Forbes: Trump Media and Technology Group's financial report reveals "significant deficiencies" in internal controls

1confirmation founder: BTC and ETH can become the Internet's native value storage in the future

Gate.io MemeBox has launched EZ, Dipper, Pepo, and Joobi

Tether CEO comments on European capital controls: Digital Euro sentiment intensifies

Gate.io and Inter Milan goalkeeper Sommer join forces to set a new benchmark for crypto trading security

Optimism: Isthmus hard fork activated, bringing key features from Ethereum’s Pectra upgrade to OP Stack and Superchain

Exclusive interviews with crypto celebrities, sharing unique observations and insights

Data analysis and visualization reporting of industry hot spots

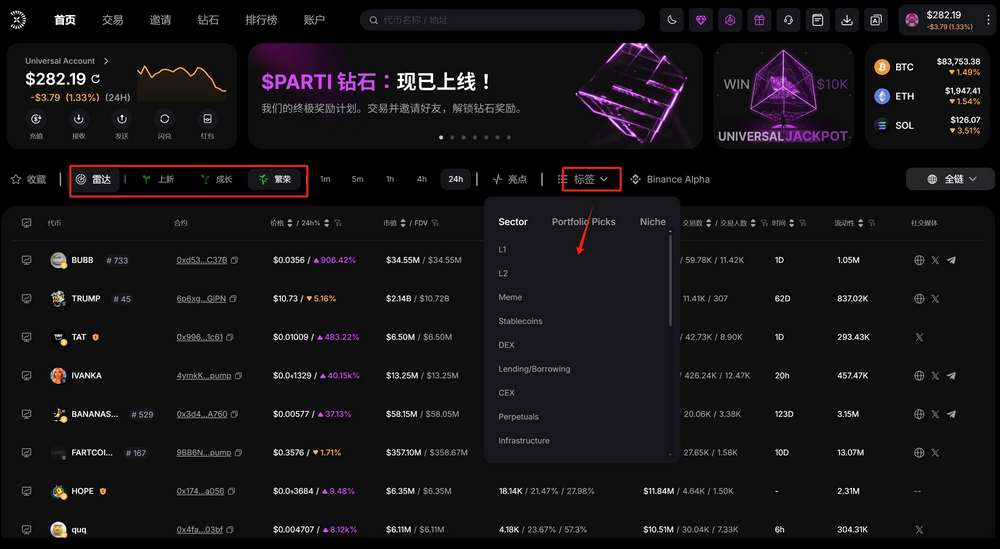

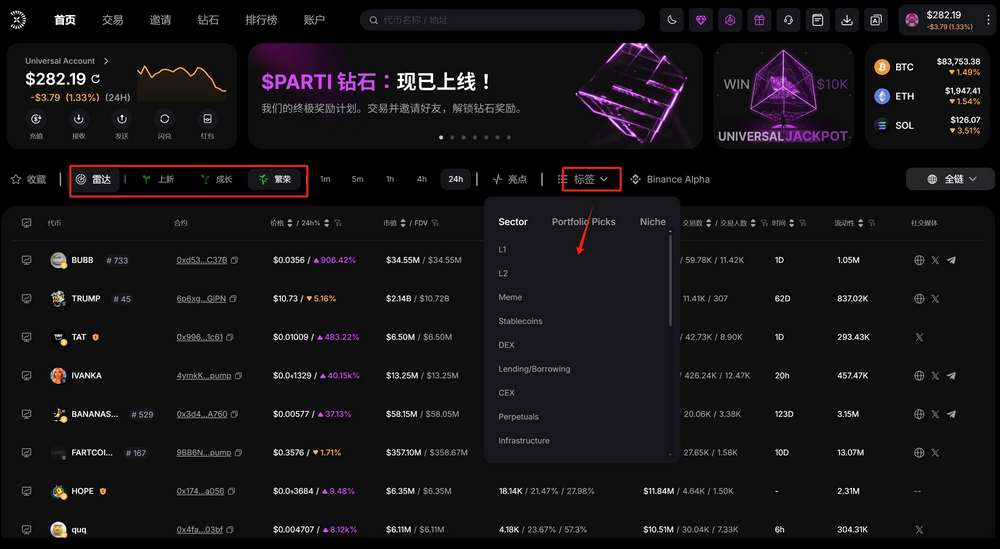

From joke culture to the trillion-dollar race, Memecoin has become an integral part of the crypto market. In this Memecoin super cycle, how can we seize the opportunity?

The AI Agen innovation wave is sweeping the world. How will it take root in Web3? Let’s embark on this adventure together!