In just a few months, the industry has experienced dramatic fluctuations, with rises, pullbacks, and shocks taking turns. Many people entered the market at high levels, the Trump team continued to operate, and liquidity was quietly transferred. Market sentiment dropped to freezing point, trading volume was bleak, some people cut their losses, and some people lay flat, looking lifeless.

Is this really a bear market?

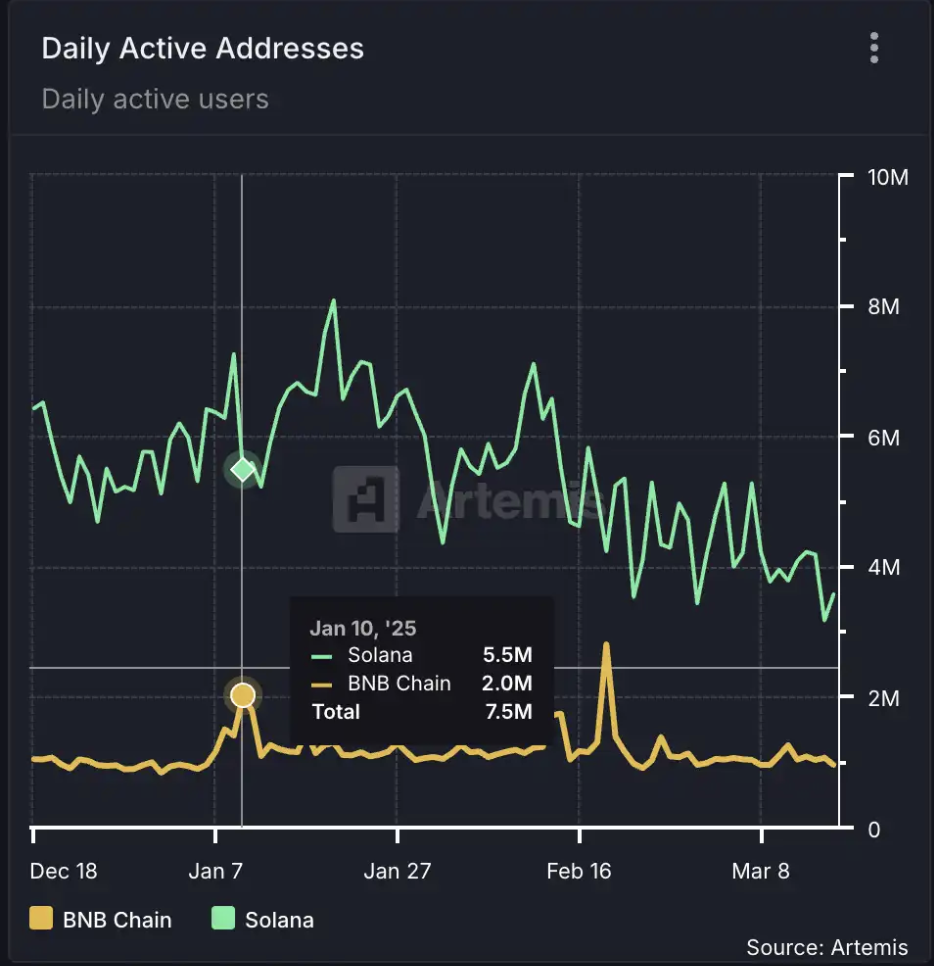

When the entire market is in a downturn and the mood is pessimistic, it is often the stage when new opportunities emerge. During this round of "garbage time" in the cryptocurrency circle, another sector is surging undercurrents - the BNB Chain ecosystem.

"Smart money" has already started to take action, and the window of opportunity for the BNB Chain ecosystem is opening

As an industry giant, Binance needs to act cautiously, but its founder CZ and co-founder He Yi have recently shown a rare "marketing" attitude. This pair of leaders, who have always been low-key, suddenly became active, and the BNB Chain ecosystem has become their fulcrum for leveraging the industry:

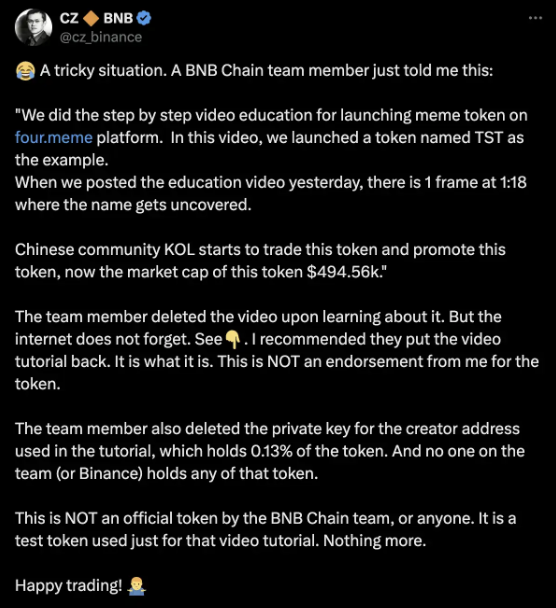

On February 5, the BNB Chain team released a promotional video for Four.Meme, which included test tokens. It is not uncommon for such test coins to be hyped by the market, and similar cases include the previous pump.fun and various DEX demonstration videos.

