On February 5, ARK Invest, founded by Cathie Wood, released its annual "Big Ideas" report. The report introduces the current status and important future trends of the accelerated development of future technologies from 11 sections, including artificial intelligence, Ai agents, Bitcoin, public chains, robots, energy storage, and autonomous driving. The full content is 148 pages in total. In the Bitcoin section of the report, ARK Invest predicts that by 2030, Bitcoin is expected to reach $1.5 million. Ai agents will bring epoch-making changes in the future.

ARK Invest said that this year's report puts forward 11 "big ideas" to show the great changes taking place today. Our research shows that these "big ideas" are expected to significantly increase productivity, completely change industries, and create long-term investment opportunities.

Carbon Chain Value has picked out 5 "big ideas": Bitcoin, artificial intelligence/Ai agents, stablecoins, and public chain expansion for readers' reference and learning. The overall feeling of this year's report is that it focuses a lot on AI and Crypto. For example, Bitcoin, public chains, stablecoins, DeFi, DEX, smart contracts, digital wallets, etc. have corresponding introductions and predictions. If readers are interested in the report, they can go to the official website of ARK Invest to download the full version of the report and read the rest of the content.

The following are the contents of the report of the five "big ideas" extracted by Carbon Chain Value:

1. Bitcoin: A maturing global currency system with a sound network foundation and growing institutional adoption

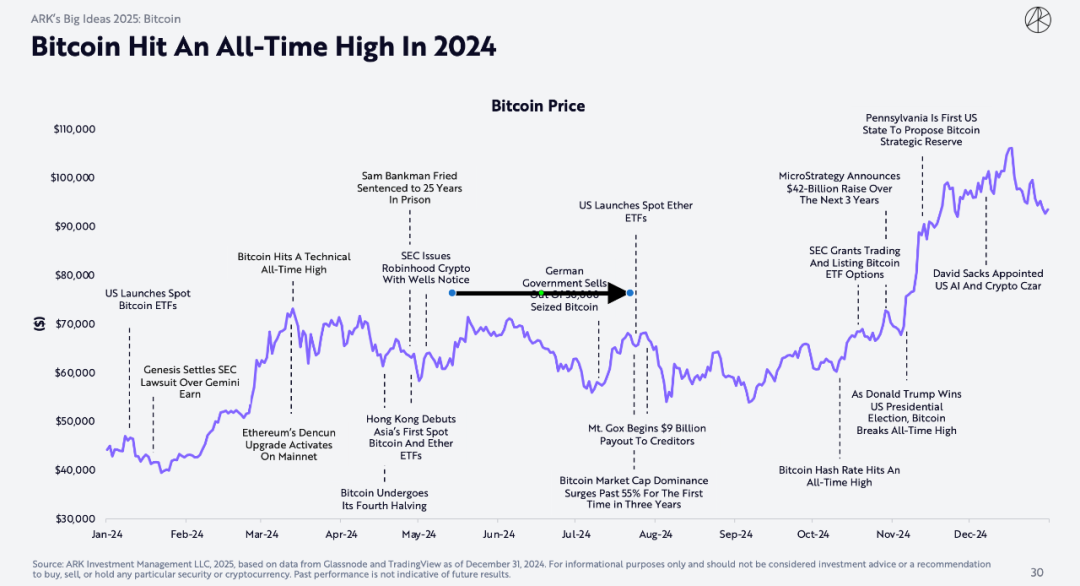

Bitcoin hits new all-time high in 2024

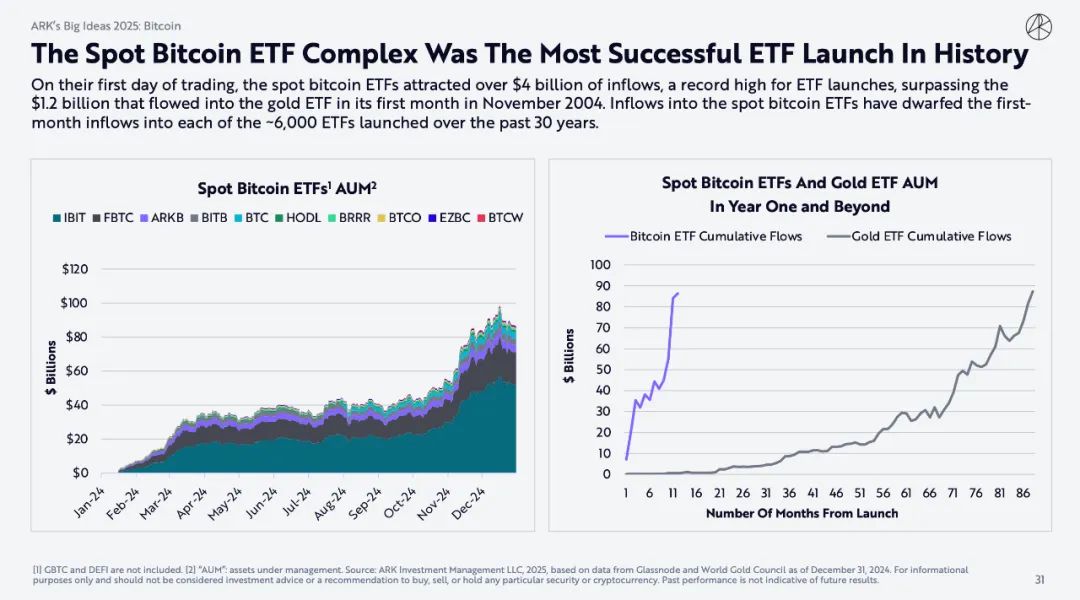

Bitcoin Spot ETF is the most successful ETF in history

On its first day of listing, the Bitcoin spot ETF attracted more than $4 billion in capital inflows, setting a record since the ETF was listed, exceeding the "2012 Bitcoin ETF Market Report" released by the US Securities and Exchange Commission. In November 2004, the gold ETF attracted $1.2 billion in inflows in its first month. The inflows of the Bitcoin spot ETF far exceeded the first-month inflows of about 6,000 ETFs issued in the past 30 years.

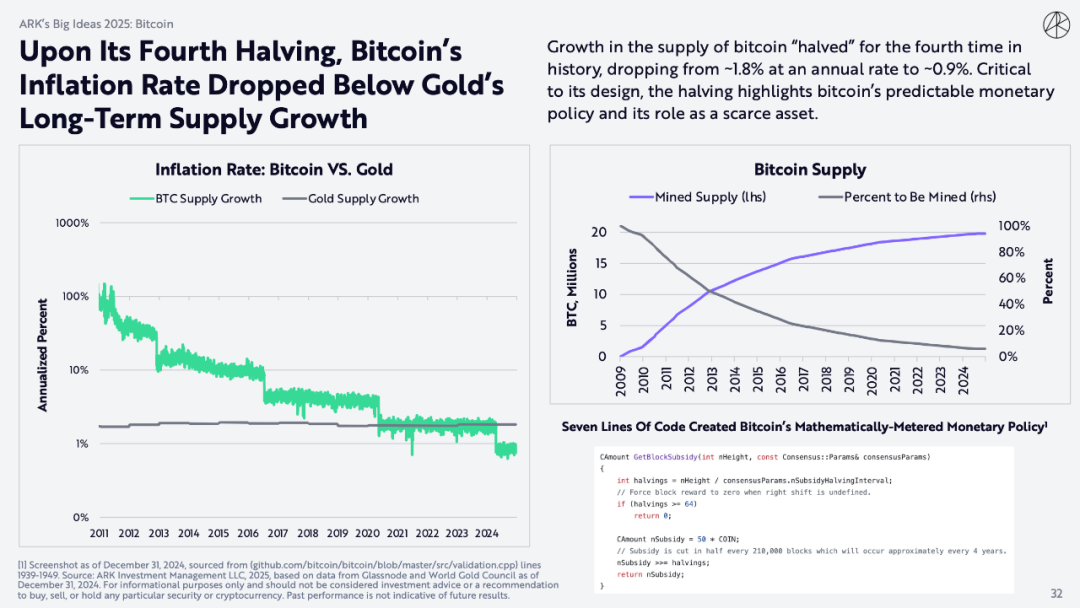

Bitcoin inflation drops below gold’s long-term supply growth after 4th halving

After the fourth “halving” in the history of Bitcoin supply growth, the annual growth rate dropped from about 1.8% to about 0.9%. The halving is crucial to its design and highlights Bitcoin’s predictable monetary policy and its role as a scarce asset.

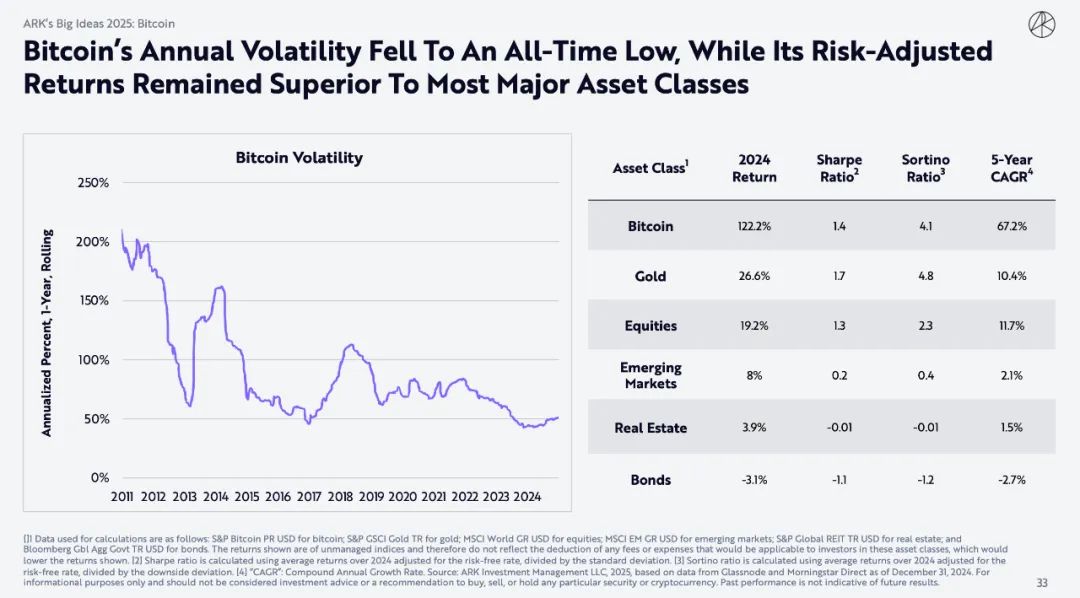

Bitcoin’s annual volatility drops to all-time low, but its risk-adjusted returns still outperform most major asset classes

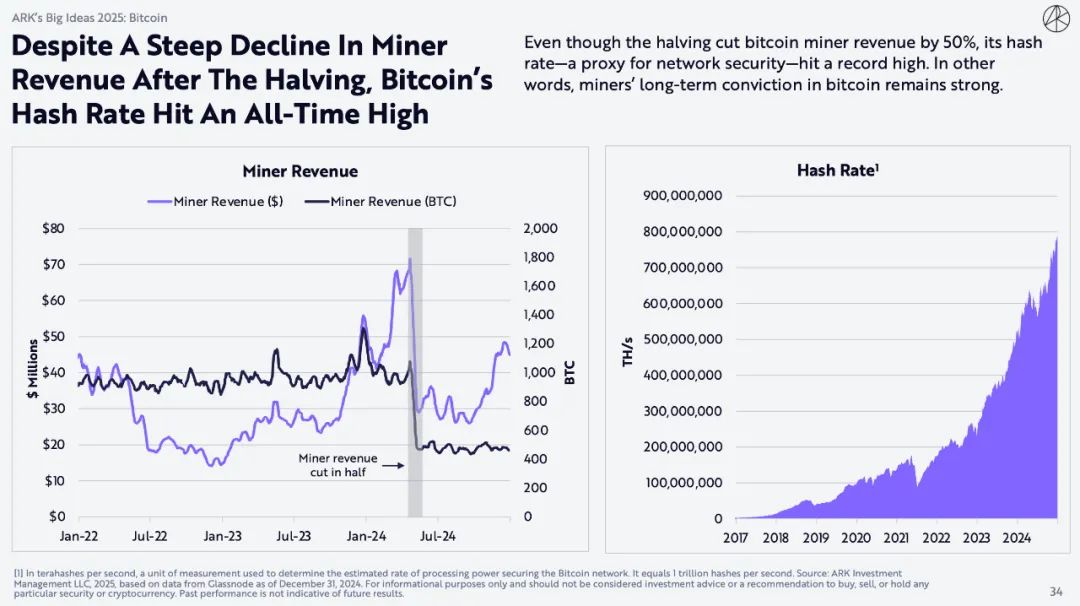

Bitcoin’s hash rate hits all-time high despite sharp drop in miner revenue after halving

Although the halving has reduced Bitcoin miners’ revenue by 50%, its hash rate has hit an all-time high. In other words, miners’ long-term confidence in Bitcoin remains strong.

