By Andrew Kang , Partner at Mechanism Capital

Compiled by Tim, PANews

PANews Editor's Note: Andrew Kang blasted the bullish view of Tom Lee, a well-known Wall Street analyst, in a tweet, saying that this was a lack of financial common sense and "retarded." However, in the Twitter comment section, some netizens disagreed with Andrew Kang's reasons for rebuttal, and some netizens even pointed out that he had predicted in April this year that ETH would fall below $1,000. Therefore, this article is somewhat subjective and readers need to make their own judgment.

Tom Lee's Ethereum theory is the most stupid I've seen from any prominent analyst recently. It completely lacks financial common sense. Let's refute it one by one. Tom's argument is mainly based on the following points:

- Stablecoin and RWA adoption

- Digital Oil Narrative

- Institutions will purchase and stake ETH to provide security for their tokenized assets and as operating capital.

- The value of ETH is equal to the sum of all financial infrastructure companies

- Technical Analysis

1) Stablecoin and RWA adoption

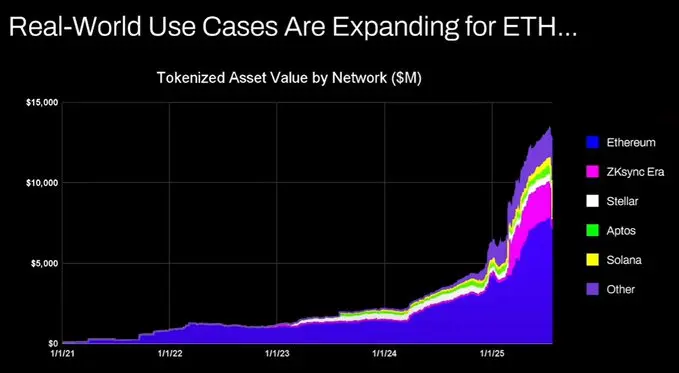

Tom's point is that on-chain activity for stablecoins and tokenized assets is increasing, which should drive up transaction volume, thereby increasing ETH fees and revenue. On the surface, this seems logical, but if you spend a few minutes thinking about the data, you'll find that this is not the case.

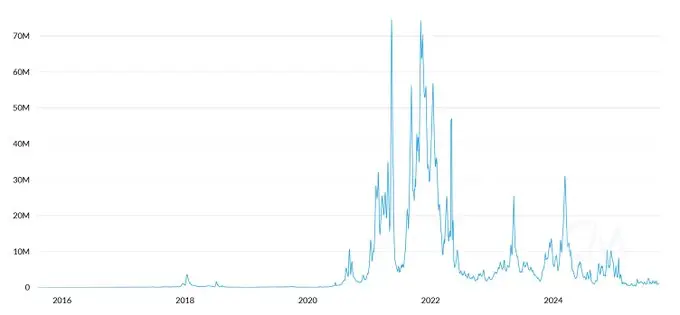

ETH daily transaction fees

Since 2020, the total value of tokenized assets and stablecoin trading volume has increased 100-1000x. Tom's argument fundamentally misunderstands the value accumulation mechanism and may lead one to believe that transaction fees will increase year-on-year, when in fact they are roughly the same level as in 2020.

Here are the reasons:

- Ethereum network upgrade makes transactions more efficient

- Stablecoin and tokenized asset activities are shifting to other chains

- Tokenizing illiquid assets generates almost no fees. The value of the tokenized asset isn't directly proportional to Ethereum revenue. Someone might tokenize a $100 million bond, but if it's only traded once every two years, how much ETH would that generate in fees? Perhaps only $0.10. A single USDT transfer, on the other hand, would generate far more fees.

You can tokenize trillions of dollars worth of assets, but if those assets aren’t actively circulated, you might only add a hundred thousand dollars of value to Ethereum.

Will blockchain transaction volume and fees increase? Yes, but the majority of these fees will be captured by other chains with stronger commercial potential. In the race to blockchainize traditional financial transactions, various parties have seen the opportunity and are actively seizing the initiative. Solana, Arbitrum, and Tempo have reaped most of the early fruits. Even Tether is supporting two new chains, Plasma and Stable, both of which aim to shift USDT trading volume to their own chains.

2) Digital Oil Narrative

Oil is a commodity. Real, inflation-adjusted oil prices have fluctuated within the same range for over a century, with occasional price spikes that eventually fall back. I agree with Tom that ETH can be considered a commodity, but that's not necessarily a positive development. I have no idea what Tom is up to!

3) Institutions will purchase and stake ETH to provide security for their tokenized assets and as operating capital.