What attracted the most attention this time was not the token itself, but CZ's change of attitude. CZ, who had never played memes, not only forwarded the promotional video the day after Four.Meme was released, but also posted a statement. In summary, it can be said in one sentence: "Happy Trading"

The gears of destiny have started, and the BNB Chain Meme ecosystem is experiencing an explosion.

CZ personally entered the Meme track, and the capital response was swift and enthusiastic, and the market sentiment was also ignited. On the same day, the Meme token $TST that he called for quickly rose to a market value of 50 million US dollars. Three days later, it was listed on Binance and directly broke through the ATH of 600 million US dollars. This wave of wealth effect directly pushed the BSC DEX trading volume to triple.

From TST, CZDOG to Mubarak, Broccoli, and with the boost from Binance Alpha 2.0, the BSC ecosystem has ushered in a new round of traffic feast in the sluggish market, igniting new hope in the market.

Whether the current popularity of BNB Chain can continue, we still need to observe the market’s reaction. BNB Chain has invested a lot of resources in this wave. CZ first stood up for Meme, and Yijie and Big Cousin are also continuously promoting it. This is not a simple short-term speculation, but a planned ecological layout.

After understanding the hot spots in the primary market, anxious secondary investors may have the same questions: the secondary market is quiet, is the bull market still there? How long will the downturn last? Is the bear market coming?

In fact, the bull market is still there, it is just temporarily grazing and gathering strength. Funds will not remain dormant forever, and sentiment will not remain depressed. The real outbreak often occurs when most people lose patience and choose to wait and see.

Exploring the catalysts for a new bull market

Exchanges are always the main battlefield for investors in the secondary market. The sudden outbreak of the BNB Chain ecosystem has given the entire industry new life. As one of the pillar industries of the industry, exchanges quickly sensed this vitality and began to show their talents, scrambling to seize this wave of dividends.

Exchanges such as MEXC and BingX adopted a "quick, accurate and ruthless" approach, quickly listing the BNB Chain project and launching related trading activities to seize the popularity; LBank took a unique approach and took the "metaphysical" route, inviting metaphysical KOLs to conduct market calculations, hoping to attract specific user groups.

At the same time, some exchanges have adopted a more pragmatic approach. Although the BSC ecosystem has passed its peak and secondary market investment opportunities are gradually decreasing, exchanges such as Coinstore have chosen to use the Space discussion forum to explore the next possible track through open dialogue. This form of communication not only focuses on the present, but also looks to the future, providing investors with more forward-looking value.

In the crypto market where hot spots are fleeting, platforms that can help users plan for the next opportunity in advance can often build more lasting trust in the minds of users. Although this form of discussion may seem bland, in a market environment where information is value, it may have more long-term significance than simply chasing hot spots.

Market momentum analysis: What will be the driving force behind the new round of upward cycle?

