What happened this weekend? Trump's threat on social media (to impose 100% tariffs on Chinese goods and an export ban on all critical software) was like a financial nuclear bomb, triggering market panic. Cryptocurrency assets saw a devastating 24-hour decline: approximately $19.1 billion in positions were liquidated, with the majority being long positions. Highly leveraged long positions have turned the market into a tinderbox, triggering a stampede of exodus at the slightest sign of trouble. Disorganized market quotes and a drying up of DeFi liquidity further fueled the fire. Even the world's third-largest cryptocurrency, USDe, instantly depreciated to $0.65 (not due to USDe's own fault, but to an error in Binance's quote mechanism). Major cryptocurrencies like ETH and SOL were also affected, plummeting by over 20% during trading. Subsequently, this Saturday, October 11, 2025, many crypto industry insiders were plunged into poverty overnight. One individual was even found dead in his Lamborghini over the weekend.

In our industry, wealth and honor are truly sought through risk.

Here are some of my personal thoughts:

1. Tail, tail, tail! The Black Swan and Taleb's work have become globally recognized because, in this digital, intelligent, and interconnected age of the Dharma Ending Age, the karmic resonance of greed, hatred, and ignorance is making low-probability events no longer low-probability, and tail events no longer tail. Even in the past five years, we've experienced COVID, FTX, UST, the Binance lawsuit in the United States, and today's flash crash. It feels like every year feels like a year without a major shock. Therefore, we must always be prepared for that big shock.

2. Does your investment portfolio affect your sleep? The book "The Psychology of Money" shares an interesting perspective: Whether you can sleep at night is a crucial indicator of your investment portfolio. After all, the purpose of making money is to make yourself happy, not to cause a surge in cortisol and then lose everything in a painful blow.

3. The crypto market is an offshore small-cap stock market: In the past, practitioners studied the four-year halving every day. Now that the crypto market has grown up, left the laboratory environment, and entered the global macro market, everyone should become a macro student and learn more about Druckenmiller and Soros.

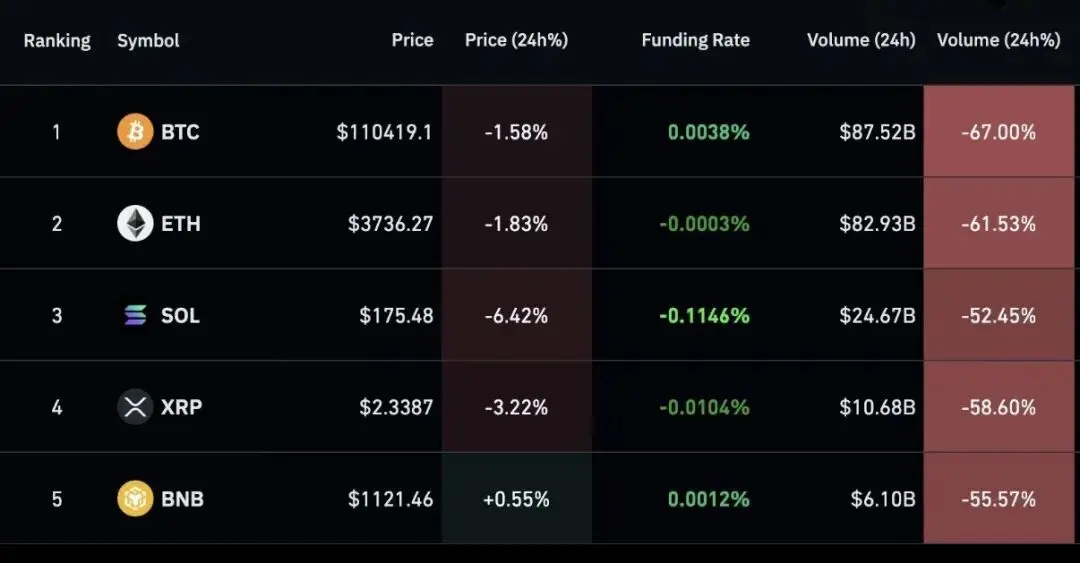

4. Survivorship bias: As of 8:00 AM on October 11th, the total amount of liquidated positions in this market was approximately $19.134 billion, of which approximately $16.679 billion was from long positions. This was the worst bloodbath in crypto history. Yet, on social media, you'll mostly only see people sharing how they profited from the crisis. If you ignore other news, you might think we've just experienced a big rally. It reminds me of World War II, when engineers discovered numerous bullet holes in the wings of returning bombers and fighters. They held a meeting to discuss strengthening the wing armor. Later, they realized that planes with punctured fuel tanks couldn't return. Instead, you should reinforce the fuel tank armor.

5. Centralized exchanges struggle to maintain transparency: Until this incident, users were unable to see that Binance's USDe price was its own, rather than a weighted price derived from a comprehensive market analysis. However, Binance plans to address its mistake and compensate users, marking a step forward for the industry.

6. House Always Wins:

A Bitcoin whale closed 90% of its BTC short positions on Hyperliquid and completely closed its ETH short positions, profiting approximately $190-200 million in a single day. Notably, this whale established nine-figure short positions in BTC and ETH minutes before the market crash. This represents only its public positions on Hyperliquid; its activities on centralized exchanges or other platforms remain unknown. This account may have played a key role in the market movement that day. This whale's family name may be Trump. In this world, wealth is not only earned through value creation, as seen by companies like Tesla and Alibaba, but also through the transfer and the plundering of value. This is unfair, but it is the truth.

b. The world increasingly needs Open Finance/DeFi: Ordinary people need it because it's convenient and permissionless; the wealthy need it because it's permissionless, anonymous, and tax-free; and policymakers need it because it's convenient, anonymous, and allows them to run short and long trades at any time. Therefore, DeFi will only prosper.

7. I recently read about a person: Rick Guerin. He was the third partner of Buffett and Munger in their early days. Like them, he believed in value investing, but more aggressively—he favored using leverage to amplify returns. During the stock market crash of 1973–1974, he was forced to close his positions due to high leverage, suffering heavy losses and having to sell a large number of Berkshire Hathaway shares to repay his margin calls. He subsequently faded from public view, missing out on Berkshire Hathaway's spectacular growth over the next few decades. Buffett later said of him, "The three of us were essentially on the same path, but Charlie and I wanted to get rich slowly, while Rick wanted to get rich quickly."

I hope we can all become Buffett and Munger, not Rick.