Author: 0xBrooker

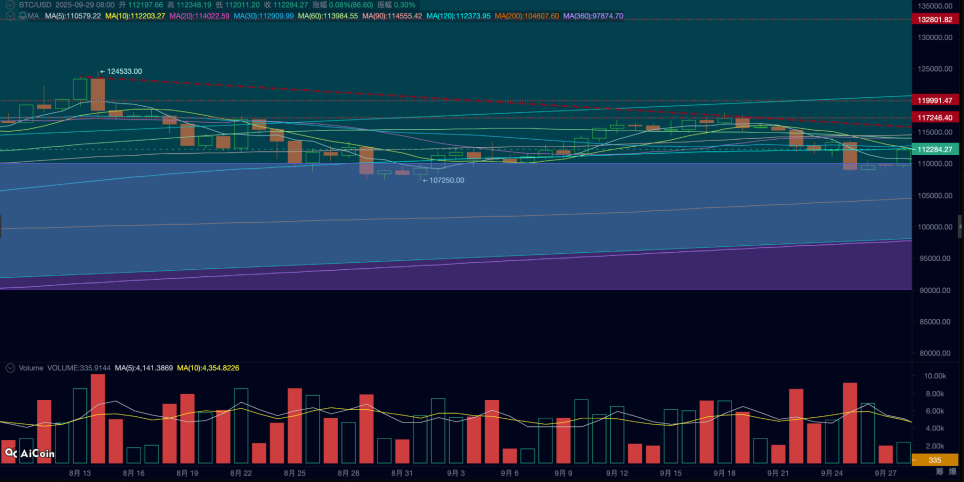

This week, BTC is still in the market volatility after the interest rate cut. With the continued selling pressure and the fading buying power, the price has fallen again.

The main factors involved in BTC pricing include fluctuations in risk appetite caused by the unclear path of interest rate cuts, continued selling by long-term investors, the shift of buying power from inflow to outflow, leverage cleanup in the contract market, and end-of-quarter volatility in the futures market.

The Nasdaq is also in the market turmoil after the interest rate cut, but BTC is affected by other factors and is significantly weaker than the Nasdaq in terms of the duration and magnitude of its decline.

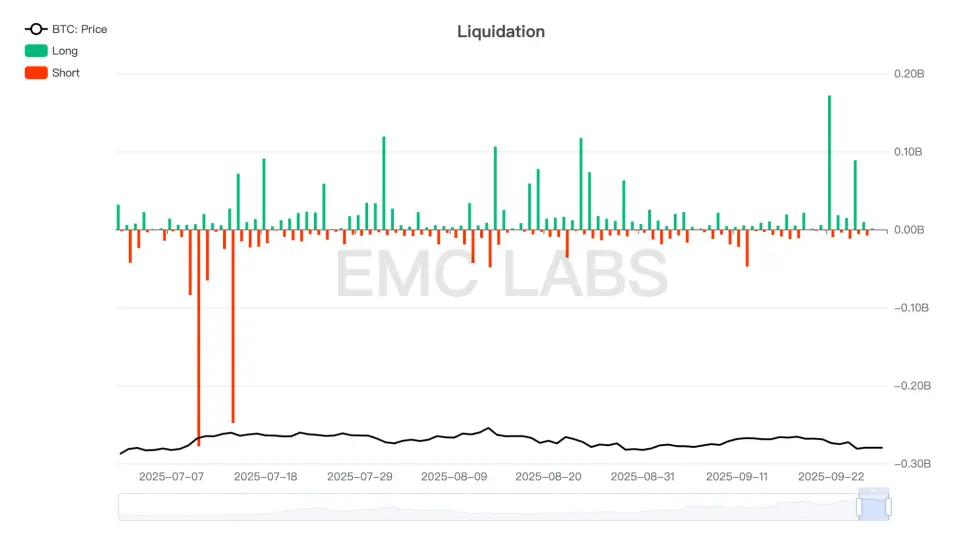

During the week-long adjustment, BTC once again fell below the key support level of $110,000 and recovered over the weekend. After experiencing more than $2 billion in margin calls throughout the week, the total open interest in the contract market fell to $77.1 billion.

After the rate cut, long-term investors intensified their selling, becoming a significant force driving downward pricing. Has BTC peaked at $124,000? The market will provide the answer in Q4.

