By Nancy, PANews

Cryptocurrency earnings season is upon us, and major institutions have submitted their 2025 midterm reports. Some have driven profits soaring thanks to skyrocketing asset valuations, while others are struggling to transform amidst a slowdown in their core businesses. The industry is gradually shifting from a single source of revenue to diversified assets and integrated financial services. In this article, PANews will review the latest financial performance and strategic trends of representative crypto-related companies, including publicly listed companies or those that have voluntarily disclosed their second-quarter financial reports, including Strategy, Tether, Coinbase, Robinhood, Kraken, and Riot Platforms.

A look at the financial performance of six crypto institutions in Q2 2025

Strategy: Earning tens of billions of dollars in net profit from Bitcoin, and plans to continue investing heavily in Bitcoin

Strategy's second-quarter revenue reached US$14.03 billion, a significant year-on-year increase of 7106.4%. It expects full-year revenue to reach US$34 billion and predicts that full-year diluted earnings per share (EPS) will rise to US$80.

The significant increase in quarterly revenue was driven almost entirely by unrealized fair value gains on Bitcoin assets, which totaled $14 billion and accounted for the vast majority of quarterly revenue. This was Strategy's second quarter since adopting fair value accounting standards in early 2025. In contrast, the company's traditional software business only generated $114.5 million in revenue during the quarter, representing only approximately 0.8% of total revenue.

At the same time, Strategy's profitability jumped in the second quarter, with net profit reaching US$10.02 billion, in stark contrast to a net loss of US$102.6 million in the same period of 2024. It expects net profit for the full year 2025 to reach US$24 billion.

As of the end of July 2025, Strategy's Bitcoin holdings had increased to 628,791, with 88,109 newly added in the second quarter. The total cost of holdings reached $46.07 billion, with an average cost of $73,277 per Bitcoin. Its Bitcoin yield (BTC) has reached 25% year-to-date, exceeding its original full-year target ahead of schedule and raising the target to 30%. To further expand its Bitcoin assets, Strategy also announced that it will raise $4.2 billion through the issuance of STRC perpetual preferred shares to continue increasing its Bitcoin holdings.

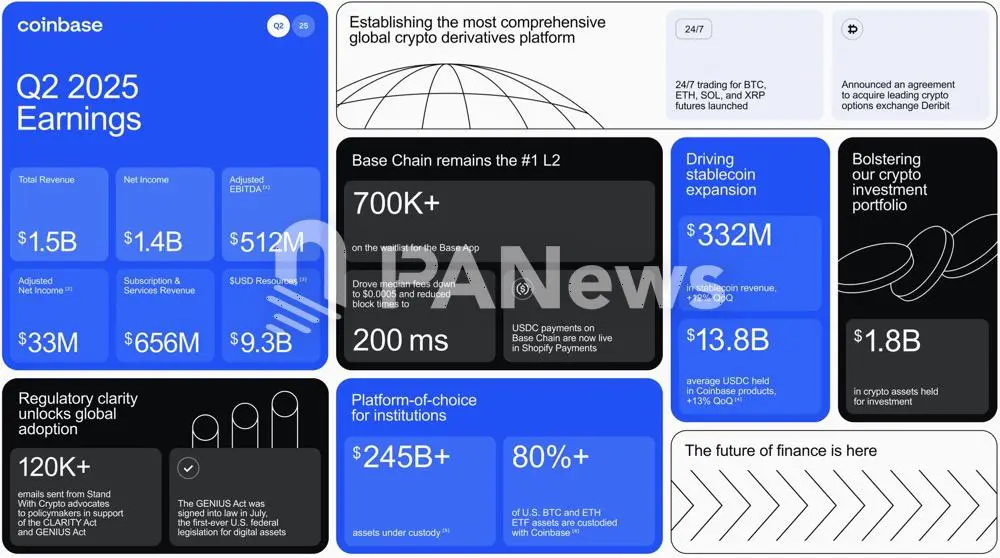

Coinbase: Core business weakens, investment income props up net profit

In Q2 2025, Coinbase achieved total revenue of $1.497 billion, a 26% decrease from the previous quarter. Trading revenue reached $764 million, a 39% decrease from the previous quarter, while subscription and services revenue reached $656 million, a 6% decrease from the previous quarter. Coinbase attributed the revenue decline to reduced volatility in the crypto market, adjustments to its pricing strategy for stablecoin trading pairs, and a decrease in trading activity across the platform. Its total trading volume for the quarter was $237 billion, a 40% decrease from the previous quarter.

