Author: Jordan, PANews

On July 30, 1863, the "Automobile King" Henry Ford was born. 127 years later, on July 30, 1990, Justin Sun was born in Xining, Qinghai Province. Just as Ford promoted the popularization of the automobile industry, Justin Sun has also made remarkable achievements in promoting the global adoption of cryptocurrency and Web3.

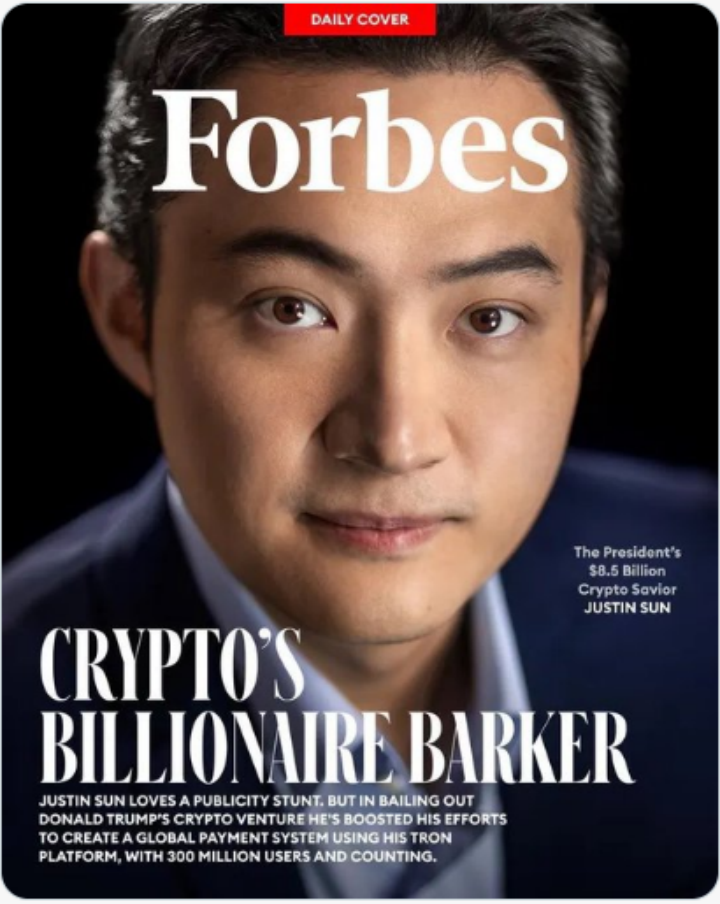

On March 28, 2025, Justin Sun, the 35-year-old founder of TRON, appeared on the cover of Forbes magazine, becoming the fourth person in the crypto field after CZ, SBF and Brian Armstrong. This event is undoubtedly a recognition of his contribution and global influence in the blockchain field, and has also attracted the collective attention of the crypto industry and traditional business.

The symbolic meaning from "controversy" to "authoritative certification"

Since entering the public eye, Justin Sun has been plagued by controversy.

From winning the first prize in the New Concept Essay Competition to successfully enrolling in the History Department of Peking University, Sun Yuchen had a smooth journey in his youth. In 2011, Sun Yuchen, who entered the University of Pennsylvania, Trump's alma mater, to pursue a master's degree, encountered something that influenced his life: Bitcoin. In the same year, he and Jiang Fangzhuo, who was studying at Tsinghua University, appeared on the cover of Asia Weekly.

Sun Yuchen, who made his first fortune through Bitcoin, returned to China to start his own business in 2015. Coinciding with the rise of the domestic blockchain industry at that time, Sun Yuchen devoted himself to it and was naturally favored by the "Post-90s Fund" under IDG. That year, Sun Yuchen also received a great gift in his life: he became the first student of the "Lakeside University" founded by Alibaba founder Jack Ma, and was the only "post-90s" among them. His selection was not unrelated to the strong recommendation of IDG founder Xiong Xiaoge. This investment circle tycoon once wrote a letter of recommendation for Sun Yuchen personally, which also gave Sun Yuchen an additional title - "Jack Ma's disciple."

It was also in 2015 that Jack Ma appeared on the cover of Forbes. As Justin Sun said on social media: "Ten years later, the world has changed, but the only thing that remains unchanged is inheritance, perseverance and construction. Ten years have passed, and everything has just begun."

