Article by: Prathik Desai

Article compiled by: Block unicorn

Foreword

The past year has been turbulent for both centralized exchanges (CEXs) and decentralized exchanges (DEXs). Over the past 12 to 18 months, participants in the cryptocurrency space have witnessed a shift in trading momentum and liquidity from centralized exchanges (CEXs) that rely on trust and compliance to decentralized exchanges (DEXs) that promise user transparency, composability, and self-custody.

Despite media reports claiming a strong comeback for centralized exchanges, a deeper analysis of the data reveals that the actual situation is far more complex.

In this quantitative analysis, I will delve into the data from DEX and CEX to better understand the evolution of spot and leveraged liquidity in cryptocurrency trading.

CEX-DEX War

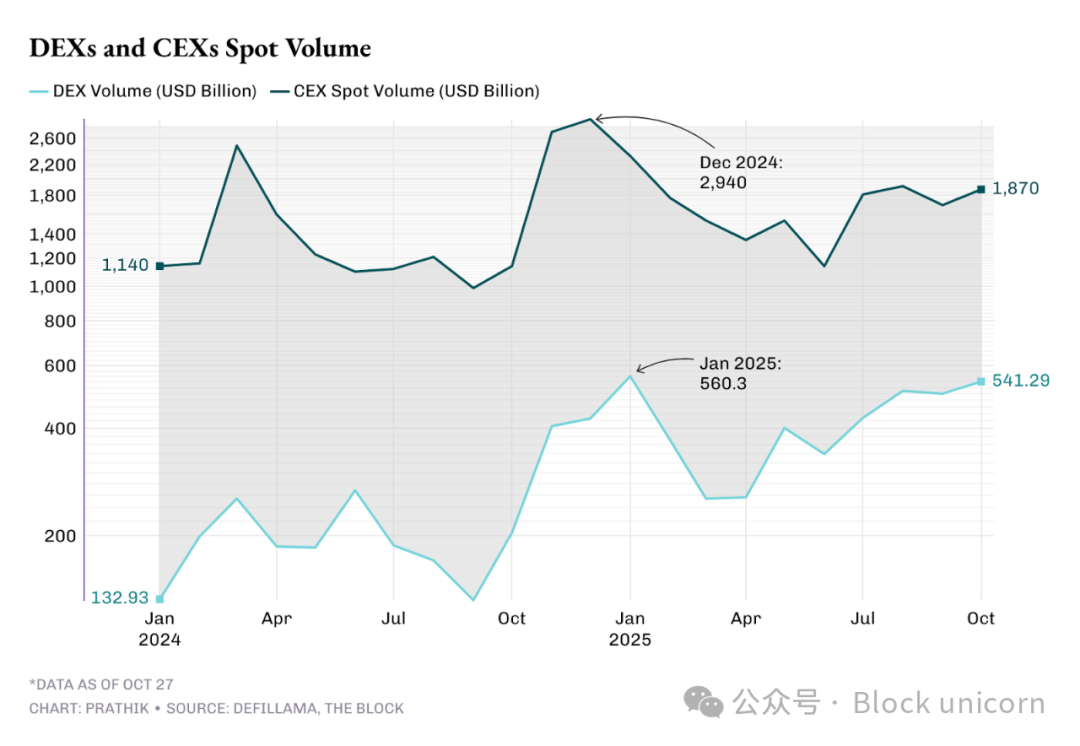

In the long run, 2025 appears to be a year of strong recovery for centralized exchanges (CEXs) after nearly two years of declining confidence and shrinking liquidity. From January 2021 to May 2022, the average monthly trading volume of CEXs well exceeded $1.5 trillion. However, from June 2022 until November 2023, monthly trading volume only surpassed the $1 trillion mark once.

Trading volume on CEXs has surged over the past two years. Benefiting from ETFs and favorable macroeconomic factors, trading volume has repeatedly reached new highs. By December 2024, this figure had climbed to $2.94 trillion.

