1. Market observation

Keywords: ACT, ETH, BTC

ACT experienced a flash crash on Binance yesterday, and the price of the coin was almost halved. Wintermute, as the market maker of ACT, also withdrew multiple ACT tokens from Binance after the plunge and sold them on the chain. Market fluctuations are not isolated cases. DF, LEVER, MUSK, GUN and other tokens also experienced a 20%-50% drop.

Bitcoin has been fluctuating for several days. Zack Wainwright, an analyst at Fidelity Digital Assets, pointed out that although Bitcoin is still in the acceleration phase, the cycle is nearing its end. He predicts that if this cycle will reach a new high, it may start from the base price of around $110,000. Arthur Hayes, co-founder of BitMEX, is more optimistic and believes that if the Fed's policy shifts from quantitative tightening to quantitative easing of Treasury bonds, Bitcoin is expected to bottom out from the $76,500 it hit last month, then rise to $110,000 first, and then gradually climb to the target price of $250,000 by the end of the year.

Institutional investment attitudes are also divided. Despite the many uncertainties in the market, Strategy, Metaplanet, MARA and other institutions are still continuing to increase their holdings of Bitcoin, and GameStop plans to issue $1.5 billion in convertible bonds to purchase Bitcoin. However, BlackRock CEO Larry Fink is cautious about Bitcoin, warning that it may damage the international status of the US dollar, but at the same time he also recognizes the advantages of tokenization. In terms of supervision, the three major EU regulatory agencies, ESMA, and others recently issued a joint report, pointing out that the United States' increasingly friendly crypto policies are deepening the linkage between crypto assets and traditional financial markets, which may increase systemic risks.

On the macroeconomic level, Trump is about to announce a new global trade tariff policy at 4 a.m. on April 3, which is expected to impose a 20% comprehensive tariff on all trading partners. Major financial institutions have different reactions to this policy. The former head of economic research at Bank of America believes that this may be just the beginning of a trade war, while the head of research at Pepperstone warns that tariffs may increase the risk of stagflation in the US economy, while economists at Wells Fargo have noted that tariff expectations have pushed up the manufacturing price index, and continued uncertainty is suppressing market demand. Changes in these macroeconomic factors are expected to continue to affect the trend of the cryptocurrency market, and market participants need to pay close attention to policy developments and their chain reactions.

2. Key data (as of 13:30 HKT on April 2)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $84,119.27 (-10.17% year-to-date), daily spot volume $25.592 billion

Ethereum: $1,857.62 (-44.17% year-to-date), with a daily spot volume of $16.19 billion

Fear of corruption index: 44 (neutral)

Average GAS: BTC 1 sat/vB, ETH 0.43 Gwei

Market share: BTC 61.8%, ETH 8.3%

Upbit 24-hour trading volume ranking: XRP, COMP, BTC, MASK, MEW

24-hour BTC long-short ratio: 0.9223

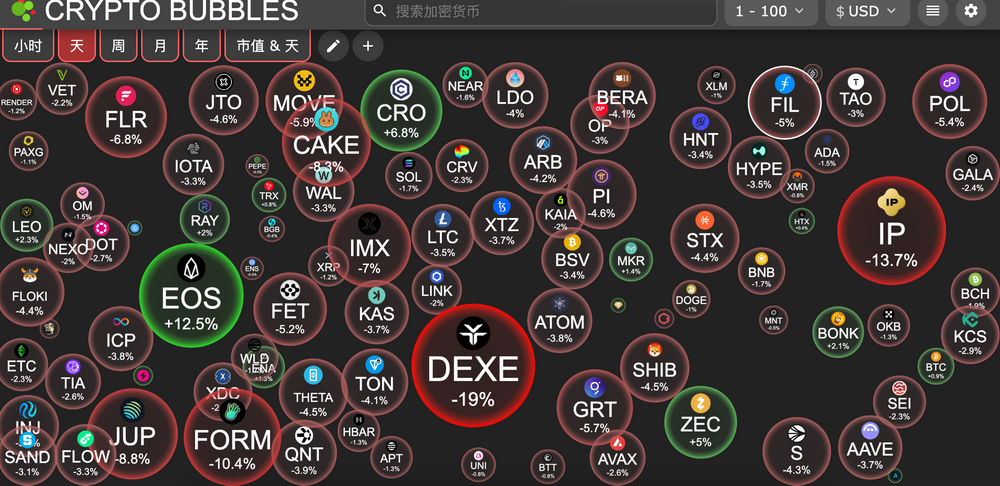

Sector ups and downs: The crypto market fell across the board, with the AI Meme sector falling 7.2% and the SocialFi sector falling 4.5%.

