Author: Monchi | Editor: Monchi

1. Bitcoin market and mining data

From January 13 to January 19, the price trend of Bitcoin showed a certain volatility. The main changes during this period are as follows:

On January 13, the trading volume of Bitcoin soared during the US trading hours. It rebounded after a sharp drop, and quickly pulled back after falling below $89,000 for a short time. It opened at $94,540.5, rose to a high of $95,906.9, and reached a low of $89,664.8. The panic greed index rose. On January 14, Bitcoin rebounded across the board and rose strongly to $97,120.94. On January 15, it remained around $96,600 and continued to fluctuate, with an upward trend. It quickly rose to $99,000 in the evening of the 15th, and continued to successfully break through the psychological barrier of $100,000. The intraday high reached $100,671.0 and closed at $100,499.8. The sharp increase in trading volume showed that the market was strong in buying. On January 16, after a continuous small fluctuation and rise, the price slightly corrected due to profit-taking, reaching a low of $97,400.2 and closing at $100,004.5, but the market sentiment remained optimistic. From January 17 to 19, the price of Bitcoin continued to rise, showing a steady upward trend. On January 17, Bitcoin stood firm at the psychological barrier of $100,000. After opening, it fluctuated slightly and continued to rise, showing that the bullish force was still accumulating, breaking through the recent high of $105,843.8. On January 18, it briefly corrected to around $102,820 due to profit-taking, but the market quickly pulled back to $104,610, reflecting strong buying intentions. On January 19, the price of Bitcoin continued to fluctuate and rise. As of the time of writing, Bitcoin remained around $104,630. The market sentiment remained optimistic and the bullish pattern was consolidated.

Bitcoin price trend (2025/01/13-2025/01/19)

Market dynamics and macro background

1. Capital Flow

As more companies accumulate Bitcoin, corporate Bitcoin holdings will surge 43%. Currently, 68 public companies hold Bitcoin on their balance sheets, and VanEck predicts that number will reach 100. The company expects the number of Bitcoins held by private companies to increase from about 765,000 in December to more than 1.1 million this year.

2. Technical pressure

On Friday afternoon, Bitcoin was trading around $104,800, having hit a new 2025 high of $105,900 earlier in the day. On Thursday, December Consumer Price Index (CPI) data showed that core price pressures eased more than expected, pushing Bitcoin prices above $100,000. Currently, Bitcoin prices are near $105,000, close to the pressure range of the all-time high of $108,309. In this area, selling pressure is high, which may lead to a price correction in the short term.

3. Changes in market sentiment

Market sentiment is optimistic, and investors are positive about the possible cryptocurrency-friendly policies that the Trump administration may introduce. In addition, the recent Bitcoin price breakthrough of $105,000 has further boosted market confidence.

4. Industry News

Trump is about to take office, and the Trump administration's cryptocurrency-friendly policies are one of the important factors driving the surge in Bitcoin prices. He plans to issue multiple executive orders targeting cryptocurrencies after taking office, which indicates that the crypto industry will receive more support, which has boosted market confidence in cryptocurrencies, especially Bitcoin. In addition, the recent lower-than-expected U.S. core consumer price index (CPI) has increased the possibility of a rate cut by the Federal Reserve, which is usually beneficial to risky assets, including Bitcoin. Trump also plans to issue more than 100 executive orders, focusing on the digital asset industry, which may bring a more favorable regulatory environment to the cryptocurrency market.