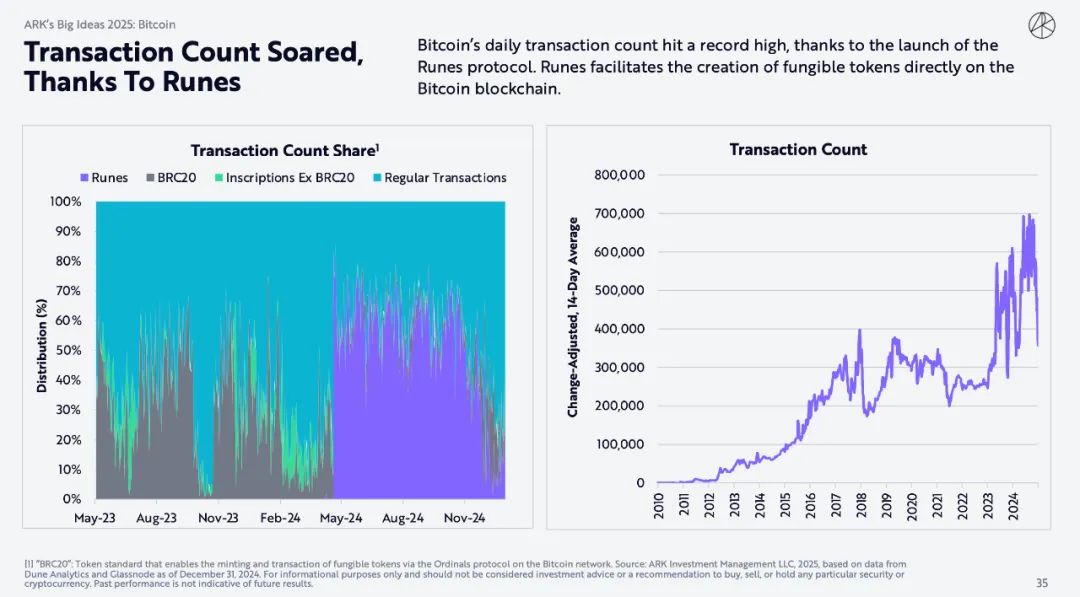

Transaction volume surges thanks to Runes

Bitcoin’s daily transaction count hit an all-time high, thanks to the launch of the Runes protocol, which facilitates the creation of fungible tokens directly on the Bitcoin blockchain.

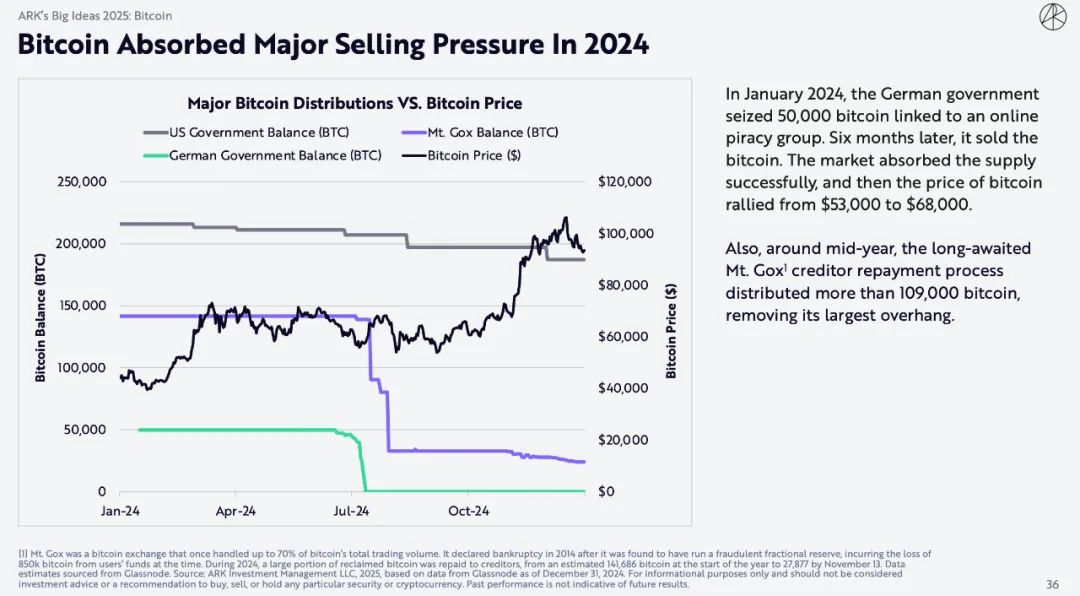

Bitcoin Absorbs Significant Selling Pressure in 2024

In January 2024, the German government seized 50,000 bitcoins linked to an online piracy ring. Six months later, it sold them. The market successfully absorbed the supply, and the price of bitcoin then rose from $53,000 to $68,000. Also, around mid-year, the long-awaited Mt. Gox1 creditor repayment process distributed more than 109,000 bitcoins, removing its biggest overhang.

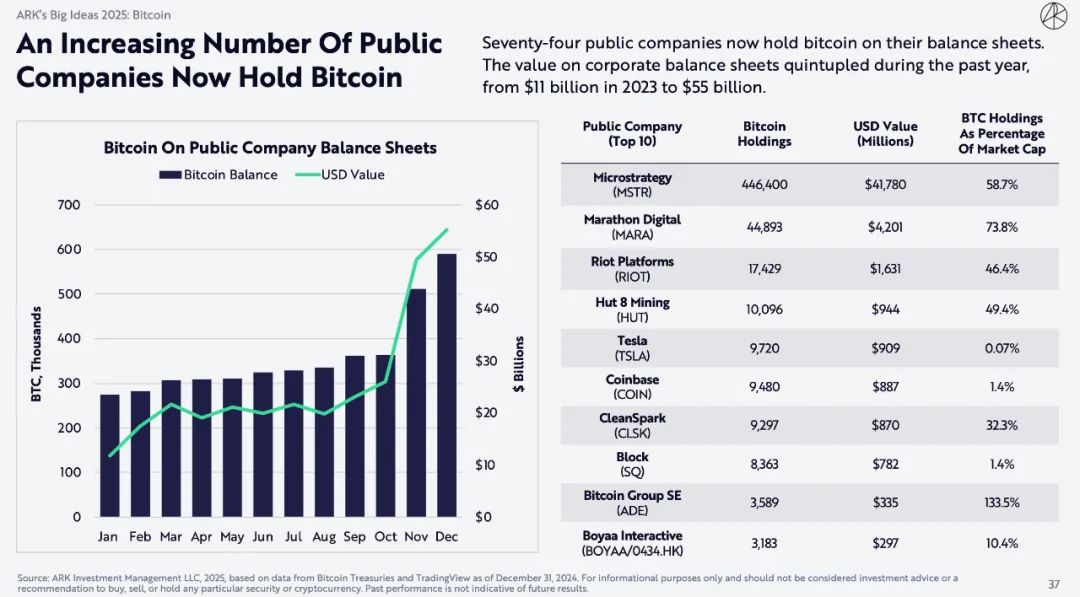

More and more public companies hold Bitcoin

There are currently 74 public companies holding Bitcoin on their balance sheets. Over the past year, the value of Bitcoin on corporate balance sheets has increased fivefold, from $11 billion to $55 billion in 2023.

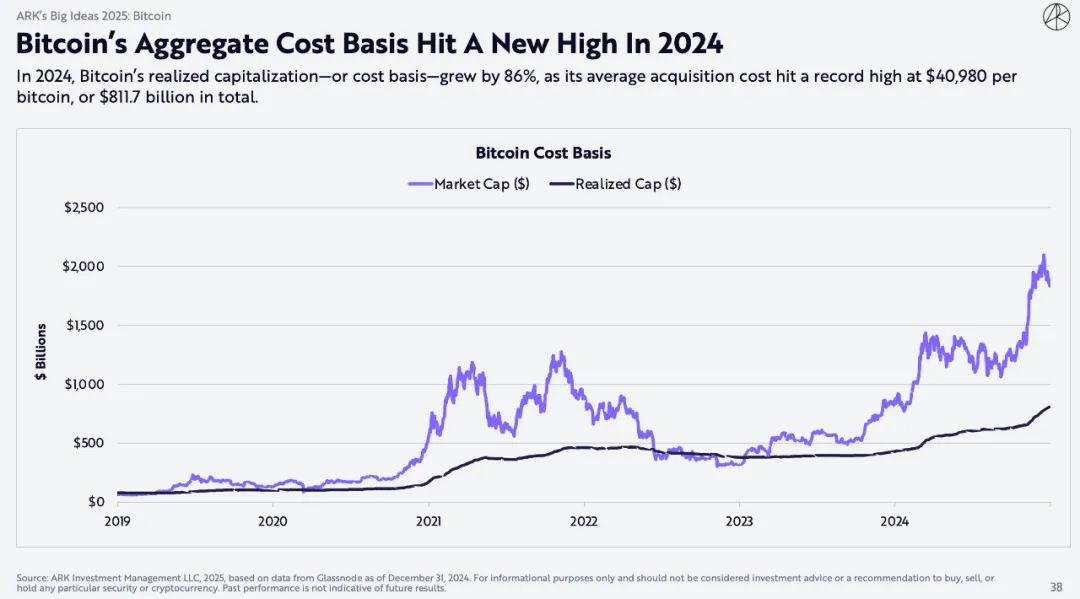

Bitcoin’s Total Cost Basis Hits New High in 2024

In 2024, Bitcoin’s realized capitalization (or cost basis) grows 86% as its average acquisition cost hits an all-time high of $40,980 per Bitcoin, totaling $811.7 billion.

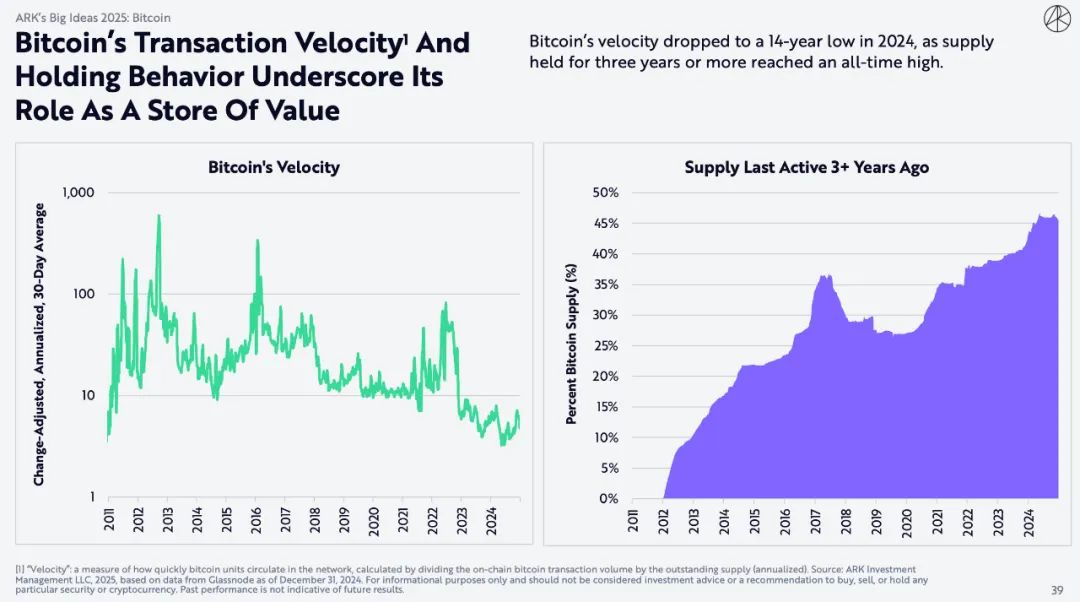

Bitcoin’s transaction speed and holding behavior highlight its role as a store of value

In 2024, Bitcoin’s transaction velocity fell to its lowest level in 14 years as the supply held for three years or longer reached an all-time high.

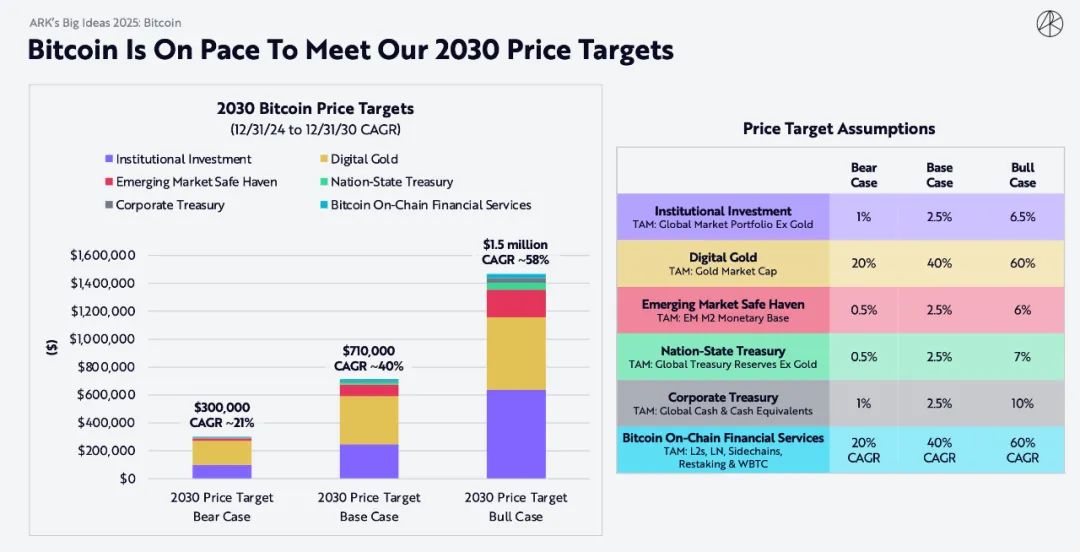

Bitcoin is on track to achieve our 2030 price target: $1.5 million/BTC

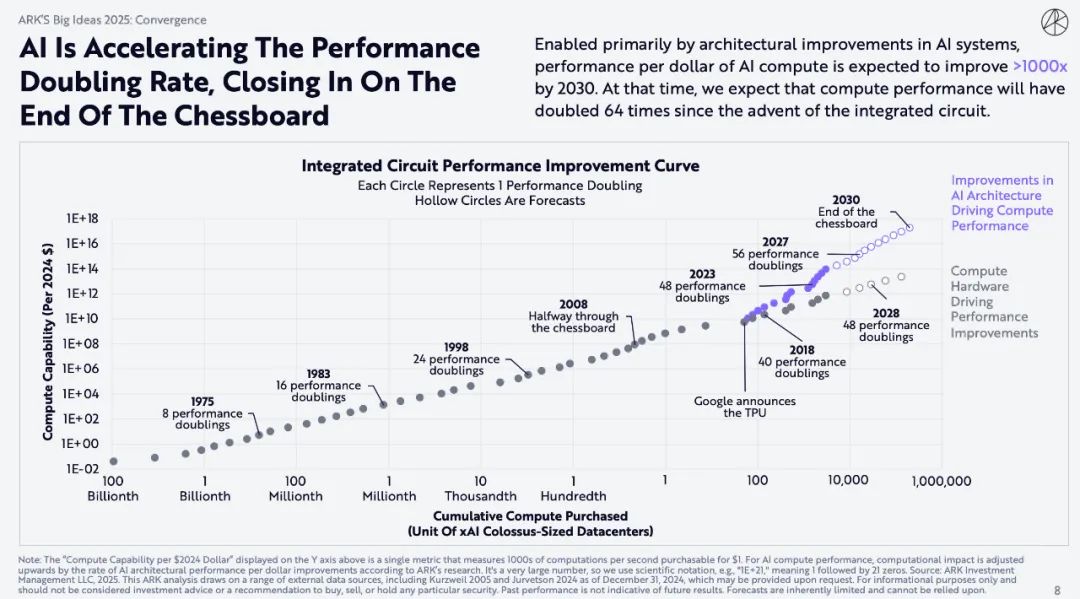

2. AI computing is doubling at an accelerated rate and is about to reach the end of the chessboard

Thanks largely to improvements in AI system architecture, AI computing performance per dollar is expected to increase more than 1,000 times by 2030. By then, we expect computing performance to have doubled 64 times since the advent of integrated circuits.

