🏛️ Government Bitcoin Panic Sale

The German government once sold 50,000 BTC during market panic , with an average selling price of $54,000.

A total of $2.7 billion was recovered at the time, but today these coins are worth $3.8 billion.

The mere fact that they “didn’t hold on” (not knowing how to HODL) caused them to miss out on $1.1 billion in profits.

📌 Lesson: Don’t let bureaucrats hold your private keys.

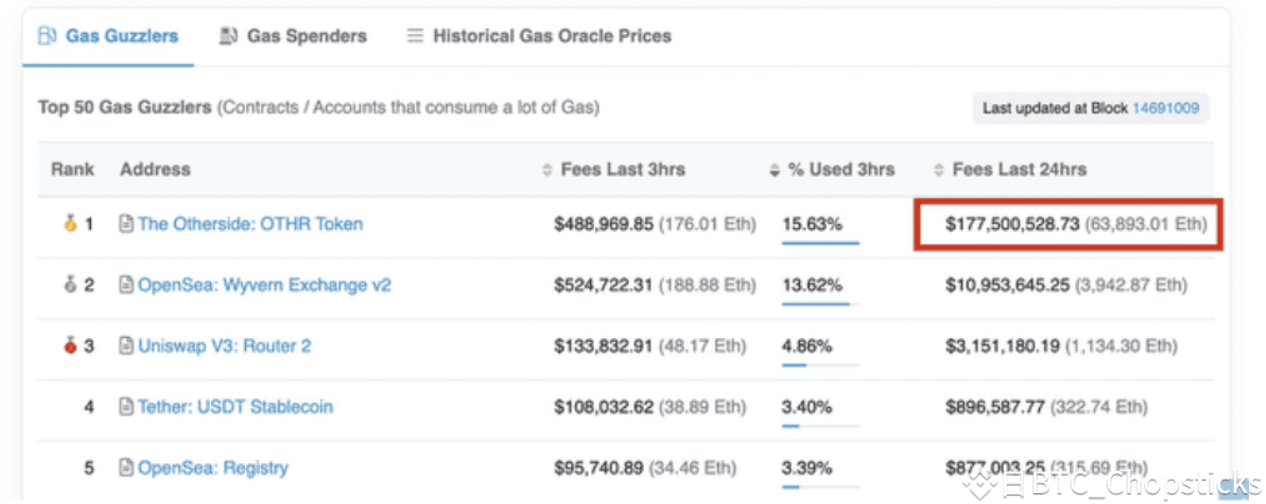

🧱 Otherside Land Minting: The $200M Gas Disaster

Yuga Labs originally thought that it would easily make money through Otherside land minting, but it ended up creating a $200 million Gas war.

Each minting was as high as 2.5 ETH , all due to insufficient optimization of the smart contract, which resulted in the Ethereum network being overwhelmed.

They tried to shift the blame to Ethereum, but we all understand that "don't hype a product that's not done well" is a basic quality for entrepreneurs.

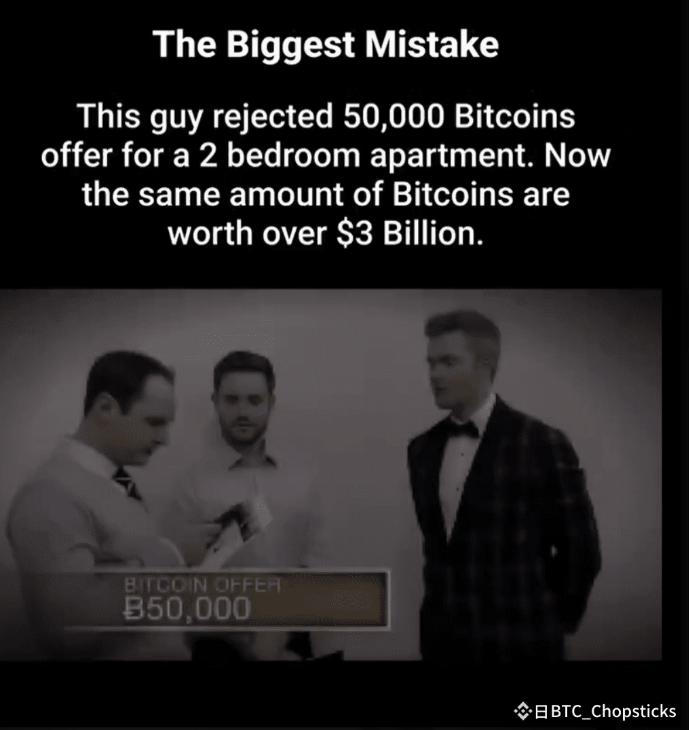

🏡 What happened to those who didn’t want Bitcoin to buy houses back then?

In 2015, someone offered 50,000 BTC (worth $13 million at the time) for a property.

The seller shrugged it off and said, “I want real money.”

That sum of Bitcoin is now worth $3.18 billion, and that house has probably been renovated three times.

📌 Lesson: Missing out early on will lead to a lifetime of regret at the dinner table.