What really made Sun Yuchen famous was the sensational "Buffett lunch incident" in 2019. At 3:48 am on June 4, 2019, Sun Yuchen announced on major social platforms that he had successfully bid for Buffett's 20th anniversary charity lunch at a record-breaking price of $4.568 million (about RMB 31.54 million). However, on July 23, 2019, Sun Yuchen suddenly announced that he had to cancel the lunch with Buffett due to sudden kidney stones. Finally, on January 23, 2020, Sun Yuchen posted a photo on Twitter, showing that he had dinner with Buffett at a private country club in Omaha, USA. The dinner lasted more than 3 hours, and they exchanged topics such as Bitcoin and Tesla.

Frankly speaking, Sun Yuchen's early behaviors did cause a lot of controversy. The crypto community believed that he created a personal image of a "post-90s entrepreneurial pioneer" for himself and used media publicity and business success cases to quickly increase his personal popularity. During this period, Sun Yuchen was more regarded as a hype master, and the cryptocurrency industry had mixed views on him. Some people recognized his marketing capabilities, but many people felt that he frequently used high-profile remarks and even "ridiculed the popularity."

However, as the crypto market becomes more mature, the industry's perspective and attitude towards Justin Sun has quietly changed.

At the end of 2024, Justin Sun spent US$6.24 million (about RMB 45 million) to bid for the "most expensive banana" at Sotheby's auction house and paid with cryptocurrency. At the subsequent press conference, he also ate the banana on the spot. His behavior has become part of art, reflecting the charm of art - challenging traditional cognition to cause people to think deeply.

If it can be said that Justin Sun's "wealth" mainly relies on the celebrity effect and the bull market cycle of the crypto market, but as the industry begins to enter its mature stage, the crypto community has gradually understood and recognized the once unacceptable views or behaviors. This time, appearing on the cover of Forbes magazine is not only a recognition from the international mainstream media , but also an important signal of a re-evaluation of the values of the crypto industry.

Behind the Forbes report, the market trend has changed

Since the birth of Bitcoin, the cryptocurrency industry has gradually grown from a niche technology experiment to an important part of the global financial system. In this process, the attitude of traditional media has also undergone significant changes: from initial disregard, to vigilance and criticism, to today's cooperation and acceptance. The change in the media's position not only reflects the development trajectory of the industry, but also has a profound impact on the public's perception of cryptocurrency.

In the early stages of cryptocurrency, mainstream media paid little attention to this emerging technology, and even remained in a state of "ignorance" and "vigilance" for a long time. Even if there were reports, they were often condescending, suspicious, and dismissive, such as:

● In 2011, Time magazine mentioned Bitcoin for the first time, but did not conduct an in-depth analysis of its potential value. Instead, it described it as “an experimental currency used by geeks to challenge the existing financial system” and did not give it a positive evaluation of its financial innovation.

● In 2013, a column in Forbes openly described Bitcoin as a "Ponzi scheme of the 21st century" and said that it "lacks fundamental value support and may eventually collapse."

● In 2015, The Economist published an article stating: "Bitcoin may never become a real currency because it lacks government support and its price volatility makes it an impossible means of payment." The article believes that Bitcoin may be technologically innovative, but its economic foundations are flawed.

In fact, not just the media, but also the mainstream venture capital circles at that time were still skeptical about cryptocurrency people.

However, as BTC breaks through the $100,000 mark and the cryptocurrency industry enters a new stage of development, traditional media are no longer condescending and their attitudes have changed further. Not long ago, the Financial Times published an article publicly apologizing to readers for its negative coverage of cryptocurrencies over the past fourteen years. The media said in a statement:

“With the recent move above $100,000 for Bitcoin, a significant number of commenters have felt that we owed our readers an apology for our long-standing cynicism. We therefore apologize for any decision you may have made over the past fourteen years to not buy something that subsequently saw its price increase based on our coverage. That price increase is certainly welcome. At the same time, if you misinterpreted our cynicism about crypto as support for traditional finance, we apologize, as we hate that behavior, too.”

The mainstream media's "apology" to the crypto industry actually illustrates one thing from the side: the wind direction has changed.

