Key Takeaways

- The global cryptocurrency market capitalization reached $4.46 trillion, up 12.6% this week from $3.96 trillion last week. As of October 6th, US Bitcoin spot ETFs had seen a cumulative net inflow of approximately $60 billion, with a net inflow of $3.24 billion for the week. US Ethereum spot ETFs had seen a cumulative net inflow of approximately $14.42 billion, with a net inflow of $1.3 billion for the week.

- The total market value of stablecoins is US$298.7 billion, of which USDT has a market value of US$176.3 billion, accounting for 59% of the total market value of stablecoins; followed by USDC with a market value of US$75.3 billion, accounting for 24.6% of the total market value of stablecoins; and DAI with a market value of US$5.36 billion, accounting for 1.79% of the total market value of stablecoins.

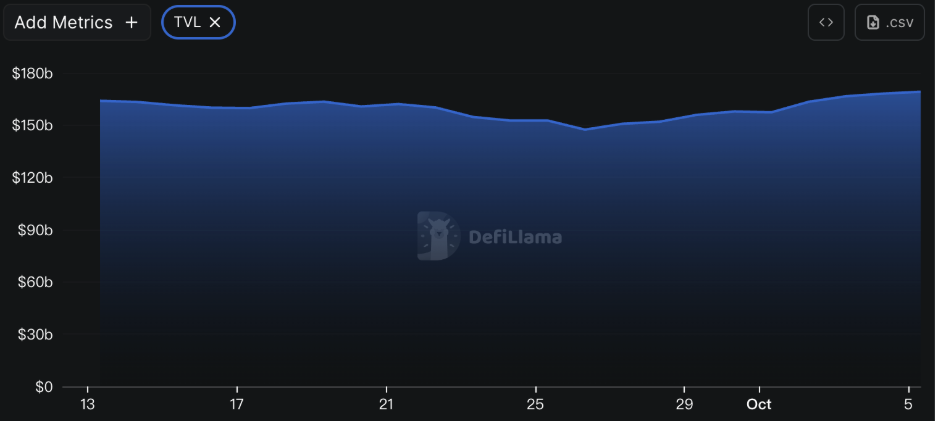

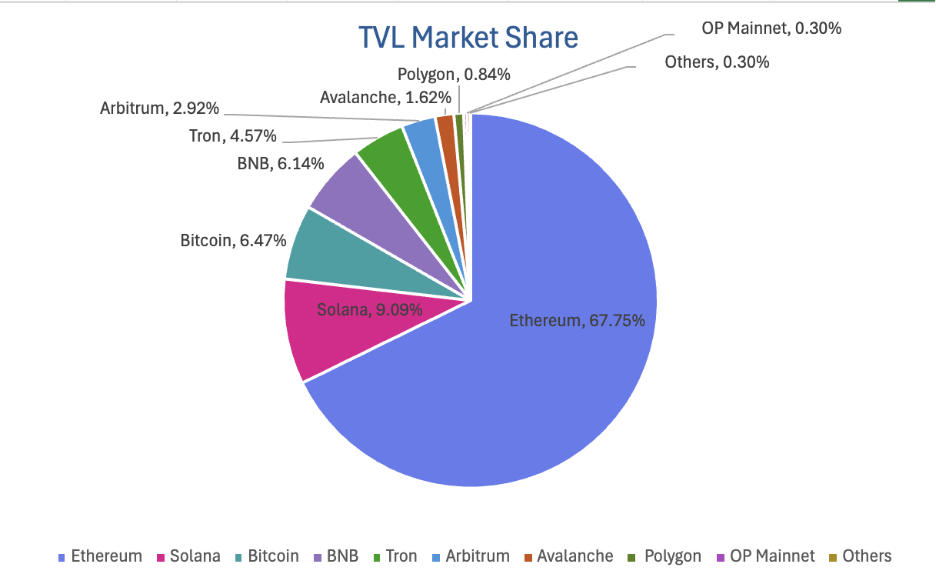

- According to DeFiLlama, the total DeFi TVL reached $169.1 billion this week, up approximately 8.74% from $155.5 billion last week. Breaking down the TVL by public blockchain, the three chains with the highest TVL are Ethereum , with a 67.75% share; Solana, with a 9.09% share; and Bitcoin, with a 6.47% share.