Coinbase's net profit for the quarter reached $1.429 billion, significantly exceeding the $36 million it earned in the same period last year. This profit growth was primarily driven by $1.5 billion in gains from its Circle investment and $362 million in unrealized gains from its crypto portfolio. However, a previous user data breach cost Coinbase $308 million, pushing total operating expenses to $1.5 billion (a 15% increase quarter-over-quarter), significantly pressuring net profit. Excluding gains from strategic investments and crypto assets, adjusted net income was only $33 million, indicating that its core trading business has hit a growth slump.

Faced with this predicament, Coinbase is actively pursuing a strategic transformation. Its Vice President of Product, Max Branzburg, announced the expansion of its trading product categories. New products will include tokenized real-world assets, stocks, derivatives, prediction markets, and early-stage token sales. These products will initially launch in the United States and will subsequently expand internationally, subject to regulatory approvals. Coinbase's goal is to become a "universal exchange" capable of on-chain trading of all assets, placing it in more direct competition with platforms like Robinhood, Gemini, and Kraken.

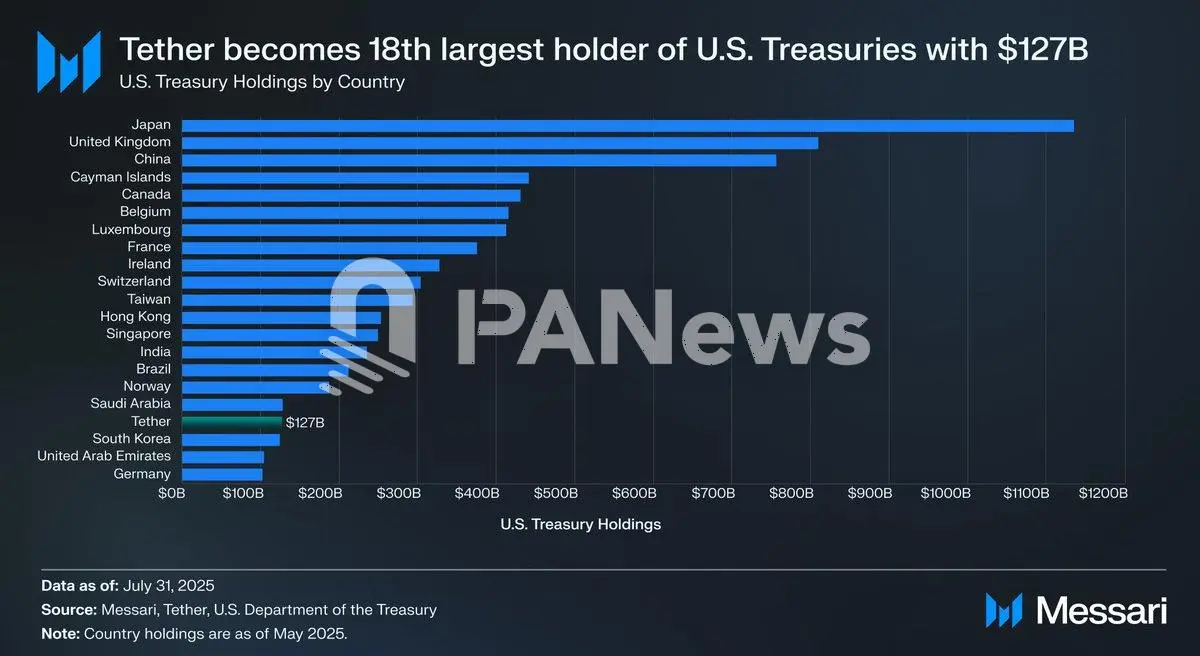

Tether: Quarterly net profit of US$4.9 billion, US Treasury holdings exceed US$127 billion

As of Q2 2025, Tether's total assets reached US$162.575 billion, exceeding its liabilities of US$157.108 billion, and its excess reserves reached US$5.467 billion (a slight decrease from US$5.6 billion in the previous quarter); the circulation of USDT exceeded US$157 billion, an increase of US$20 billion since the beginning of the year.

In terms of asset composition, it holds more than $127 billion in U.S. Treasury bonds (including $105.5 billion in direct holdings and $21.3 billion in indirect holdings), an increase of approximately $8 billion from the first quarter, ranking it among the 18th largest U.S. debt holders in the world. It also holds $8.9 billion worth of Bitcoin and $8.7 billion worth of precious metals (gold).

Tether's net profit in the second quarter was approximately $4.9 billion, significantly higher than the $830 million in the first quarter. Year-to-date, Tether's net profit has reached $5.73 billion, of which $3.1 billion is recurring income and $2.6 billion comes from the growth of the market capitalization of Bitcoin and gold.

