Nansen — Smart Money’s Coin Screener

Low-cap projects, those with a potential market cap of less than $10 million, are reasonable bets for quick 100x returns. The question is, how do you spot them early?

KOLs like to tout their choices, but the truth is often more than meets the eye: KOLs are paid to promote, or they buy first and then let you take over. So I think making decisions based on on-chain data is one of the best ways to start.

Fortunately, a simple strategy for finding early, low-cap projects using Nansen already exists. Unfortunately, you’ll need to pay a $99 monthly subscription fee. That’s not too much if you really want to trade on-chain.

My favorite Nansen strategy is to use Token Screener to find newly deployed tokens (7-14 days old) that are being bought by Smart Money. Go to Token Paradise, scroll to Token Screener, and select “On-Chain Metrics.” Sort by number of smart holders, txs, FDV, or whatever you like.

In the screenshot below, we have found tokens that were deployed within 7 days. I like to see the number of holders grow as the number of transactions increases. You can see that these are mostly low market cap tokens, even as low as ISHI with $559k FDV.

At this stage it is still hard to know which one will hit 100x, so further analysis is needed. For example, MDAI is the first coin on the list. Find it on Coingecko, look it up on X, check their website, and judge for yourself if it is worth paying attention to.

MindAI’s project description is “unleashing the power of your personal assistant”, which is basically ChatGPT on Telegram.

AI? Sounds sexy, but it’s probably just to follow the AI trend, so I don’t support it, but simply use it as an example.

You also need to check token holder concentration and whether smart money is buying or selling. MDAI has 21% deposited in the Uniswap LP pool, of which 28% is staked, but whales still hold a large number of tokens.

Check the community vibe on Discord/Telegram, engagement, check who in your X circle is following it, who are the investors, unlock schedule, and utility of the token.

Next, you need to repeat this process for all the other coins on your list and decide where to buy.

My personal experience trading this way has been mixed. I have had more gains than losses, but have yet to achieve a 100x return.

Frankly, I spend more time creating content and finding new airdrops than chasing 100x tokens. But I believe Nansen’s Token Paradise offers a better opportunity than following KOL’s advice about X.

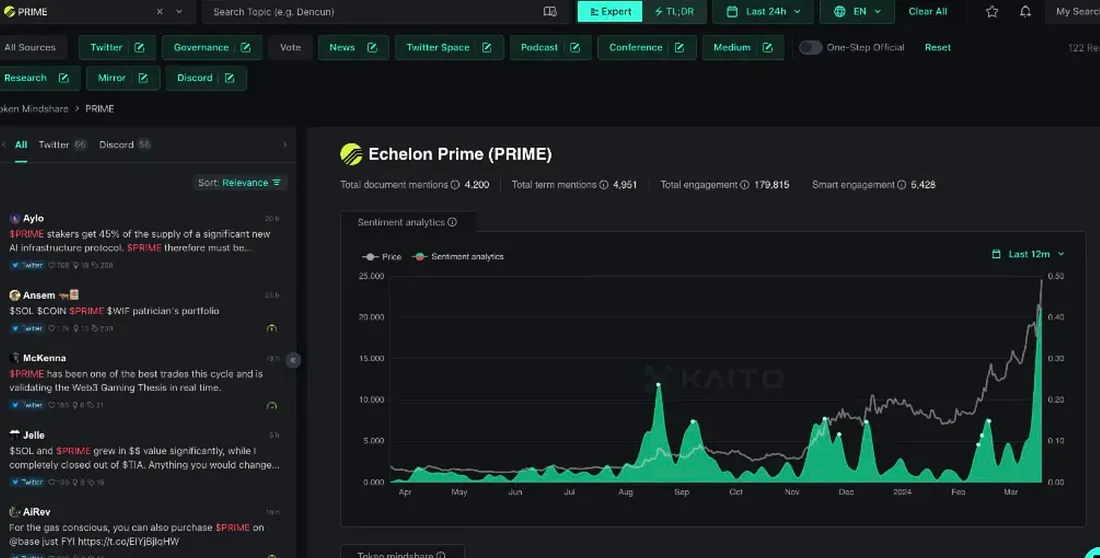

Kaito — Find trending narratives, smart follows, token mindshare and more

Kaito is my newest favorite. I use it to track market sentiment, identify popular narratives, discover hot topics, transcribe podcasts, and more.