On the other hand, Forbes does not choose its cover person at random, but based on a series of strict evaluation criteria, involving industry and international influence, business achievements, innovation, and topicality. As the founder of TRON, Justin Sun has promoted the application and development of blockchain, not only making TRON one of the world's core public chains besides Ethereum, but also through cooperation with multiple DeFi and NFT platforms, TRX's market value once ranked among the top ten in the world. Based on Justin Sun's influence in the crypto industry, business operation capabilities, international market expansion and high topicality, although the outside world has mixed opinions about him, it is undeniable that Justin Sun's role in the blockchain industry makes him qualified to be on the cover of Forbes.

Upgrading and Transforming into a “Global Business Leader”

Last November, Justin Sun joined the Trump family's crypto project World Liberty Financial (WLFI) as an advisor. WLFI also bluntly stated that Justin Sun's insights and experience will help it continue to innovate and develop. The day before the official announcement of this news, Justin Sun had invested $30 million in WLFI and became the largest investor in the token.

In fact, for Justin Sun and the WLFI project, cooperation is a "win-win" attempt, because TRON's native token TRX has also been accepted by the mainstream crypto project endorsed by the US President. According to Arkham monitoring data, TRX has now become the fourth largest token in the Trump family's crypto project WLFI, second only to ETH, WBTC and USDC:

1. ETH: 7,933, equivalent to US$14.63 million;

2. WBTC: 162.69, equivalent to approximately US$13.5 million;

3. USDC: 11.199 million, equivalent to US$11.2 million;

4. TRX: 40.718 million pieces, equivalent to US$9.62 million .

As described in Forbes magazine, the $75 million investment ignited a WLFI buying frenzy in the crypto market. These operations only brought Sun Yuchen a little paper return, and his WLFI holdings were locked indefinitely, while the Trump family made a huge profit of about $400 million. However, this seemingly "unfavorable" investment brought Sun Yuchen huge cross-border influence.

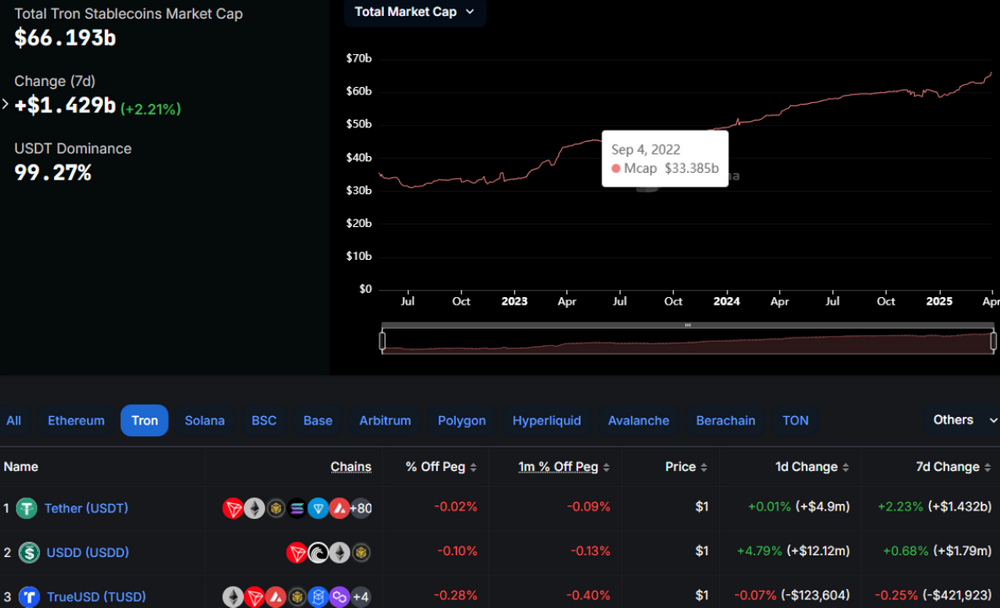

At a time when the US government strongly supports stablecoins, the TRON public chain has maintained its leading position in the stablecoin market. Taking USDT, the largest dollar stablecoin by market value, as an example, according to DeFiLlama data, TRON has become the blockchain with the largest total circulation of USDT, second only to Ethereum.

DeFiLlama data also shows that the market value of TRON ecological stablecoin has exceeded US$66 billion, currently reaching a historical high of US$66.193 billion, and has been showing a steady upward trend.