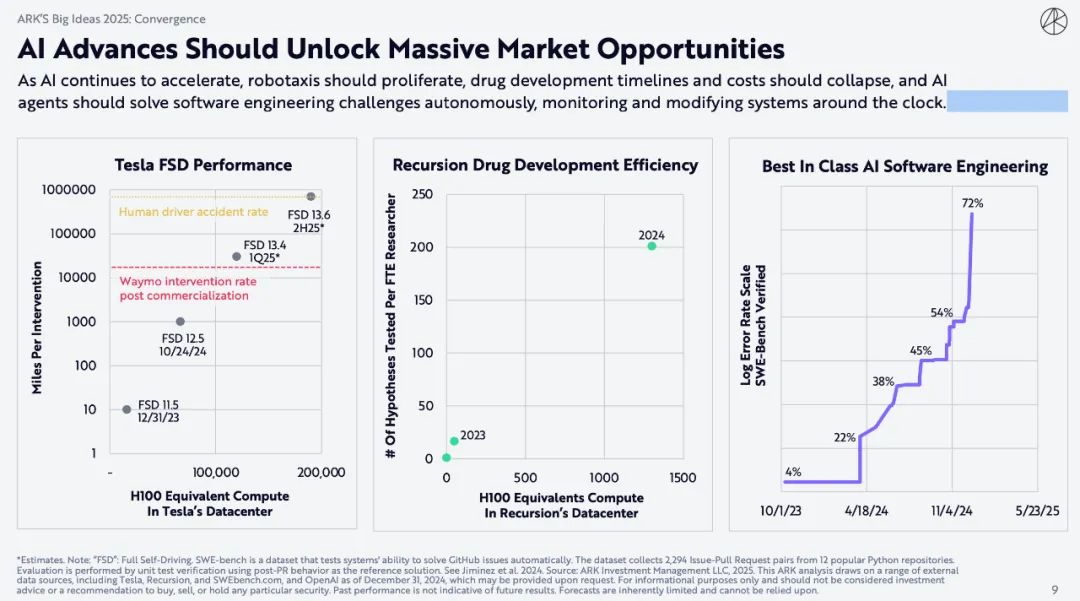

Advances in AI will unlock huge market opportunities

As artificial intelligence continues to accelerate, self-driving taxis will become more common, drug development time and costs will drop dramatically, and AI agents will be able to autonomously solve software engineering challenges and monitor and modify systems around the clock.

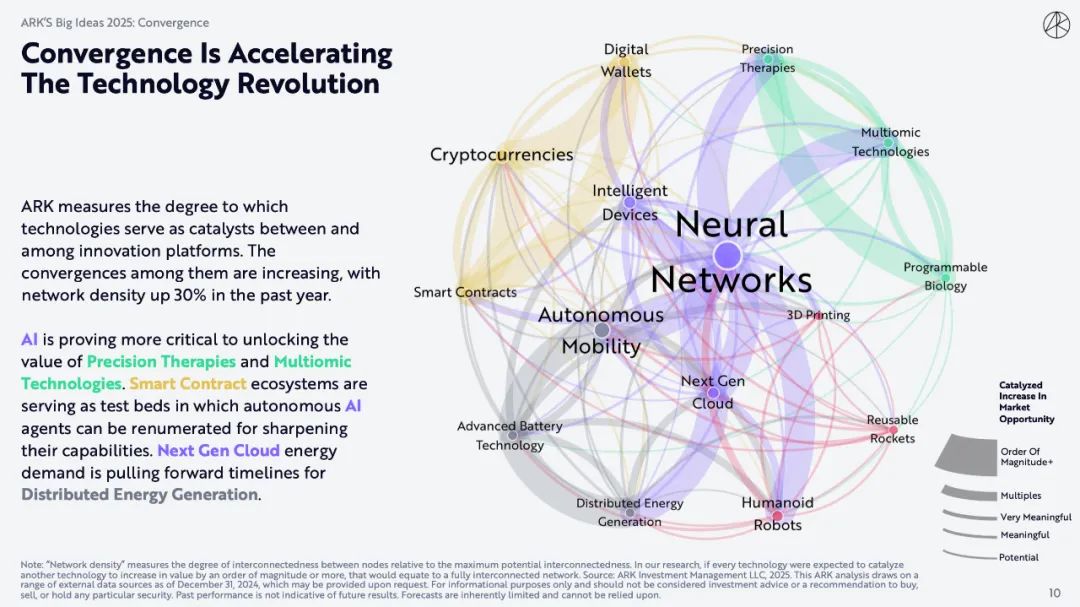

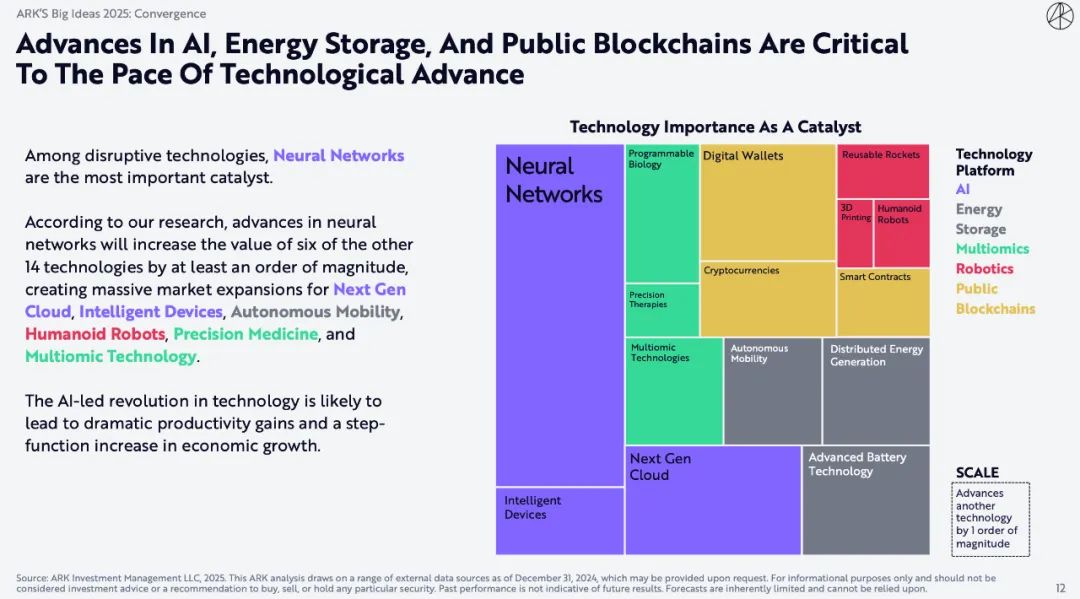

Technological revolution accelerates integration

ARK measures the extent to which technology is acting as a catalyst between innovation platforms. Convergence between them is increasing, with network density increasing 30% over the past year.

AI is critical to unlocking the value of precision medicine and multi-omics technologies. Smart contract ecosystems are becoming testbeds where autonomous AI agents can be paid for improving their capabilities. Next-generation cloud energy requirements are driving timelines for distributed energy generation.

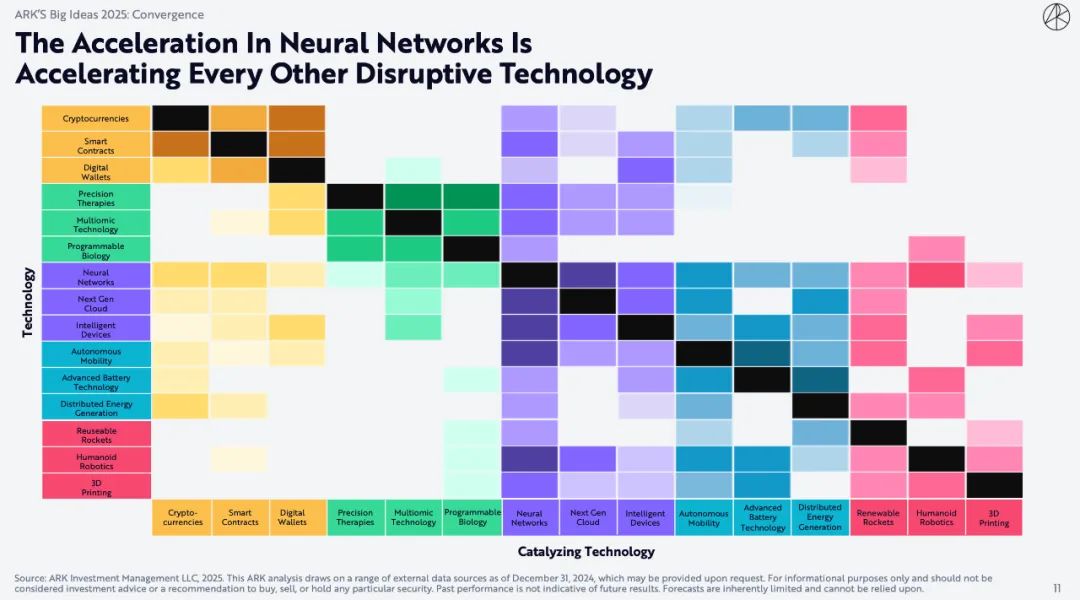

The acceleration of neural networks is accelerating the development of all other disruptive technologies

Advances in AI, energy storage, and public blockchains are critical to the pace of technological progress

Among disruptive technologies, neural networks are the most important catalyst.

According to our research, advances in neural networks will increase the value of six of the other 14 technologies by at least an order of magnitude, creating a massive market expansion for next-generation cloud, smart devices, autonomous mobility, humanoid robots, precision medicine, and multi-omics technologies. The technological revolution led by AI could lead to a massive increase in productivity and a step-change in economic growth.

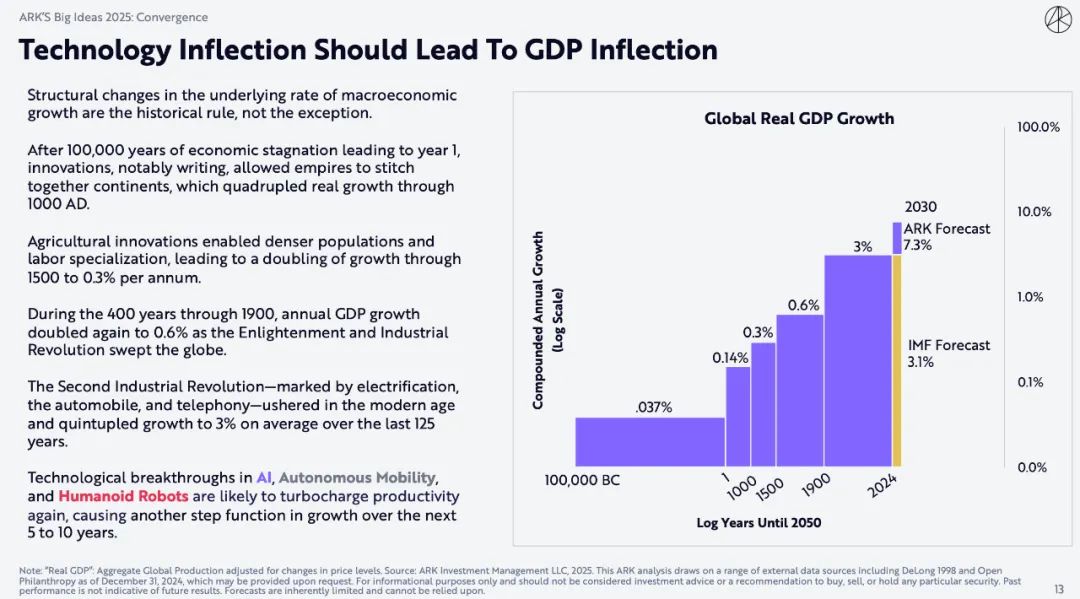

The technological turning point should bring about a GDP turning point

Structural changes in the basic growth rate of the macroeconomy are a historical rule, not an exception.

After 100,000 years of economic stagnation, innovations, particularly the advent of writing, enabled empires to connect continents, and by 1000 AD real growth had quadrupled.

Agricultural innovations enabled population density to increase and the labor force to specialize, doubling annual growth rates to 0.3% by 1500.

In the 400 years before 1900, as the Enlightenment and the Industrial Revolution swept the world, annual GDP growth doubled again, to 0.6%.

The second industrial revolution, marked by electrification, cars and telephones, ushered in the modern era, with an average growth rate of 5 times over the past 125 years, to 3%. Technological breakthroughs in artificial intelligence, autonomous driving and bio-inspired robotics could boost productivity again, leading to another step in growth over the next 5 to 10 years.