Have major banks and other financial institutions already held ETH on their balance sheets? No.

Have any of them announced any plans? No.

Do banks hold a lot of gas because they have to keep paying for energy? No, it's not important; they only pay when they need it.

Do banks buy shares in the custodians they use? No.

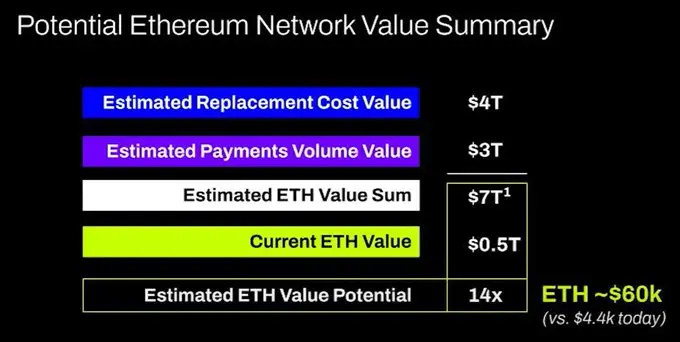

4) The value of ETH is equal to the sum of all financial infrastructure companies

I mean, come on. Another fundamental misunderstanding of the mechanisms of value accumulation, and pure delusion.

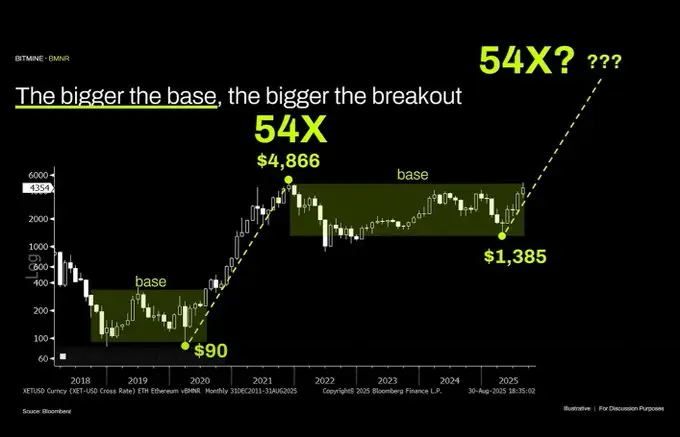

5) Technical Analysis

I'm actually a big fan of technical analysis and think it's very valuable when viewed objectively, but unfortunately, Tom seems to be using technical analysis to draw stochastic lines to support his biases.

The most objective conclusion from observing this chart is that Ethereum is stuck in a multi-year range. This is quite similar to crude oil prices, which have also fluctuated within a wide range over the past 30 years. Ethereum is not only currently range-bound, but has recently reached the top of this range and has yet to break through resistance. From a technical perspective, Ethereum's trend is bearish. The possibility of a long-term range-bound range between $1,000 and $4,800 cannot be ruled out. Just because an asset has experienced a parabolic rise in the past doesn't mean it will continue indefinitely.

Crude oil prices

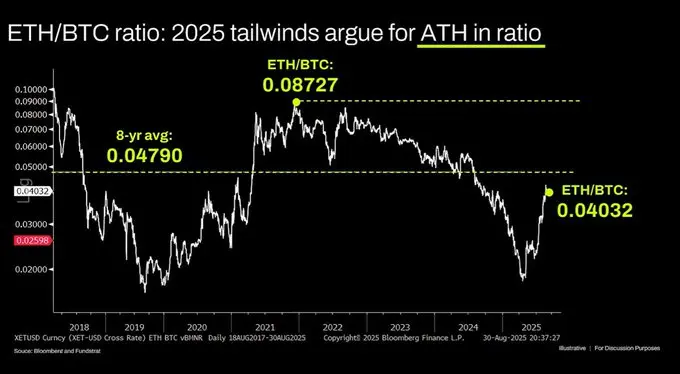

The ETH/BTC chart is also misinterpreted in the long term. While it is indeed in a multi-year sideways trading range, the past few years have been dominated by a downtrend, with a recent bounce from long-term support. This downtrend is driven by a belief that Ethereum's narrative is saturated and its fundamentals cannot support valuation growth, and these fundamentals have not materially changed.

Ethereum's valuation stems primarily from a lack of financial market understanding. Objectively speaking, this understanding gap can indeed create a significant market capitalization, as evidenced by XRP. However, valuations driven by this lack of understanding ultimately have a ceiling. While the accommodative macro liquidity environment is temporarily maintaining ETH's price, unless structural changes occur, it is likely to remain in a persistent downturn.