By Joakim Book

Compiled by Tim, PANews

Last Sunday night, Bitcoin experienced a flash crash, with a large negative bar appearing; even more bizarrely, Bitcoin continued to fall on Monday morning, falling below $111,000.

In Bitcoin price analysis circles, it's often said that no one knows why the price moves. Sometimes, though, we do find clues, though they're not as clear-cut as we'd like. Today, I'll explore two things: the market turmoil of the past 24 hours and Federal Reserve Chairman Powell's speech last weekend.

Bitcoin's unruly price

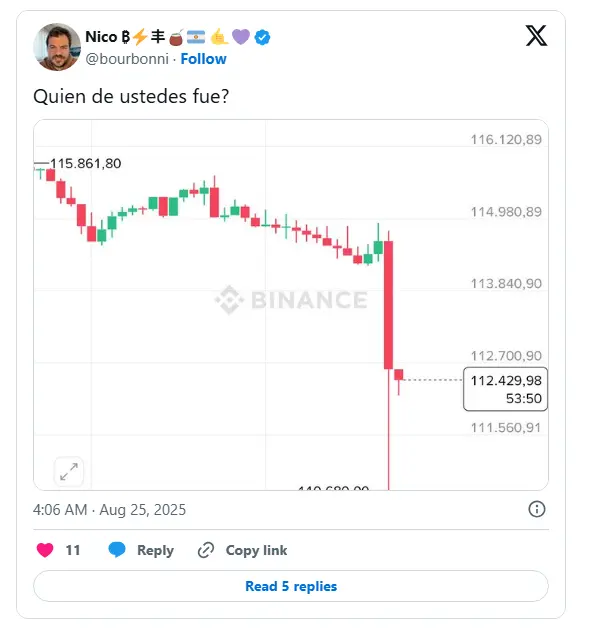

Sunday night in Europe was a nerve-wracking time:

When Bitcoin prices move like this, it's hard to say "no one knows" why. Someone must have known the reason behind the nearly $3,000 price drop in just a few minutes. Short of a specific macro event like last week, only two things could have ripped through the order book at such a rapid pace: a massive sell order or (essentially the same thing) a massive forced liquidation.

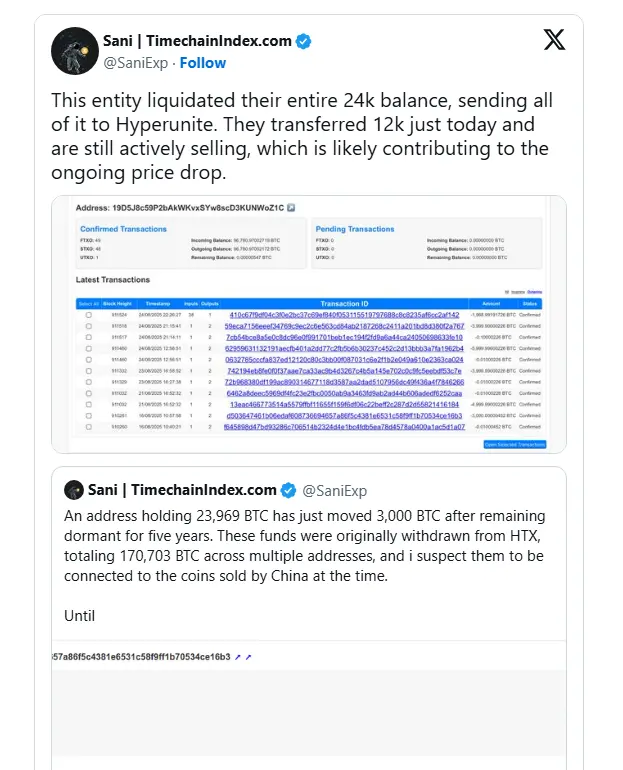

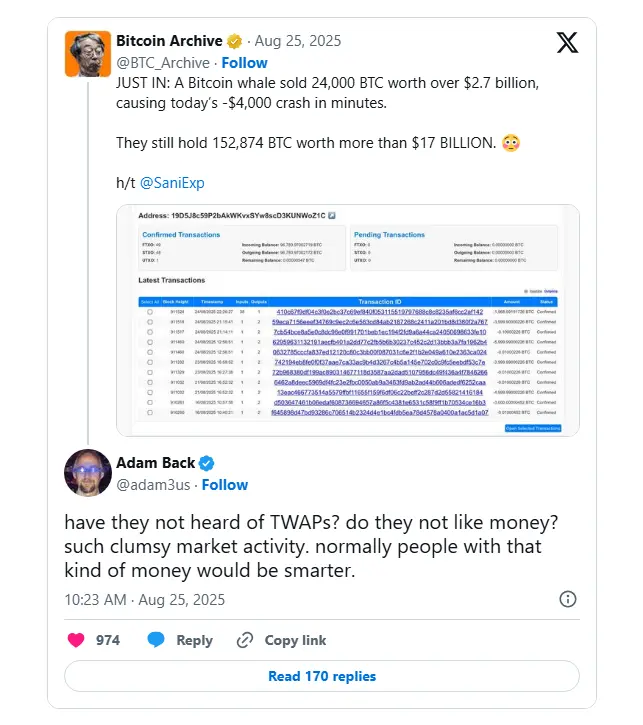

Yesterday, there were signs of both:

or

This is an immature market, we are ridiculously small, the Bitcoin market liquidity is ridiculously low, and we are still subject to manipulation by individuals. (As is often the case in the Bitcoin world, there are always some idiots who try to make a good thing out of an obviously bad thing.)

Last night’s instant 2.5% drop in Bitcoin’s price was likely a one-off event triggered by whale selling or liquidations, but the gradual diagonal decline overnight and into Monday morning, which took Bitcoin below $111,000, is more concerning.

