The market has recovered strongly recently. People in various groups show off their earnings and send battle reports every day, and FOMO sentiment is at its peak.

I have gradually reduced my position and am waiting for the next correction opportunity. Even if the market continues to rise in the future, I will only make less money. Since the profit has reached the expected level, I will just lock it in.

This year marks my fifth year in the cryptocurrency world. From a young, ignorant teenager with no investment experience, I have now become able to manage my positions with both knowledge and practice. My biggest feeling is not that I have really made money in the cryptocurrency world, but that I have begun to be less panic about the market and have a sense of accomplishment in investing.

When I had nothing to do these days, I found a few wallets that were scattered around and put them on the data website to scan them.

As an old investor, I have been playing DeFi since the summer of 2020. I have at least hundreds of wallet addresses. At that time, I participated in various early participations, new listings, and airdrops. Now when I open them, I can’t remember what I did in the first place.

I once carefully made a table to record the purpose and assets of each wallet, but as time went by, the data became invalid due to lack of timely updates.

One-click scanning, unexpected discovery of 500U

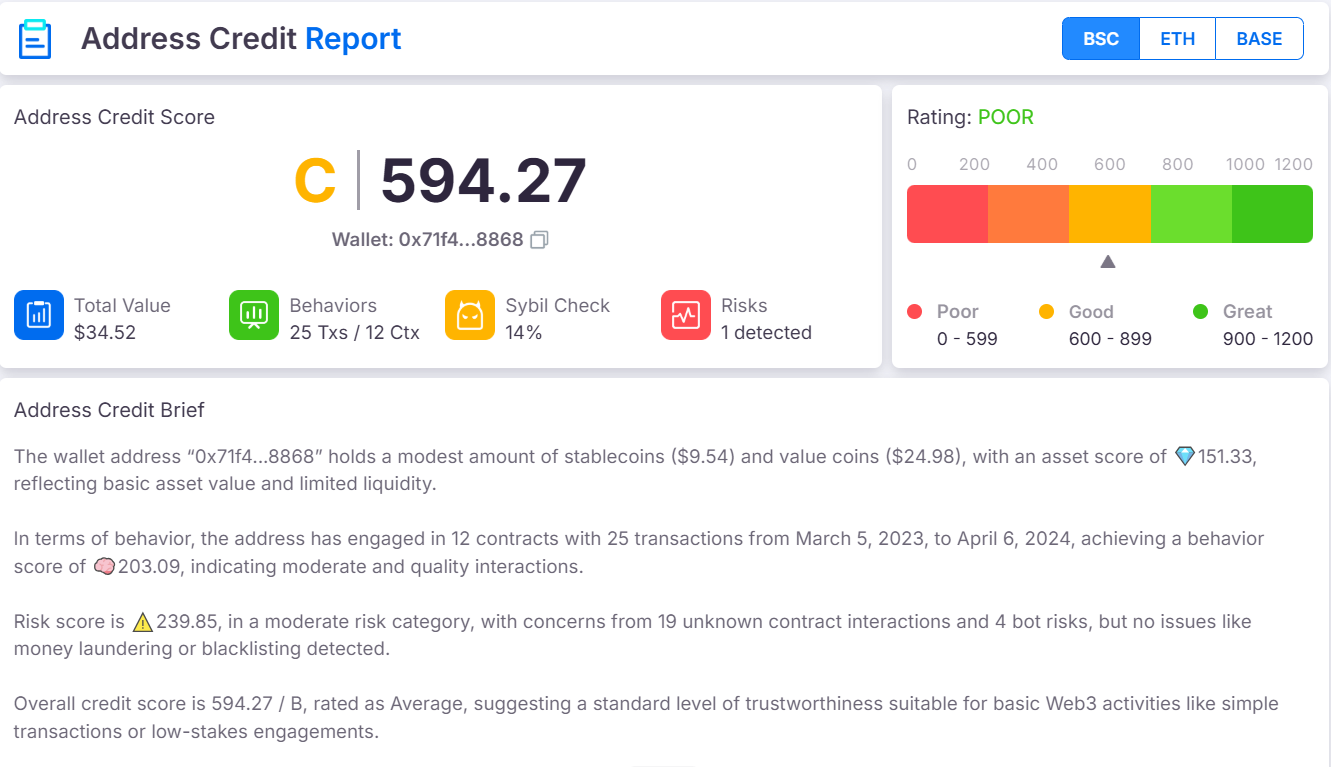

Originally, I just wanted to give it a try, so I used the Creditlink tool recommended by a friend to scan a few addresses.

Unexpectedly, in an old wallet that has not been used for a long time, there is actually a stablecoin LP asset worth about 500U!

These assets came from my early participation in a liquidity mining project. Later, the project lost popularity and I forgot about it.

Creditlink not only identifies the LP assets themselves, but also clearly marks the composition of the LP, the liquidity pool, and the number of redeemable stablecoins.

