Author: Baba

Compiled by Luffy, Foresight News

Last Friday's leveraged liquidation caused heavy losses for many people, and I hate to see anyone suffer that fate. But like a forest regrowing after a fire, new opportunities will emerge in the cryptocurrency market.

With the disappearance of leverage and the collapse of basis trading, capital and attention are being structurally forced to shift: from perpetual contracts to spot trading, from centralized exchanges (CEX) to decentralized exchanges (DEX), and from mainstream cryptocurrencies to smaller-cap cryptocurrencies. This shift marks the beginning of a new on-chain cycle, in which reflexivity will replace leverage as the dominant market mechanism.

While last Friday's crash has made many people wary of leverage, traders' thirst for high-yield investment opportunities has not disappeared and may even be intensified by the desire to recover losses through revenge trading. Liquidity will not disappear; it will only flow to the best opportunities.

This market environment is just the right thing to inject new vitality into the Memecoin super cycle.

Overall, as participants return to more traditional trading methods, activity among on-chain currencies will increase, and Memecoin in particular has the potential to attract significant attention. Memecoin offers returns comparable to leveraged positions, requiring minimal capital investment to generate high returns in a short period of time. Furthermore, Memecoin carries no risk of liquidation (disclaimer: your holdings may still be lost to zero, so please trade with caution).

Trader's Perspective

First, let’s break down the fundamental logic behind why people choose to trade perpetual contracts instead of spot.

The core reason market participants prefer perpetual swaps is that they address capital efficiency, trading barriers, and flexibility, particularly in the crypto market, where liquidity is fragmented and volatility persists. For traders, the core goal is to maximize expected returns per unit of risk and capital.

The spot market uses a fully collateralized model, requiring full capital investment to achieve 1:1 exposure. Perpetual swaps, however, overcome this limitation. Traders can gain greater exposure by simply depositing margin, rather than paying the full principal. This leverage mechanism can both amplify gains and exacerbate losses. Capital is the most precious resource in cryptocurrency trading, making efficient capital allocation highly attractive to traders.

Cryptocurrency is one of the most volatile asset classes, offering traders the opportunity to generate outsized returns in the short term. However, high returns come with high risks: when prices rise, the candlestick chart often rises vertically; when prices fall, it can seem bottomless. This characteristic attracts traders with a high risk appetite, as their gains are theoretically capped at unlimited, while losses are limited by their margin.

Essentially, perpetual contracts inject the most powerful catalyst yet into an already highly volatile asset: they give traders the opportunity to pursue the fabled 1,000x returns on a currency that is considered safer than on-chain Memecoin.

However, returns always come with risks. Funding rates can invert, leading to account losses; margin calls can trigger premature liquidations; and reliance on exchange solvency can introduce systemic risks. Despite this, traders are willing to take these risks because perpetual swaps offer a more attractive return structure. Traditional markets rely on stability, while crypto markets thrive on instability.

Volatility, shifting narratives, and new underlying protocols have long been the norm in crypto trading. In such markets, information decays rapidly, and new opportunities constantly emerge amidst the chaos. Risk-taking isn't irrational, but strategic: given the periodic market resets, entering early and aggressively often yields greater returns than playing it safe later. Crypto markets reward those who act quickly, not those who wait for validation.

Market incentives

Currently, market sentiment for perpetual swaps is at a recent low, creating an opportunity for a new mainstream play. Astute teams are aware of this and are working tirelessly to attract attention for their products. From airdrops to product launches, the coming weeks are likely to see numerous projects release major updates. As has been shown in countless past cases, timing is often crucial to a project's success or failure.

Take WIF, for example. Its launch timing was perfect. Solana was on an upward trajectory, the Solana community had just received a liquidity injection from the JTO airdrop, and the Memecoin supercycle was just beginning. If WIF had launched in January 2024, the Solana ecosystem would have already established a leading Memecoin, while WIF would have become just one of the thousands of Memecoins launched daily.

If I were Alon from pump.fun, the Bonk.fun team, or a member of the Solana Foundation, I would do everything in my power to bring attention back to the Solana battleground—and the easiest way to do that would be to revitalize the Memecoin market. Memecoin was once a core driver of user attraction to the Solana ecosystem, and now they have the opportunity to play that role again. Price increases are generally the most effective marketing tool, and driving Memecoin upwards requires minimal capital.

