Compiled by Tim, PANews

Avalanche was originally designed as a high-performance public blockchain for institutional finance, but its next phase of development will focus on the RWA space. Rather than competing solely on throughput or virtual machine compatibility, Avalanche is positioning itself as the preferred platform for tokenized credit, treasury bonds, and other regulated assets.

According to recent news, Grove Finance plans to deploy approximately $250 million in RWAs on the Avalanche blockchain through Centrifuge and Janus Henderson. This move will introduce new institutional partners and financial products to the ecosystem.

In this article, we will introduce Avalanche’s technical architecture for institutions, Grove’s RWA deployment and its impact, and explain why tokenized credit and government bonds make Avalanche the preferred public chain in the RWA space.

Why is Avalanche important to RWA?

The Avalanche platform, leveraging its unique Avalanche consensus protocol, delivers sub-second transaction finality and high throughput, enabling developers to build custom, compliant, and high-performance Layer 1 networks: subnets. These attributes make the platform particularly well-suited for institutional applications, where deterministic settlement and low transaction fees are paramount.

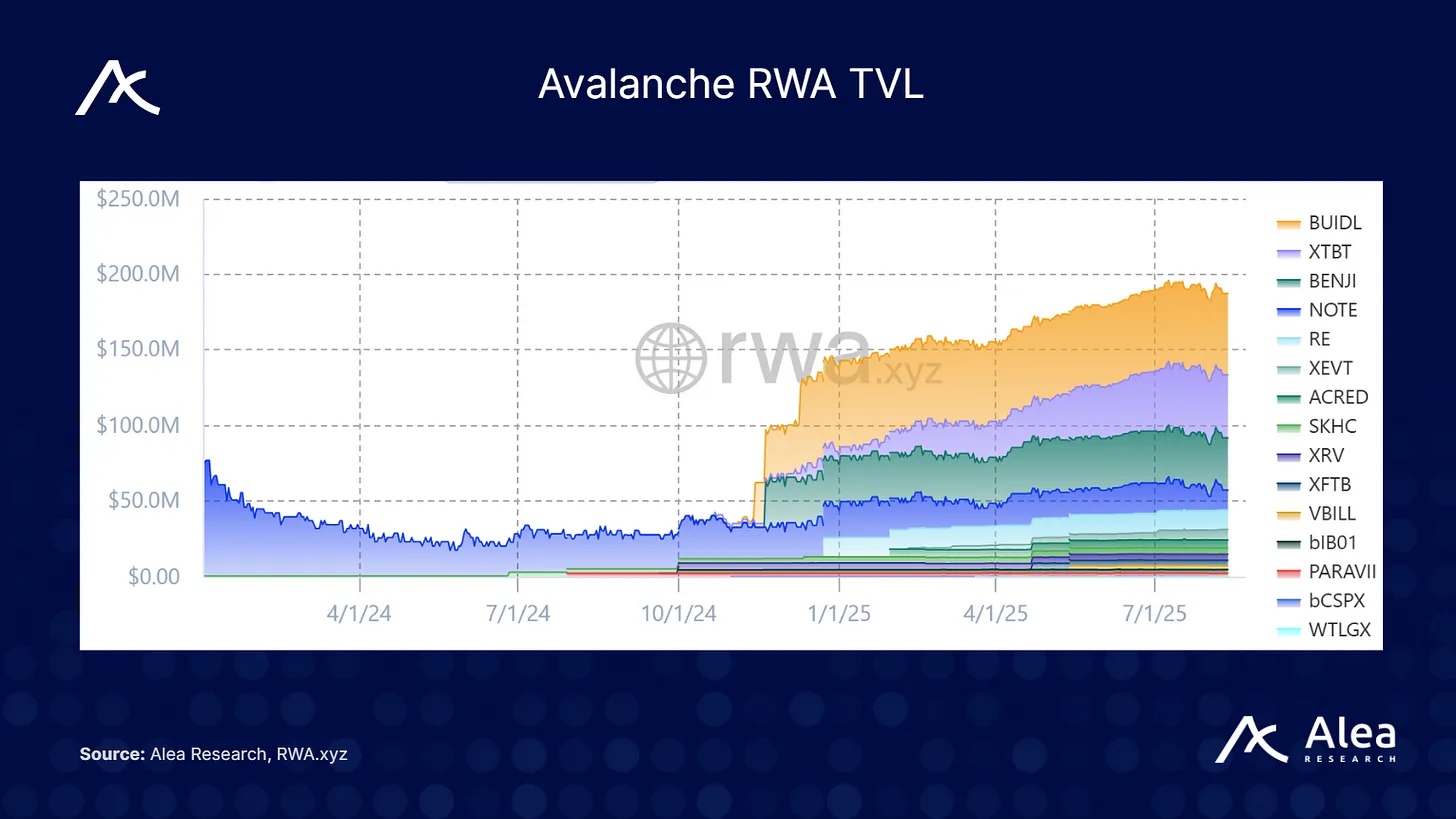

As of now, Avalanche carries nearly $180 million in tokenized RWA value, covering 35 asset classes.

These assets already include some important traditional financial product categories, such as tokenized government bonds, credit products, institutional funds and alternative assets.