It can be seen that Justin Sun is using his efforts to break the traditional public perception that "crypto = speculation" and reshape the image of the crypto industry. In the process, Justin Sun's personal IP has also changed step by step, from early "high-end hype" to technology or industry leader, and then to "global business leader".

Justin Sun’s “Political Economics”: Crypto-finance layout pushes TRON’s “tentacles” to extend to the US market

Today, cryptocurrencies are no longer limited to the role of financial instruments, but are gradually becoming a new lever for capital operations, political influence, cross-border trade, and wealth management.

The cryptocurrency industry is playing an increasingly important role in the global political and business system. The crypto community played a vital role in Trump's successful election as the 47th President of the United States. Sun Yuchen's cooperation with the Trump family's crypto project WLFI is a perfect extension of this trend. It also shows how crypto assets can build a bridge between traditional finance and the political system and redefine the way global capital operates. Sun Yuchen's appearance on the cover of Forbes magazine is more like a milestone summary of a series of important events in recent times, but Sun Yuchen's "political economics" will never be limited to this. His deep layout of crypto finance has actually quietly unfolded.

In the early days, TRON's strategy was to compete with Ethereum in public chain technology, but the public chain market was highly competitive, and Ethereum's EVM ecosystem and Layer2 expansion technology dominated. Faced with the ceiling of public chain competition, Justin Sun adjusted his strategy in a timely manner: from technology competition to financial infrastructure, building a global capital flow network with stablecoin + TRON public chain as the core, and at the same time from C-end users to institutional users to promote stablecoins into cross-border payments, asset management and compliant financial systems, and from decentralized narratives to compliance and policy penetration, to enhance cooperation with governments and financial institutions. At least at this stage, the above-mentioned "combination punches" have indeed achieved remarkable results. At the same time, the crypto community's expectations for TRON are getting higher and higher.

Will TRON be used to improve the efficiency of the US government? Earlier this year, sources revealed that Musk would try to "govern the country with blockchain" and had started a dialogue on using blockchain technology in the newly established US government efficiency department. This is the latest sign that the Trump administration wants to boost the digital asset industry. An anonymous person familiar with the matter said that Musk, who is leading the effort to improve government efficiency, has proposed the idea of using digital ledgers to reduce government costs, and discussed exploring the use of blockchain to track federal spending, protect data, make payments, and even manage buildings.

It is reported that relevant personnel from the Ministry of Government Efficiency have met with representatives of several public blockchains to evaluate their technologies, and the TRON blockchain has undoubtedly received attention.

As a blockchain network that can process thousands of transactions per second, TRON can be used for real-time transaction confirmation in government tax systems or high-speed storage and query of public data registries (such as land ownership and company registration). TRON has almost zero transaction fees on the chain, especially in TRC-20 token transactions, where the cost is lower than Ethereum gas fees. Therefore, it can support low-cost cross-border payments, such as the US government's funding for international aid projects and reducing the operating costs of internal government payments (such as pension payments and government contract payments). Social Security and Medicare in the United States are basically paid through banks and financial institutions, with high fees and manual approval. Using the government stablecoin issued by TRON for automated payments reduces bank intermediary fees, increases the speed of funds arriving, and the ledger is traceable throughout the process to prevent fraud.

In addition, TRON smart contracts can automatically execute government procurement, social welfare distribution and other matters without manual approval, reducing corruption and inefficient management. They are suitable for automatically executing social insurance (such as Medicaid and Old Age Security) and automatically distributing government contract funds (to prevent the abuse of funds). Currently, US government procurement involves a large number of middlemen, which may lead to corruption, waste of funds and contract delays. Through the TRON blockchain, the procurement process can be tracked, contract execution can be ensured, payment flows can be monitored in real time, and supply chain efficiency can be improved. The transparent and tamper-proof characteristics of on-chain data can be applied to the tax system to realize automated tax collection and auditing. Smart contracts can automatically calculate taxes and deduct taxes immediately after the transaction is completed, thereby improving tax efficiency.

Of course, despite TRON’s many technological advantages, it still faces many challenges in promoting it in the U.S. government system. For example, stablecoins (TRC20-USDT) may face regulation by the U.S. Securities and Exchange Commission. There is still uncertainty as to whether the U.S. government is willing to adopt TRON for official payments. They are likely to prefer private permissioned chains rather than public chains like TRON. Therefore, Justin Sun may need to consider providing customized enterprise-level solutions and privacy computing solutions (such as zero-knowledge proofs or layered storage strategies) on TRON.