The fourth quarter of 2024 marked a turning point for trading volume growth. Spot trading volume on CEXs surged from $1.14 trillion in October to $2.94 trillion in December, bringing the quarterly average monthly trading volume to over $2.25 trillion.

This growth aligns with the improved market risk appetite following US President Donald Trump's re-election and the progress of negotiations supporting cryptocurrency regulation.

This growth momentum continued into the first quarter of 2025, with average monthly trading volume approaching $1.8 trillion, but declined by about 30% to $1.3 trillion in the second quarter. However, trading volume rebounded rapidly in the third quarter of 2025, with average monthly trading volume exceeding $1.8 trillion.

While centralized exchanges (CEXs) have experienced a strong recovery, decentralized exchanges (DEXs) have not stagnated. In fact, their growth rate has consistently outpaced that of centralized exchanges.

In January 2024, spot trading volume on DEXs was approximately $133 billion. Just 18 months later, that figure quadrupled to over $540 billion.

In the first quarter of 2025, the average monthly trading volume on DEXs was $395 billion, and in the second quarter it was $332 billion. By the third quarter of 2025, the average monthly trading volume had increased by 50% to $480 billion. October's trading volume had already exceeded $540 billion.

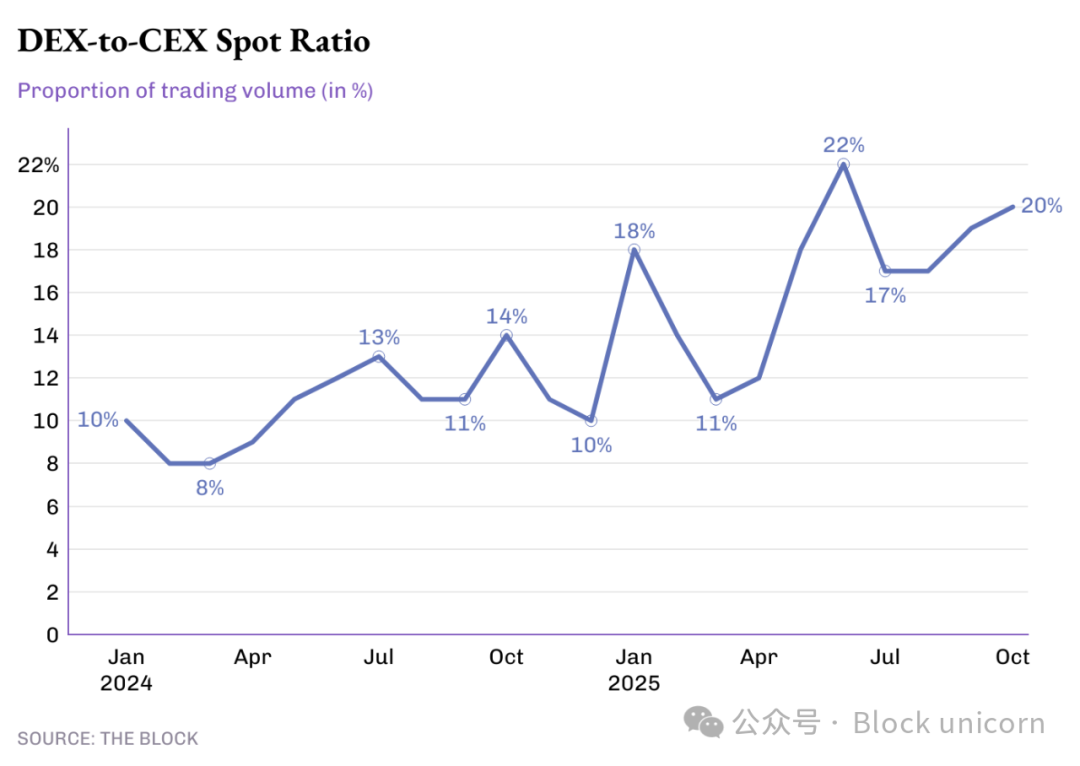

So far this year, decentralized exchanges (DEXs) have accounted for nearly 20% of all spot trading volume, up from just over 10% in 2024. While centralized exchanges (CEXs) still dominate the market due to their superior fiat deposit channels, DEXs have become the preferred choice for users seeking speed, composability, anonymity, and self-custody.

