Author: Seed.eth

S&P Global Ratings has assigned Strategy Inc. (formerly MicroStrategy) a B- rating with a stable outlook.

On the surface, this appears to be a "non-investment grade" rating. However, placed in the context of the crypto industry's development, this result reveals a deeper problem: traditional rating models still have significant understanding and valuation biases when faced with emerging paradigms such as "Bitcoin Treasury Companies."

Strategy's business model is very clear: it raises funds through various means such as issuing stocks, convertible bonds, preferred stock and bonds, and continues to purchase Bitcoin, having accumulated approximately 640,000 Bitcoins to date.

This means that the company's core strategy is not to rely on software business profits, but to build a new corporate structure with Bitcoin assets at its core and capital market financing capabilities as its support. The traditional standards used to evaluate "operating companies" are basically ineffective here.

However, S&P still used its inherent framework in the rating report, highlighting the following risks: excessive concentration of assets in Bitcoin, a single business structure, weak risk-adjusted capital strength, insufficient US dollar liquidity, and a "currency mismatch" problem where all debts are denominated in US dollars while assets are mainly in Bitcoin.

Traditional rating systems: Not always "correct"

Historically, credit rating agencies like S&P have not always been accurate during major financial transformation cycles.

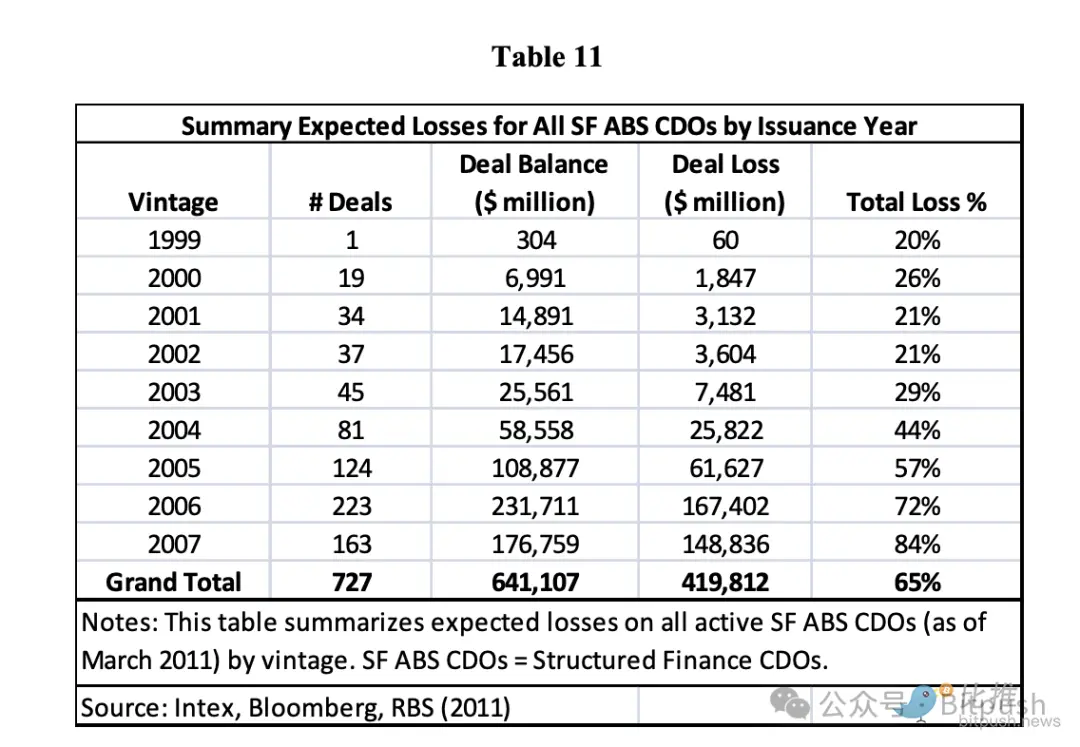

Back in the mid-2000s, US structured finance products (particularly CDOs backed by subprime mortgages) received numerous high ratings upon issuance, many even receiving the AAA label. Research indicates that between 2005 and 2007, 727 asset-backed CDOs (SFABS CDOs) were issued in the US, totaling approximately $641 billion. However, these products subsequently suffered write-downs totaling approximately $420 billion.