Once reflexivity and speculative sentiment kick in, the prophecy of high-market-cap memecoins becomes self-fulfilling. FOMO drives people into the market: a memecoin performs well, traders FOMO in, price targets are pushed higher, bulls become more vocal, and more memecoins follow suit, leading to more listings. This is a mutually reinforcing flywheel of speculation and validation.

The increased activity of Memecoin bulls like @theunipcs and @miragemunny on social media suggests a return of hype to the Memecoin space. For pump.fun and Bonk.fun, increased activity will generate more transaction fee income, driving buybacks of PUMP and BONK tokens. The current upward trend in the prices of USELESS and NEET may be an early sign of this trend.

Think about it from the perspective of the traders whose accounts were wiped out by liquidation last Friday: they generally have two options:

- Temporarily exit the crypto market and re-evaluate trading strategies;

- Continue to take higher risks and make revenge trades.

I don't recommend emotional trading, but our goal is to predict market participants' behavior, not to tell them what to do. These traders already have a high risk appetite and are naturally drawn to opportunities that offer the greatest chance of recovering all losses. If the Memecoin space shows upward momentum, they're likely to pounce.

Attention and capital flows

Essentially, Memecoin is the purest form of money in the attention economy. How can it reach a multi-billion dollar market capitalization despite having no fundamental value? The answer is attention.

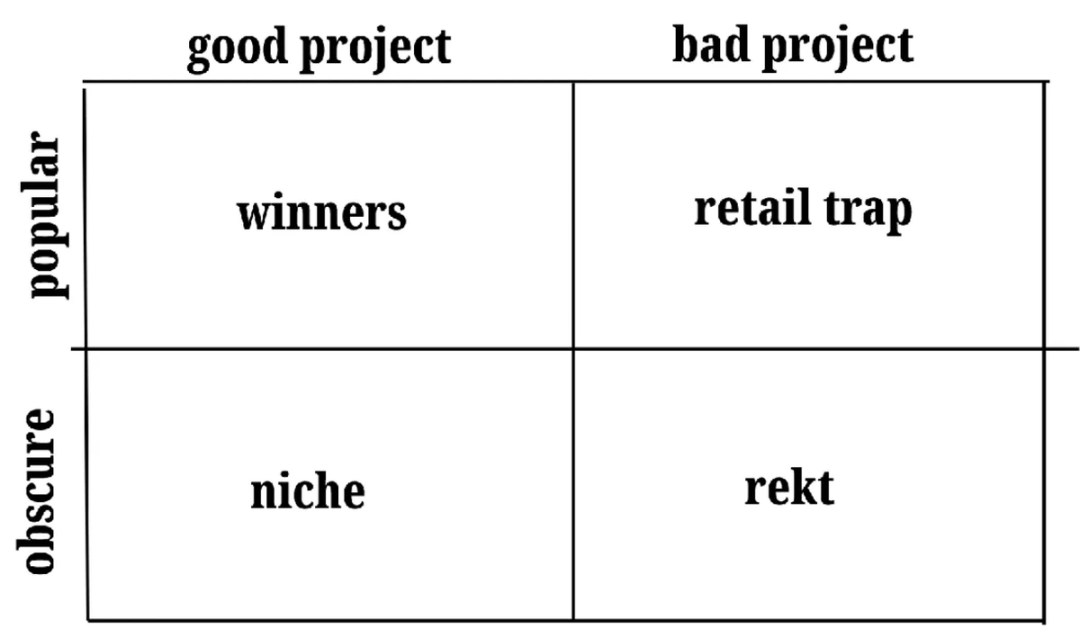

Attention is the core driver of capital flows in the crypto market. This explains why high-quality products don't necessarily drive price increases, while products with poor user experiences, like Cardano, can perform well in terms of price. In the crypto space, projects take years to create value for their protocols, but the crypto community's attention span is as short as a goldfish: their expectations for projects often focus on the next few weeks or even days. This means that price movements rarely accurately reflect changes in the protocol's fundamentals. Instead, price fluctuations are more likely to be driven by hype on Twitter or opinions in Telegram groups.