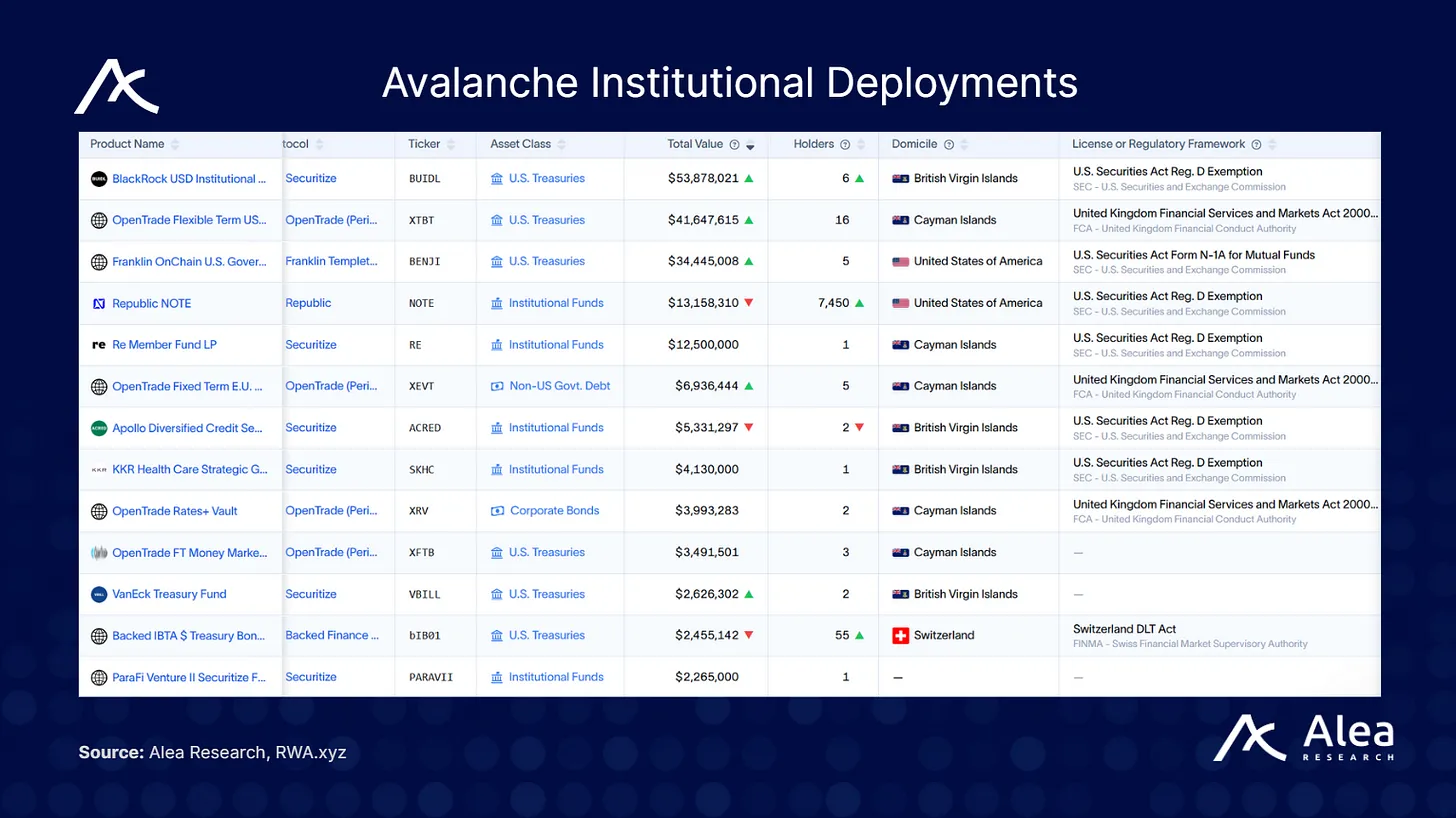

- Tokenized Treasury and Credit Products: OpenTrade connects U.S. Treasury short-term notes and institutional credit to DeFi, while Backed Finance introduces regulated stocks such as SPY and COIN to the blockchain under the Swiss regulatory framework.

- Institutional Funds: BlackRock’s BUIDL Fund, issued through Securitize and available for deposit into Avalanche wallets and as DeFi collateral, contributed $53 million to institutional RWA TVL.

- Reinsurance and Alternative Investments: RE tokenizes reinsurance premiums to create uncorrelated income streams.

Avalanche's network supports custom subnets, enabling asset managers to deploy dedicated chains with independent validator nodes and compliance rules. The ecosystem is compatible with programmable