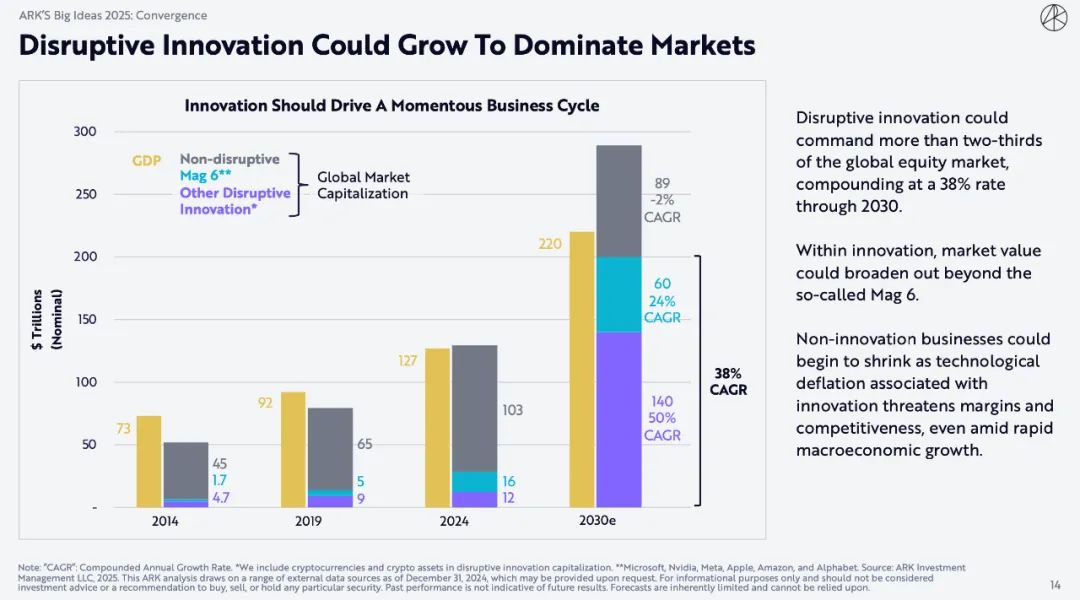

Disruptive innovations may gradually dominate the market

Disruptive innovation could account for more than two-thirds of the global stock market, with a compound annual growth rate of 38% by 2030.

In the innovation space, market value may extend beyond the so-called Mag 6. Non-innovative firms may begin to shrink as innovation-related technological deflation threatens profit margins and competitiveness, even in the face of rapid macroeconomic growth.

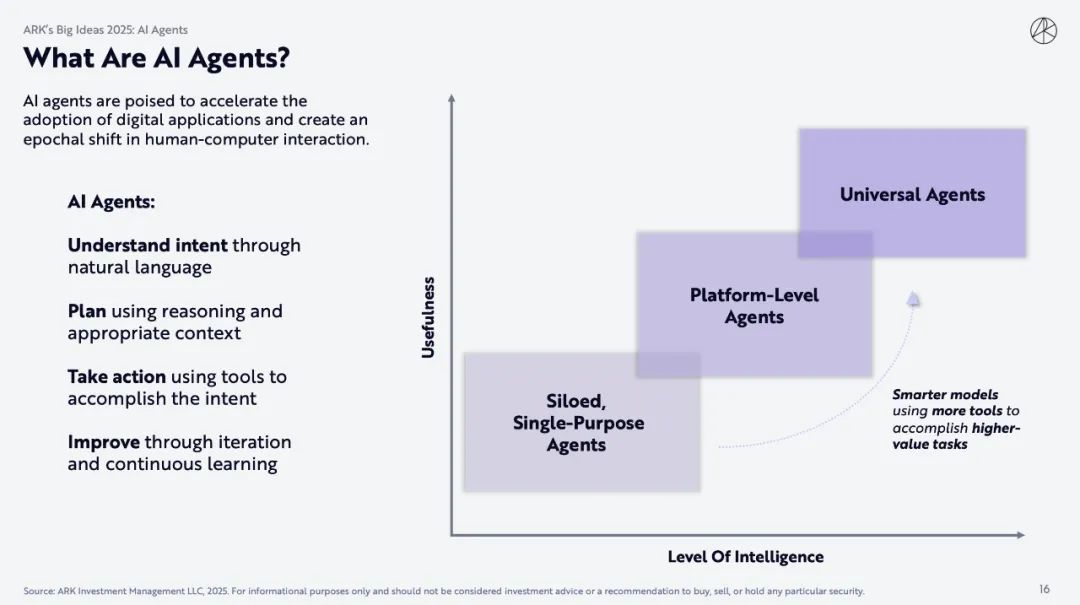

3. AI Agents: Redefining Consumer Interactions and Business Workflows

What are AI Agents?

AI Agents are expected to accelerate the popularization of digital applications and bring about epoch-making changes in the field of human-computer interaction.

AI Agents:

Understand intent through natural language, use reasoning and appropriate context to plan. Leverage tools to take actions to fulfill intent. Improve through iteration and continuous learning. Smarter models that leverage more tools to accomplish higher-value tasks.

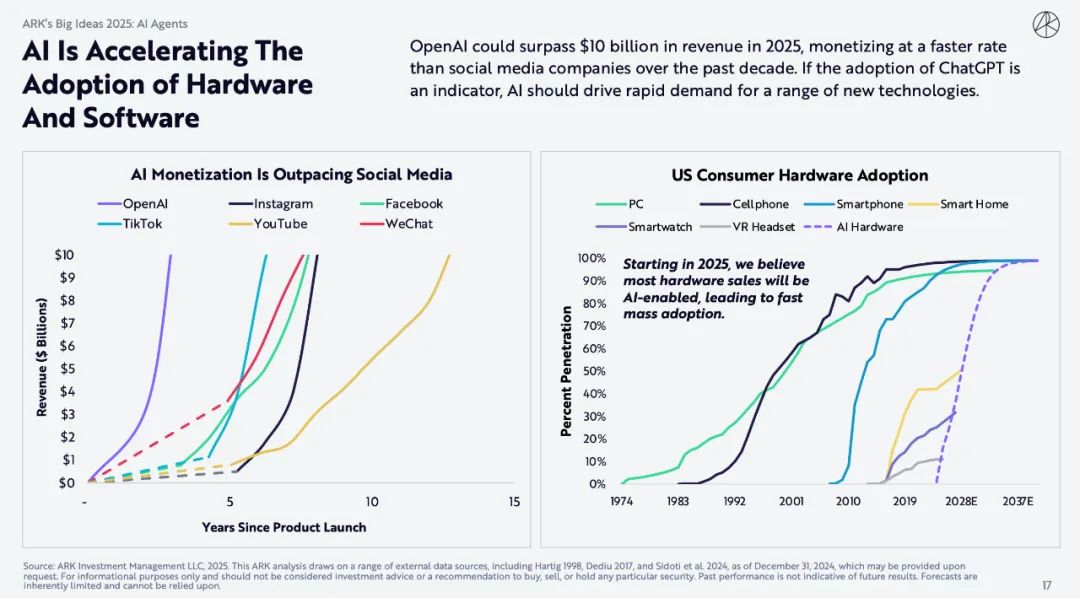

AI is accelerating the adoption of hardware and software

OpenAI’s revenue could exceed $10 billion by 2025, monetizing faster than any social media company in the past decade. If the adoption of ChatGPT is an indicator, AI should drive rapid demand for a range of new technologies.

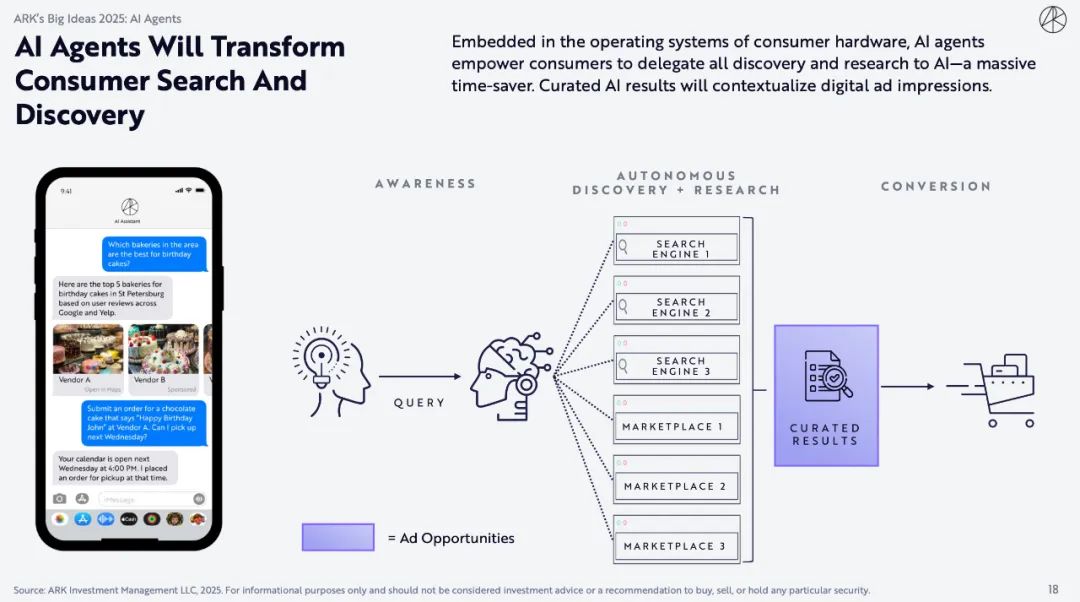

AI Agents Will Transform Consumer Search and Discovery

AI Agents are embedded in the operating system of consumer hardware, enabling consumers to delegate all discovery and research to AI, saving a lot of time. Carefully curated AI results will make digital advertising impressions more contextual.

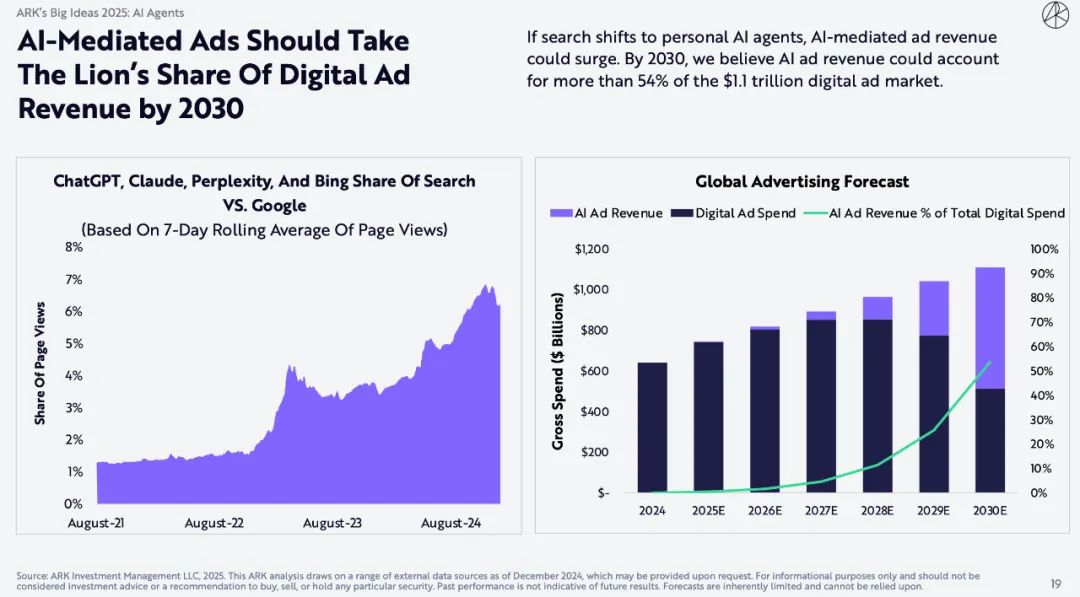

Digital advertising revenue will account for the largest share in 2030

If search shifts to personal AI Agents, AI advertising revenue could surge. By 2030, we believe AI advertising revenue could account for more than 54% of the $1.1 trillion digital advertising market.

AI-powered shopping could account for 25% of global addressable online sales by 2030

The increasing use of AI agents in consumer shopping should simplify product discovery, personalization, and purchasing.

ARK research shows that by 2030, AI Agents could facilitate nearly $9 trillion in total online consumption worldwide.

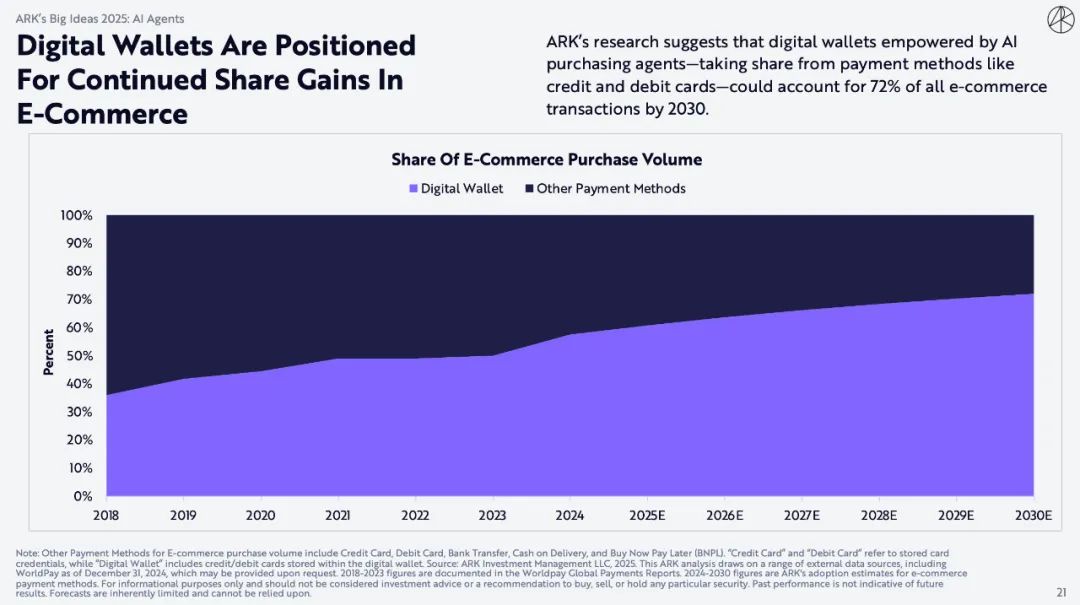

Digital wallets are expected to continue to expand their share of e-commerce

ARK’s research suggests that by 2030, digital wallets powered by AI purchasing agents (replacing payment methods like credit and debit cards) could account for 72% of all e-commerce transactions.

