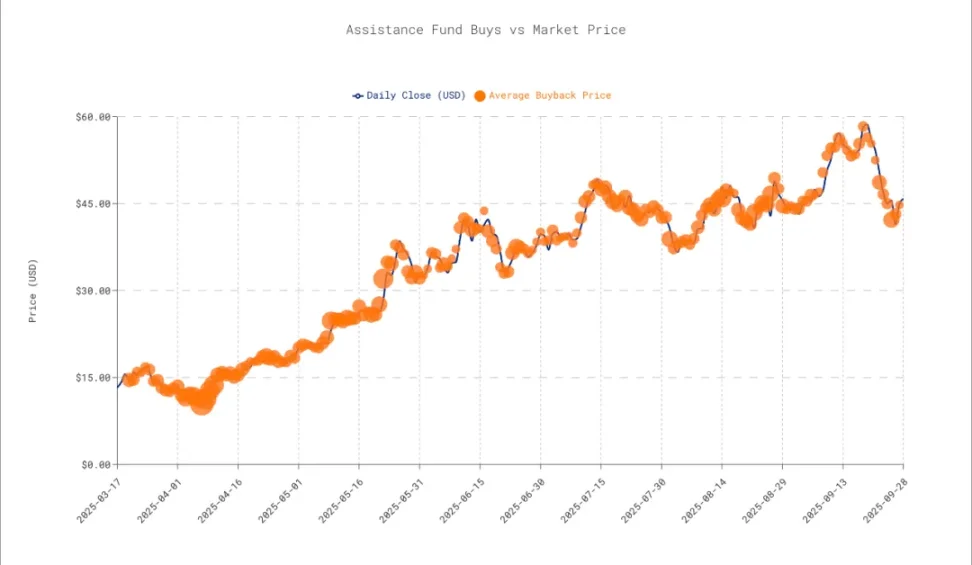

As of now, Hyperliquid's repurchase amount has reached US$1.4 billion.

In November 2024, after the $HYPE airdrop is completed, the main spot trading will be concentrated within itself, but a fork is needed at this time because Hyperliquid is no longer just a spot and contract exchange, and HyperEVM is still in pre-research and will not be launched until early 2025.

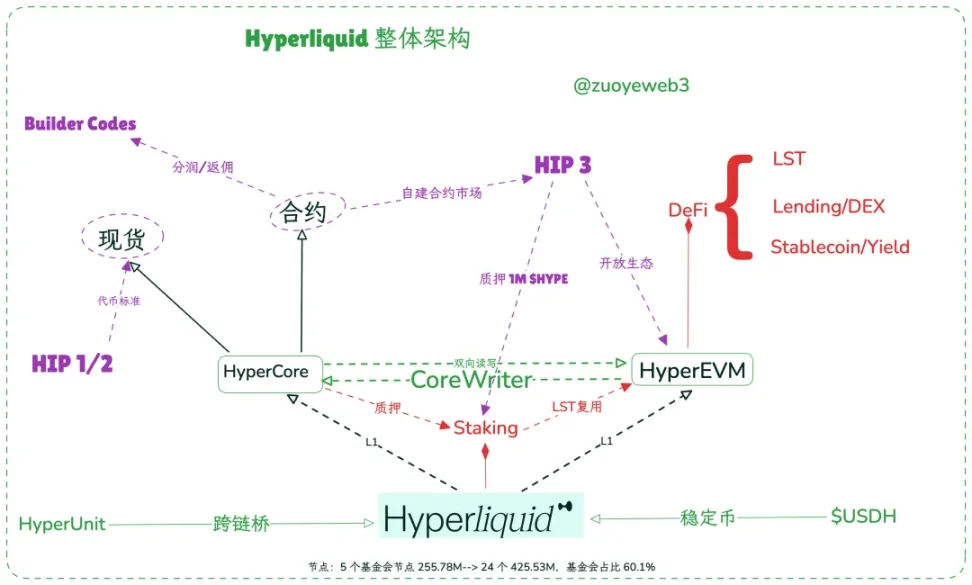

To categorize, Hyperliquid is a bit like Ethereum with a consensus layer + two execution layers. HyperBFT is its consensus layer, and the so-called nodes maintain the consensus of HyperBFT, while HyperCore is the contract and spot exchange L1, and HyperEVM is an open L1 with no permission.