stablecoins like avUSD and sAVAX, as well as permissionless lending protocols and a variety of liquidity staking solutions, including innovative protocols like sAVAX, ggAVAX, and yyAVAX.

Collaboration between Grove, Centrifuge, and Janus Henderson

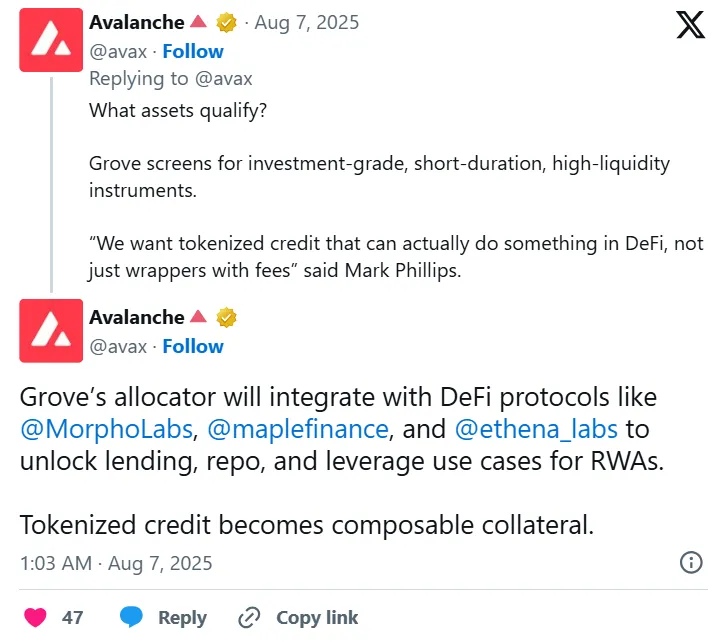

In late July 2025, Avalanche announced that the institutional credit protocol Grove Finance will be launched on its platform, aiming to introduce approximately $250 million in RWAs. Grove is currently working with tokenization pioneer Centrifuge and Janus Henderson, a giant fund management company with $373 billion in assets under management, to promote the on-chain deployment of the two funds:

- Janus Henderson Anemoy AAA CLO Fund (JAAA): A CLO fund that allocates senior credit assets through regulatory standards.

