Author:rosie

Compiled by: Luffy, Foresight News

Have you noticed that in the cryptocurrency space, projects that raise millions of dollars often have nothing but a fancy website?

This is not just luck, nor is it all a scam; game theory is actually at work behind the scenes.

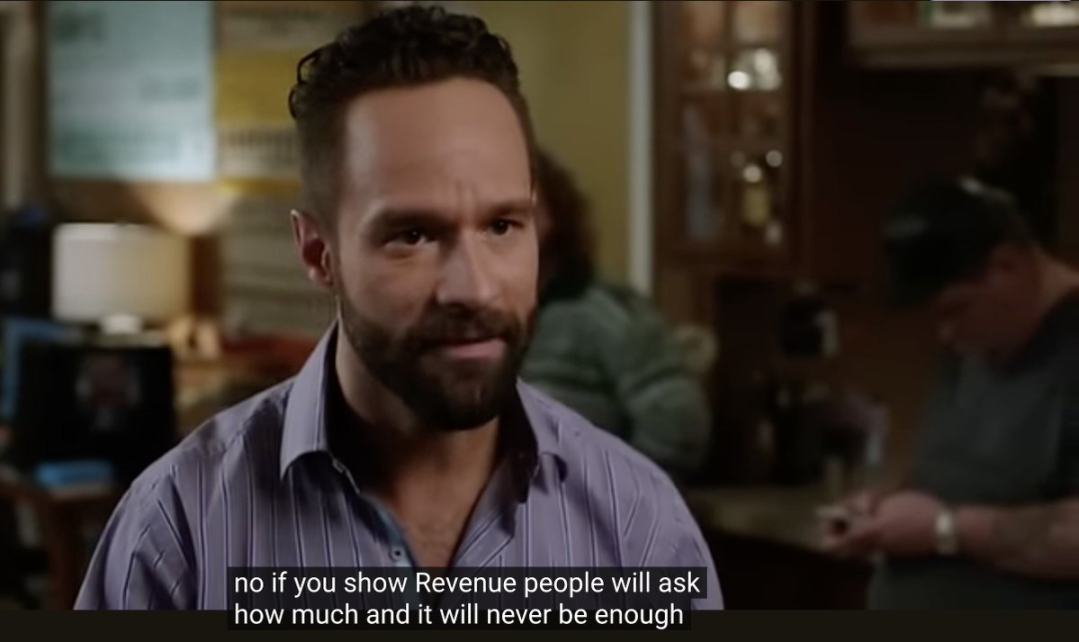

Remember that scene in the American TV series Silicon Valley? Companies with no revenue are valued higher than companies that actually make a profit. Venture capitalists explained it this way: "If you show revenue, people will ask 'how much', and no matter how much, it will never be enough. But if you have no revenue, people can imagine unlimited revenue."

The cryptocurrency space takes this logic to an extreme: the less real your product is, the more money you can raise. This is not a loophole, but the most profitable feature of the cryptocurrency space.

Reality Limits Valuation

When you have a viable product, you have to face one uncomfortable thing: facts.

The facts mean:

- Actual number of users (usually disappointing)

- Real technical limitations (always frustrating)

- Measurable indicators that cannot be faked (extremely lethal)

But what if a project only has a white paper? Its potential value is limited only by your imagination.

This creates a weird situation: projects that actually get built are punished by the market.

Complete Information Game

Game theory ultimately comes down to this: people make choices based on the information they know and their own interests.

In the cryptocurrency fundraising process, there are several parties:

- Project founder (knows everything)

- Venture capitalists (know some of the information)

- Average investor (knows almost nothing)

If you are a founder without a product, the winning strategy is obvious:

- Everything is vague, but exciting.

- Talk about potential, not reality

- Creating FOMO by any means necessary

The more vague you are, the harder it is for others to prove you wrong. The less functionality you have available, the less you can expose for failure.

Why No One Asks for Better Results

In game theory, there is a famous scenario called the "prisoner's dilemma", which reveals why people make choices that harm others and themselves.

The same is true for cryptocurrency investing: if everyone demanded to see a viable product before investing, the market would be much healthier.

But anyone who waits will miss out on big early gains. The earliest investors typically profit the most — even if the project ultimately fails.

So, each investor's seemingly smart move (getting in early based on promises alone) resulted in stupid results for everyone (focusing on hype over substance).

Selling dreams and reality

A project with just one article published on Medium can claim to revolutionize everything and capture trillions of dollars in value.

A project with actual code has to deal with:

- How many users do you actually have?

- What can and cannot technology do?

- Why do we lose out in the competition?

This gives rise to what I call a “bullshit premium” — a valuation premium that is completely unconstrained by reality.

Collaborative hype

When no one can tell which projects are good, everyone looks for the same signals:

- Which influential people are talking about it

- Which exchanges will list it?

- How fast the token price increases

Projects without a product can spend all their resources on creating these signals instead of, you know, developing them.

The less you invest in developers, the more you can invest in marketing, and in crypto, marketing always trumps development.

Real-life example: All-star lineup without product

The cryptocurrency space is a graveyard of billions of dollars of white papers, which confirms the above theory:

- Berachain: Created one of the most enthusiastic communities in the cryptocurrency space, and has achieved a multi-billion valuation without launching a mainnet. This proves that in the cryptocurrency space, the less real your product is, the more people will project their dreams onto it.

- Aptos: Raised $350 million for a blockchain project that claimed to “process 162,000 transactions per second”, but could only process 4 transactions per second when it went live. The less evidence a technology requires for its claims, the more money it gets.

- Worldcoin: "Providing biometric data in exchange for tokens" Somehow this sounded like a great idea to venture capitalists, and they threw billions of dollars at it.

There is a common pattern in these examples: the more abstract or technically complex the promise, the more money they raised, and the bigger the failure.

Why this won’t stop

Logically, investors should demand to see a viable product.

But game theory shows us why this doesn’t happen:

- The fear of missing out (FOMO) is real: early investors stand to gain the most, which creates pressure to invest before a project is proven.

- You can’t verify claims: Most investors lack the technical skills to assess whether a project can deliver on its promises

- Fund managers don't care: They're paid based on this quarter's returns, not long-term success

- The incentive mechanism is all wrong: what is good for individuals is bad for the market

This is why projects without a product will continue to raise more money than those that actually build a useful product.

The rules of the game are not broken, it's just that some people are playing it too well.