Image caption: Hyperliquid overall architecture, Image source: @zuoyeweb3

Through the CoreWriter system, HyperEVM can call and allocate HyperCore liquidity. For example, the LST protocol does not need an intermediary to package assets, but can directly reuse the native staking standard.

In addition, Unit Protocol can bridge external ecosystem assets to Hyperliquid, and Builder Codes allows any front-end to use HyperCore liquidity and participate in fee sharing. Rabby Wallet and Based App are both such front-end access.

As mentioned above, Hyperliquid relied on passive time windows to proactively create two supermarkets: spot and contract markets. However, how to avoid the liquidity split before and after the launch of $HYPE was not mentioned. A complete description is given here.

Let’s first piece together the Hyperliquid growth flywheel. Here’s the most logical path:

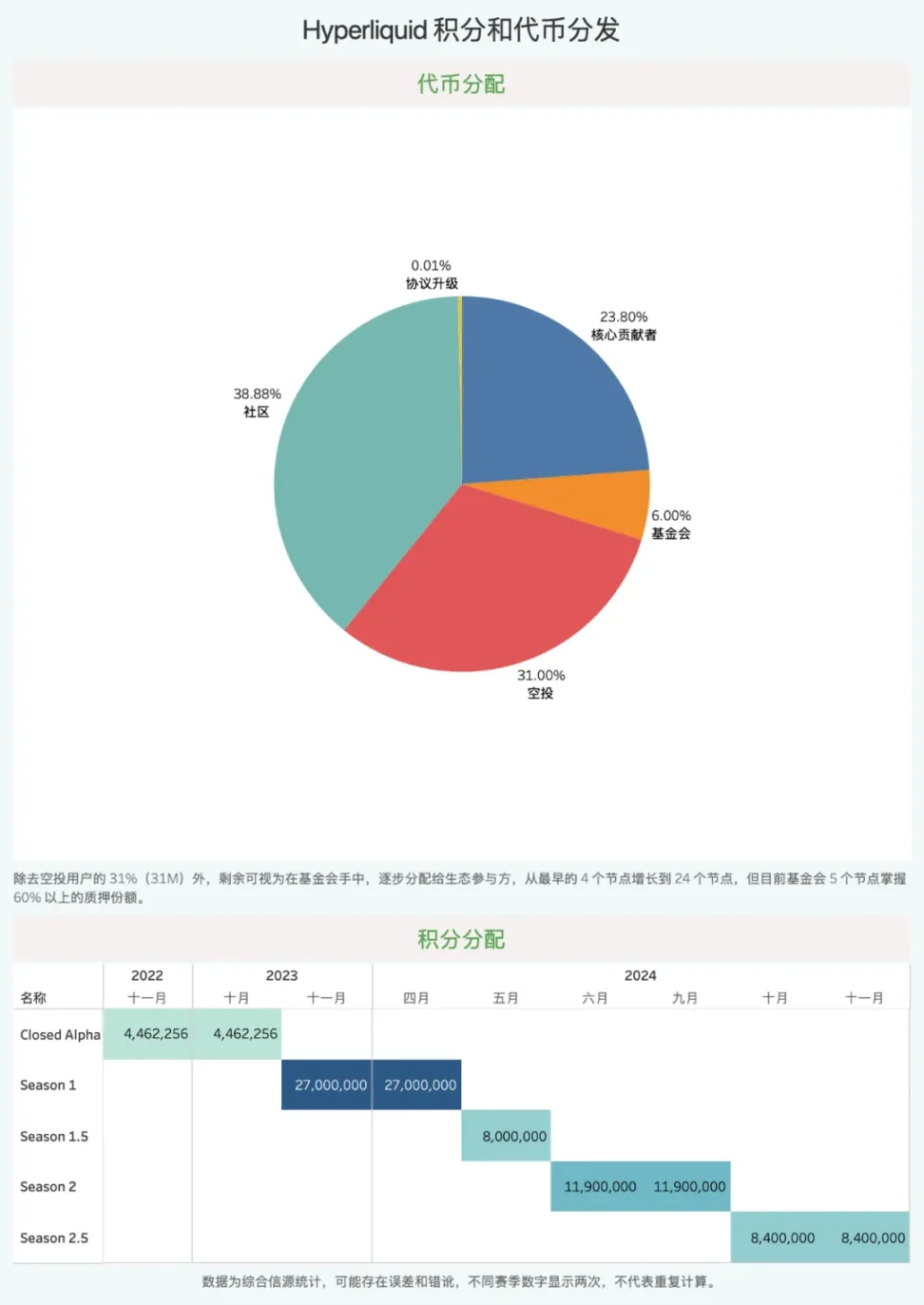

- S1 and points system, token airdrop in November 2024, 31% (31M) of tokens distributed to S1 and Closed Alpha users, the criteria at this time is mainly to examine the user's contract transaction volume;

- However, please note that the hidden S1.5 and S2.5 activities have been ongoing since the airdrop. This public and semi-hidden activity gives the Hyperliquid team great flexibility.

- Hyperliquid claims to have 10 people, no VC, and is committed to community interests. Its fees are roughly evenly distributed between HLP (liquidity treasury, responsible for liquidation) and repurchased $HYPE, which is also an important source of support for token prices.

That is, it depends on points before the airdrop and on buyback after the airdrop.

Image caption: Hyperliquid points system, Image source: @zuoyeweb3

Anatoly, the founder of Hyperliquid and Solana, is very similar. They both attach great importance to the market price of tokens and regard it as an important indicator to continuously stimulate the activity of the ecosystem. This is not common. Vitalik cares more about technology and the value of "doing good". Public chains and large projects with VC participation are always under game theory pressure from all parties to sell off.