The stablecoin USD1 launched by Trump's crypto project WLFI may also cooperate with TRON in the future. In March this year, WLFI officially announced that it would launch a stablecoin USD1 that is 1:1 redeemable for US dollars. The stablecoin will be 100% supported by short-term US Treasury bonds, US dollar deposits and other cash equivalents. Each USD1 is designed to maintain a value of 1 US dollar. The reserves are regularly audited by a third-party accounting firm. It will be issued on Ethereum and Binance Smart Chain in the early stage.

Although USD1 did not initially choose TRON, WLFI has made it clear that it plans to expand to other blockchains in the future. From a technical perspective alone, TRON, which has processed countless USDT transactions, has more cost and transaction efficiency advantages than Ethereum, and can actually be regarded as one of the most suitable blockchains for USD1 issuance.

It is worth mentioning that 15% of the WLFI token distribution plan is reserved as a "strategic partner incentive pool", and SunSwap, the leading DEX on the TRON chain, added a WLFI token liquidity mining area in March 2025, building a user usage scenario in advance . More importantly, TRON's stablecoin solution has been applied in developing countries. For example, TRC20-USDT has now become the preferred digital dollar solution for Argentines to recharge their SUBE transportation cards.

If TRON is eventually selected as the USD1 issuance chain, it will undoubtedly further strengthen its dominant position in the global stablecoin ecosystem and may have a profound impact on the compliance process of the crypto industry. It may even push it to become one of the main financial infrastructures for the operation of U.S. political capital. If it is recognized by more governments and institutions, it may push TRON into the "mainstream fintech" track.

It is undeniable that Justin Sun’s crypto-finance layout has gone beyond simple capital linkage and has entered a stage of “eco- co-construction” , forming a closed loop with WLFI’s stablecoin strategy. The Trump family’s policy resources will further strengthen TRON’s compliance narrative.

The “Atypical Growth” of Post-90s Entrepreneurs

Perhaps influenced by his "alumni" Trump, Justin Sun was deeply involved in the early ecological construction of Ripple Labs during his time at the University of Pennsylvania. Perhaps this experience implanted in him the original technological ideal of "blockchain changing financial hegemony."

When industry observers criticized its lack of originality, Justin Sun demonstrated amazing business acumen. He realized that in the context of blockchain technology not yet breaking through the performance bottleneck, ecological construction can capture user value better than technological innovation. This thinking runs through his strategic layout.

In the traditional business world, "entrepreneurship" is often framed in a narrative of stability, low-key and long-termism, but Justin Sun has fused traffic operations, capital games and technological innovation into a sharp blade that splits industry perceptions. His growth trajectory not only reflects the underlying logic of the blockchain industry's rapid development, but also implies the attempt of entrepreneurs in the Web3 era to reconstruct business ethics. This continuous capture of user attention is precisely the survival strategy of crypto startups against cyclical fluctuations.

Justin Sun’s traffic strategy reveals the survival rules of the crypto industry: When technology has not yet formed an absolute barrier, traffic operation capabilities determine the life and death of a project . Through the three-stage approach of “creating momentum through controversial events - expanding the circle through capital binding - retaining customers through technology upgrades”, Justin Sun has led TRON to break out of the public chain red ocean and become one of the few Web3 infrastructures with both high market value (TRX market value ranks firmly in the top 10) and strong ecology ( nearly 300 million on-chain accounts ) . This path of “marketing as infrastructure” is reshaping the underlying logic of blockchain entrepreneurship.

The controversy surrounding Justin Sun comes precisely from his subversion of traditional business rules. What was considered a "bubble" marketing tool in the classical Internet era has become a necessary tool for building consensus in the crypto world; his "opportunism" that was once criticized is actually an accurate prediction of discontinuous changes in the industry. When the Web3 revolution redefines the way value is created, perhaps a new coordinate system is needed to examine this atypical post-90s entrepreneur - he is neither a pure idealist nor a vulgar profit-seeker, but a "complex of contradictions" that is bound to appear in the evolution of blockchain civilization.