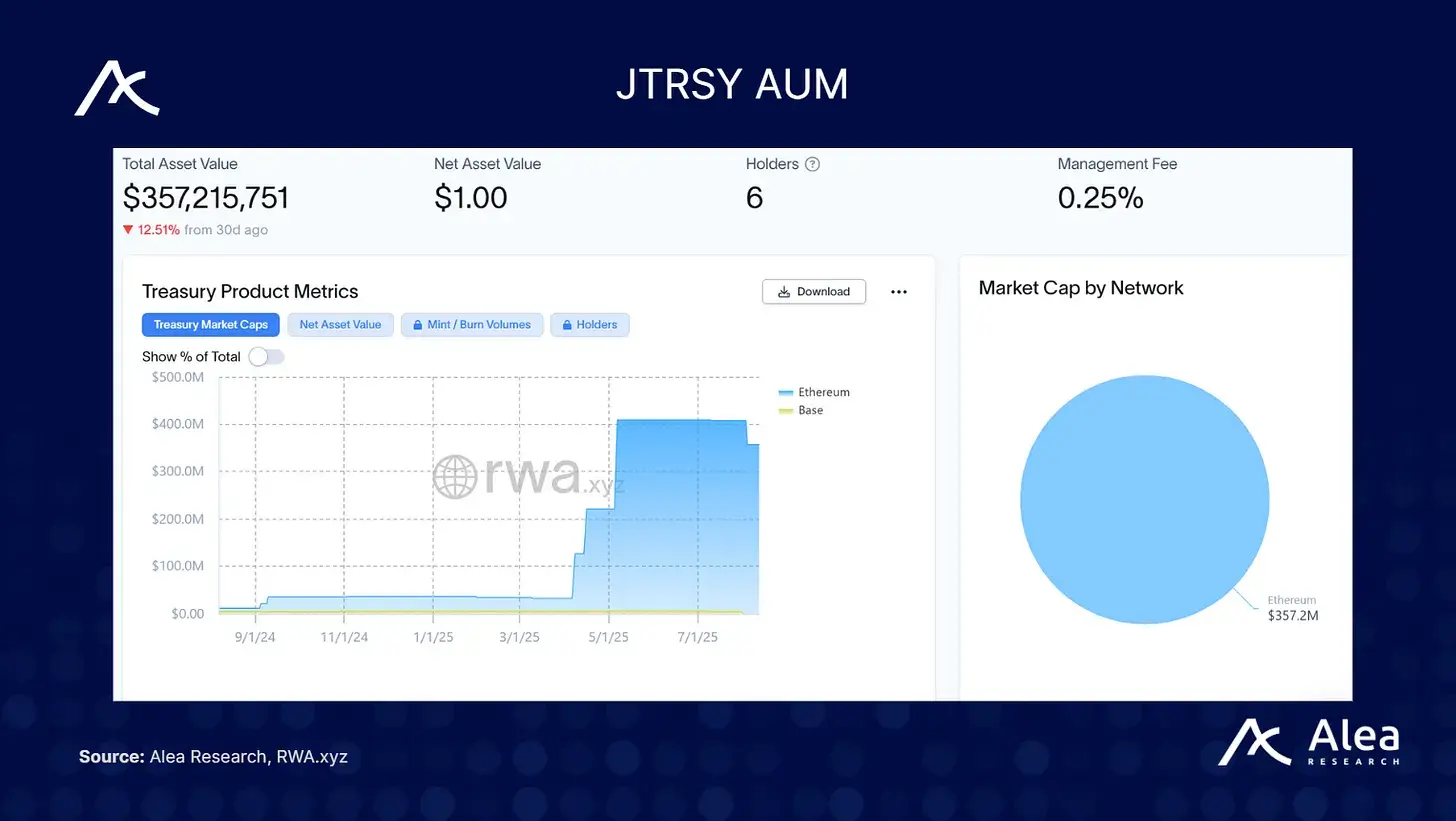

- Janus Henderson Anemoy Treasury Bond Fund (JTRSY): A strategy that invests in short-term U.S. Treasury bonds.

The influx of Grove's capital will more than triple Avalanche's presence in the RWA sector. This partnership will also introduce powerful new partners to the ecosystem, deepening strategic synergies with asset management giant Janus Henderson and decentralized asset protocol Centrifuge. Product deployments by institutions including Apollo Global Management's ACRED, WisdomTree's tokenized fund, KKR Healthcare Growth Fund, and BlackRock, Franklin Templeton, and VanEck demonstrate Avalanche's strong momentum in institutional adoption.

RWA adoption on Avalanche

For users and developers, Avalanche's expanding RWA ecosystem provides new foundational components for building income strategies and fixed-income products.

Developers can integrate tokenized collateralized loan obligations and U.S. Treasuries into lending markets or automated vault systems, allowing retail investors to enter financial areas traditionally limited to institutions.

For asset allocators, Avalanche is emerging as a reliable alternative to Ethereum in the institutional RWA space. Its high-performance architecture, low fees, and proven subnet technology make it particularly attractive to asset managers seeking to tokenize their funds.

The Grove deployment demonstrates the operationalization of large credit portfolios on-chain, potentially unlocking liquidity and increasing transparency for investors. The network's partnership with Visa for global stablecoin settlement, coupled with record DEX trading volumes, confirms that Avalanche is building infrastructure for payments and capital markets.