Protocols such as Uniswap v4, Hyperliquid L1, and Raydium offer a better user experience, lower gas costs, and smaller spreads, narrowing the experience gap between the two ecosystems.

The driving force of derivatives

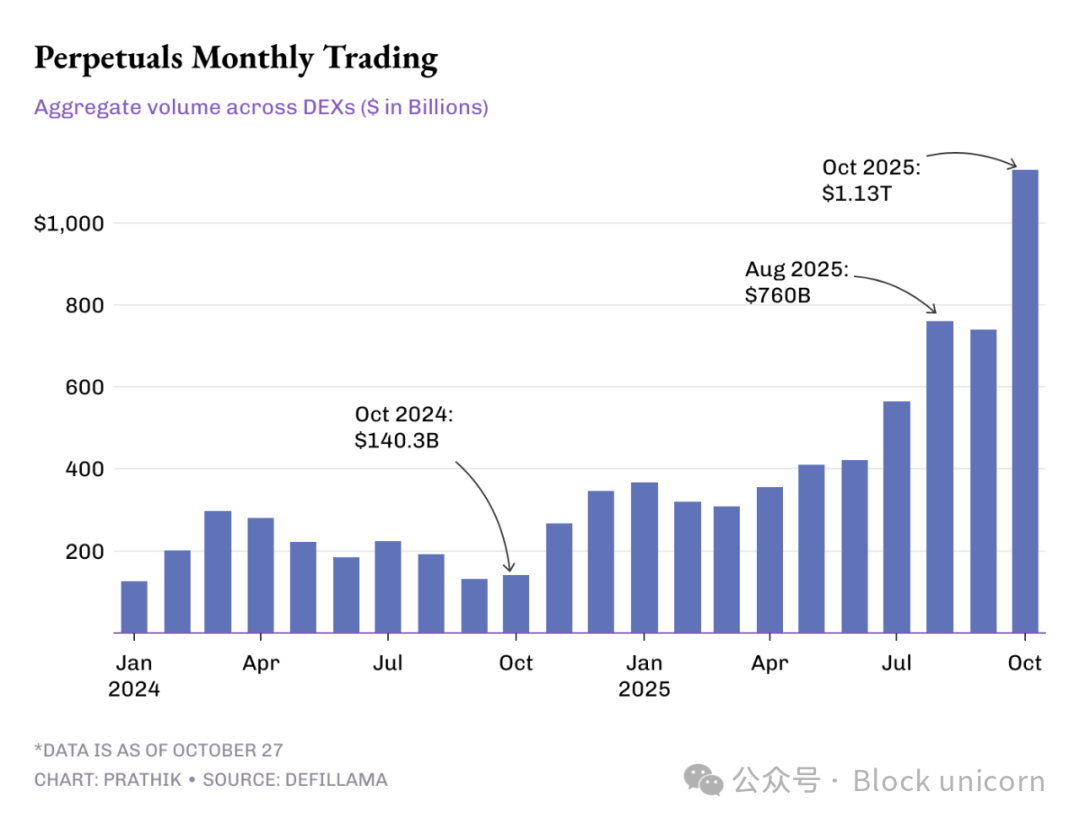

If you were to ask me what the most important factor driving DEX activity is, I would unhesitatingly choose perpetual contracts. Before 2024, on-chain perpetual contracts remained a niche product, with monthly trading volumes only in the hundreds of billions of dollars. This was primarily concentrated on protocols such as dYdX, GMX, and a few other Arbitrum-based DEXs. However, by the end of 2025, these platforms began to rival the scale of the entire decentralized exchange (DEX) spot market.

In January 2024, the monthly trading volume of perpetual contract DEXs was $127 billion. By December 2024, this figure had nearly tripled to $345 billion.