Hash rate changes:

Between January 13 and January 19, 2025, the hash rate of the Bitcoin network experienced significant fluctuations, showing a "high-fall-recovery" trend. The overall fluctuations were large, but the recovery speed was fast, showing the active participation of miners and the resilience of the network. Specifically, on January 13, the hash rate rose from 866.27 EH/s to 975.86 EH/s, and then fell back to 809.73 EH/s. On January 14, the hash rate continued to decline after staying near 809.73 EH/s, eventually falling to a low of 685 EH/s, and then rebounded to 868.80 EH/s. From January 15 to 16, the hash rate fluctuated and fell to 726.77 EH/s, and fluctuated between 724 EH/s and 773 EH/s. On January 17, the hash rate rebounded to 807.53 EH/s, but then continued to drop to 657.35 EH/s. Between January 17 and 18, the hash rate gradually recovered to 815.18 EH/s and remained around 800 EH/s. On January 19, the hash rate fell from 818.46 EH/s to 718.95 EH/s, but soon rebounded to 832.75 EH/s, showing a strong momentum of market recovery.

Bitcoin network hash rate data

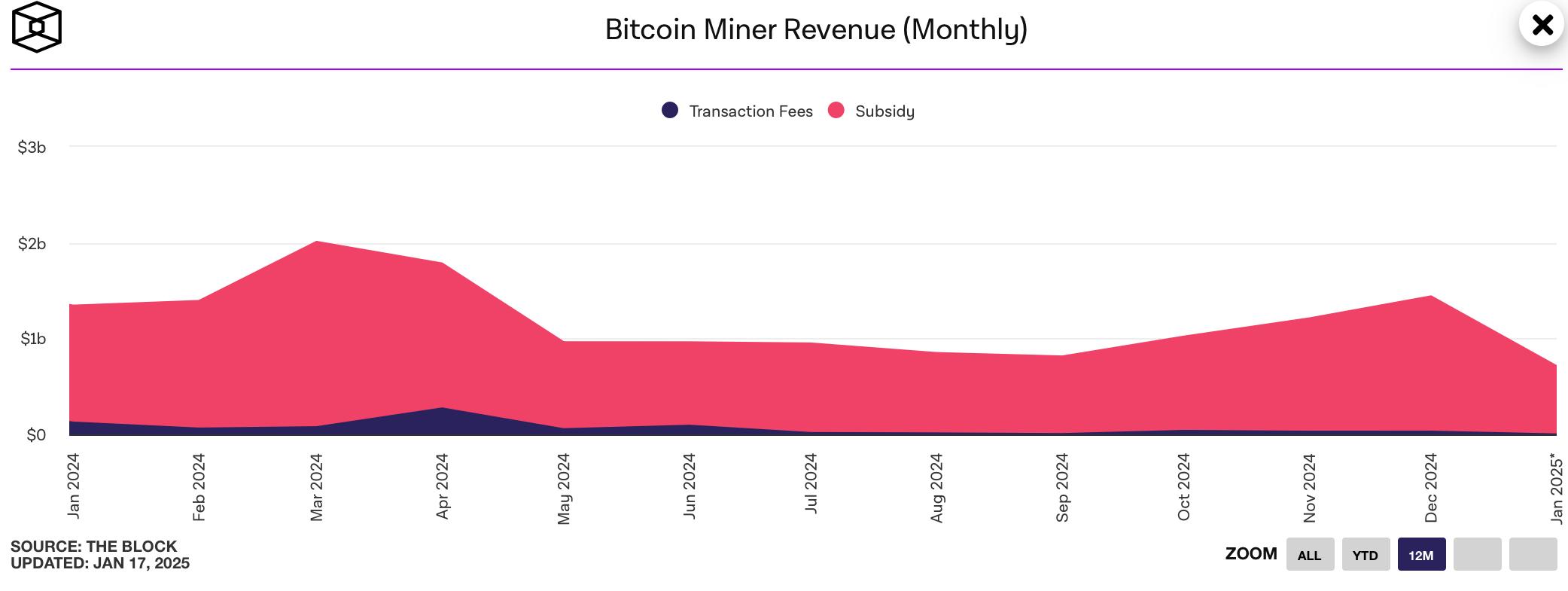

Mining income:

According to data from TheBlock, as of January 19, 2025, the total revenue of Bitcoin miners in January 2025 has reached US$704 million.