In the attention economy, Memecoins are the perfect attention-suckers. They are inherently reflexive tools: small circulating supply, high turnover, and attention-driven price fluctuations. A $1 million injection into a $10 million Memecoin will result in price fluctuations 10 times greater than the same amount injected into an altcoin on a centralized exchange. This convex payoff structure attracts residual funds after liquidations to flow back into the Memecoin casino.

The resulting attention vacuum will attract onlookers to enter the market, and no one can resist the vertically rising green candlestick, which adds fuel to the Memecoin cycle.

In the risk economy of cryptocurrencies, leverage and reflexivity are substitutes. When perpetual swaps have sufficient leverage, reflexivity in the spot market is suppressed; when leverage collapses, reflexivity in the spot market becomes dominant.

Prior to the crash, perpetual swap interest and liquidity reached historic highs, thanks to the success of Hyperliquid and the rise of competitors like Lighter and Aster. Meanwhile, Memecoin's market sentiment and interest plummeted to a cyclical low. Its candlestick charts were dismal, players were turning to other areas, social media platforms were filled with mockery of Memecoin, and sellers were running out of coins. This situation suggests the sector is ripe for a rebound.

My personal opinion on whether Memecoin is more beneficial than harmful to the cryptocurrency market as a whole fluctuates, but my opinion is irrelevant. Ultimately, the market and price will determine whether Memecoin can replace perpetual contracts in the spotlight. This is a classic manifestation of the Keynesian beauty contest in modern markets: in Keynes's original metaphor, investors don't choose the face they find most beautiful, but rather the face they believe others will find beautiful.

Judging from the current market environment, Memecoin appears to be the most likely winner of the beauty contest. It ticks all the boxes for attracting perpetual contract traders—high returns, high volatility, and minimal short-term investment. With many wary of the risk of liquidation crashes, attention is shifting to new mainstream trading methods, and capital will naturally follow.

Solana Ecosystem Status

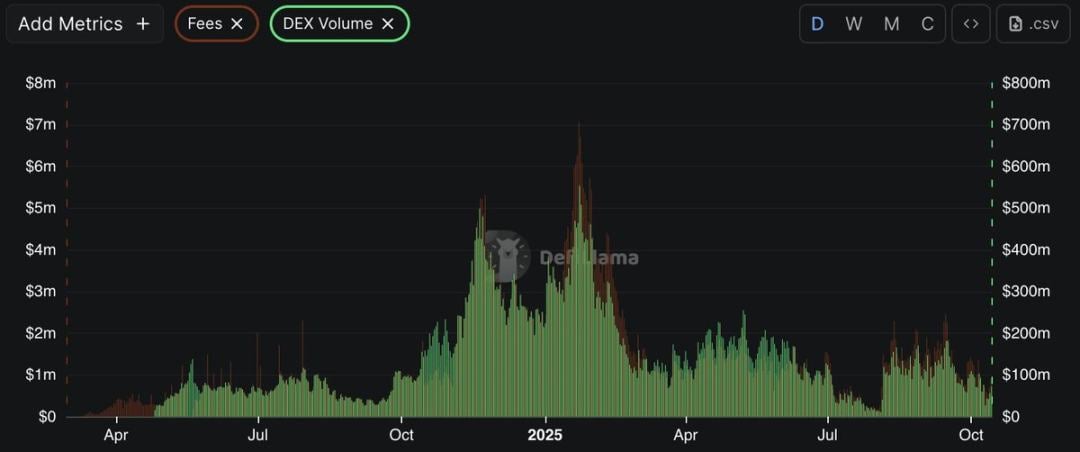

Solana, the Memecoin craze that began in 2023, is likely at the center of it again. While Memecoin sentiment and on-chain activity are currently low, a bit of upward momentum could quickly reverse the situation. As shown in the chart below, pump.fun's transaction volume and fees have been declining since mid-September—even though Bitcoin has recovered from its September lows and reached a new all-time high in October, on-chain activity has not recovered accordingly.

