By Ben Strack

Compiled by AididiaoJP, Foresight News

Following dovish comments from Federal Reserve Chairman Jerome Powell, now seems like a good time to roll out a strategy, especially as macro factors continue to have a growing influence on the cryptocurrency market over time.

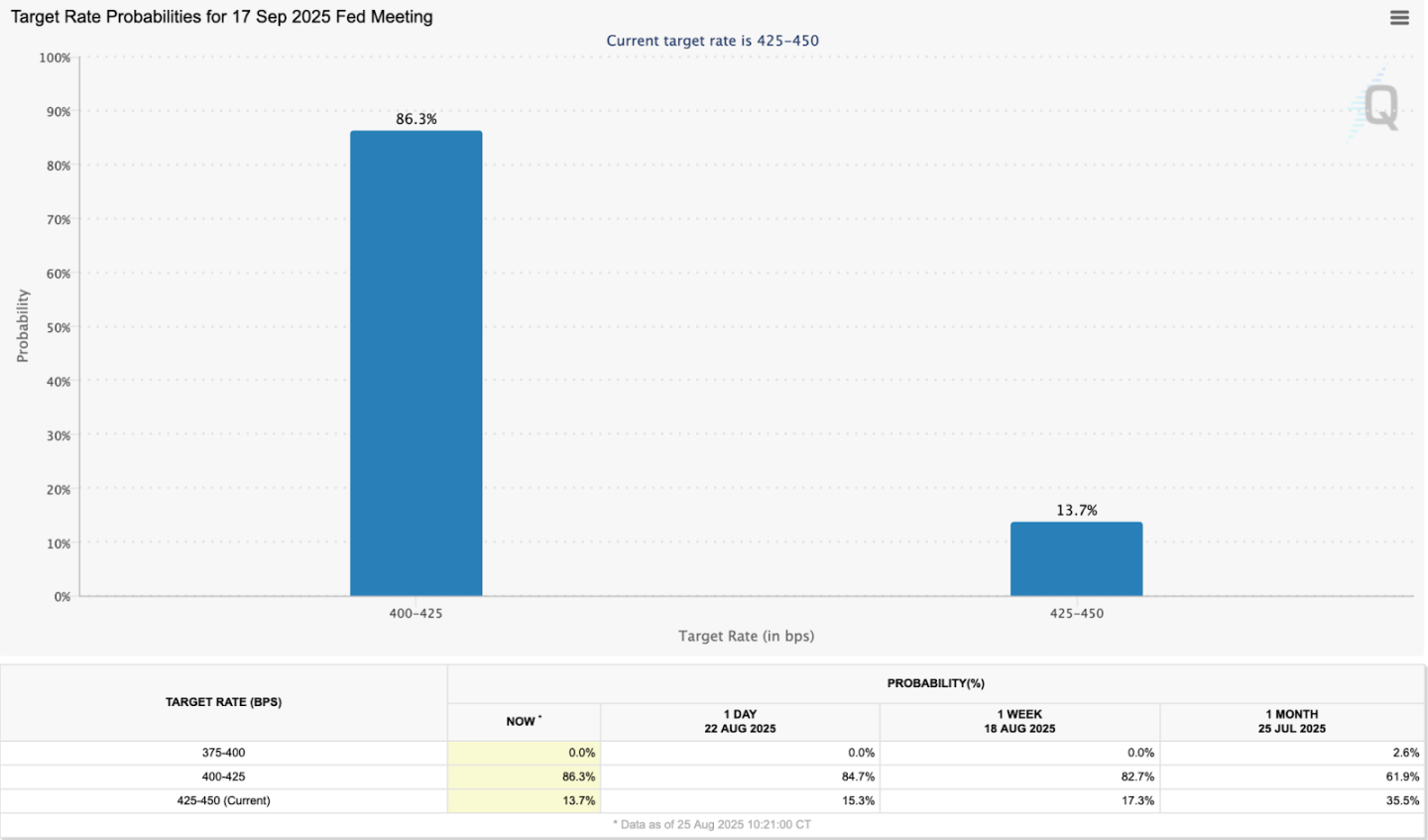

We still don’t know what the Fed will do at its September 17th meeting. But for many, Powell’s comments had a dovish slant, opening the door to a rate cut next month.

If we look at the CME Group's FedWatch tool, based on 30-day fed funds futures prices, as of midday Monday, many people believed a 25 basis point rate cut was possible, a much higher expectation than a month ago:

While rate cuts are generally bullish for risk assets like Bitcoin, the reality is more nuanced. Bitcoin surged above $117,000 on Friday before retreating below $111,000. The asset was trading around $112,600 at 1:30 PM ET, having now fallen below $110,000.

Ruslan Lienkha, head of markets at YouHodler, believes that the broader trajectory of the cryptocurrency market will still depend on the macro backdrop.

“If inflationary pressures persist, the Fed may be forced to extend the pause again, limiting the lasting impact of a single rate cut,” he told me. “Also, if a rate cut is viewed as an emergency response to a recession, it could drag down cryptocurrencies and other risk assets.”

Best-case scenario? Rate cuts as part of the Fed's successful effort to achieve a soft landing.

“In this environment, Bitcoin is likely to attract the majority of institutional inflows given its status as the most established digital asset,” Lienkha said. “Some altcoins may outperform due to their higher volatility and lower liquidity, which could amplify altcoin gains when flows expand beyond Bitcoin.”