From January 13 to January 19, 2025, Bitcoin miners' income was affected by multiple factors. Although the mining difficulty continued to increase, setting a record high of 110.45T, the rise in Bitcoin prices (breaking through $100,000) effectively increased miners' income. In addition, miners optimized energy efficiency and computing power with the help of a new generation of efficient mining machines and energy management technologies, ensuring that they can maintain stable income in a high-difficulty environment. As the computing power of the Bitcoin network continues to grow, the potential for increasing miners' income is still large, especially with the support of price increases and technological progress.

Bitcoin Miner Income Data

Energy costs and mining efficiency:

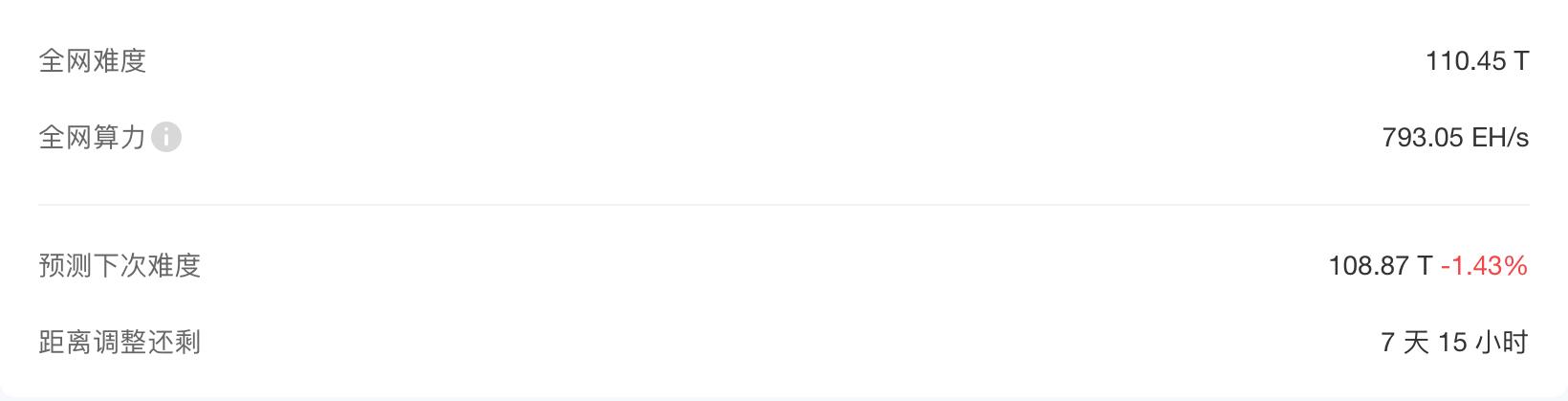

According to CloverPool data, the Bitcoin network completed a new round of difficulty adjustment at 04:01:51 on January 13, 2025 (block height 878,976), with the difficulty value increased by 0.61% to 110.45T, once again refreshing the historical peak. This is the eighth consecutive positive adjustment in Bitcoin mining difficulty. The current mining difficulty is about 110.45 trillion times that of the Bitcoin Genesis block. The Bitcoin network adjusts the difficulty every 2016 blocks to ensure that an average of one block is produced every 10 minutes.

This round of adjustments marks a continued rise in Bitcoin mining difficulty, similar to the situation during the 2018 bear market and the 2021 bull market. In 2021, due to the sharp drop in computing power caused by China's ban on mining, Bitcoin mining difficulty experienced 9 consecutive adjustments, and finally reached its peak in November 2021 when the Bitcoin price exceeded $69,000. In 2018, when the Bitcoin price entered a bear market from a high of $20,000, the network also experienced 17 consecutive positive adjustments, and the price eventually fell to a low of $3,000.

Currently, Bitcoin's 7-day moving average hashrate has reached 775 EH/s, and is expected to break the 1 ZH/s milestone before the next halving. Although multiple consecutive difficulty adjustments have not formed a clear trend, they are usually accompanied by periodic tops or bottoms, reflecting the continued strong performance of the Bitcoin network. The next difficulty adjustment is expected to take place in about 7 days.