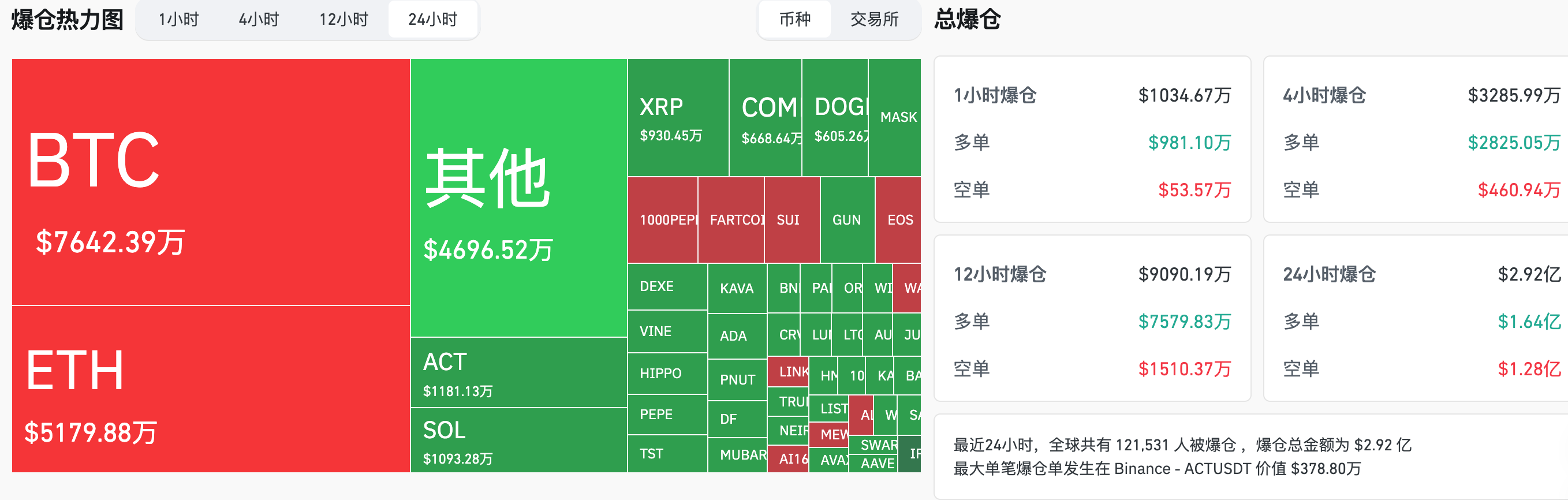

24-hour liquidation data: A total of 121,531 people were liquidated worldwide, with a total liquidation amount of US$292 million, including BTC liquidation of US$76.42 million and ETH liquidation of US$51.79 million

BTC medium- and long-term trend channel: upper channel line ($85,497.74), lower channel line ($83,804.72)

ETH medium- and long-term trend channel: upper channel line ($1,951.99), lower channel line ($1,913.34)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend, otherwise it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 1 EST)

Bitcoin ETF: -$157 million

Ethereum ETF: -$3.58 million

4. Today’s Outlook

Ethena (ENA) unlocked 95.31 million tokens, worth about $33.5 million

Jupiter (JUP) unlocked 53.47 million tokens, worth about $25.4 million

Trump to announce reciprocal and industry-specific tariffs at 4 a.m. on April 3

Number of initial jobless claims in the United States for the week ending March 29 (10,000 people) (20:30, April 3)

Actual: Not announced / Previous: 22.4 / Expected: 22.5

The biggest gainers in the top 500 by market value today: Alchemist AI (ALCH) rose 23.74%, WhiteRock (WHITE) rose 23.72%, Cat in a Dog's World (MEW) rose 15.28%, EOS (EOS) rose 11.87%, and 0x0.ai (0x0) rose 10.79%.

5. Hot News

GameStop Raises $1.5 Billion in Convertible Bonds to Buy Bitcoin

Tether announces Bitcoin address, holding over 90,000 BTC worth $7.7 billion

Metaplanet purchased 696 BTC, and its total holdings increased to 4046

EOS breaks through $0.8, with a 24-hour increase of more than 31%

US think tank proposes issuing "BitBonds" to support Trump's Bitcoin reserve plan

Binance Announces KernelDAO (KERNEL) as Fourth Megadrop Project

Backpack Completes Acquisition of FTX EU and Starts User Fund Return Process Today