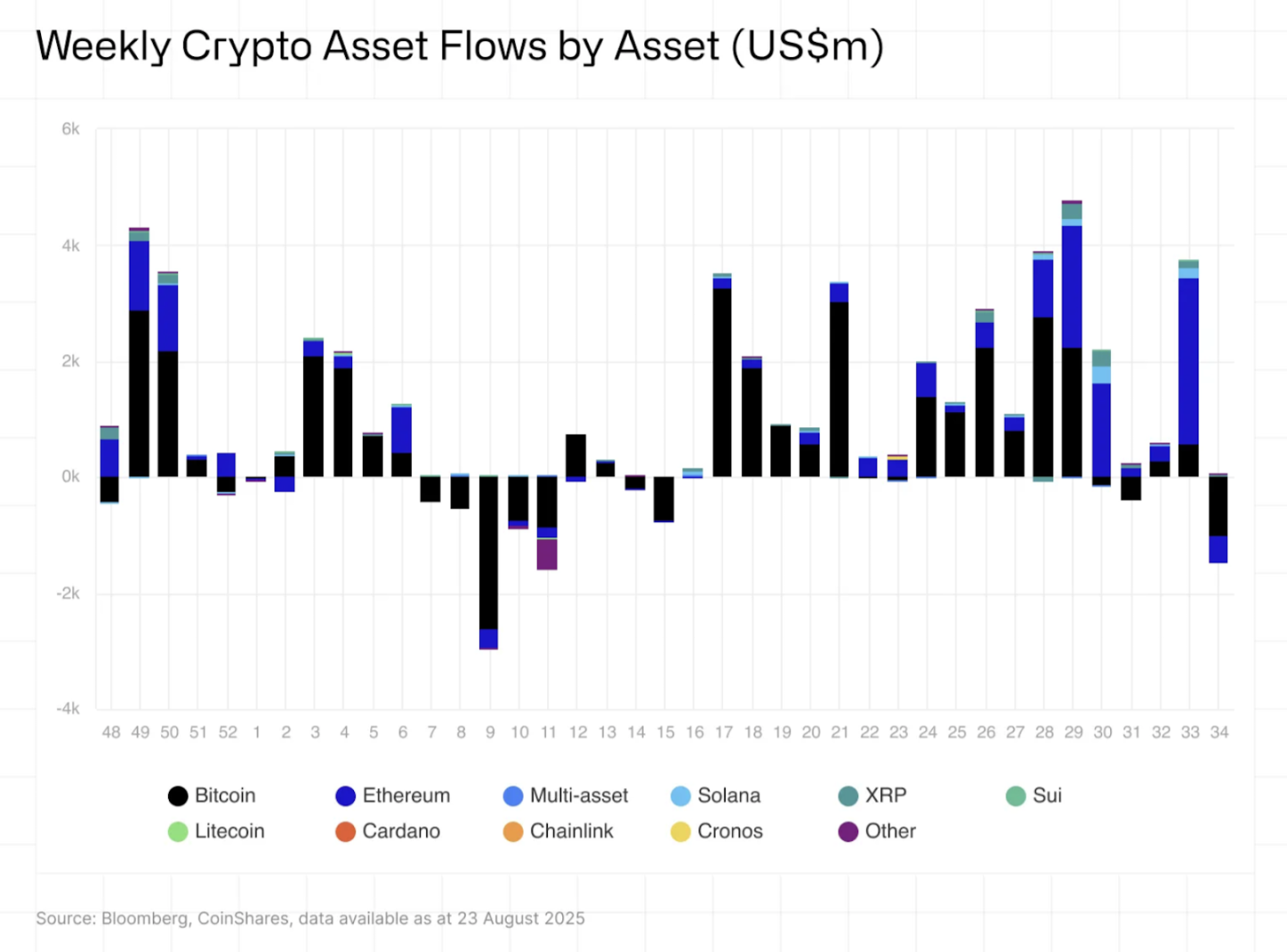

Turning to institutional flows, according to CoinShares data, cryptocurrency investment products saw outflows of over $1.4 billion last week, the highest weekly total since March. In this data, we see that pessimism about the Fed's stance at the beginning of the week appears to have driven outflows, followed by a recovery (primarily into Ethereum products) following Powell's comments.

While US ETH ETFs saw combined inflows of $625 million on Thursday and Friday, BTC funds saw outflows of $217 million over those two days. Month-to-date, ETH and BTC ETFs have seen net inflows of +$2.5 billion and -$1 billion, respectively, “signaling a notable shift in investor sentiment towards both assets,” noted James Butterfill of CoinShares.

What signal did investors get from Friday?

CK Zheng, co-founder of cryptocurrency hedge fund ZX Squared Capital, said Powell's shift toward possibly starting rate cuts is "hugely significant" for risky asset classes.

His year-end target for Bitcoin is between $125,000 and $150,000. He expects Ethereum to end the year between $6,000 and $7,000. (It was hovering around $4,600 on Monday afternoon.)

Matt Lason, chief investment officer at Globe 3 Capital, said any signal of a rate cut would validate the hedge fund’s bullish position because more liquidity is crucial for cryptocurrencies. He expects the current cryptocurrency bull run to peak in the fourth quarter.

The expected rate cuts prompted Globe 3 Capital to shift more of its holdings into smaller-cap tokens “as we see early signs of the long-awaited altcoin season,” Lason added.

What should we expect after the fourth quarter? 50T Funds founder Dan Tapiero commented on X over the weekend, citing Morgan Stanley research:

Zheng said he expects Bitcoin’s dominance to continue declining after the GENIUS Act is signed, and estimates the stablecoin market will grow tenfold (from approximately $270 billion) in the coming years. Coinbase’s latest simulation suggests the stablecoin market capitalization could reach $1.2 trillion by the end of 2028.

We know the cryptocurrency market moves quickly, but I think it’s worthwhile to reflect on where we are right now, even if everything changes in a matter of weeks, days, or hours.