BTC daily trend

Policy, macro-financial and economic data

Important U.S. economic and employment data released this week include initial claims for the week of September 20 and August core PCE.

Initial jobless claims for the week ended September 20th, released Thursday, came in at 218,000, below expectations of 235,000 and the previous reading of 232,000. Continuing claims, at 1.93 million, remained above the critical 1.9 million mark. This suggests continued employment pressure remains high, but the situation hasn't deteriorated beyond expectations. This helps maintain expectations of a rate cut. US stocks closed higher that day.

On Friday, August core PCE data was released. The core PCE price index rose by 0.2% month-over-month, in line with expectations, and by 2.9% year-over-year, in line with expectations. However, personal spending rose by 0.6% month-over-month, slightly exceeding the expected 0.5%. This indicates that rising inflation was within expectations, but there are still concerns.

Last week, Powell stated that the Fed's emphasis on the deteriorating labor market situation did not mean it would completely ignore inflation data. This left the market in a precarious position, having already priced in three rate cuts totaling 75 basis points this year. Consequently, traders took profits ahead of the release of key data this week, pushing the market lower. The decline only halted and led to a slight rebound after the release of expected data on Thursday and Friday.

After a week of volatility, the market slightly lowered its expectations for rate cuts. The US dollar index rebounded sharply by 0.53% this week after a series of declines, putting downward pressure on stock and crypto asset valuations. The 2-year US Treasury bond rebounded by 1.65%, and the 10-year US Treasury bond rebounded by 1.21%, dampening the optimism that "rate cuts equal easing liquidity" and exerting some pressure on the stock market and long-term assets.

As of the weekend, FedWatch showed that the market still supports two 50 basis point rate cuts before the end of the year, but the probability has slightly decreased compared to last week. Both US stocks and Bitcoin fell before the release of key data this past week, stabilizing and rebounding slightly after the releases, but still showing slight losses for the week.

Crypto Market

BTC fell in tandem with the Nasdaq this week, but its 2.68% drop was far greater than the Nasdaq's 0.65%.

Technically, BTC has fallen below the 120-day moving average this week, and has returned to the "Trump bottom" (US$90,000-110,000) where it has been lingering for 10 months, indicating that medium-term prices may weaken.

ETH fell below the rising channel since April and once fell below the important key support level of $4,000.

The weakening of BTC is the result of the combined effect of multiple factors.

First, the decline in risk appetite stemming from lowered expectations for interest rate cuts. This ultimately manifested itself in a shift in funds flowing into the BTC Spot ETF channel, with limited financing capabilities for DATs leading to reduced buying power.

Secondly, there's the curse of the cyclical law. Historically, BTC's peak often occurs 525 ± 7 days after the halving, corresponding to the 21st of this month. We've noticed that long-term investors, who strictly adhere to the cyclical law, have continued to sell, even after the price broke through this week. This has undoubtedly accelerated the price decline.

Finally, there was the liquidation of leverage in the futures market. Around the time of the mid-September interest rate cut, open interest in BTC and ETH futures approached record highs. This week, prices broke through these levels, eliminating tens of billions of yuan in open interest, with margin calls exceeding $2 billion.

BTC perpetual contract liquidation statistics

The current Crypto market has undergone tremendous changes, with different factors pointing to support and opposition to the judgment that it has reached its peak.

Institutional and US stock funds have become the primary buyers, and while cryptocurrency funds are retreating, cyclical investors, driven by long-term trends, still hold significant amounts of BTC, and their impact on the cycle remains significant. With over 95% of BTC already in circulation, the impact of production cuts on these assets is minimal. Another factor that cannot be ignored is that the Federal Reserve is indeed pushing for interest rate cuts, which will benefit high-risk assets in the long term.

We tend to respect the power of all parties and wait and see how the situation develops while controlling our positions.

Long-term traders trading according to the "cycle law" are selling off their positions in an orderly manner, becoming the biggest short sellers. Their performance in the rest of this month and before and after another interest rate cut in October will be very important.

At the same time, we also need to pay close attention to economic and employment data that affect expectations of interest rate cuts and whether funds into ETFs and DATs companies can resume inflows in a timely manner.

Cycle indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0, which is in the rising relay period.