Bitcoin mining difficulty data

2. Policy and regulatory news

El Salvador's President Plans to Install a Bitcoin Node in Every Household in the Country

On January 14, according to Bitcoin Magazine, Max Keiser, a senior Bitcoin adviser to the President of El Salvador, revealed that Salvadoran President Bukele is preparing to install Bitcoin nodes in every household in the country.

Malaysian Prime Minister announces exploration of cryptocurrency and blockchain policy

On January 15, Malaysian Prime Minister Anwar Ibrahim said that the government is studying and formulating digital financial policies in order to recognize cryptocurrency and blockchain technology. During the Abu Dhabi Sustainability Week, he discussed with the Abu Dhabi government and Binance founder Zhao Changpeng how to promote the development of this field.

Anwar stressed that cryptocurrency and blockchain technology, similar to artificial intelligence, are rapidly changing the financial world and Malaysia cannot fall behind. He suggested that the Ministry of Finance, the Securities Commission and the National Bank of Malaysia conduct a comprehensive study and said that the government will learn from international experience including Binance and the UAE.

He revealed that he would submit a relevant policy draft to the cabinet and give priority to promoting policy innovation in this area in order to break away from the constraints of the traditional financial system and move towards a new model of digital finance.

The US SEC is ready to promote crypto policy reforms immediately after Trump takes office

On January 15, according to Reuters, three people familiar with the matter said that senior Republican officials of the U.S. Securities and Exchange Commission (SEC) are preparing to begin reforming the agency's cryptocurrency policy as early as next week after Trump takes office.

The steps being considered by Commissioners Hester Peirce and Mark Uyeda include launching proceedings to ultimately write guidance or rules clarifying when the agency would consider cryptocurrencies to be securities and reviewing some cryptocurrency enforcement cases pending in court, two of the people said.

Texas Senator Submits SB 778 to Establish State-Level Strategic Bitcoin Reserve

On January 16, Texas Senator Charles Schwertner tweeted that he had submitted SB 778, proposing to establish the first state-level Bitcoin strategic reserve in the United States. If the bill is passed, it will enable Texas to take a leading position in the digital economy and promote economic growth and freedom.

Tweet screenshot

3. Mining News

Russian crypto mining machine sales triple as regulatory stance turns loose

According to Cryptonews on January 13, in the fourth quarter of 2024, the demand for Russian crypto mining machines and related services increased threefold year-on-year. Sergey Bezdelov, chairman of the Industrial Mining Association, said this was due to new regulations that allow individuals and companies to legally mine within a certain energy consumption range. The new regulations give mining a legal status and require miners with more than 6,000 kWh to register, but they are still in a relatively loose regulatory environment. The Russian Ministry of Finance estimates that crypto miners' tax revenue can reach $500 million per year. At the same time, lawmakers said that supervision may be further simplified, especially for companies that use cryptocurrencies to circumvent sanctions, to promote market development.

Nasdaq-listed company NMHI received a delisting notice, having announced its entry into the Bitcoin mining field a month ago

On January 15, Nasdaq-listed company Nature's Miracle Holding Inc. (NMHI) received a delisting notice, which stated that trading of the company's common stock and warrants will be suspended on Nasdaq, effective from the opening of the market on January 15, 2025. The company is considering appealing the ruling. NMHI has just recently launched its Bitcoin business, announcing a month ago that it would acquire 90% of the fully diluted shares of Bitcoin mining company J&Y Marigold Ltd. for a total purchase price of US$5.32 million, entering the Bitcoin mining field.

New Arkansas bill would ban cryptocurrency mining within 30 miles of any U.S. military installation in the state

On January 16, Arkansas lawmakers proposed a new bill that would ban cryptocurrency mining within 30 miles of any U.S. military facilities in the state.