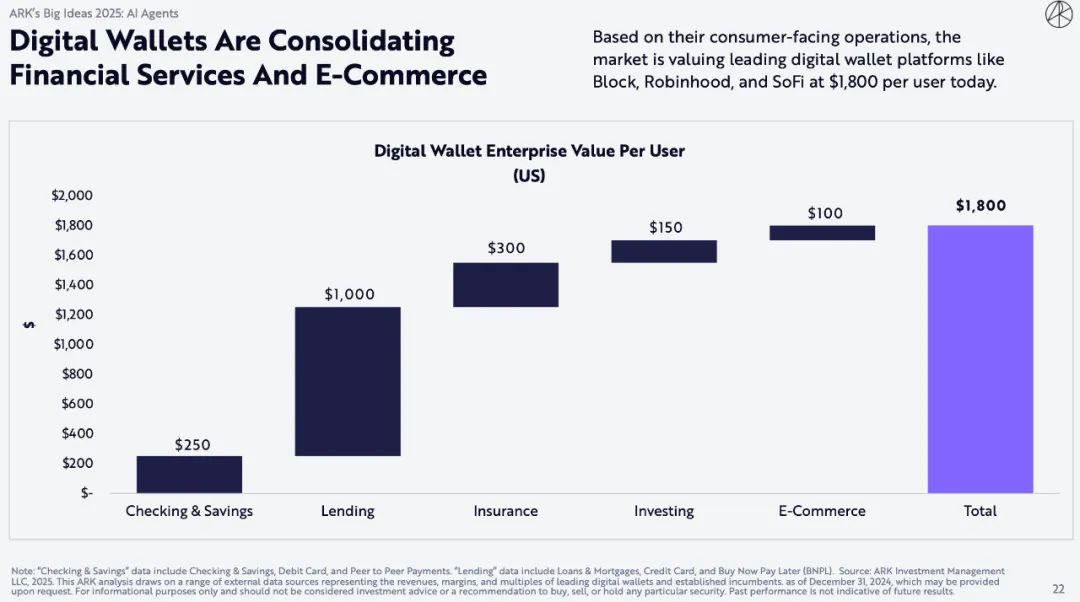

Digital wallets are integrating financial services and e-commerce

The market currently values leading digital wallet platforms such as Block, Robinhood, and SoFi at $1,800 per user based on their consumer-facing operations.

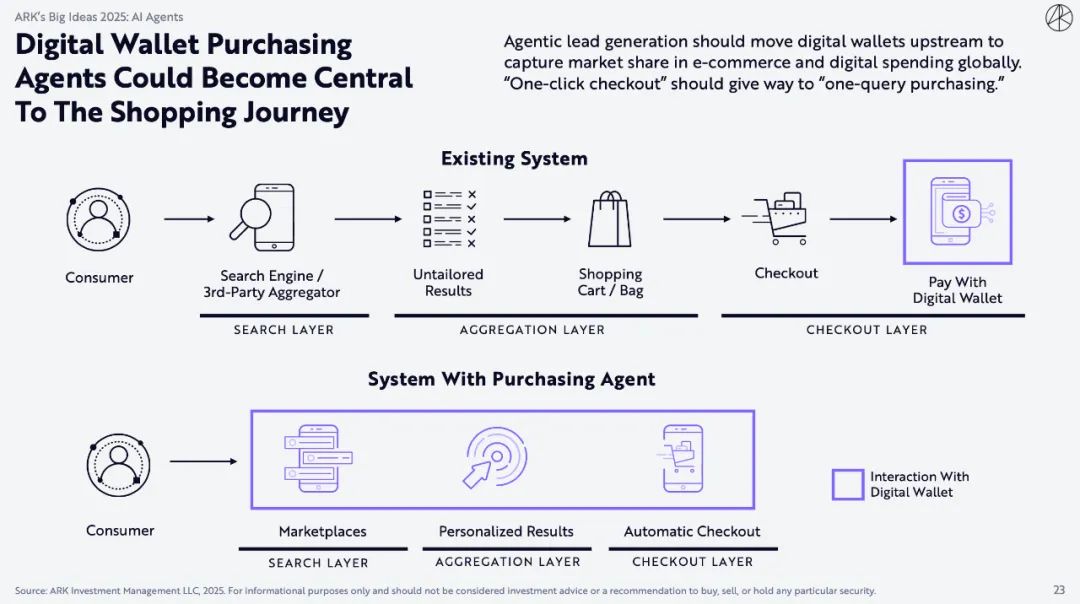

Digital wallet purchasing agents may become central to the shopping journey

Agent lead generation should push digital wallets upstream to capture market share in global e-commerce and digital consumption. “One-click checkout” should give way to “one-click purchase.”

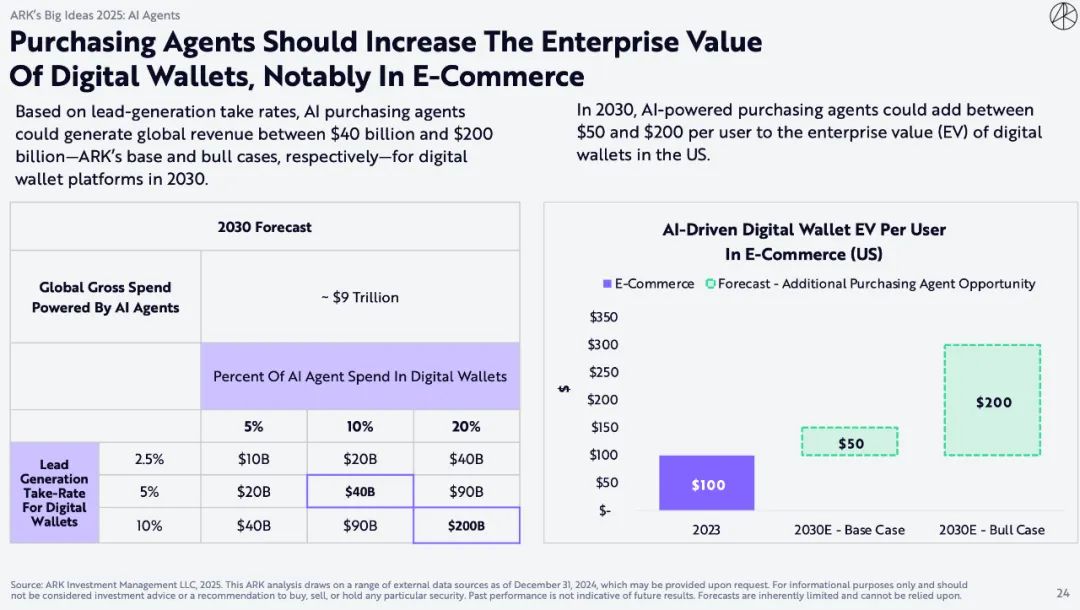

Purchasing agents should be able to increase the enterprise value of digital wallets, especially in the e-commerce sector

Based on lead generation rates, AI Agents could generate $40 billion to $200 billion in global revenue for digital wallet platforms by 2030 (ARK’s base and bullish cases, respectively).

By 2030, AI Agents could add $50 to $200 in enterprise value (EV) per user of digital wallets in the US.

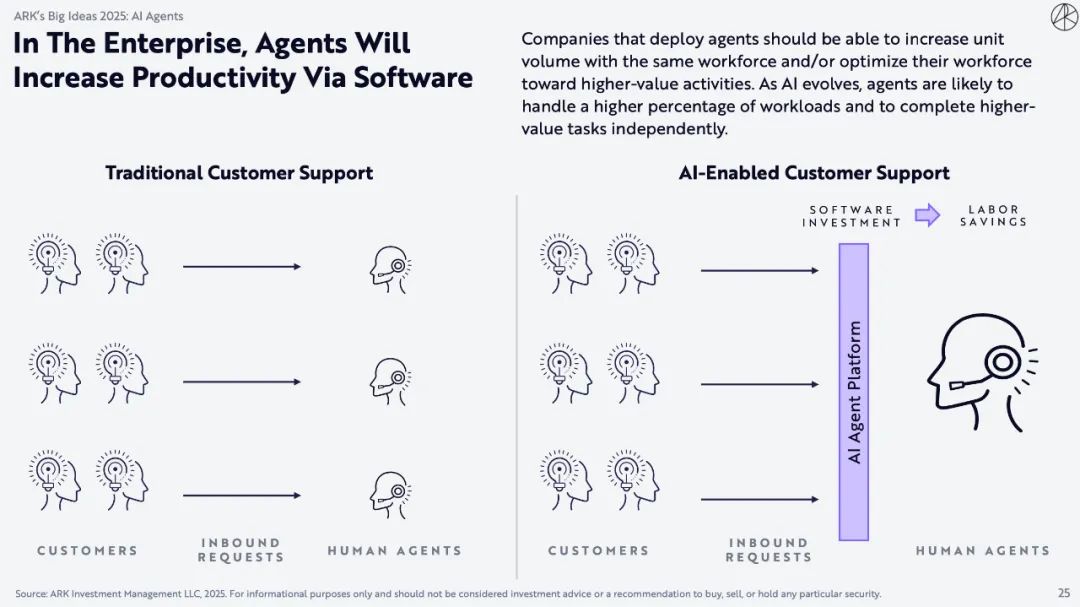

In the enterprise, AI agents will improve productivity through software

Companies deploying AI Agents should be able to increase the number of units with the same workforce and/or optimize their workforce for higher-value activities. As artificial intelligence advances, AI Agents may handle a higher proportion of the workload and complete higher-value tasks independently.

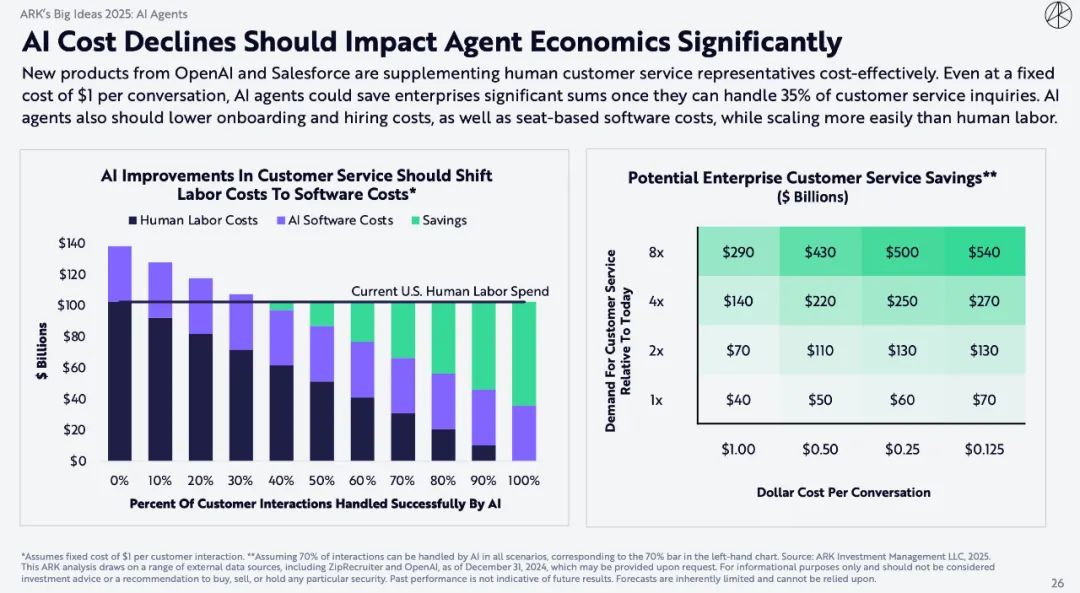

The decline in AI costs will significantly impact the AI Agents economy

New products from OpenAI and Salesforce are complementing human customer service representatives in a cost-effective way. Even at a fixed cost of $1 per conversation, if AI Agents can handle 35% of customer service inquiries, it can save companies a lot of money. AI Agents should also reduce onboarding and recruitment costs and seat-based software costs, while being easier to scale than humans.

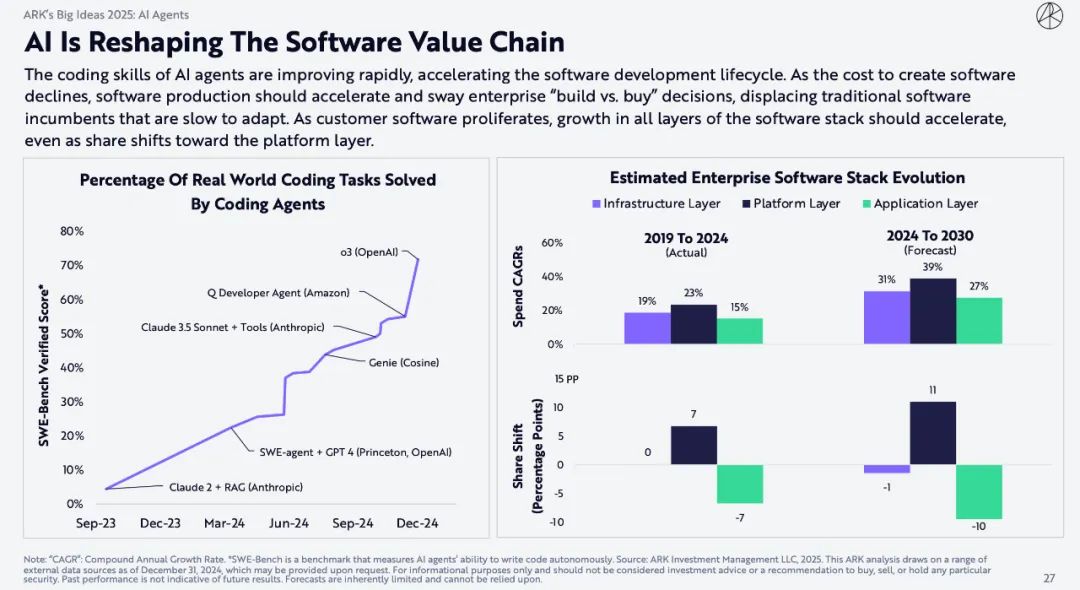

Artificial Intelligence is Reshaping the Software Value Chain

Coding skills for AI Agents are improving rapidly, accelerating software development cycles. As the cost of creating software decreases, software production should accelerate and influence enterprise “build vs. buy” decisions, displacing less adaptable legacy software companies. With the proliferation of client software, growth at all layers of the software stack should accelerate, even as share shifts to the platform layer.