But 2025 changed that trend. The average monthly trading volume of perpetual contracts more than doubled, from $332 billion in the first quarter to $688 billion in the third quarter. In October alone, its trading volume exceeded $1.13 trillion, marking the first time that on-chain derivatives trading volume has surpassed one trillion dollars, more than twice the size of the DEX spot market.

These data not only indicate that more traders are entering the on-chain space, but also suggest increased trading activity per trader. On-chain DEXs offering perpetual contracts now replicate some features of centralized exchanges (CEXs), such as independent margin, deep order books, and cross-chain collateral. Furthermore, they offer a high degree of composability that CEXs cannot provide. These advantages are sufficient to retain a large number of high-value traders on-chain.

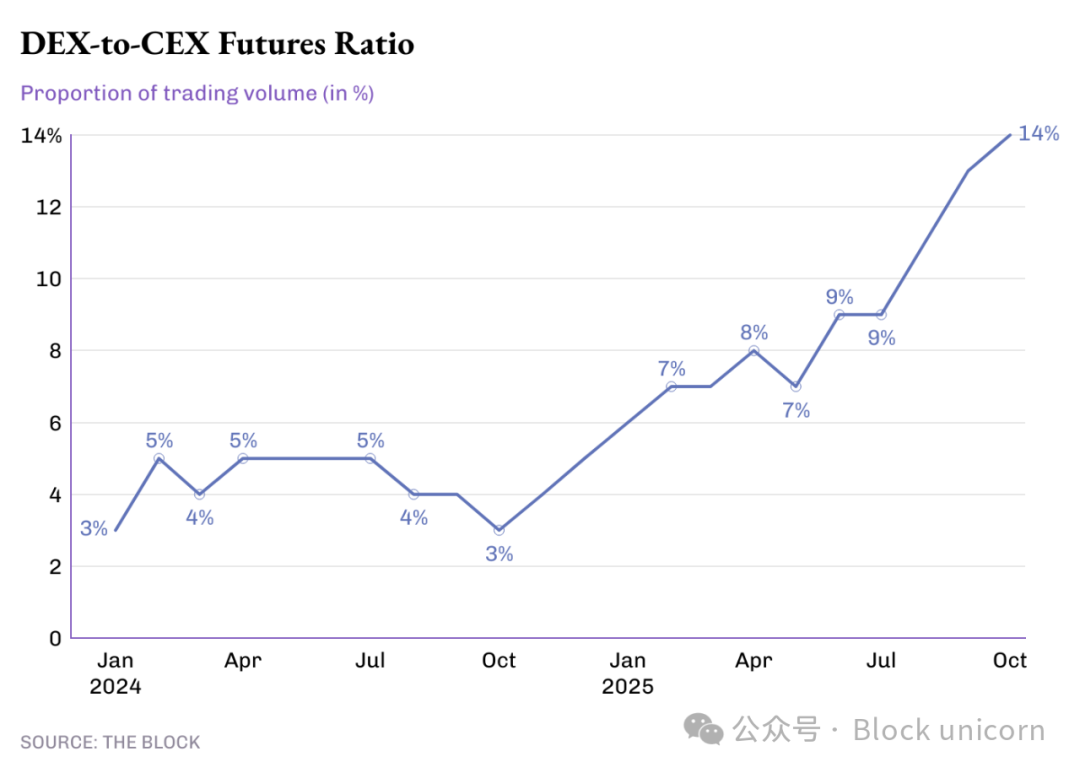

This trend is reflected in the steady increase in the trading ratio of decentralized exchanges (DEXs) and centralized exchanges (CEXs) in derivatives trading.

In 2024, decentralized exchanges handled less than 5% of global futures trading volume. By mid-2025, this figure had doubled to 10%, and by October it had reached 14.3%, marking the highest percentage of on-chain derivatives relative to centralized exchanges.

This number is still small compared to Binance's size, but it foreshadows future trends. While centralized exchanges' derivatives trading volumes have remained largely range-bound this year, decentralized exchanges have seen quarterly growth in trading volumes since mid-2023.