- This week, transaction and ecosystem data across multiple public chains rebounded. With the exception of Ethereum, which saw an 18.5% decrease in daily trading volume, all other chains saw increases, with Sui (+87.56%) and Aptos (+58.46%) showing the most significant growth. Solana's transaction fees surged by 105%, while Aptos and Sui saw increases of 39% and 8.79%, respectively. In terms of daily active addresses, Ethereum (+15.29%) and Solana (+7.14%) performed particularly well, while BNB and Aptos saw declines of approximately 18.5%. TVL (TVL) rose overall, with Sui seeing the largest increase (+22.79%). Solana, BNB, and Aptos saw increases of 14.23%, 13.39%, and 11.89%, respectively.

- New projects to watch: Stable is a Layer 1 blockchain jointly launched by Bitfinex and Tether. Its unique feature is that USDT is used as the native gas token, making peer-to-peer USDT transfers fee-free. Limitless is a decentralized prediction market platform built on the Base chain, focusing on short-term price predictions at the minute, hour, and daily levels. StandX is a decentralized perpetual swap trading platform (Perps DEX) that has launched the interest-generating stablecoin DUSD. Users earn income by minting USDT/USDC, which can also be used as contract margin.

Table of contents

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

2. Panic Index

3.ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange rates

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance

2. Hot money trends this week

1. This week's top five VC and Meme coins

2. New Project Insights

3. New Industry Trends

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

4. Reference Links

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

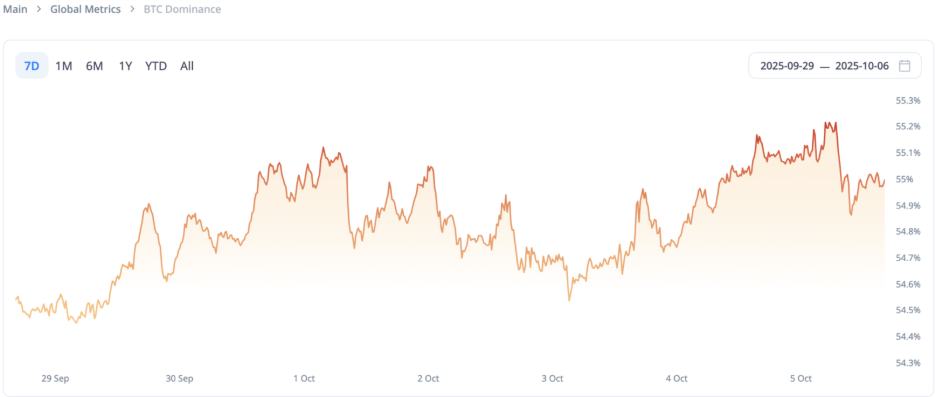

The total market value of global cryptocurrencies is US$4.46 trillion, up 12.6% from US$3.96 trillion last week.