If it hadn't automatically scanned and displayed it in a structured manner, I might not have remembered that I had this money until the next bull market.

Creditlink can also analyze the assets and interaction records of multi-chain wallets with one click, and also mark risky addresses and Sybil behaviors. I didn’t have high hopes at first, after all, I have tried many such tools before, and they basically only check the balance. But the experience of Creditlink completely exceeded my expectations.

I haven’t touched this wallet for almost two years. If the system hadn’t automatically identified and displayed the LP details, I would never have remembered that there were any assets there.

It can be said that Creditlink is the most detailed and intelligent wallet analysis tool I have ever used. It suddenly gave me a sense of security that my assets can be traced.

Although there are only a few dozen dollars in the wallet in the picture, if there are more small fragments of assets, they can add up to several thousand dollars. For ordinary users, this kind of change-style recycling experience is very practical.

Batch address screening: a powerful tool for project parties to accurately airdrop

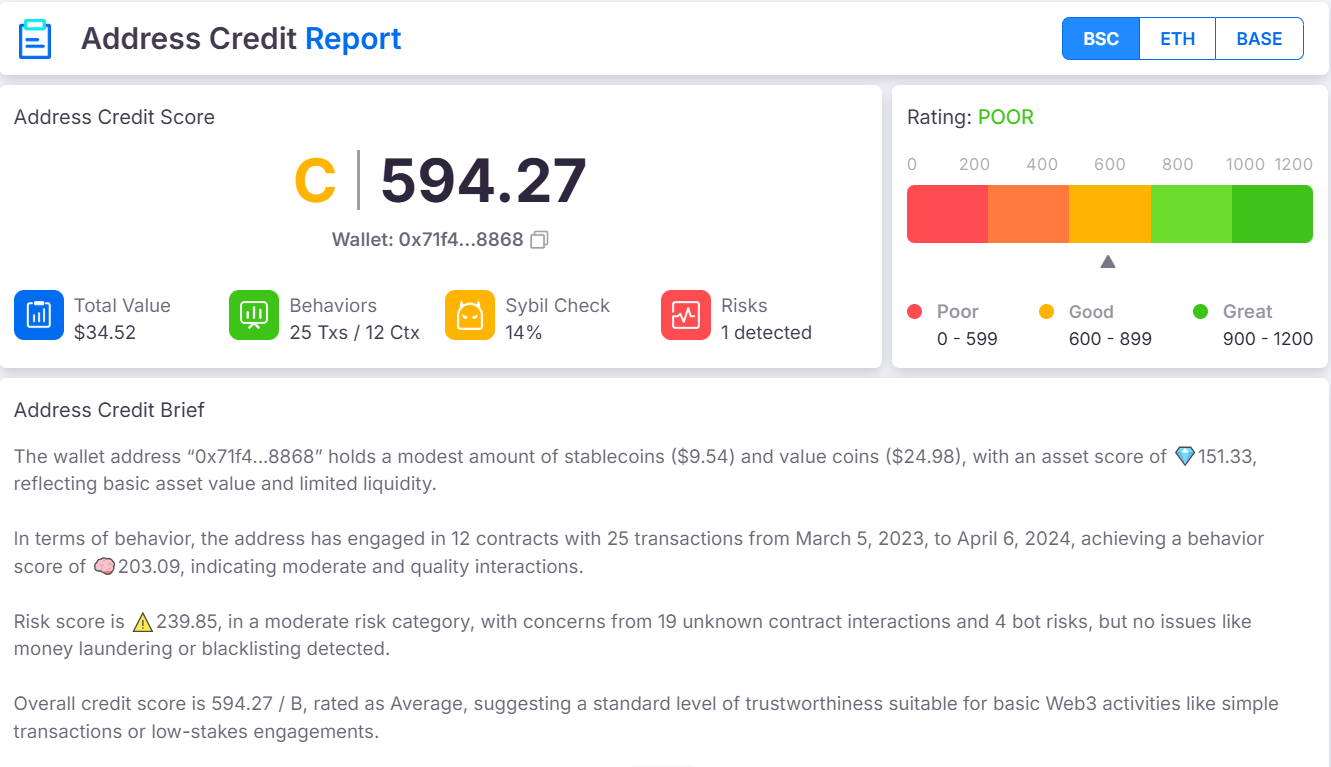

Creditlink provides a powerful and flexible batch address filtering system. Users can directly upload txt files to batch import wallet addresses, and combine multi-dimensional conditions to achieve efficient screening and analysis. The core screening dimensions supported include:

Wallet creation time filter

Asset holdings and exclusions

Specified asset holdings

Minimum asset threshold

Contract interaction record filtering

The batch address filtering function is suitable for a variety of application scenarios, including precise airdrop delivery, community growth and user portrait analysis, hacker address and risk address investigation, marketing channel conversion effect tracking, on-chain old player identification, etc.!