Overall, Tether demonstrated strong asset growth and profitability this quarter, and its diversified asset allocation (such as gold and Bitcoin) also provided flexibility to its profit structure.

Robinhood: Revenue Nears $1 Billion, Crypto Business Drives Profits to Double

As of the end of the second quarter of 2025, Robinhood held a total of US$4.2 billion in cash and cash equivalents on its balance sheet, providing sufficient "ammunition" for global expansion and trialing new businesses.

This quarter, Robinhood achieved revenue of $989 million, a 45% year-on-year increase; net profit reached $386 million, doubling year-on-year to a record high. Adjusted EBITDA reached $549 million, with a profit margin of 56%. The core engines driving this growth were the strong rebound in crypto trading and options trading. Options trading revenue reached $265 million, a 46% year-on-year increase, remaining its core revenue source. Crypto trading revenue reached $160 million, a 98% year-on-year increase, becoming a new growth driver. Stock trading revenue also reached $66 million, a 65% year-on-year increase.

Robinhood also maintains strong user base and asset accumulation. The platform's current account count reached 26.5 million, a 10% year-on-year increase. Total platform assets exceeded $279 billion, nearly doubling. Active investment accounts reached 27.4 million, a 10% year-on-year increase. High-value users (those subscribing to Robinhood Gold) grew 76% to 3.5 million. Notably, average revenue per user (ARPU) reached $151, a 34% year-on-year increase, reflecting the platform's continued strength in user monetization.

From a strategic perspective, Robinhood's aggressive crypto expansion this quarter is particularly noteworthy. These include the formal completion of its acquisition of Bitstamp, a long-established European exchange; the acquisition of over 50 crypto compliance licenses and the launch of crypto services in 30 European countries; the launch of equity token products; the introduction of crypto staking in the United States; and the planned acquisition of Canada's WonderFi in the second half of the year. Furthermore, Robinhood is steadily building its own financial marketplace, with examples such as the Robinhood Strategies digital investment advisory service achieving $500 million in AUM, $20 billion in retirement account assets, and 300,000 Gold credit card users.

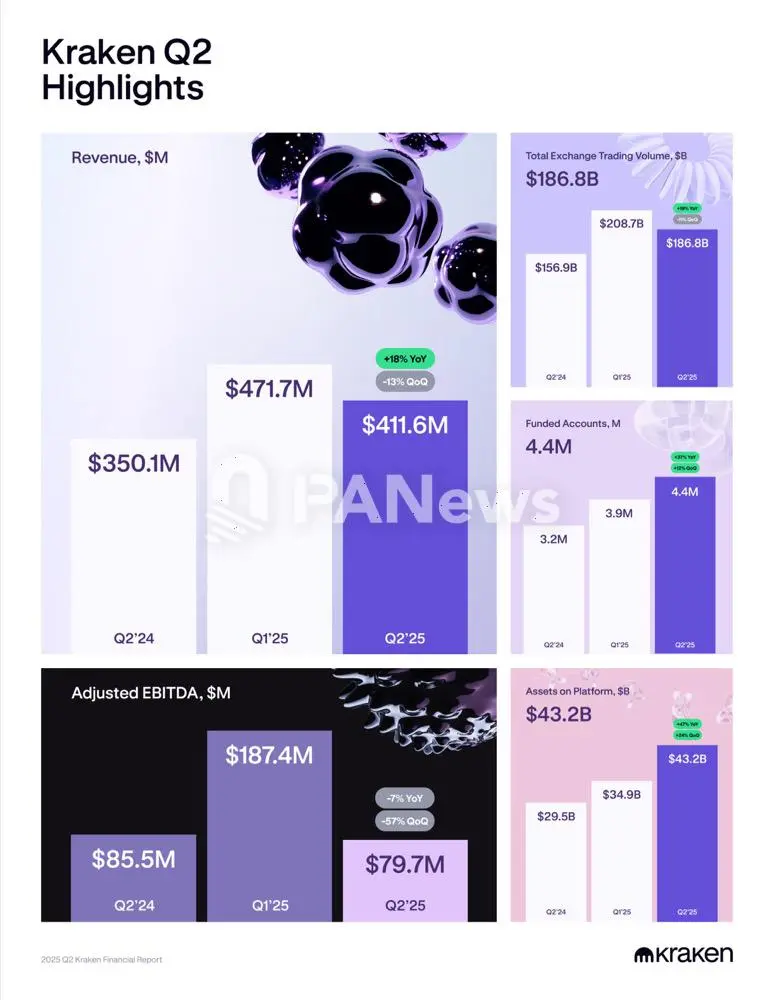

Kraken: Profits halved, plans to accelerate diversification

In the second quarter of 2025, Kraken continued to advance in multi-asset trading and global expansion, but overall market trading activity slowed slightly, causing some key indicators to decline on a month-on-month basis.