For example, it scans Twitter posts to identify coins that are gaining more attention compared to other coins.

Kaito AI then assesses sentiment (bullish or bearish), engagement on X, and even Discord. It combines information from various online sources to summarize protocol features and updates, saving me time checking documentation, Discord, X, the DAO, etc.

In the two screenshots above, you can see that PRIME dominates Token Mindshare. Sentiment analysis has become very bullish over the past week. But is it worth buying? In fact, we need more due diligence: token economics, unlocks, market cap, and more!

One of the easiest ways to find Alpha is through Smart Following. Kaito’s “Smart Accounts” are divided into Mega Brains” and “Alpha Hunters”.

I usually filter by 7 days to see which accounts Alpha Hunters have been following recently and then analyze if there is a specific project that caught my attention. Usually, these projects have not yet launched a token and we have time to prepare for the token launch.

I asked Sandra, who was identified as the Alpha Hunter by Kaito. She had just left Nansen and joined Kaito AI.

She said finding 100x coins “is usually a matter of exhaustively researching one narrative and then using on-chain to support my thesis that some ‘smart’ wallets are moving their tokens to other narrative baskets.”

“You can often also tell by looking at off-chain data, and that’s where Kaito comes into play, we have something called ‘mindshare analysis’ to see how much a token is being talked about, and when a token gets peak mindshare, that’s a sign of ‘peak enthusiasm’ for token X, and often also signals a local top”

Innovative tokens from zero to one

This is my favorite strategy. Every once in a while a token comes along that is so unique and different that it changes the trajectory of an industry. Ingenuity in token economics can propel an industry forward and kick-start a new space within the crypto space.

Spotting the clever “zero to one” token early can be confusing at first, but can lead to nice gains if you act early.

Noticing innovation from zero to one may seem simple, but it is made more difficult by our own biases. When something new and hot emerges, it may garner little to no interest from the community. It may even be completely ignored by the crypto community as not worthy of attention.

That’s why having an open mind and being willing to try every new hot thing, especially controversial ones, can increase your chances of finding a 100x asset.

I say "asset" because it may not be a token. NFT is the most prominent zero-to-one innovation in token economics, with Punks and BAYC being the most successful examples.

In token economics, I think other assets are also innovations from zero to one, such as Ampleforth, Olympus DAO, Compound Finance COMP, Curve's CRV, Yearn Finance's YFI, Nexus' NXM, and Synthetix's SNX.

These zero-to-one innovations often lead to multiple copycat projects. But I believe 100x gains will come from the original protocol.

How to find innovation from zero to one:

- Look for technological innovation. Something that has never existed before.

- Look for community: Does anyone care about it? A large group of naysayers is also a good sign.

- Look for confusion: New things are often confusing because—

1) Technological innovation;

2) Challenging preconceived notions/narratives;

The latest example of zero-to-one innovation is Ordinals — trading NFTs and memecoins that were thought to be impossible just a few months ago.

I think the next 100x token will come from the Rune protocol, which launches after the Bitcoin halving. Are you ready, are you prepared to do the necessary work to catch the 100x wave? Will you study the Bitcoin ecosystem, how the Rune protocol works, etc.? If you really want to get a 100x return without gambling, you need to put in the effort.