4. Bitcoin related news

Global companies and countries continue to increase their holdings of Bitcoin

Matador: Purchased 29 bitcoins at an average price of $96,341, with a total investment of $4.5 million CAD.

Lead Benefit: Purchased 500 bitcoins at an average price of $94,375, with a total investment of $47 million, for short-term investment and high liquidity.

BlackRock: Currently holds approximately 559,564.44 bitcoins through its Bitcoin Spot ETF (IBIT), which exceeds 2% of the total supply of Bitcoin and has a market value of more than US$56.22 billion (as of January 16).

Genius Group: Plans to increase its Bitcoin reserves to $86 million through a $33 million rights issue and a loan of up to $20 million.

Grayscale: Increased holdings of 2,356 ETH and 647,072 BTC, with a total value of $72.28 million. Goodfood Market Corp. (TSX: FOOD): Canadian listed company Goodfood announced that it will adopt Bitcoin as a financial reserve asset, has invested approximately $1 million through spot ETFs, and plans to continue to use part of its future cash flow for Bitcoin investment to increase its holdings.

El Salvador: Currently holds 6,032.183 bitcoins, equivalent to approximately US$628 million.

Trump’s Treasury Secretary Nominee Scott Bessent Reveals $500,000 in Bitcoin ETFs

On January 13, according to Cointelegraph, Trump’s Treasury Secretary candidate Scott Bessent disclosed that he owns a $500,000 Bitcoin ETF.

Meta Shareholders Suggest Using Part of the Company's $72 Billion Cash Reserve to Buy Bitcoin

On January 13, according to beincrypto, Meta shareholder Ethan Peck submitted a proposal urging the company to allocate part of its $72 billion cash reserves to Bitcoin. The proposal cited BTC's potential as a hedge against inflation and its superior performance compared to traditional assets. In the proposal, Peck expressed concern about inflation eroding the value of cash held by Meta. He believes that Bitcoin has performed strongly compared to traditional assets and can hedge against inflation while increasing shareholder value. Peck cited Bitcoin's impressive returns, pointing out that it has increased by 124% in 2024 and an astonishing 1,265% in five years. These figures far exceed the modest yields of bonds and other traditional financial instruments. He also emphasized that Meta's indirect exposure to cryptocurrencies through the company's second largest institutional investor BlackRock, which has allocated 2% of Bitcoin to the company.

BlackRock: Bitcoin adoption is outpacing the internet and mobile phones and is becoming an integral part of the financial landscape

On January 14, according to a recent report from BlackRock, Bitcoin's adoption rate has surpassed past transformative technologies, including the Internet and mobile phones.

The report highlights that since its launch in 2009, Bitcoin has rapidly evolved from a niche innovation to a globally recognized asset, attributing this evolution to demographic trends, economic changes and the ongoing digital transformation of finance.

Younger generations, often referred to as “digital natives,” are more likely to accept Bitcoin than Generation X and Baby Boomers. Their familiarity with technology and preference for digital-first solutions make them a leading demographic for cryptocurrency adoption.

With regard to economic shifts, trends such as rising inflation, geopolitical tensions, and concerns about the traditional banking system highlight the value of Bitcoin as a decentralized asset. As the global economy digitizes, BTC is becoming an integral part of the evolving financial landscape.

Michael Saylor: Companies should turn to Bitcoin investment because traditional bonds such as government bonds are "poison"

On January 14, MicroStrategy co-founder and chairman Michael Saylor said at the ICR Conference in Orlando that companies should turn to Bitcoin investment because traditional bonds such as government bonds are "poison." He emphasized that since the company began implementing its Bitcoin investment strategy in 2020, Bitcoin has outperformed bonds, and suggested that companies view Bitcoin as digital capital.