Data source: CryptoRank

Data as of October 5, 2025

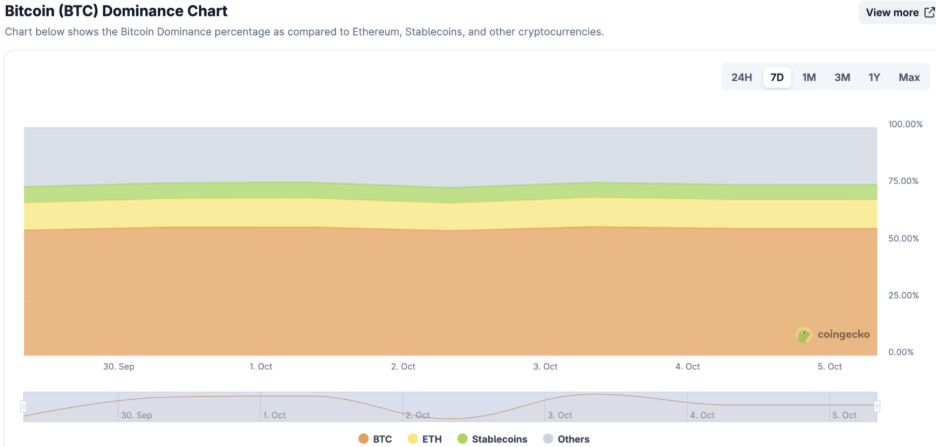

As of October 6, Bitcoin ’s market capitalization was $2.45 trillion, representing 54.9% of the total cryptocurrency market capitalization. Meanwhile, stablecoins’ market capitalization was $298.7 billion, representing 6.69% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of October 5, 2025

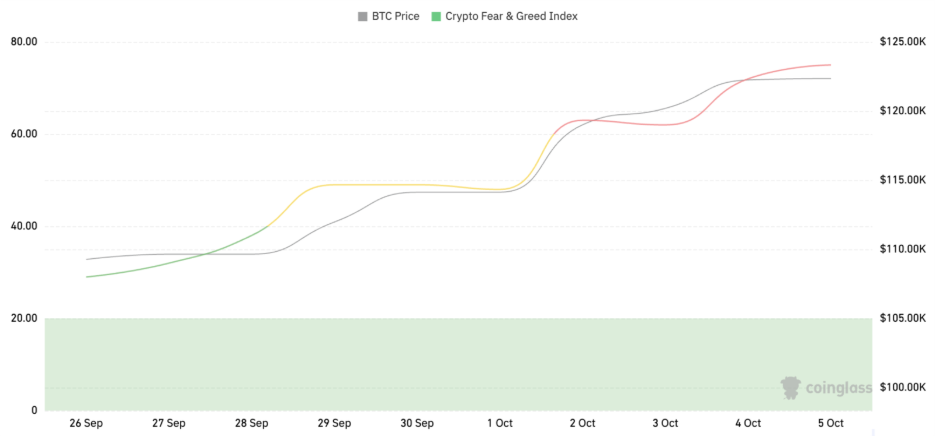

2. Panic Index

The cryptocurrency fear index is at 75, indicating greed.

Data source: coinglass

Data as of October 5, 2025

3.ETF inflow and outflow data

As of October 6, the U.S. Bitcoin spot ETF had a total net inflow of approximately $60 billion, with a net inflow of $3.24 billion this week; the U.S. Ethereum spot ETF had a total net inflow of approximately $14.42 billion, with a net inflow of $1.3 billion this week.

Data source: sosovalue

Data as of October 5, 2025

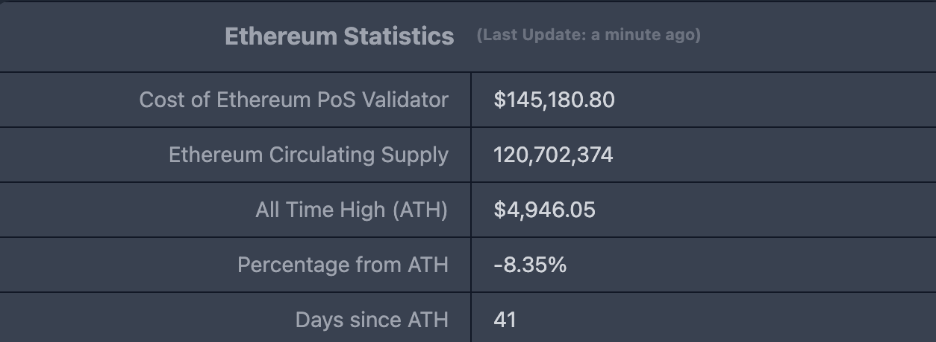

4. ETH/BTC and ETH/USD exchange rates

ETHUSD: Current price: $4,537.29, historical high: $4,946.05, a drop of approximately 8.35% from the previous high.