In fact, it is hard to believe that Hyperliquid has no external financial support at all. Initial market making requires proprietary trading or third-party investment to attract real retail investors and institutions. You can understand this by looking at how Aster's trading volume instantly surpassed Hyperliquid.

The current Hyperliquid nodes have multiple market maker names, such as Infinite Field, Alphaticks, CMI, Flowdex, FalconX, etc., and Galaxy has also become its node, plus Paradigm confirmed to buy $HYPE in November 2024.

The most reasonable guess is that market makers participated in the Hyperliquid transaction early on, but unlike the previous VC investment model of dividing equity and tokens, market makers gradually purchased tokens from the foundation. This does not violate the character of no VC at all, and MM is indeed not a VC.

Warning: Be aware, however, that Hyperliquid data is not completely transparent, especially before November 2024.

For MM, Hyperliquid's strong repurchase mechanism can also guarantee their long-term interests. Hyperliquid can also obtain long-term liquidity support, thus breaking the dilemma of declining trading volume after coin issuance, followed by falling token prices, and ultimately no one subscribing to the node.

According to estimates by @Mint_Ventures, approximately $50 million flowed into the repurchase fund Assistance Fund before and after the airdrop, plus $40 million given to HLP. The latter can be counted as market-making fees, and the former is the overall marketing fee. As for VCs and market makers, they are hidden in it and cannot be accurately distinguished.

In addition to market makers, HLP and repurchase mechanisms also contribute to price support, but the ultimate use of HLP also depends on the Hyperliquid team. In the $JELLYJELLY incident, the team ultimately decided to use the HLP treasury to fill $20 million in bad debts, but when it came to the $XPL hedging incident, they chose to let users bear the losses.

But there is good news, Arthur Hayes sold $5M and DragonFly followed closely and bought $3M.

Institutions have not abandoned Hyperliquid. The only debate is how much $HYPE is worth?