Saylor revealed that MicroStrategy recently increased its holdings of Bitcoin again with $243 million, which is the tenth consecutive week of purchases. The company currently owns about $41 billion in Bitcoin, accounting for more than 2% of the total supply of Bitcoin. He also criticized companies such as Microsoft and Nvidia for failing to follow MicroStrategy's Bitcoin investment strategy. Saylor encouraged companies to "embrace the future" and said that "the only consequence of taking action is to get rich."

US SEC Chairman: Bitcoin is like gold, 7 billion people around the world want to trade it

On January 15, Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), said in an interview, "Bitcoin is a highly speculative asset, but 7 billion people around the world want to trade it. Just like we have had gold for 10,000 years, we now have Bitcoin."

In terms of regulatory stance, Gensler pointed out that the SEC has never classified Bitcoin as a security. For thousands of other crypto projects, he emphasized the need to prove their actual use cases and fundamental value. When the host quipped, "You must hold Bitcoin," Gensler said that he has never held any cryptocurrency in the past 7-8 years. The host then joked, "Now you can hold it because you are about to step down as SEC Chairman."

Screenshot of Gary Gensler's interview

ARK Invest: Bitcoin's relative volatility is low and is expected to rise further in 2025

On January 15, ARK Invest said in its "Bitcoin Monthly" report that although Bitcoin's volatility soared at the end of the fourth quarter, it was "not significant from a historical perspective." Bitcoin's monthly volatility in December was relatively mild compared to its annual volatility. The low relative volatility means that Bitcoin has not yet entered the frenzy phase of its cycle, which means that further increases are possible, especially in a bull market.

“Indeed, these data points suggest that there is further room for market upside in 2025,” the ARK report said.

CryptoQuant: Trump's policies may push Bitcoin to $249,000 by 2025

On January 15, the latest weekly report of the on-chain analysis platform CryptoQuant predicted that $520 billion of new funds may flow into the Bitcoin market in 2025, pushing the price of Bitcoin to $145,000 to $249,000. The report pointed out that favorable regulation, monetary policy and cyclical conditions will continue to drive capital inflows.

Samson Mow, CEO of JAN3, is more optimistic, predicting that the price of Bitcoin is expected to exceed $1 million in 2025, with daily fluctuations of up to $100,000. Filbfilb, co-founder of DecenTrader, said that the current performance of Bitcoin is like an "underwater beach ball" suppressed by the traditional market, and the market's concerns about the Fed's policies may overly affect the performance of the crypto market.

52% of Americans have sold traditional assets such as stocks or gold to invest in Bitcoin

On January 16, a recent survey launched by Chainplay and Storible showed that 52% of Americans have sold traditional assets such as stocks or gold and invested in Bitcoin. One in five U.S. residents now allocate more than 30% of their investment funds to cryptocurrencies, and 68% of Americans own cryptocurrencies.

The survey shows that cryptocurrency adoption will surge after November 5, 2024. 64% of Americans who own cryptocurrency have recommended it to family members, and 60% expect to double their holdings by 2025. In addition, 77% plan to buy more cryptocurrency, indicating that cryptocurrency adoption is increasing.

California State Representative Phillip Chen to Draft Bill Supporting Bitcoin

On January 18, California House of Representatives member and Republican Phillip Chen will draft a bill to support Bitcoin. Phillip Chen's office has appointed Proof of Workforce to be responsible for various Bitcoin-related initiatives and assist in drafting formal bills for the upcoming legislative session.

It is reported that Workforce Proof is a non-profit organization based in Santa Monica, California, which aims to help workers, unions, pensions and municipalities carry out education-based Bitcoin adoption.

Wyoming House of Representatives Submits Strategic Bitcoin Reserve Legislation

On January 18, U.S. Congressman Cynthia Lummis said that Wyoming has taken a bold first step towards strategic Bitcoin reserves. Congressman Wasserburger proposed legislation to allow permanent funds to diversify into Bitcoin.

Massachusetts Introduces Two Bills Regarding Bitcoin Strategic Reserves

On January 19, Cointelegraph published an article stating that Massachusetts has introduced two more bills on Bitcoin strategic reserves.