ETHBTC: Currently at 0.036865, with a historical high of 0.1238

Data source: ratiogang

Data as of October 5, 2025

5.Decentralized Finance (DeFi)

According to data from DeFiLlama, the total TVL of DeFi this week was $169.1 billion, up about 8.74% from $155.5 billion last week.

Data source: defillama

Data as of October 5, 2025

Divided by public chains, the three public chains with the highest TVL are Ethereum, accounting for 67.75%; Solana, accounting for 9.09%; and Bitcoin, accounting for 6.47%.

Data source: CoinW Research Institute, defillama

Data as of October 5, 2025

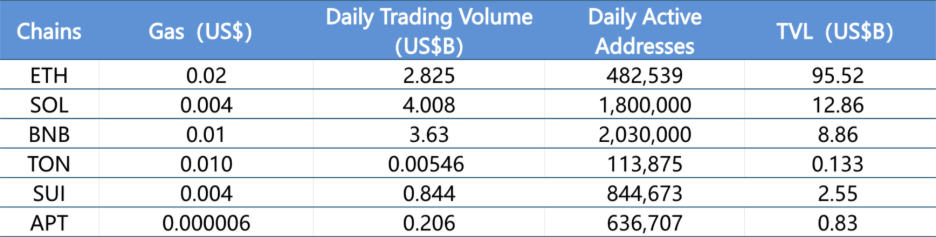

6. On-chain data

Layer 1 related data

The main analysis is based on daily transaction volume, daily active addresses, and transaction fees. The current Layer 1 data includes ETH, SOL, BNB, TON, SUI, and APTOS.

Data source: CoinW Research Institute, defillama, Nansen

Data as of October 5, 2025

- Daily Trading Volume and Fees: Daily trading volume and fees are core indicators of public chain activity and user experience. In terms of daily trading volume, only Ethereum saw an 18.5% decrease this week, while all other chains saw increases: Solana (48.4%), TON (+36.5%), BNB (+26.4%), Sui (+87.56%), and Aptos (+58.46%). Regarding transaction fees, Ethereum, BNB, and TON remained flat this week compared to last week; Solana saw a 105% increase; Aptos and Sui saw increases of 39% and 8.79%, respectively.

- Daily Active Addresses and TVL: Daily active addresses reflect the level of participation and user engagement in a public chain's ecosystem, while TVL reflects user trust in the platform. This week, daily active addresses saw increases for Ethereum (+15.29%), Solana (+7.14%), and TON (+0.24%), while all other chains saw decreases. BNB and Aptos both saw decreases of approximately 18.5%, while Sui saw a 10% decrease. In terms of TVL, Sui saw the largest increase this week, at 22.79%, followed by Solana, BNB, and Aptos, with increases of 14.23%, 13.39%, and 11.89%, respectively. TON saw a slight increase of 2.31%.

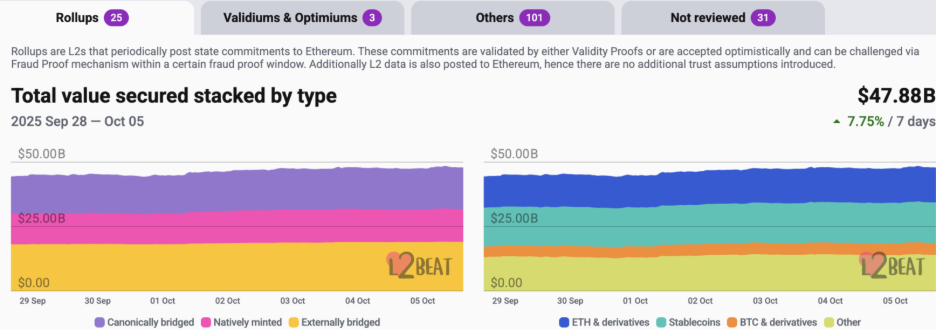

Layer 2 related data

According to L2Beat data, the total TVL of Ethereum Layer 2 is US$47.88 billion, an overall increase of 5.8% this week compared to last week ($45.23 billion).