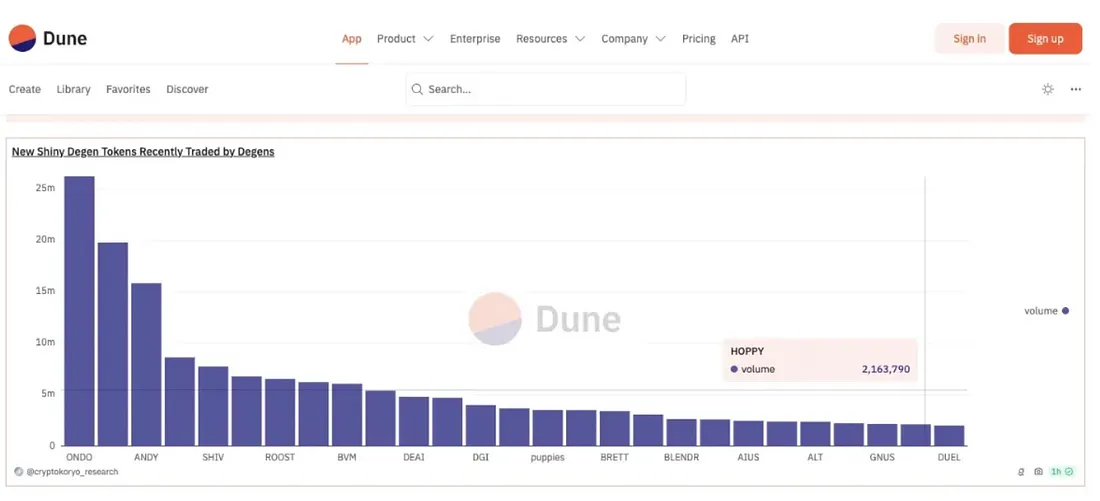

Utilize the Memelords Dune Dashboard

Dune is a free board (as Nansen and Kaito are both paid). Crypto Koryo is the expert on Dune dashboards and he built the Memelord Dune dashboard.

What we call "crypto" is now a very large market, and there are many niches within crypto where you can make money. Airdrops, yield farms, trading, etc. But there are undoubtedly 100x gains that come only from trading. But they are also a very small niche within trading.

It’s easy to achieve 2x-10x gains trading cryptocurrencies over relatively long time frames. But if you really want 100x, you have to narrow down the assets you trade.

- Market Cap: Market cap is a good simple metric for how high a token can go. According to CoinMarketCap, there are less than 100 assets with a market cap of more than $1 billion. $10M * 100 = $1B. So if you want that 100x, you need to pick projects with a market cap of less than $100 million.

- Project Age: As we all know, new projects tend to perform better. Focus on projects that have been listed in the last 12/6/3 months. It's rare to see old projects pull >20x. If the project was really good, then it should have been priced in, if not, it wouldn't have done 100x.

- Narratives: Only a few narratives have 100x potential. Dex/option/oracle projects may never reach 100x. In 2024, to achieve 100x, you should focus more on meme and AI tokens.

- No matter what project you are interested in, if at some point the majority of people don't think so, the price won't go up.

- Being early is important. This means being a contrarian. Seeing potential trends before everyone else.

- Attention Economy: When you start something very early and you are part of a minority group that thinks this token will go up, it can become a 100x coin. You need to find the minority group that thinks like you and is also looking for 100x. But you shouldn't look for them in Telegram/Discord groups, you don't even need to talk to them.

For points 1 to 6 above, you should make use of the Memelord Dune board built by Crypto Koryo.

The tables 'New Shiny Degen Tokens Recently Traded by Degens' and 'Top 100 Most traded degen tokens by Meme traders — Last 2 weeks' are the two places you need to focus on. The 100x answer is in these two tables. These two tables combine points 1 to 6 above.

https://dune.com/cryptokoryo/memelords

Airdrops, but not all

There are two types of airdrops I want to highlight:

- Liquidity Mining Airdrop

- Participation-based airdrops

You must know that I am bullish on Liquid Retaken tokens. But if you don’t have funds (ETH) to stake, you won’t get a high airdrop.

Instead, I would look for participation-based airdrops where even a small amount of capital can qualify you for a large allocation.

These include bridges (LayerZero, etc.), oracles, L1 or L2, using testnets and actively participating in the early stages of the protocol to receive “early member” NFTs.

It takes effort and consistency, but if you’re starting with a small portfolio, airdrops are how you make it happen.