Ignore those restless whales for now, but then there was another sharp drop, so what is going on? It should have risen sharply but it is slowly falling, my God!

Global macro trends are all pointing higher: why would Bitcoin's price be trading in this range? Any reasonable assessment would suggest it should double or triple. (No, we didn't break below $111,000, whether or not this was related to, caused by, or anything else related to Metaplanet's announcement of a buyout).

Bitcoin prices follow their own will, and altcoins follow their own will.

Bitcoin desperately needs psychological treatment: its price moves in complete caprice, disregarding market sanity or rational assessment. Even in the most optimistic bull market, it shows no concern. I've heard this called the "maximum pain theory," and even Saylor's "million-dollar cost" averaging strategy has had limited success.

One of the "magic tea leaves" readings (the 128-day moving average) tells us that our Bitcoin Magazine Pro team's current forecast is $108,500. So we're likely to reach that price. Saylor and others have already sold kidneys and chairs to buy Bitcoin, so I wonder what else they have to sell.

Even more frightening is that altcoins will continue to fall, hitting new lows. Our exclusive explanation is that Mr. Bailey, owner of BTC Inc., is one of the institutions operating these altcoins, and he recently lost approximately $41 million. He had previously gorged on these coins this spring, but now he is forced to purge them: some were buried in large black candlesticks triggered by liquidations, while others were buried in the slow and grueling time-weighted price decline.

A certain OG cypherpunk seemed to be aware of this situation.

Bitcoin Price and Powell's Movement

Sometimes we do (sort of) know what's happening in the market. For example, last week at 10:00 AM Eastern Time on August 22nd, the Federal Reserve released its monetary policy framework statement and updated documents on its official website. The market generally interpreted this as a foregone conclusion that monetary policy easing was imminent. How did we know? Because all cryptocurrencies jumped in that minute, and the US dollar index plummeted in response:

- 9:59:49 AM: Bitcoin price is $112,393, according to Bitcoin Magazine Pro's price chart.

- 10:00:49: One minute later, it is $113,459

- Shortly after the announcement, the price of Bitcoin soared to $115,000, a 2.3% increase.

This is the kind of news that moves markets, and the sudden, massive move makes us pretty sure this is the reason.

(Reference data: At 9:59, the US dollar index (DXY) was at 98.7; two minutes later, it fell to 98.15; and one minute later, it dipped to 97.8. A drop of 1% in the blink of an eye—it's amazing how much the US dollar index fluctuates!)

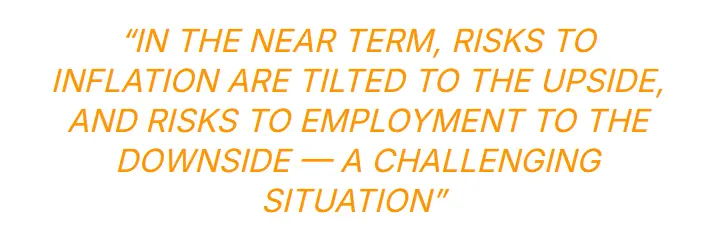

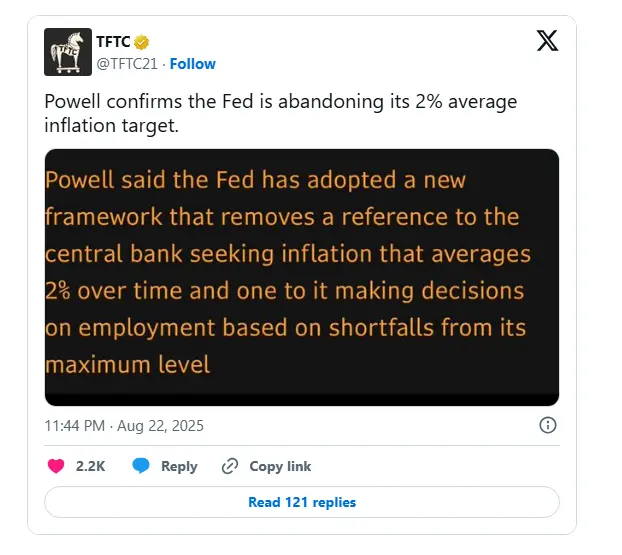

Now we have the reason for the rally: Powell’s dovish speech. What part of his speech shook the market?

Data releases like inflation figures and the Bureau of Labor Statistics' unemployment report are often accompanied by simple trading algorithms that immediately crawl website content for real-time updates and make split-second assessments, often triggering second-order trading. When humans and AI weigh in, these market fluctuations often reverse within ten, twenty, or even half an hour, ultimately resulting in a false alarm. This time, however, Bitcoin's price continued to rise throughout the weekend (until someone disrupted the fun on Sunday).

Powell's remarks last week

- Inflation has risen slightly but is under control and is declining.

- GDP growth has slowed significantly

- Unemployment remains stable and in equilibrium (but it’s “a peculiar equilibrium” where both supply and demand fall) → Overall risk rises.

They will scrap their misguided plan for average inflation targeting (based on some never-specified time period).

However, Powell concluded that these risks "may warrant an adjustment in our policy stance."

In the minutes and hours following Powell’s speech and statement, Bitcoin’s price surged to $117,000 before retreating to $116,000, suggesting that market participants were organically dissecting and assessing the implications of this new development.

The key to my "no one knows why" view is this: No one can discern which part of Powell's statement actually mattered, because new information is always intertwined with market participants' pre-existing expectations, and we can almost never be sure what those expectations were. When we engage in such retrospective, improvisational interpretations, we are essentially playing the game of post hoc rationalization, which is really not a big deal.

This is all so sad, what we need are wealthy Bitcoin players, not impoverished, distracted speculators.