When Sun Yuchen gave a speech at the United Nations Blockchain Forum as an "industry ambassador", he was always questioned: "Does excessive marketing dilute the value of technology?" In this regard, he gave the answer in an interview with Bloomberg: "In a market where 99% of people don't know what a wallet is, the cost of education must be included in the business model." This logic of equating traffic acquisition with user education reveals the particularity of crypto entrepreneurship - technology without a consensus foundation is like a castle in the air. Especially in the early wild growth stage of cryptocurrencies with vague supervision and mixed user cognition, competition is extremely cruel. Many times, project parties can only accept such a reality: traffic is consensus, and consensus is market value.

For Sun Yuchen, who has mastered the alchemy of traffic, the early stage did cause a lot of controversy over values, but just as a coin has two sides, the conflict between commercial success and moral judgment always exists. Supporters believe that he has broken the monopoly of traditional VCs and allowed retail investors to share the growth dividend through the token economy; critics accuse him of using regulatory arbitrage to reap leeks. The essence of this controversy is the projection of the contradiction between the "decentralized ideal" and "centralized operation" in the crypto industry. When Sun Yuchen had to act as the "decentralized flag bearer" of the TRON ecosystem and had to use the power of the foundation to adjust the rules at a critical moment, commercial reality once again defeated technological utopia.

Of course, while pursuing traffic and interests, Justin Sun is also adhering to "industry justice". The latest industry event: When the stablecoin TUSD's reserve funds of up to $456 million were misappropriated and faced a crisis, Justin Sun stepped in to rescue it and provided TUSD with sufficient liquidity support by providing nearly $500 million. He has never given up his adherence to industry justice. Justin Sun said that he did this to give users confidence, protect users from losses, and enable the industry to develop healthily and stably in the long term. It is such a repeatedly questioned figure who chose to stand up when faced with the industry's dark side. This may be the contradiction and charm that comes with him.

The "mainstream" code of the crypto world behind the cover of Forbes magazine may accelerate the overseas expansion of Huobi HTX

As one of the oldest business media in the United States, Forbes magazine deeply intervenes in the public discourse system through its authoritative lists and business reviews. The richest wealth rankings and influence rankings it publishes not only reflect the actual power structure, but also influence the public's perception of business leaders through the selection criteria. Forbes pointed out that Justin Sun has been shortlisted for various lists such as Forbes' "30 Under 30 Asia" many times. He is an avid fan of art collection, video games, investment, charity and space exploration. At the end of 2024, Justin Sun was appointed as the Prime Minister of the Republic of Liberland, reshaping the totem of the crypto world with the spirit of freedom and innovation.

On the other hand, the Forbes family also has a special status in the American elite circle. The family-style operating model enables them to continue to participate in the "revolving door" politics. Its president, Steve Forbes, is not only a media tycoon, but also participated in the presidential election twice, transforming business discourse into political capital . The group of Jewish billionaires that Forbes magazine has long tracked and reported (Jews occupy 16 seats among the top 40 billionaires), and they constitute the core circle of American political and economic power . The "entrepreneurship spirit" it advocates is essentially a media expression of ideology. By shaping business idols such as Bill Gates and Elon Musk, it binds technological innovation and wealth accumulation as a new annotation of the "American Dream."

From this perspective, Sun Yuchen, an iconic figure in the crypto industry, appearing on the cover of Forbes magazine may have sent a signal that mainstream traditional power institutions have fully accepted crypto assets. Trump once criticized Bitcoin in his first term, but vigorously promoted the new crypto policy in his second term, marking a fundamental change in the US power institutions' understanding of crypto assets. He not only announced that he would establish a national Bitcoin reserve to incorporate crypto assets into the national strategic resource system, but also issued the Meme coin TRUMP, building a channel to monetize political influence.

Since Sun Yuchen appeared on the cover of Forbes magazine, the crypto community has also begun to pay attention to another key question: Will Sun Yuchen help Huobi HTX accelerate its overseas expansion? Many people know Sun Yuchen's other identity: Huobi HTX Global Advisor. The WLFI project is a key carrier for the Trump family to deploy in the crypto field. Sun Yuchen's advisory role in the project may make him deeply embedded in the circle of American political elites . This network of relationships has effectively enhanced Huobi HTX's regulatory dialogue rights in the United States. Especially in the context of the Trump administration's implementation of the new crypto policy, Huobi HTX can quickly adapt to the U.S. Securities and Exchange Commission's classification regulatory framework with the help of WLFI's compliance experience , which may create a policy window for Huobi HTX to access the mainstream financial system in the United States.