Data source: L2Beat

Data as of October 5, 2025

Base and Arbitrum occupy the top position with 38.26% and 35% market share respectively. The market share of Base chain has slightly decreased in the past week, while that of Arbitrum has increased.

Data source: footprint

Data as of October 5, 2025

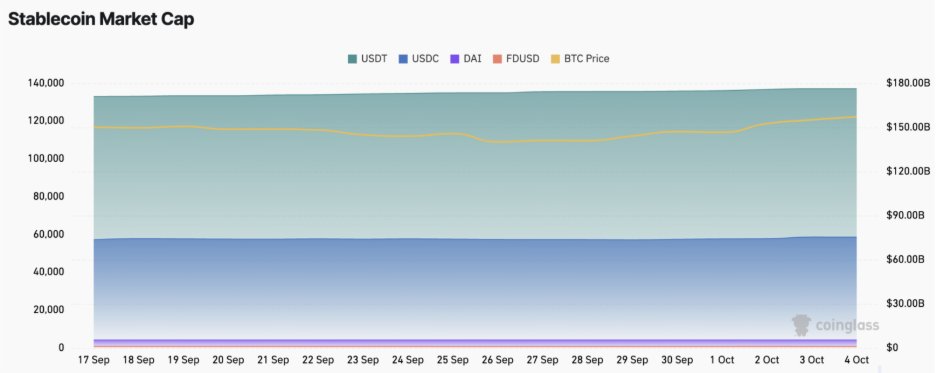

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market value of stablecoins is US$298.7 billion, of which USDT has a market value of US$176.3 billion, accounting for 59% of the total market value of stablecoins; followed by USDC with a market value of US$75.3 billion, accounting for 24.6% of the total market value of stablecoins; and DAI with a market value of US$5.36 billion, accounting for 1.79% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of October 5, 2025

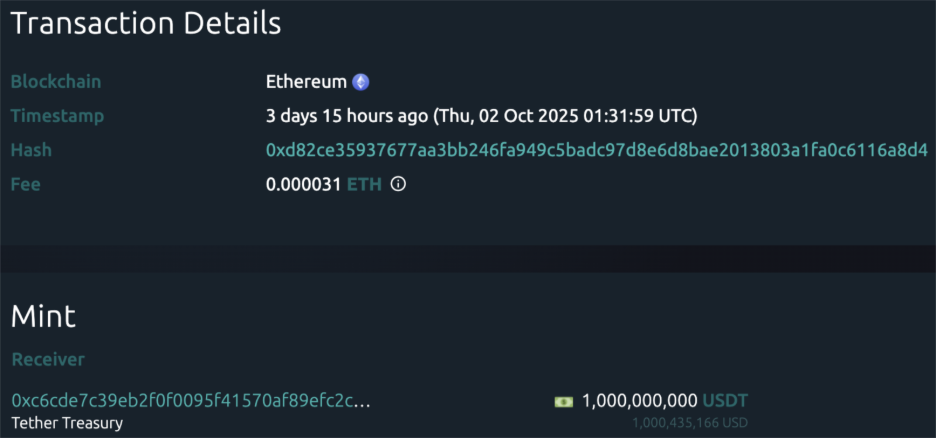

According to Whale Alert data, USDC Treasury issued a total of 4.04 billion USDC this week, and Tether Treasury issued a total of 2 billion USDT. The total stablecoin issuance this week reached 6.04 billion, a 4.49% increase from last week's total of 5.78 billion.