Wikipedia and other sources point out that "many CDOs issued between 2005 and 2007, after receiving top ratings, were downgraded to junk status or suffered principal losses by 2010." In these events, financial giants like Lehman Brothers were deeply trapped in CDO and MBS assets. When the value of these assets plummeted and leverage got out of control, they eventually went bankrupt or were acquired.

In other words, structured products that rating agencies once "understood" as having an A (or higher) rating ended up becoming the hardest hit areas. This illustrates a fact—when the market changes, old models are prone to misjudgment.

Returning to Strategy, traditional rating agencies may have noticed that it lacks diversified revenue streams, its liquidity is potentially affected by Bitcoin volatility, and its debt is denominated in USD while its assets are denominated in Bitcoin, meaning that a sharp drop in Bitcoin's value could damage its debt repayment chain. However, the industry is also recognizing that the Strategy model's success is underpinned by capital markets, global Bitcoin liquidity, and institutional funding. Traditional models haven't fully incorporated this logic.

The "old system" that cannot be awakened

Not only S&P, but many well-known traditional investment research institutions are using the old framework to view crypto asset companies.

For example, Charles Schwab's Schwab Equity Ratings system (rated from A to F, with F being the lowest expected performance) has almost consistently rated Coinbase (COIN) and MicroStrategy (MSTR) as F for the past 3-5 years.

And what happened during this period?

- COIN doubled multiple times from 2022 to 2025, while Schwab maintained its F rating.

- MSTR has increased by over 1000% since 2020, while Schwab remains at F.

- Even when MSTR's actual results in some quarters far exceeded analysts' expectations, the rating remained unchanged.

- This is not a one-time occurrence, but a consistent low rating that has persisted for many years.

in other words:

Prices change, markets change, Bitcoin narratives change, but the model remains the same.

Schwab didn't "misjudge"—it simply insisted, based on its modeling logic, that these companies "did not conform to traditional profit logic."

Similarly, Moody's and S&P have maintained Coinbase's credit rating in the speculative range for a long time, citing the following reasons:

- High business volatility

- Revenue is dependent on market cycles

- Lack of predictable cash flow

- Risk exposure is too concentrated

Does this sound familiar?

This uses the same template as the logic for Strategy B-.

Summarize

It's actually not complicated: the root of the problem is that they are still using the valuation models of the previous generation to measure the asset forms of the next generation.

Traditional financial institutions are not unprofessional; they simply cling to their established thinking. In their understanding, a high-quality asset must generate predictable cash flows, a healthy business must operate stably in a low-volatility environment, and its valuation must strictly adhere to comparable company analysis or an income-based approach.

However, emerging crypto treasury companies tell a completely different story. Their core logic is: "We don't rely on traditional operating cash flow to support asset value. Instead, we gain strong financing and market confidence through innovative asset structures." This isn't a simple debate of right and wrong, but a profound paradigm shift.

Therefore, S&P's B- rating for Strategy isn't crucial in itself. The truly symbolic signal is that the new model represented by Bitcoin Treasury has evolved to the point where traditional rating systems can no longer ignore it and must attempt to explain it.

But we must clearly understand that "interpretation" is not the same as "understanding," "understanding" is not the same as "acceptance," and "acceptance" certainly does not mean integrating it into the mainstream framework. The cognitive transformation of the old system will be as slow as the movement of a glacier—it will eventually awaken, but it will never happen overnight.

History has repeatedly shown that a completely new market structure often takes shape quietly while the old system is still in a state of semi-consciousness.

Including Bitcoin on company balance sheets has gone from a pioneering experiment to a fait accompli. Whether the traditional world recognizes it, accepts it, or even truly understands it is only a matter of time.