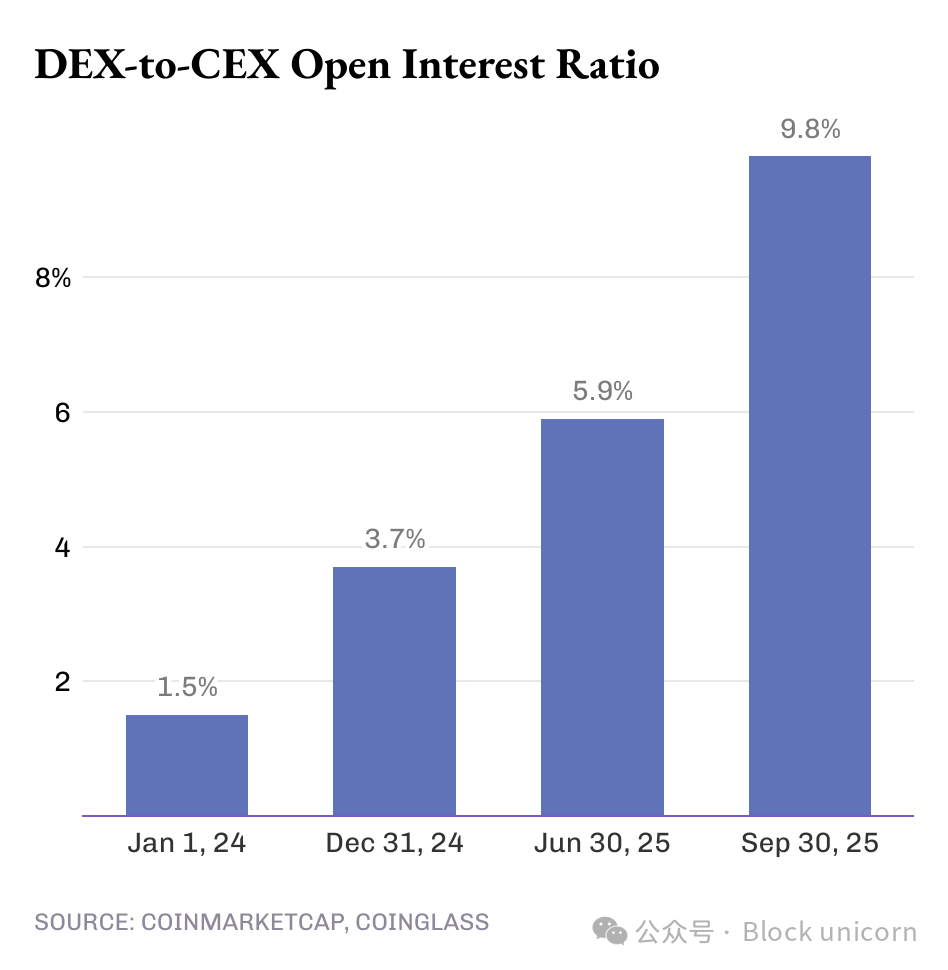

While trading volume reflects some aspects, open interest (OI) provides more detailed information. As of January 1, 2024, open interest on on-chain exchanges accounted for only 1.5% of global derivatives trading volume. By December 31, 2024, this proportion had doubled to 3.7%, reaching 5.9% by June 30, 2025. And by September 30, 2025, this proportion had reached 9.8%. In less than two years, it grew more than 6.5 times.

These changes collectively indicate that while centralized exchanges (CEXs) remain liquidity hubs, decentralized exchanges (DEXs) are quickly becoming new risk centers. Traders' choices of where to trade depend not only on trust but also on the platform's additional features.

The growth of DEXs in spot, derivatives, and perpetual contracts demonstrates that they offer functionality that CEXs cannot replicate, at least not yet. While the absolute number of on-chain traders may still be a minority, their intentions and the functionality they demand send a clear message to cryptocurrency developers: what should be prioritized when developing cryptocurrency exchanges.

That concludes this quantitative analysis report. See you in the next article.