🖼️ NFT collectors who sold “holy objects”: I made money and I lost money

A wallet once sold 7 Alien Punks and 7 Ape Punks for less than 100 ETH 8 years ago , which was considered a "high price" at the time.

But today, the total value of these NFTs is as high as 35,077 ETH (about $54 million).

📌 Lesson: In the crypto world, “the rarest things always rise the most”, so never spend pocket money on your “holy objects”.

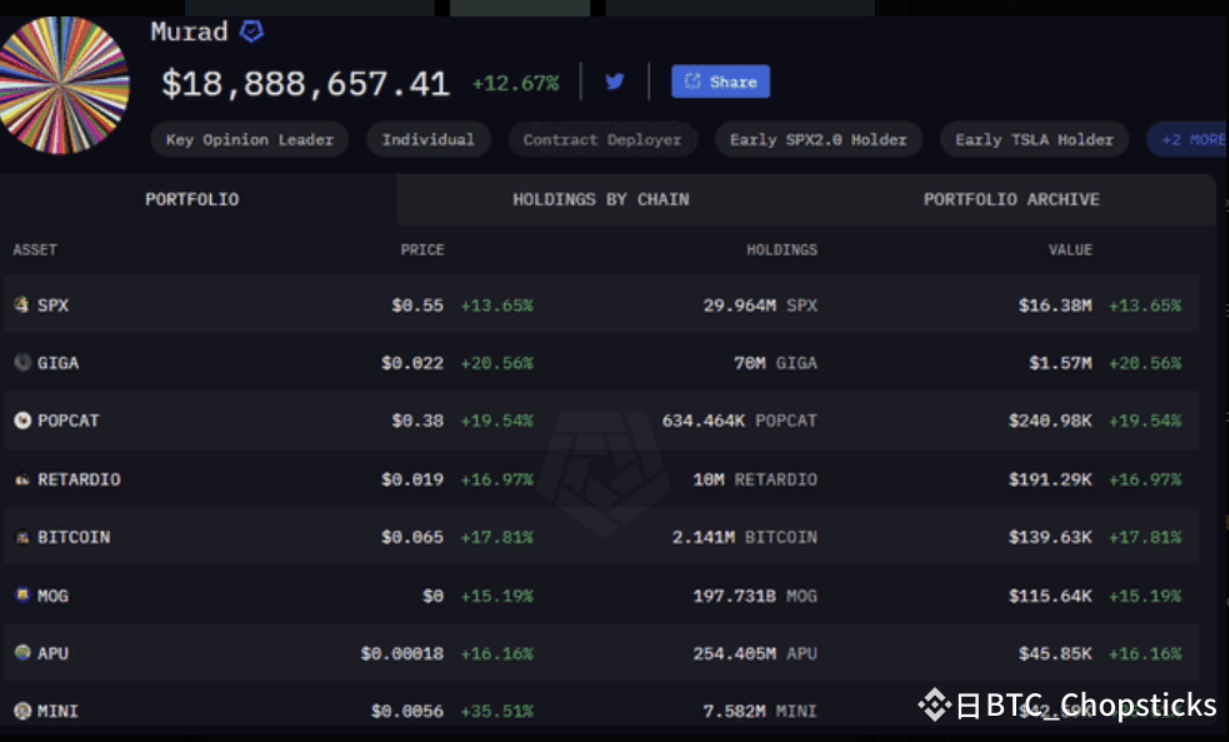

🪙 The “meme trader” who fell from $40M to $10M

Murad Mahmudov became the "legendary coin holder" thanks to the meme coin.

His portfolio was once worth $40 million, but now it's down to $10.7 million - and he's still holding on.

Is this a patient strategy or a stubborn reluctance to admit defeat?

📌 Lesson: Memecoin is not a test of faith, but a test of the limits of mental toughness.

🔥 The developer who destroyed the $10 million pre-sale instead ignited a $700 million market value?

The Slerf project accidentally burned $10 million in tokens and thought it would be "smashed" by the community.

As a result, the market went crazy and the total market value soared to $700 million.

In the crypto world, “chaos + scarcity = heat” sometimes holds true.

📌 Lesson: That’s the absurd charm of crypto. Screw it up, and it could make you rich.

🐿️ Peanut the Squirrel: A $2 billion meme that turned into an ICO disaster

Well-known KOL Alex Becker once invested six figures out of FOMO to buy "Peanut the Squirrel", which was valued at $2 billion at the time.

The ending was a tragic slash, comparable to the ICO liquidation wave in 2018.

📌 Lesson: Memecoins are the ultimate speculative trap, popular today, zero tomorrow. Timing is everything.

📌Conclusion:

Web3 is one of the few areas where mistakes can become a joke, or even legend.

But it also reminds us:

✅Governments that don’t understand technology should not touch crypto assets

✅ Polish the smart contract before promoting it

✅Don’t judge long-term assets from a short-term perspective

✅Don’t let memes take away all your rationality

✅In the crypto world, you are not betting against the market, but against your own emotions, greed and fear.

The worst thing is not losing money, but making money but not being able to hold on to it.