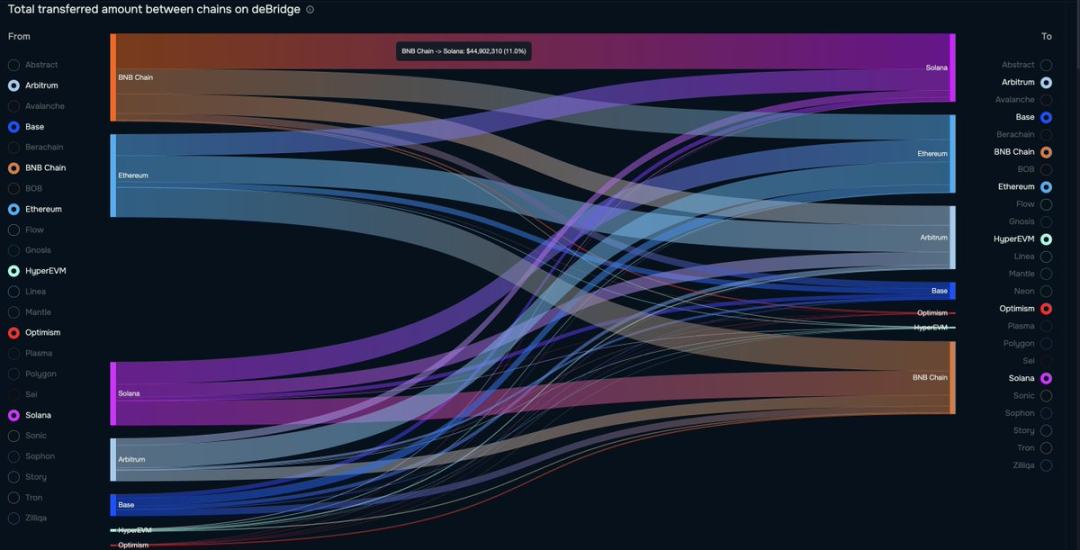

Over the past seven days, BNB Chain has seen the largest outflow of funds, with 11% of this flowing into Solana via cross-chain transactions. This signal indicates that funds profiting from the Binance craze are returning to the Solana ecosystem. If this trend continues, it's reasonable to speculate that a significant portion of this capital will flow into Memecoin.

Trading strategies

Assuming that after the liquidation, attention and funds will return to Memecoin, the trading strategy is actually quite simple: if you agree with the Memecoin revival theory, making an early layout is the option with the highest expected value.

While the leading memecoins from the previous cycle may rebound as activity increases, the ones with the greatest potential for gains often come from newly launched memecoins. New memes represent fresh memes, fresh code, and new possibilities—these qualities generate far more engagement than older coins whose stories have already been priced in.

While established coins often carry historical baggage: past highs, locked-in investors, and fragmented narratives, new coins are free from these constraints. They lack a psychological price ceiling and community legacy issues, making it easier for traders to believe that this time will be different. The first few bullish candlesticks of a new coin can create the illusion of discovering new opportunities, which can trigger a reflexive feedback loop.

As past Memecoin cycles have shown, those who first embrace trends always profit, as leading coins often emerge at the beginning of a boom. Take WIF and FARTCOIN, for example. They were both launched early in their upward trend, allowing ample time for user acquisition. No matter how strong a memecoin's momentum, it can't maintain a vertical upward trend forever: it must experience significant pullbacks to flush out early holders and provide attractive entry points for sideline traders. This creates a more committed group of holders, leading to a wider distribution of tokens and, in turn, attracting more attention.

Until a new memecoin leader emerges, no one can accurately predict its shape. Therefore, now is the time to closely monitor Twitter, Telegram, and Dexscreener to discover the memecoin with the potential to become the next on-chain leader. When researching memecoins, consider the following questions:

What is the addressable market (TAM)? Will it resonate only with the crypto community, or does it have the potential to enter the mainstream (like FARTCOIN)?

Who has the incentive to make this token a success? Are there large institutions willing to stake their reputations on it?

What is the consensus point? What is the core narrative that is driving the price higher?

How contagious is a meme? Do they have the ability to spread themselves?

This list is not exhaustive, and a leading coin may not meet any of the above criteria. The main purpose of listing these questions is to make you think about the key factors that drive the attention of Memecoin.

Conclusion

I can't guarantee a Memecoin revival, nor does this article encourage you to blindly buy every new coin listed on Dexscreener. However, this is a trend worth watching, and there are clear signs of a return to Memecoin: rising trading volume on decentralized exchanges, the addition of new trading pairs, increased market capitalization of newly listed tokens, and increased sharing of K-line charts on social media platforms. Believe in the value of certain things.