Data source: Whale Alert

Data as of October 5, 2025

2. Hot money trends this week

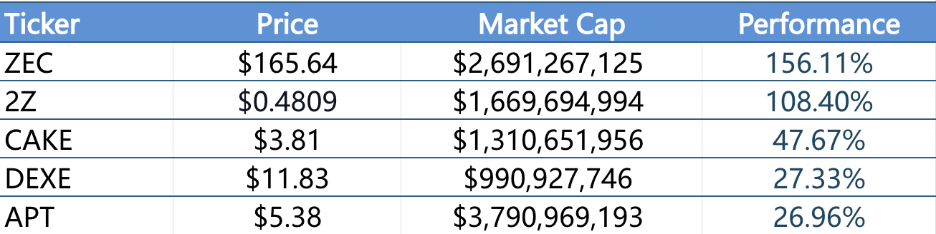

1. This week’s top five VC and Meme coins with the highest growth

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of October 5, 2025

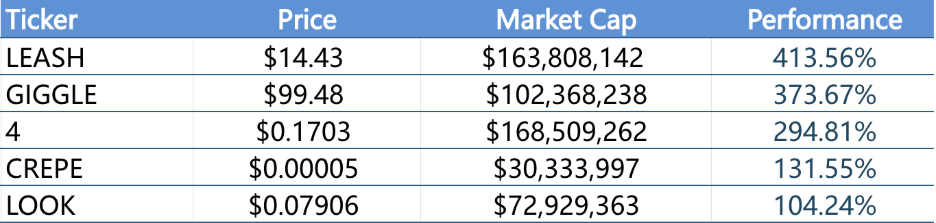

Top 5 Meme Coins with the Most Gains in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of October 5, 2025

2. New Project Insights

- Stable is a Layer 1 blockchain jointly launched by Bitfinex and Tether. Its distinguishing feature is USDT as its native gas token, enabling fee-free peer-to-peer USDT transfers. The chain also supports running smart contracts directly on stablecoins, providing a "gas-free" user experience for applications, native fiat currency integration, and bridgeless cross-chain transfers via USDT0. It also features prioritized execution channels and a compliance architecture, aiming to provide a predictable and stable infrastructure for institutional-grade stablecoin use cases such as payments, cross-border settlement, and treasury management.

- Limitless is a decentralized prediction market platform built on the Base chain, focusing on short-term price predictions at the minute, hour, and daily levels. It has completed two rounds of funding, totaling approximately $7 million, including a recent $4 million strategic funding round. It has also launched a Points Farming program, allowing users to accumulate points through trading, providing liquidity, and referrals for future airdrops and token releases.

- StandX is a decentralized perpetual swap exchange (Perps DEX) that offers an interest-generating stablecoin, DUSD. Users earn income by minting DUSD against USDT/USDC, which can be used as margin for futures contracts. The project has received support from the Solana Foundation and has surpassed $50 million in TVL, demonstrating strong early growth momentum.

3. New Industry Trends

1. Major industry events this week

- On September 29, 2025, Falcon Finance (FF) completed its Token Generation Event (TGE) and launched a number of airdrop and incentive activities, including distributing tokens to early holders, launching small airdrops, and establishing a Launchpool reward pool. Users can participate by staking tokens to promote ecosystem growth and enhance community activity.

- On September 29, 2025, Anoma announced the official launch of its Q1 XAN token airdrop query function. Eligible users can claim through the official website until 09:00 UTC on October 5. Anoma also announced the upcoming launch of a larger Q2 airdrop event, primarily rewarding those who continue to contribute and support the community after the Token Generation Event (TGE), including Discord members, NFT holders, and app testers.