The price of leverage

Extend the selling curve and slow down the selling speed.

Interest rate is the speed at which money flows, and price is the difference in valuation between the two parties.

If we simply compare Hyperliquid's income and expenses, the income includes spot listing fees (Dutch auction), spot transaction fees, contract transaction fees, liquidation fees, and Builder Codes' commissions, while the expenses include repurchase and destruction.

But it won’t be that simple, otherwise the price of $HYPE will become another representation of trading volume, which should be around 10% of $BNB, or $100. Unfortunately, it is only $40-50 at the moment.

Image caption: $HYPE buyback price, Image source: @asxn_r

Continuing from the previous article, $HYPE's repurchase and the Ethereum Foundation's sale at the current high point are mirrored. This neither affects the normal development of the ecosystem nor relies entirely on repurchases to raise prices and create a false prosperity. On the other hand, if EF makes a move, you'd better run away.

There are three factors that disrupt the $HYPE valuation system:

- High control: HYPE's main spot and contract trading volume occurs in HyperCore, and the foundation controls most of the $HYPE pledge and circulation;

- Price-to-sales ratio (P/S) is only valid in a fully traded market. Coinbase and Circle represent the prices of CEX and stablecoins in the US stock market, respectively. However, $HYPE can be manipulated by highly controlled market makers.

- Institutional pricing, participation of major players in ETH and DAT, and the interplay between the staking system and the HyperEVM ecosystem are still in their growth stages, and there is no market consensus on $BNB's transition cycle.

However, P/S can give us an illusion, and a false illusion can also appear objective through numbers. Let's simply calculate P/S to see how far HYPE is from $1,000:

- As of now, Hyperliquid's revenue in 2025 is $730 million. Assuming that the annual revenue is $1 billion, it is more reasonable to assume that the market value is $15 billion and the P/S is around 15.

- Coinbase's P/S is 11.8, Binance's annual revenue is approximately $10 billion, BNB's market capitalization is $136 billion, and its P/S is approximately 13.6. Robinhood's current value is 30, which is obviously too high. It was also 11.4 before the Cannes press conference in June.

According to a less accurate estimate, the P/S ratio of US stocks of a normal CEX/crypto brokerage is around 11, which means that the token price includes 10x leverage, which is a discounted price of everyone's 10x imagination space.

However, the price of Hyperliquid is "managed" in a variety of ways. The only problem is that Arthur Hayes believes that the repurchase of $HYPE cannot outrun the selling pressure. He predicts that on November 29, 237.8 million $HYPE will need to be unlocked, creating massive selling pressure and crushing the future of HYPE, but maintaining the long-term forecast of 126x unchanged.

Faced with the end of S2, the Hyperliquid team chose to empower NFTs instead of continuing to directly airdrop tokens. This can also be seen as diverting traffic to HyperEVM rather than directly causing selling pressure on $HYPE.

$BNB is a reflection of Binance's unique position in the trading field. It is not enough for Hyperliquid to dominate the Perp DEX field. It needs to defeat Binance to maintain $HYPE at a high level. Once the market fluctuates violently or turns bearish, the current huge buying pressure will reverse and turn into selling pressure. UST is not Bitcoin, and $HYPE may not be $BNB.

Either it will be the next living Binance, or it will be the next dead FTX.

Conclusion

Sow the seeds of the breeze and leave the storms for future generations.

Hyperliquid did not surpass the times, but seized the rare time window to provide the strongest synergy effect from the market combination. The early Midjourney was the same. Hyperliquid truly pushed Perp into the retail market, daily use on the DeFi OG chain, the experimental field of institutions, and the hunting ground of whales.

Let go and launch the meme, seize the opportunity to grow yourself.

After growing stronger, Hyperliquid did not choose to enter a sell-off mode, but instead tried to maintain the price of $HYPE in the middle range. It must be noted that it took Binance 8 years to push BNB to $1,000, Hyperliquid 3 years, and $HYPE 2 years to catch up.