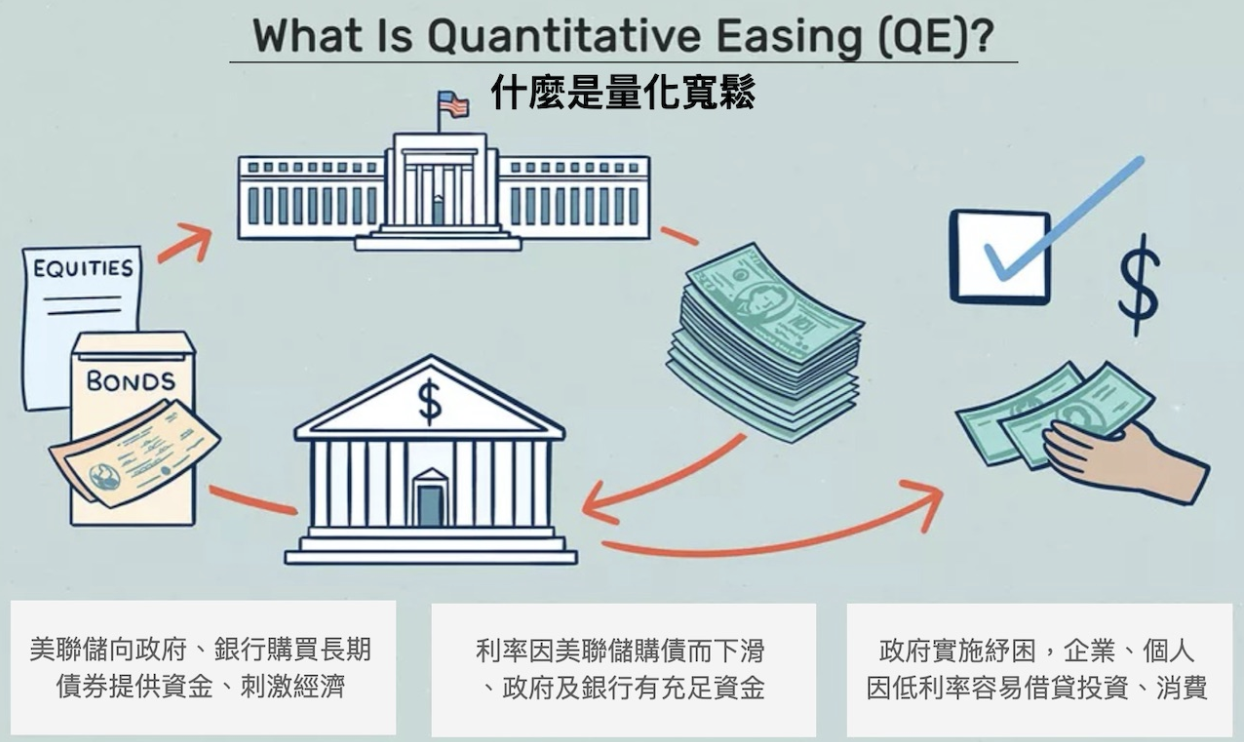

Quantitative easing: More money in the market!

On March 19, 2025, the Federal Reserve released the FOMC meeting statement and economic forecasts. As expected by the market, there was no interest rate cut. Subsequently, Chairman Powell delivered a speech, and the market reacted positively. The "loose trading (QE)" sentiment was obvious: the 10-year US Treasury yield fell 8 basis points to 4.24%, the three major US stock indexes rose collectively, the US dollar index weakened, and gold once broke through $3,050/ounce during the session. The crypto market also rose sharply, with Bitcoin breaking through $87,000 and Ethereum returning to above $2,000.

So what is quantitative easing (QE)? Simply put, it means that the central bank prints money to release liquidity and promote economic growth. Historically, whenever the market is short of money, the Federal Reserve will "sprinkle money" by lowering interest rates and buying bonds to allow funds to flow back into the market. For example, during the 2020 epidemic, the Federal Reserve printed money crazily, and the U.S. stock and crypto markets were in a frenzy, with Bitcoin directly reaching more than $60,000.

The Federal Reserve has continued to raise interest rates due to excessive inflation, but the economy has recently slowed down, and the market generally expects interest rate cuts to begin in the second half of 2024. Once monetary easing and more money in the market, risky assets (including crypto assets such as Bitcoin and ETH) will become more popular, which is a major positive for the currency circle.

New SEC Chairman Takes Office: Will the Regulatory Stick Become Softer? What Does This Mean?

In recent years, the crypto industry has been troubled by Gary Gensler (a well-known old stubborn person in the cryptocurrency circle). When Trump was campaigning for votes, in order to win the support of crypto enthusiasts, he vowed that if elected, he would fire the current chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, and appoint a new chairman.

The market generally speculates that the new chairman will not be as tough as Gensler and may relax the crypto industry. If the regulatory attitude changes from "suppression" to "acceptance", the probability of institutional funds entering the market will be greatly increased, and market confidence may also be restored.

Of course, the time of taking office has yet to be confirmed, but the signal of slowing down of regulatory trend has been released. Both exchanges and investors need to keep a close eye on regulatory dynamics and the flow of institutional funds, make arrangements in advance, and seize new opportunities brought by market adjustments.

Historical experience tells us that every favorable regulation and recovery in liquidity will bring about a market explosion. The current adjustment may be the prelude to the next major uptrend in the bull market.

Conclusion

The market will not stagnate forever, and the bull market will not happen overnight. Looking back at history, each bull market outbreak came after most people lost their patience. Garbage time is not idleness, but the "patient time" of smart people.

The rise of the BSC ecosystem, the loosening of the regulatory environment, and the recovery of liquidity are igniting a new engine for the market. Instead of waiting for the wind to come, it is better to stabilize the kite before the wind blows - at this stage, patience and strategy are far more important than impulse and passion.