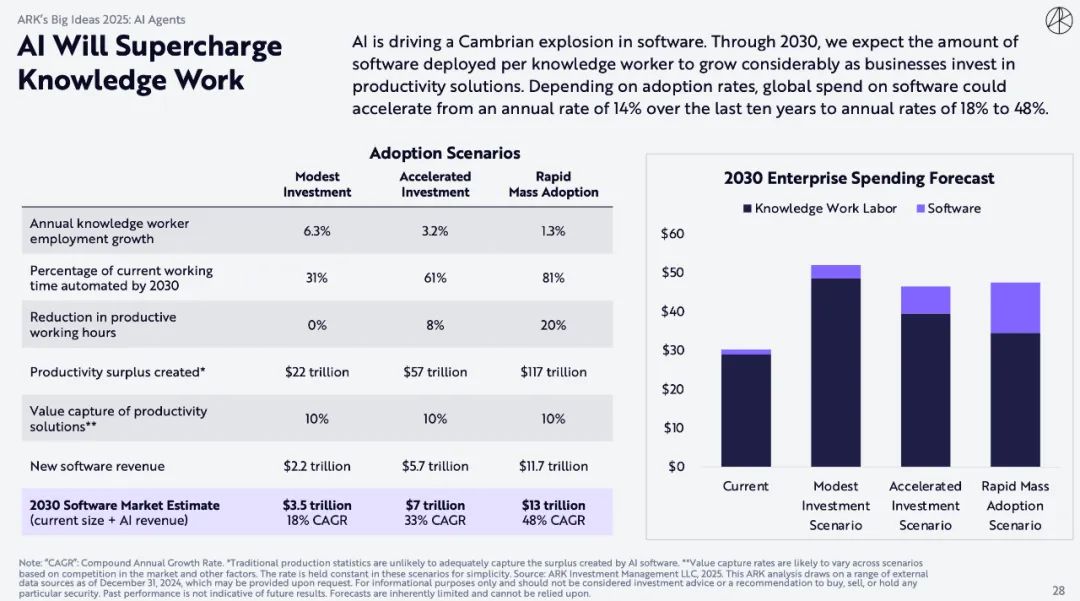

Artificial intelligence will enhance knowledge work

AI is driving a Cambrian explosion in software. By 2030, we expect the amount of software deployed per knowledge worker to grow dramatically as businesses invest in productivity solutions. Depending on the rate of adoption, global software spending could accelerate from an average annual growth rate of 14% over the past decade to an average annual growth rate of 18% to 48%.

4. Stablecoins: Reshaping the digital asset sector

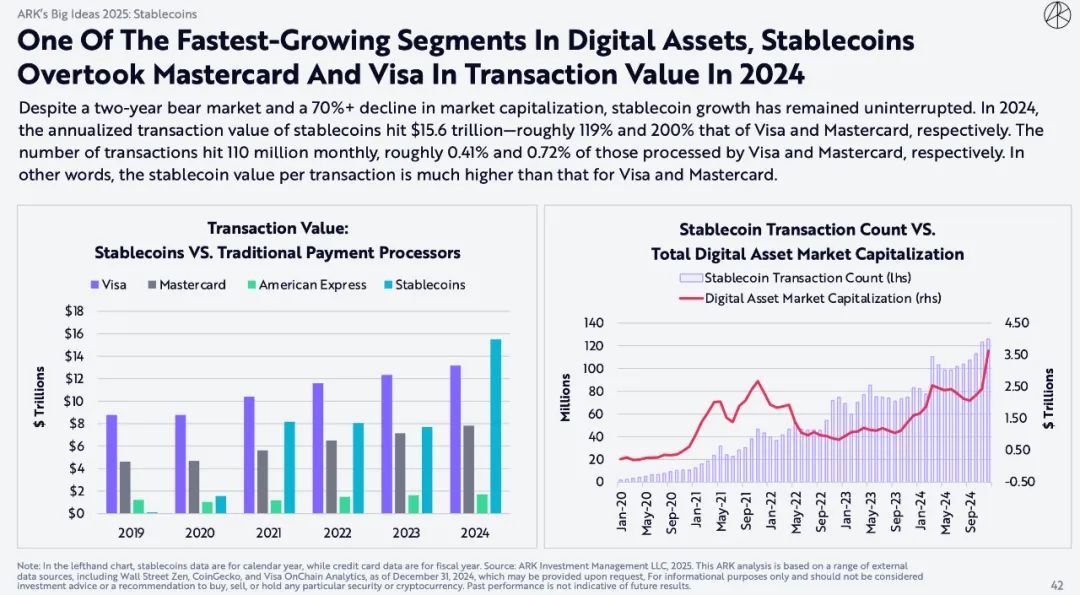

As one of the fastest growing areas of digital assets, stablecoins are expected to surpass Mastercard and Visa in transaction volume by 2024

Despite a two-year bear market and a more than 70% drop in market value, the growth of stablecoins has not been interrupted. In 2024, the annualized transaction volume of stablecoins reached 15.6 trillion US dollars, which is about 119% and 200% of Visa and Mastercard respectively. The monthly transaction volume reached 110 million transactions, accounting for about 0.41% and 0.72% of the transaction volume processed by Visa and Mastercard. In other words, the value of stablecoins per transaction is much higher than that of Visa and Mastercard.

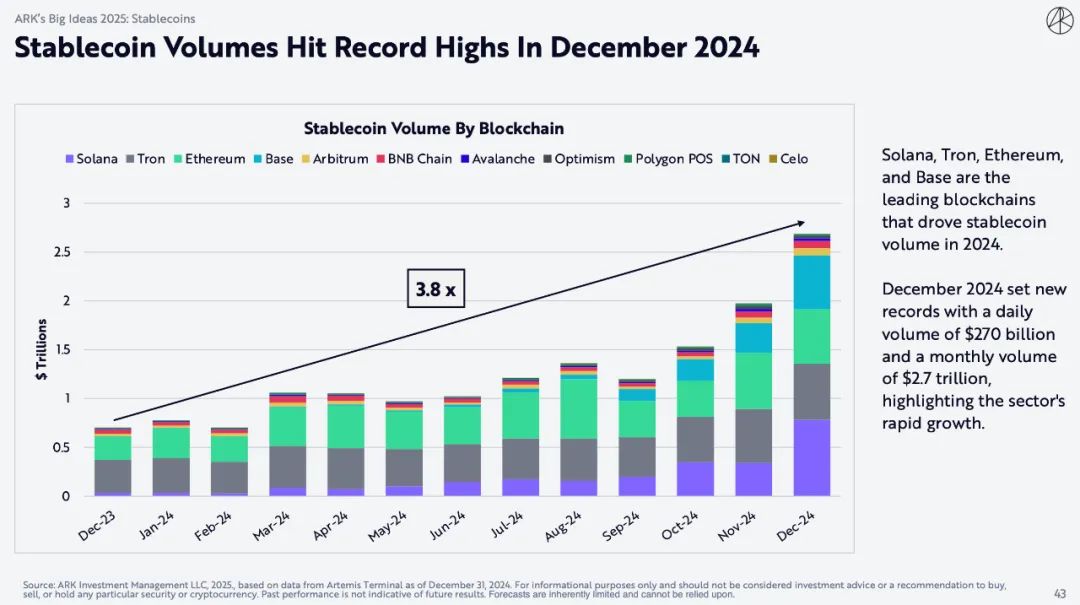

Stablecoin transaction volume hits record high in December 2024

Solana, Tron, Ethereum, and Base are the main public chains driving the growth of stablecoin transaction volume in 2024. A new record was set in December 2024, with daily transaction volume reaching US$270 billion and monthly transaction volume reaching US$2.7 trillion, highlighting the rapid growth of the industry.

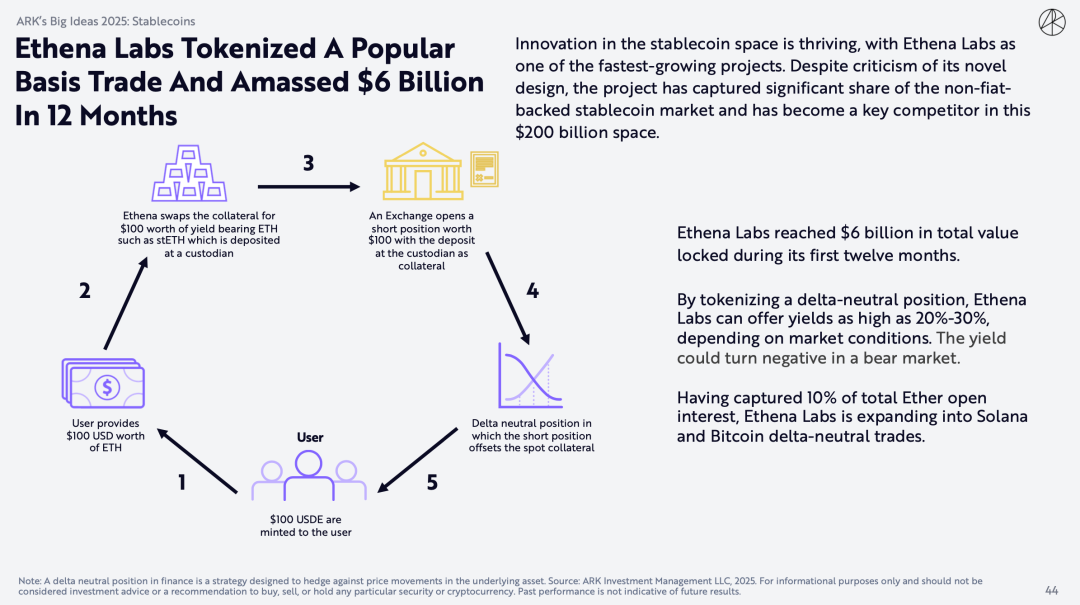

Ethena Labs tokenizes popular basic transactions and accumulates $6 billion in 12 months

Innovation in the stablecoin space is booming, and Ethena Labs is one of the fastest-growing projects. Despite criticism for its novel design, the project has captured a large share of the non-fiat-backed stablecoin market and has become a major competitor in this $200 billion space.

Ethena Labs has locked in $6 billion in total value in the first 12 months. By tokenizing delta-neutral positions, Ethena Labs can provide a yield of up to 20%-30%, depending on market conditions. In a bear market, the yield may turn negative. Ethena Labs already accounts for 10% of the total Ethereum holdings and is expanding to Solana and Bitcoin delta-neutral trading.

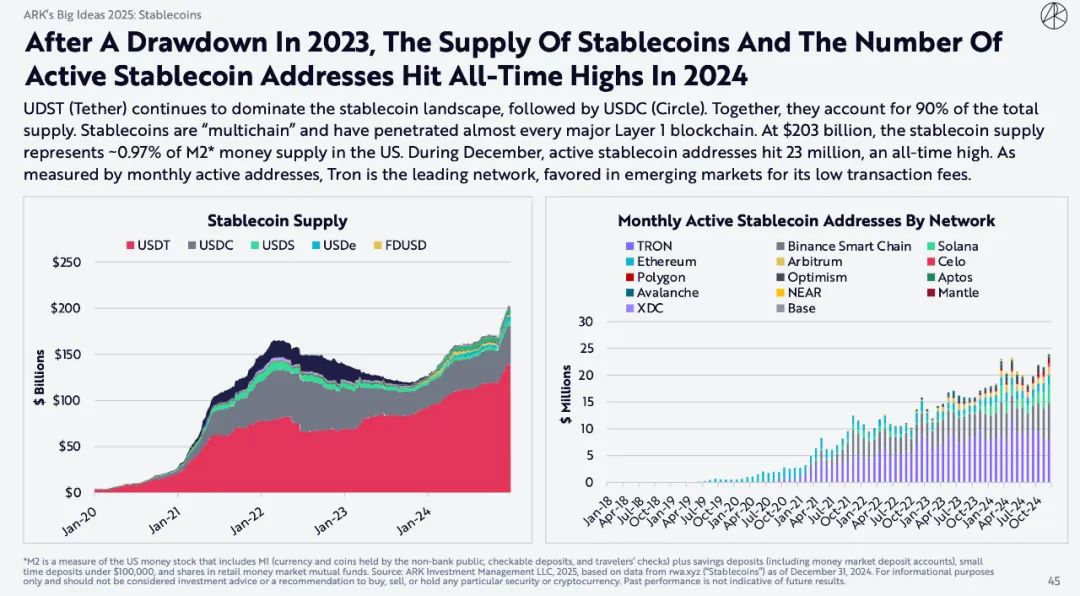

After falling in 2023, stablecoin supply and the number of active stablecoin addresses hit all-time highs in 2024

UDST (Tether) continues to dominate the stablecoin space, followed by USDC (Circle). Together they account for 90% of the total supply. Stablecoins are "multi-chain" and have penetrated almost all major layer 1 blockchains. Stablecoin supply is $203 billion, accounting for about 0.97% of the US M2 money supply. In December, active stablecoin addresses reached 23 million, a record high. Tron is the leading network by monthly active addresses, favored by emerging markets for its low transaction fees.