In February this year, Forbes magazine selected the world's 25 most trusted cryptocurrency exchanges in 2025. Huobi HTX was successfully listed, further consolidating the leading position of this established exchange with more than 11 years of operation in the crypto industry. Forbes magazine evaluated global cryptocurrency exchanges based on multiple dimensions such as trading volume, compliance, and transaction costs. Huobi HTX has strong competitiveness in BTC and ETH holdings, spot trading volume, and product lines. Data shows that among all the listed crypto exchanges, Huobi HTX's spot market share ranks sixth.

From a regional perspective, last year Huobi HTX further expanded into the European market, and its affiliated companies continued to maintain compliant operations, embrace regulation, and expand international business. By opening the door to the US market and expanding the global market, HTX will refresh its value in the international market. As Justin Sun himself said: "Not long ago, Forbes rated Huobi HTX as one of the most trusted crypto exchanges in the world. This time (being on the cover of Forbes magazine) is very helpful for our overseas expansion. After we upgraded our international brand to HTX, the brand is also easier for overseas users to understand. I am very optimistic about the subsequent development of Huobi HTX." It is not difficult to find from Justin Sun's words that this will be a paving stone for the Huobi HTX brand to move towards the international market and open a new chapter.

Looking back at every important layout of Huobi HTX in the past, each one was accompanied by a huge wealth effect. From Asia to North America, Huobi HTX's globalization strategy is becoming clearer and clearer, and the strategic layout of the US market may become the next outbreak point of HTX.

Conclusion: Beyond the cover, what kind of leader does the crypto industry need?

In December 2024, Bitcoin broke through $100,000, which inspired the enthusiasm of global investors, provided a strong impetus for a new round of bull market, and further promoted the mature development of the crypto industry, making it gradually move towards the mainstream. From the approval of Bitcoin and Ethereum ETFs, to the booming bull market, to the promotion of the US election, Bitcoin and other cryptocurrencies have reached record valuations. Cryptocurrencies have truly stepped onto the big stage of the global financial market and have begun to influence the social and political landscape step by step. 2025 is bound to be a critical period for the accelerated development of the crypto industry, the continuous iteration of technology, and the continuous popularization of innovation. All practitioners are faced with unprecedented development opportunities.

Against this background, Justin Sun’s appearance on the cover of Forbes magazine seems to have been given more “historical significance”.

From being labeled as a "currency marketing genius" to becoming a "crypto business leader" recognized by the mainstream media, it not only reflects Sun Yuchen's personal breakthrough, but also reflects the phased evolution of the cryptocurrency industry. It can be said that Sun Yuchen has witnessed the development trajectory of the crypto industry, and Sun Yuchen's growth history is precisely the epitome of the wild growth of the crypto industry - eager to be recognized by the traditional system, but also afraid of being domesticated by mainstream rules. If we put aside our prejudices and analyze Sun Yuchen's success, his influence is not accidental.

Sun Yuchen has laid out public chains in the early stage and captured the NFT and DeFi trends. Every step he took was at the key nodes of the crypto industry. For example, the growth of TRON ecosystem depends on his positioning of high-speed transactions and low costs, which also makes it an important public chain for stablecoins such as USDT. Efficient capital operation and global acquisitions make Sun Yuchen more like a capital player. Through mergers and acquisitions, cooperation and strategic layout, he has become an indispensable figure in the industry. Traditional entrepreneurs often strategize behind the scenes, but Sun Yuchen chooses to stand in the spotlight. He is well versed in the communication rules of the social media era, dares to use controversy to create traffic, and binds his personal brand with the project, which also makes cryptocurrency gain attention in a wider market.

Being on the cover of Forbes is like a coming-of-age ceremony for Justin Sun and even the entire crypto industry: when the industry learns to pursue idealistic goals with Sun's realistic means, it can truly get rid of the "sorrows of Young Werther" and move towards a new era of mature civilization. From Justin Sun, we also see some typical qualities of crypto business leaders, such as the need to have technical idealism and the vision of ecological overall construction, the ability to break through compliance and dialogue with regulators, and the ability to shape global resource integration and brand potential.

Questioning Justin Sun, understanding Justin Sun, becoming Justin Sun - let us end the article with a question: Who can surpass Justin Sun?