- On September 30, 2025, zkVerify officially launched its mainnet and began the first phase of its VFY token airdrop. Eligible ProofPoints contributors can begin claiming tokens after the mainnet launch. The total supply of VFY tokens is 1 billion, 37% of which will be unlocked at launch. The tokens will be primarily used to pay transaction fees, staking, governance, and validator rewards.

- On September 30, 2025, OpenEden (EDEN) launched a token generation event (TGE) and airdrop activities. The TGE was launched on the Ethereum and BNB smart chains at 14:00 UTC, with an initial circulation of 183.87 million tokens, accounting for 18.39% of the total supply; the airdrop pool size was 15 million tokens (accounting for 1.5% of the total supply), and the snapshot time was from 00:00 on September 23 to 23:59 UTC on September 25. The claim started at 10:30 UTC on September 30. Users can query and claim through official channels.

2. Big events coming up next week

- Yield Basis (YB) is a decentralized finance (DeFi) protocol launched by Curve founder Michael Egorov. The project plans to hold a Token Generation Event (TGE) in the fourth quarter of 2025. A merit-based presale was held on the Legion platform from September 29 to October 5, 2025, and a public sale (FCFS) was held on the Kraken Launch platform from October 1 to October 2, 2025, with a price of $0.20 per token. After the TGE, all tokens will be immediately unlocked, with no lock-up period.

- Lern360.ai (LERN) plans to launch an IDO from October 9th to 11th, 2025, with a target fundraising of approximately $550,000. Approximately 1.25 million LERN tokens will be publicly sold, representing less than 0.3% of the total supply. The project will have a total supply of 1 billion tokens, with 40% released during the TGE. The remaining tokens will be linearly unlocked over six months, aiming to promote the development of its blockchain application ecosystem integrating AI and education.

- FacilPay (FACIL) is a Web3 project focused on simplifying digital payments and settlements. With a total token supply of 500 million, it plans to launch an IDO from October 15 to 17, 2025, with a target fundraising of $400,000. The public sale will include 16 million FACIL tokens, representing 3.2% of the total supply. The token distribution mechanism will release 20% during the TGE, with the remaining tokens unlocked linearly over five months to promote the development of its decentralized payment ecosystem.

3. Important investment and financing last week

- Flying Tulip has completed a $200 million seed round, bringing its valuation to $1 billion. The funding was structured as a Simple Agreement for Future Tokens (SAFT). Investors include renowned institutions such as Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, and Susquehanna Crypto. The funds will be used for platform development, ecosystem expansion, and ensuring the liquidity of its FT tokens. Founded by Andre Cronje, Flying Tulip is a full-stack DeFi platform that integrates spot trading, perpetual contracts, lending, stablecoins, options, and insurance, aiming to create a one-stop on-chain financial ecosystem. (September 29, 2025)

- Lava, a Bitcoin-collateralized lending platform, announced the completion of a $17.5 million Series A extension funding round. Investors include Peter Jurdjevic of the Qatar Investment Authority and former executives from Visa and Blockchain. This follows on from a previous Series A round led by Founders Fund and Khosla Ventures. The platform focuses on building decentralized financial instruments based on Bitcoin, mitigating risks in custody, issuance, repayment, and collateral management through on-chain verifiable collateralization and automated processes. (October 1, 2025)

- KGeN (Kratos Gaming Network), an Aptos ecosystem application, announced the completion of a $13.5 million strategic funding round from investors including Jump Crypto, Accel, and Prosus Ventures, bringing its total funding to $43.5 million. Founded in 2022 by Kratos Studios, KGeN is dedicated to bringing gaming communities in emerging markets to Web3 through its multi-chain game data network and Proof of Gamer (POG) engine. (September 30, 2025)

4. Reference Links

- Flyingtulip: https://flyingtulip.com/

- Stable: https://www.stable.xyz/

- StandX: https://standx.com/

- Limitless: https://limitless.exchange/

- KGeN: https://kgen.io/

- Lava: https://www.lava.xyz/