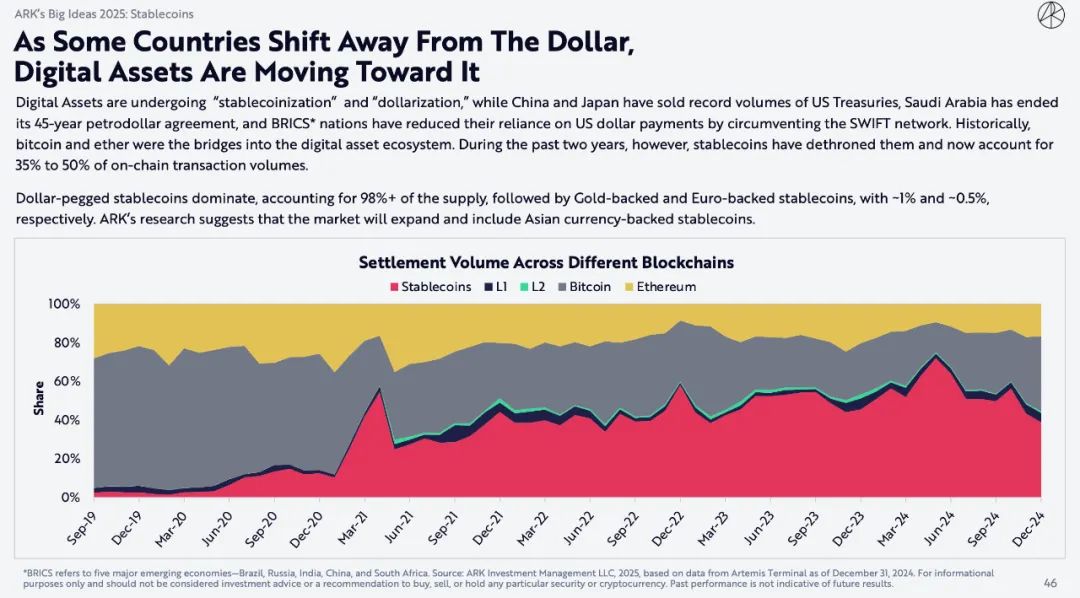

As some countries gradually abandon the US dollar, digital assets are moving closer to the US dollar

Digital assets are experiencing "stablecoinization" and "dollarization", while China and Japan sold record amounts of US Treasuries, Saudi Arabia ended the 45-year petrodollar agreement, and the BRICS reduced their reliance on US dollar payments by bypassing the SWIFT network. Historically, Bitcoin and Ethereum were bridges into the digital asset ecosystem. However, in the past two years, stablecoins have taken their place and currently account for 35% to 50% of on-chain transactions.

Stablecoins pegged to the U.S. dollar dominate, accounting for more than 98% of the supply, followed by gold-backed stablecoins and euro-backed stablecoins, which account for about 1% and about 0.5%, respectively. ARK's research suggests that the market will continue to expand and include stablecoins backed by Asian currencies.

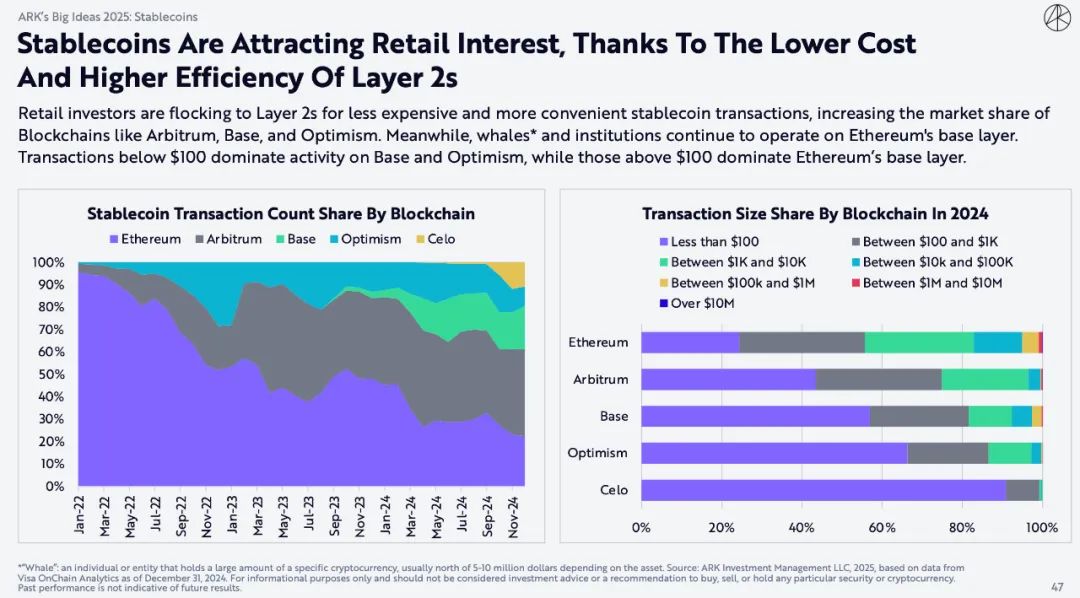

Stablecoins are gaining interest from retail investors due to lower costs and higher efficiency of Layer 2

Retail investors have flocked to Layer 2 for cheaper and more convenient stablecoin transactions, increasing the market share of blockchains such as Arbitrum, Base, and Optimism. Meanwhile, whales and institutions continue to operate on Ethereum's base layer. Transactions below $100 dominate on Base and Optimism, while transactions above $100 dominate on Ethereum's base layer.

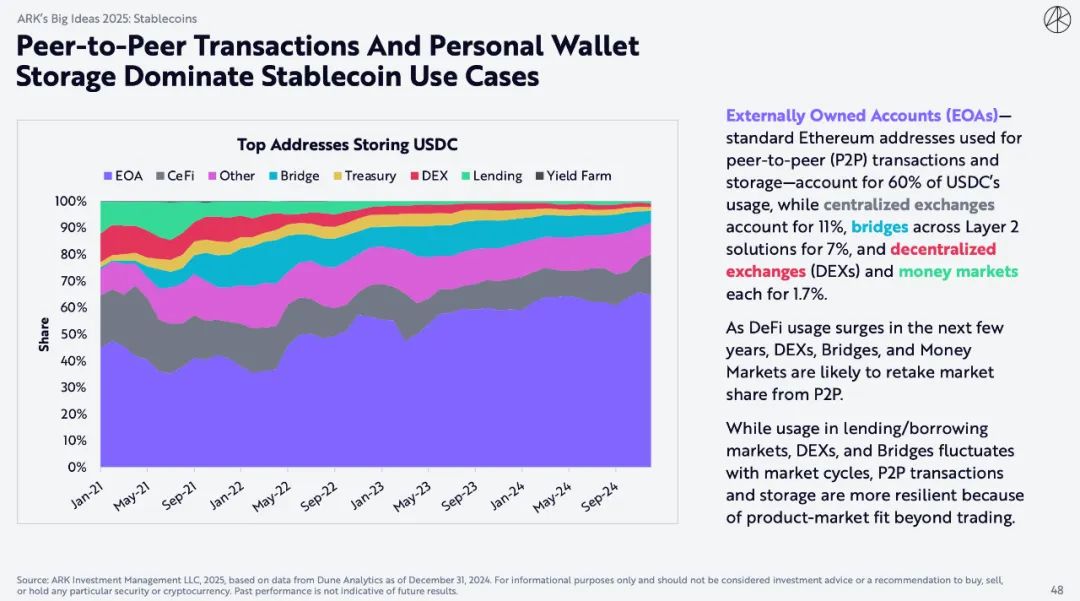

Peer-to-peer transactions and personal wallet storage dominate stablecoin use cases

Externally owned accounts (EOAs) — standard Ethereum addresses used for peer-to-peer (P2P) transactions and storage — account for 60% of USDC usage, while centralized exchanges account for 11%, Ethereum Layer 2 cross-chain bridges account for 7%, and decentralized exchanges (DEX) and money markets each account for 1.7%.

As DeFi usage surges in the coming years, DEXs, Bridges, and money markets are likely to take back market share from P2P.

While usage of lending markets, DEXs, and Bridges fluctuates with market cycles, P2P trading and storage are more resilient because there is greater product-market fit beyond trading.

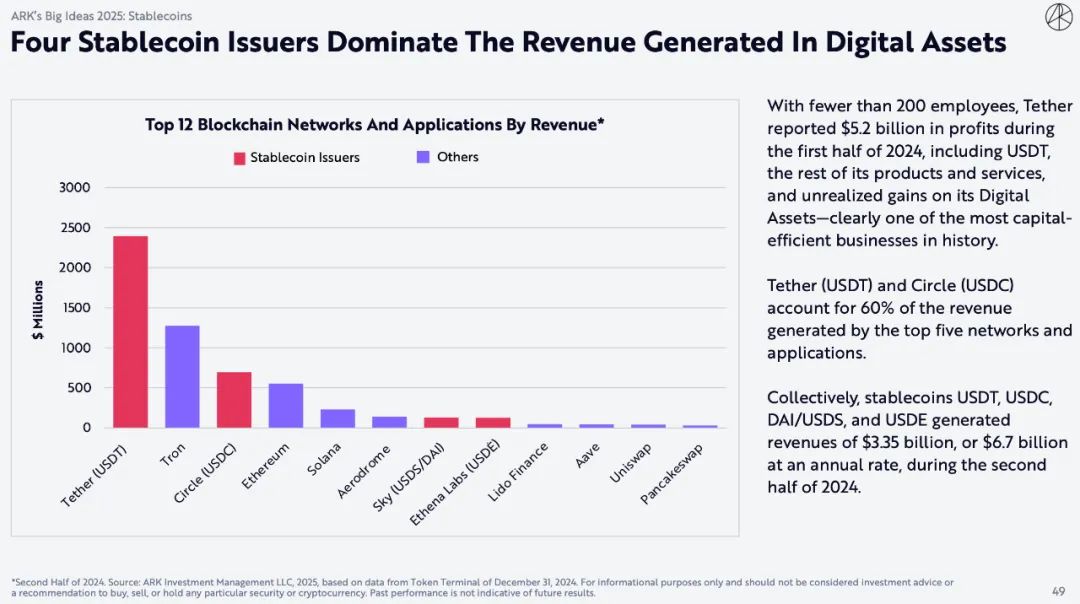

Four major stablecoin issuers dominate revenue generated by digital assets

Tether, which has fewer than 200 employees, reported $5.2 billion in profits for the first half of 2024, which includes unrealized gains on USDT, its remaining products and services, and digital assets—clearly one of the most capital-efficient businesses in history.

Tether (USDT) and Circle (USDC) account for 60% of the revenue generated by the top five networks and applications. In the second half of 2024, stablecoins USDT, USDC, DAI/USDS and USDE generated a total of $3.35 billion in revenue, or $6.7 billion on an annualized basis.

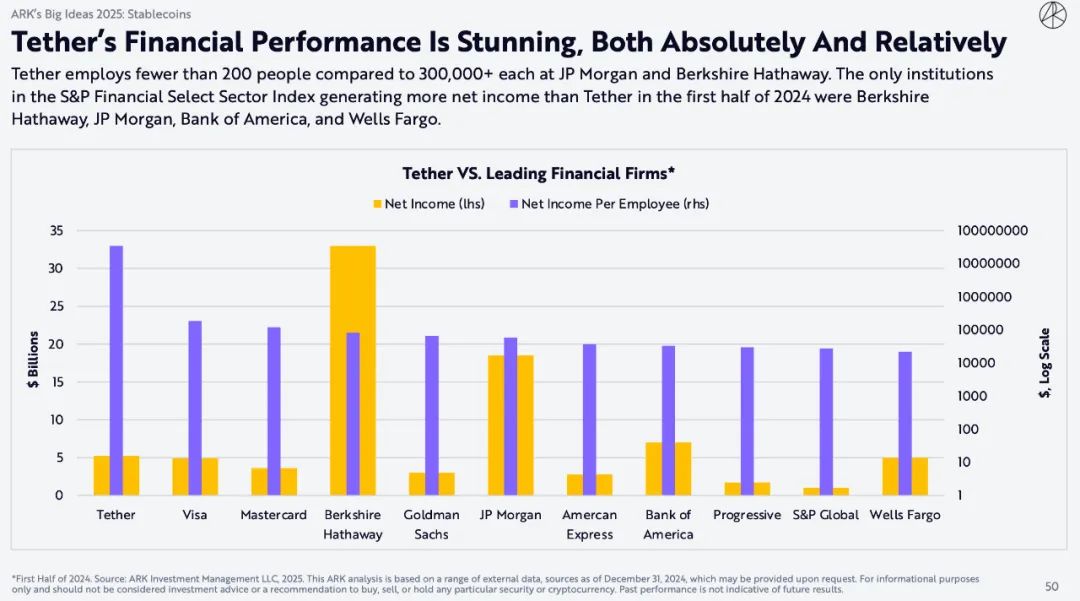

Tether’s financial performance is amazing, both in absolute and relative terms.

Tether has fewer than 200 employees, while JPMorgan Chase and Berkshire Hathaway both have more than 300,000 employees. The only institutions in the S&P Financial Select Sector Index with more net income than Tether in the first half of 2024 are Berkshire Hathaway, JPMorgan Chase, Bank of America, and Wells Fargo.