Kraken achieved revenue of $412 million this quarter, an 18% year-over-year increase, but a sequential decrease from the previous quarter (US$472 million). Adjusted EBITDA for the quarter was $80 million, a significant decrease from $187 million in Q1. Kraken's operational data shows that it has approximately 15 million global clients. Its trading volume in the second quarter reached $186.8 billion, a 10.5% decrease from the previous quarter but still a 19% year-over-year increase. Kraken's funded accounts increased to 4.4 million, a 37% year-over-year increase. Assets under custody on the platform reached $43.2 billion, a 47% year-over-year increase.

Next, Kraken's global business will continue to accelerate, including the approval of new licenses, the expansion of local funding channels, the upgrade of multi-asset experience, and the launch of innovative products such as international stocks, tokenized stocks, Kraken debit cards and NinjaTrader development.

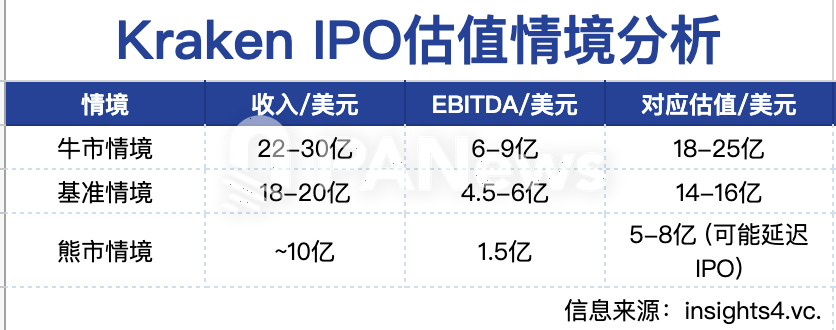

Notably, Kraken is seeking to raise $500 million at a $15 billion valuation and plans an IPO in 2026. Insights4.vc. analyzes that Kraken leads the industry with its user quality and trading activity. By expanding into new businesses such as derivatives, stock trading, and payment services, Kraken is reducing its reliance on spot trading fees and strengthening its resilience to market cycles. Furthermore, amidst tightening regulation, Kraken has obtained compliance licenses in multiple jurisdictions, demonstrating significant advantages in compliance, security, and fiat currency on-ramp services. Facing fierce competition from Binance and Coinbase, Kraken has successfully established a "second-tier" brand positioning centered on product diversity and transparent compliance. If the crypto market continues to recover over the next year, Kraken is expected to become the next publicly listed crypto exchange with stable profitability and compliance, following Coinbase.

Riot Platforms: Revenue doubled year-on-year, BTC production increased 69% year-on-year

In the second quarter of 2025, Riot Platforms achieved total revenue of $153 million, more than double the $70 million in the same period of 2024. This growth was primarily driven by its Bitcoin mining business, which contributed approximately $141 million in revenue, a year-on-year increase of over 150%. Driven by the strong Bitcoin price and production capacity expansion, the company produced 1,426 BTC in the quarter, an increase of approximately 69% from 844 in the same period last year.

Due to the anticipated halving in April 2024 and the continued rise in global computing power, Riot's average mining cost per Bitcoin (excluding depreciation) rose to $48,992, a 93% year-over-year increase, but still significantly lower than the average Bitcoin selling price (approximately $98,800) during the same period. However, if Bitcoin prices decline or mining difficulty continues to rise, gross profit margins may be squeezed, and cost control and computing efficiency will become key. Riot disclosed that with the growing demand for high-performance computing (HPC) and AI infrastructure, the company will continue to diversify its power resources, gradually transforming from a pure Bitcoin mining company to a "Bitcoin-centric infrastructure platform designed for future computing needs."

In terms of profit performance, Riot recorded a net profit of US$219.5 million, far exceeding the negative performance in the same period of 2024, and adjusted EBITDA reached US$495.3 million, reflecting the strong cash generation ability and high operating leverage of its core business.

Furthermore, the company continues to maintain a strong balance sheet. As of the end of the second quarter, Riot Platforms held 19,273 BTC (valued at approximately $2.1 billion) and $255.4 million in unrestricted cash, providing ample funding for future expansion, its high-performance computing transformation, and to navigate market fluctuations.