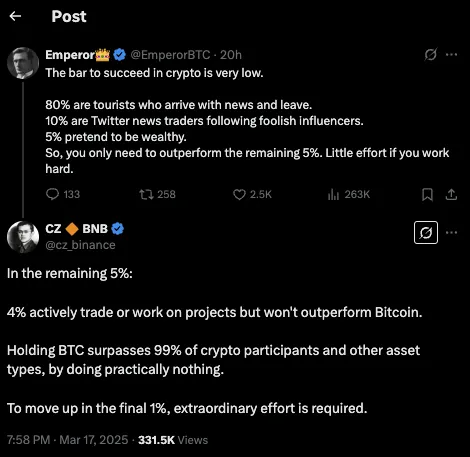

On March 17, 2025, a conversation between Emperor, a big player in the cryptocurrency circle, and CZ, a top crypto player, on Twitter triggered deep thoughts among many Web3 players:

Emperor pointed out that the threshold for success in the encryption field is very low, because 80% of people just come in to see some hot news, 10% hang out on Twitter affected by FOMO emotions, and 5% pretend to be rich. The only ones who really need to be surpassed are the last 5%.

CZ added that although 4% of them have been active on major trading platforms, their earnings may not be better than the last 1% of players who hold BTC for a long time.

It takes tremendous effort to outperform this 1%.

To put it bluntly, you are busy in and out of the market, dealing with MEME and playing with derivatives, but you may not be as good as others who bought BTC in the early years and left it alone.

On the surface, the two just talked about virtual currency investment, but behind this conversation, it actually reveals a cruel reality that deserves reflection by all Web3 investors: The reason why Web3 investment outperforms 99% of people is not luck, but long-term cognition that goes against human nature.

Many people may subconsciously think that CZ's statement "long-term holding of BTC can outperform 99%" is just a rhetoric to boost the morale of retail investors. But if you look at the data, you will find that there is actually a cold and realistic logic behind long-termism.

Take the institutional giant Strategy as an example. It has been buying BTC continuously since 2020. By March 17, 2025, it held 499,226 BTC, with a total investment of US$33.1 billion. If calculated at a price of US$82,000 per coin, Strategy's floating profit has exceeded US$7.8 billion. Most short-term players active in major exchanges may have frequently entered and exited in the past few years, but repeatedly missed opportunities, chased highs, and sold at a loss. In the end, their returns may not even be as good as those of long-term institutions and whales.

If you stay in Web3 for a long time, you will find that no matter how hot the bull market is, short-term speculators are desperately "looking for the next 100x coin", and the long-term winners are still those investors and institutions who can endure loneliness and understand the logic of assets.

Why can’t most retail investors outperform the market?

Because they are more easily swept up by emotions, led by hot spots, and influenced by bull and bear market fluctuations.

On the other hand, those people and institutions that can survive bull and bear markets and continue to outperform usually have several core commonalities:

- The long-term perspective is to look at 3 years, 5 years, or even a cycle.

- In-depth research on industry trends and regulatory directions is not just about looking at the price of the currency, but about understanding the track and technology behind it.

- Focus on core assets and avoid short-term speculation . BTC, ETH, and some of the core assets of the leading public chains always sit at the top of the food chain.

- Participate in constructive roles , either as an early developer/ecosystem contributor, or in early equity and fund layout.

We often say " Bull markets make you rich, bear markets make you train your troops. "

For project owners, the teams that can really explode in the bull market have often quietly polished their technology and accumulated ecology in the bear market. Similarly, this logic also applies to all investors who want to cross the cycle.

During a bull market, price sentiment can easily overwhelm people, but what really determines long-term returns is whether you can lay a good cognitive foundation and layout targets with long-term value during a bear market, rather than blindly chasing high prices after the market improves. Many investors who can cross cycles and make stable profits have actually done research and recognized which tracks have real value when the market is cold, and will not be swayed by short-term fluctuations.

In a bear market, you develop your cognition, and in a bull market, you reap the results. This is the correct approach to outperforming 99% of the market in the long run.

Therefore, for new Web3 investors, especially those with a Chinese background, the current dilemma may not be limited to the fact that there are few participants in the regulated Web3 market. Cognitive boundaries may be more important.

“What exactly is an investment target that can be held for a long time, participated in in compliance with regulations, and has controllable risks?”

Looking back at those who can really cross the cycle for a long time, whether individual investors or institutions, they have often already focused on:

- Recognize whether there is real value accumulation capability behind the project;

- Reasonably utilize compliant funds, equity, and service structures in Hong Kong, Singapore, and other places to comply with regulatory policies;

- Pay more attention to the technological trends and regulatory policies of the entire industry rather than the rise and fall of currency prices.

However, many Chinese investors lack a clear framework and compliance path for this purpose, which is also the key problem that Portal Labs has been helping high-net-worth users to solve.

In the current market, it seems that the bull market has not yet arrived and the bear market is coming. Many investors are waiting for the next "certain opportunity" to appear, or are hesitating and waiting in the market fluctuations.

But have you ever thought that what really determines whether you will outperform the 1% in the future is precisely whether you have laid a solid cognitive foundation and clarified your investment system in times of market uncertainty?

Finally, Portal Labs would like to leave a small question for every Web3 investor:

Will you choose to continue to wait and see, or would you like to take advantage of the market cooling-off period to prepare for the next cycle in advance?