Through Creditlink's batch screening, the originally complex and redundant wallet data is transformed into an actionable insight tool, which greatly improves the efficiency and accuracy of Web3 project parties and users in data-driven decision-making. It is a key component for building an on-chain credit system and identity portrait.

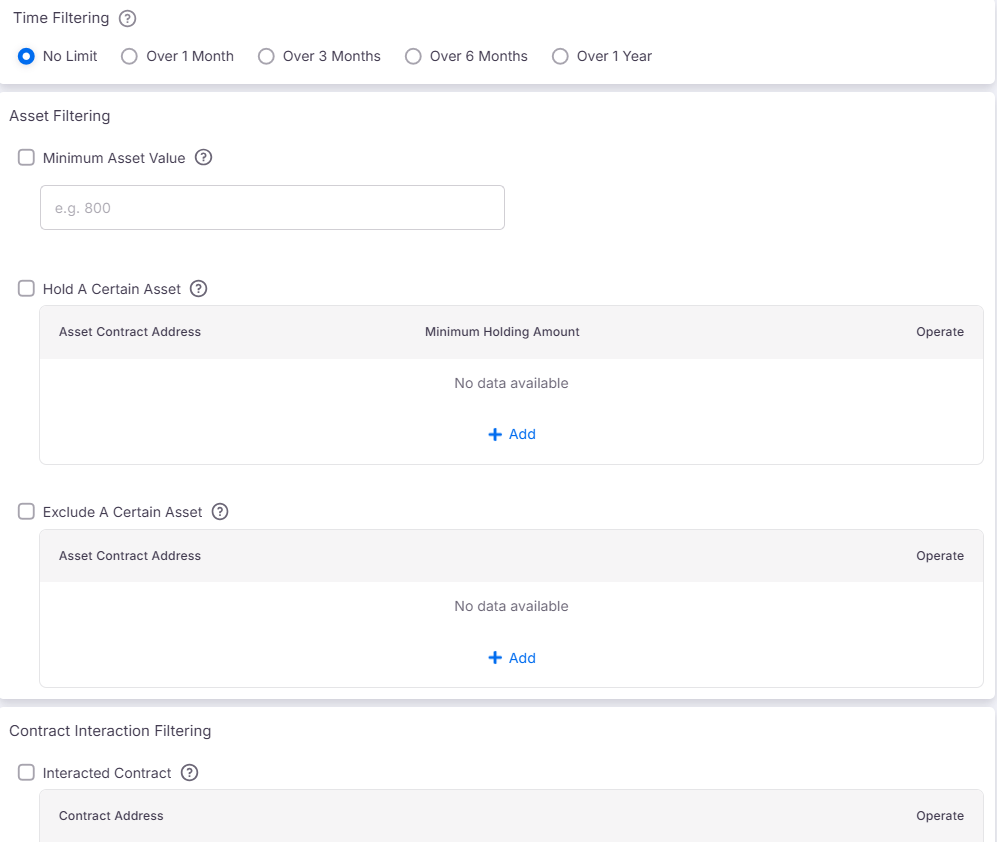

From tools to infrastructure, Creditlink is reshaping the Web3 credit system

The recovery of 500U this time is just a small case in my personal experience, but on a deeper level, what Creditlink has built is actually a smarter and more sophisticated on-chain credit and identity infrastructure.

With the exponential growth of Web3 user behavior data, the information on the chain is becoming more and more abundant, but most protocols are still at the stage of judging people by their balances - they are unable to effectively identify the true value and risks behind the addresses, and it is difficult to achieve more inclusive financial services.

That’s what Creditlink is for.

The core vision of this project is to build an on-chain identity authentication and credit scoring system driven by artificial intelligence to promote the evolution of Web3 finance from heavy collateral and KYC to uncollateralized and behavior-based.

Currently, Creditlink has launched a Beta product that supports:

Single address multi-dimensional behavior analysis

Batch address filtering function (support airdrop, anti-sybil)

Risk interaction detection and reputation labeling system

CredScore will be integrated soon, and credit NFT will be released soon

From the underlying data engine, AI scoring model, to credit NFT and behavioral incentive system, Creditlink's modular architecture will serve the entire Web3 application ecosystem: including decentralized lending, DAO governance, anti-sybil airdrops, reputation-driven incentive mechanisms, identity systems, GameFi strategies, and more.

Summarize

If you are an ordinary user, Creditlink can help you recover forgotten assets, sort out wallet behavior, and avoid potential risks.

If you are a project owner or developer, Creditlink is the best partner for precise airdrops, user screening, behavior modeling, and credit incentives.

The future of Web3 requires not only addresses that hold assets, but also addresses that are trustworthy. Creditlink is providing infrastructure support for this trust revolution.

Sometimes, a useful on-chain tool can help you recover a forgotten asset.

Check it out quickly, maybe the coin you forgot in your wallet has increased by tens of thousands of times, and you now have assets worth tens of millions!