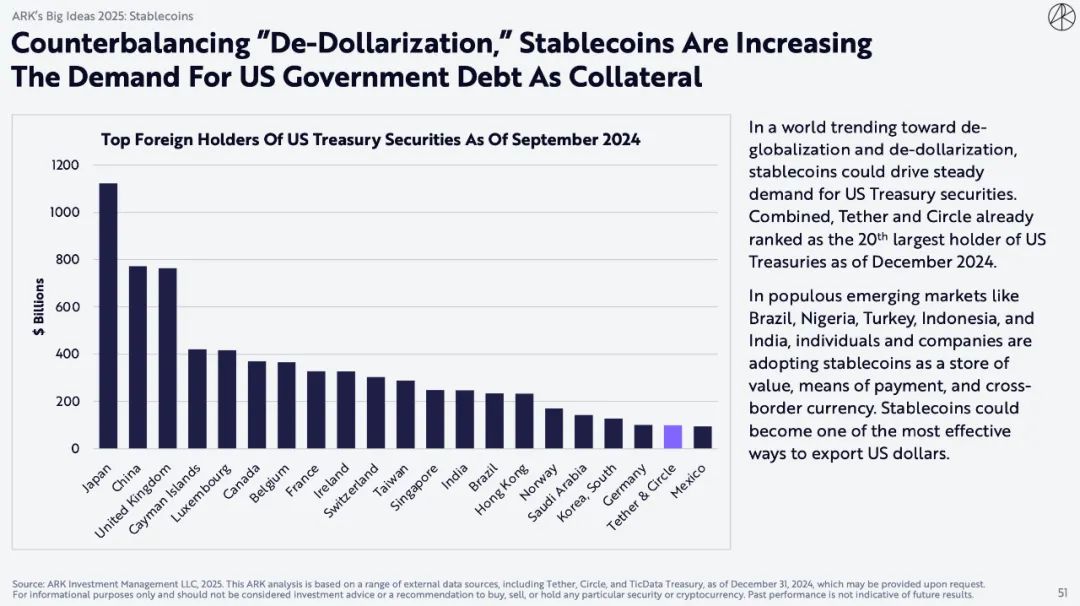

To balance the “de-dollarization”, stablecoins are increasing the demand for US debt as collateral

In a world moving toward deglobalization and dedollarization, stablecoins could drive steady demand for U.S. Treasuries. As of December 2024, Tether and Circle together have become the 20th largest holders of U.S. Treasuries.

In populous emerging markets such as Brazil, Nigeria, Turkey, Indonesia, and India, individuals and companies are adopting stablecoins as a store of value, means of payment, and cross-border currency. Stablecoins may become one of the most efficient ways to export dollars.

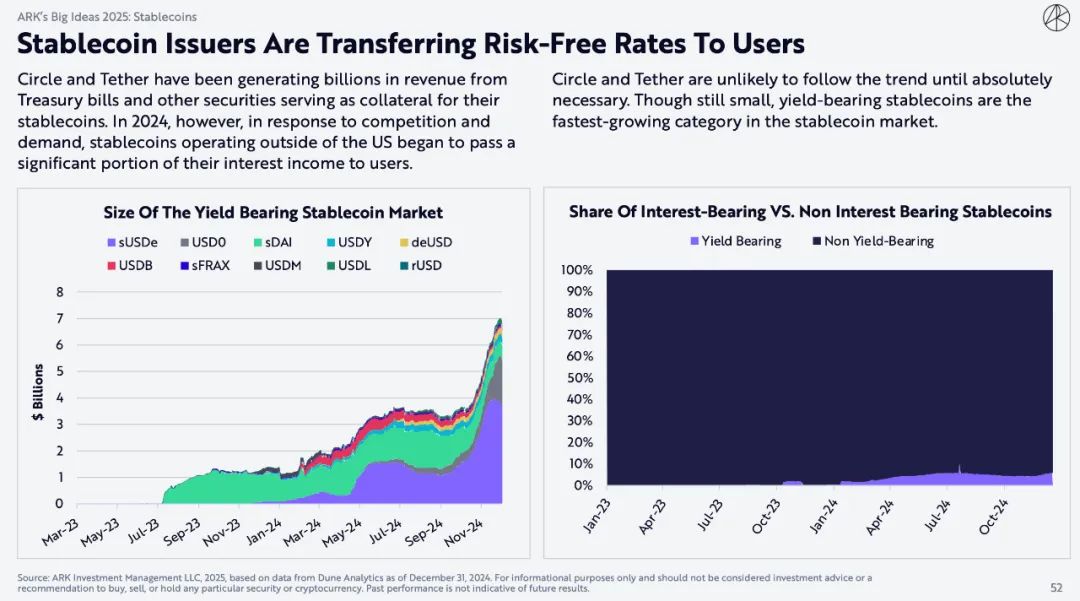

Stablecoin issuers are transferring risk-free interest rates to users

Circle and Tether have been generating billions of dollars in revenue from Treasury bills and other securities used as collateral for their stablecoins. However, in 2024, in response to competition and demand, stablecoins operating outside the United States began to shift a significant portion of their interest income to users.

Circle and Tether are unlikely to follow this trend unless absolutely necessary.Although still small, yield-generating stablecoins are the fastest growing category in the stablecoin market.

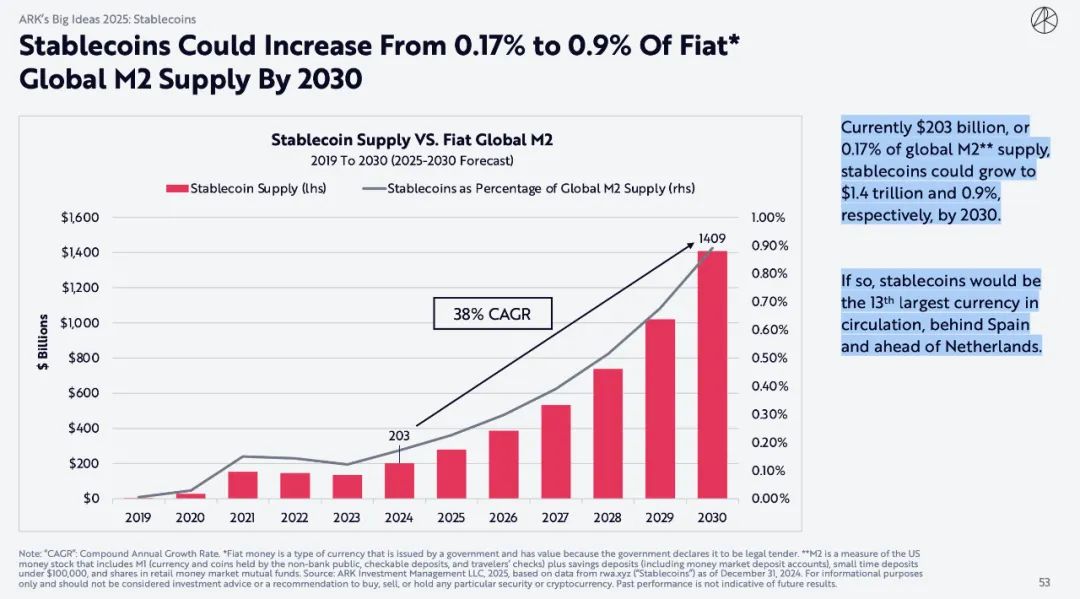

By 2030, stablecoins could increase from 0.17% to 0.9% of global M2 supply of fiat currencies

Currently, stablecoins are $203 billion and account for 0.17% of the global M2 supply. By 2030, stablecoins may increase to $1.4 trillion and 0.9%, respectively.

By then, stablecoins will become the 13th largest currency in circulation in the world, second only to Spain and ahead of the Netherlands.

5. Public chain expansion: costs have dropped significantly and new use cases have emerged at the application layer

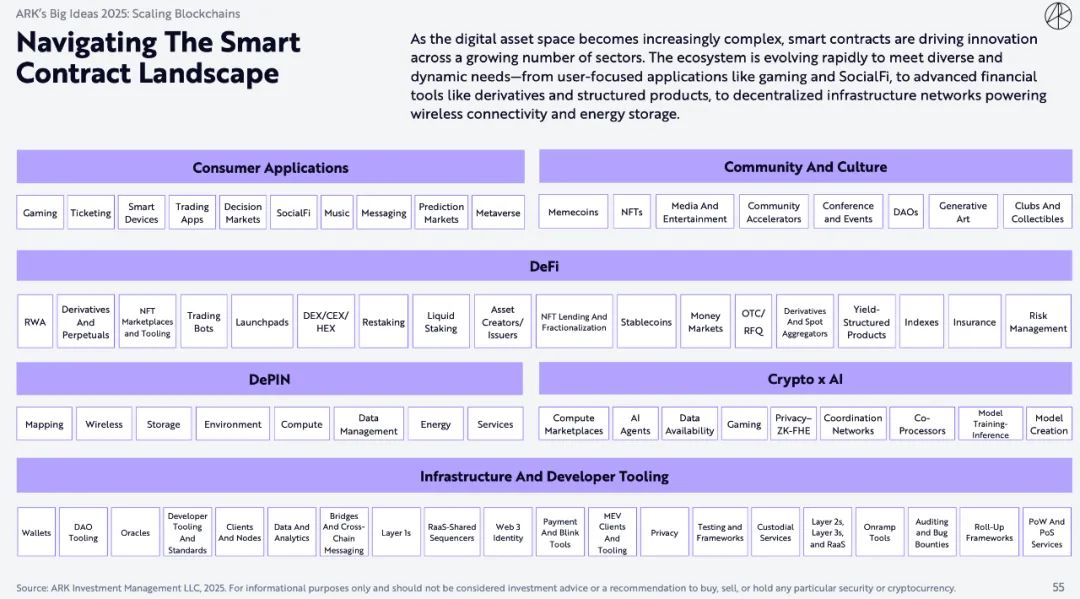

Exploring the world of smart contracts

As the digital asset space becomes more complex, smart contracts are driving innovation in a growing number of industries. The ecosystem is rapidly evolving to meet diverse and dynamic needs - from user-centric applications such as games and SocialFi, to advanced financial instruments such as derivatives and structured products, to decentralized infrastructure networks that support wireless connectivity and energy storage.

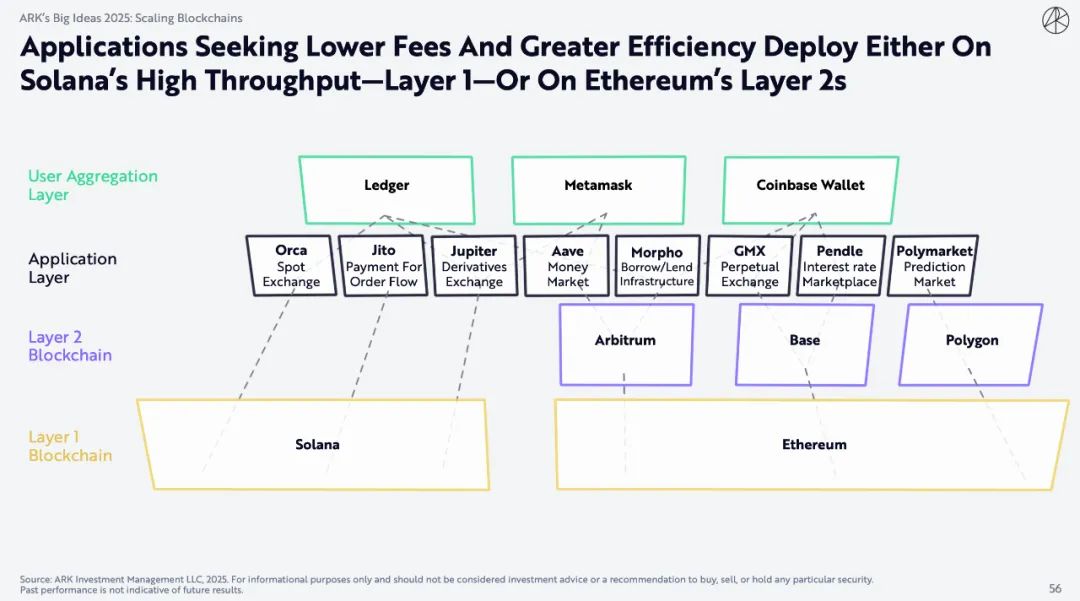

Applications seeking lower fees and higher efficiency will be deployed either on Solana’s high-throughput Layer 1 or Ethereum’s Layer 2

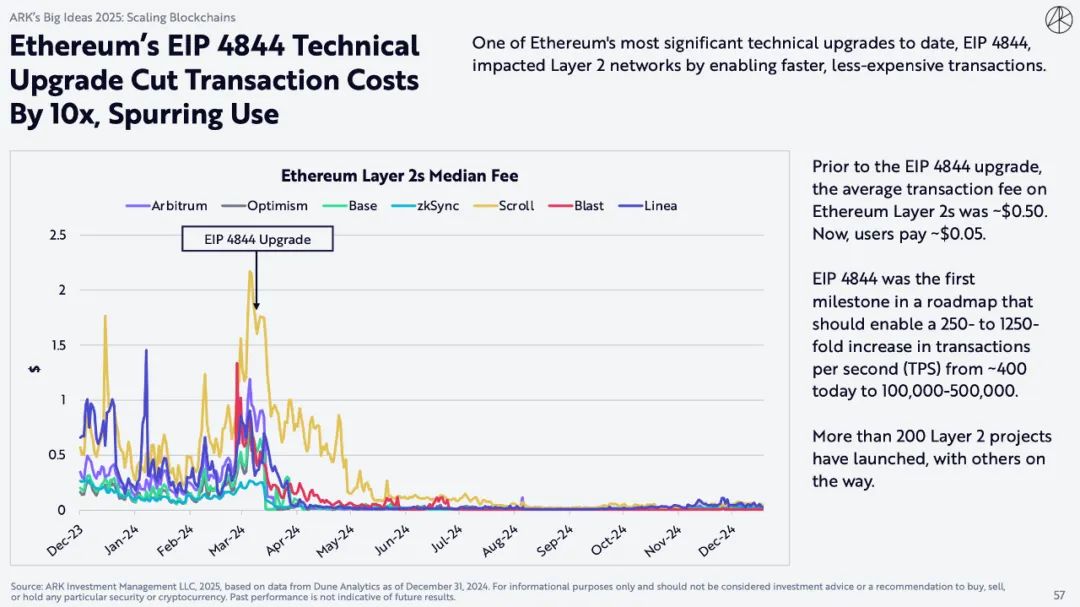

Ethereum's EIP 4844 technology upgrade reduces transaction costs by 10 times, spurring adoption

One of Ethereum’s most significant technical upgrades to date, EIP 4844, impacts the Layer 2 network by enabling faster and cheaper transactions.

Before the EIP 4844 upgrade, the average transaction fee on Ethereum’s Layer 2 was about $0.50. Now, users only have to pay about $0.05.

EIP 4844 is the first milestone in the roadmap and should enable a 250 to 1,250-fold increase in transactions per second (TPS) from today’s approximately 400 to 100,000-500,000.

More than 200 Layer 2 projects have been launched, with others in the works.

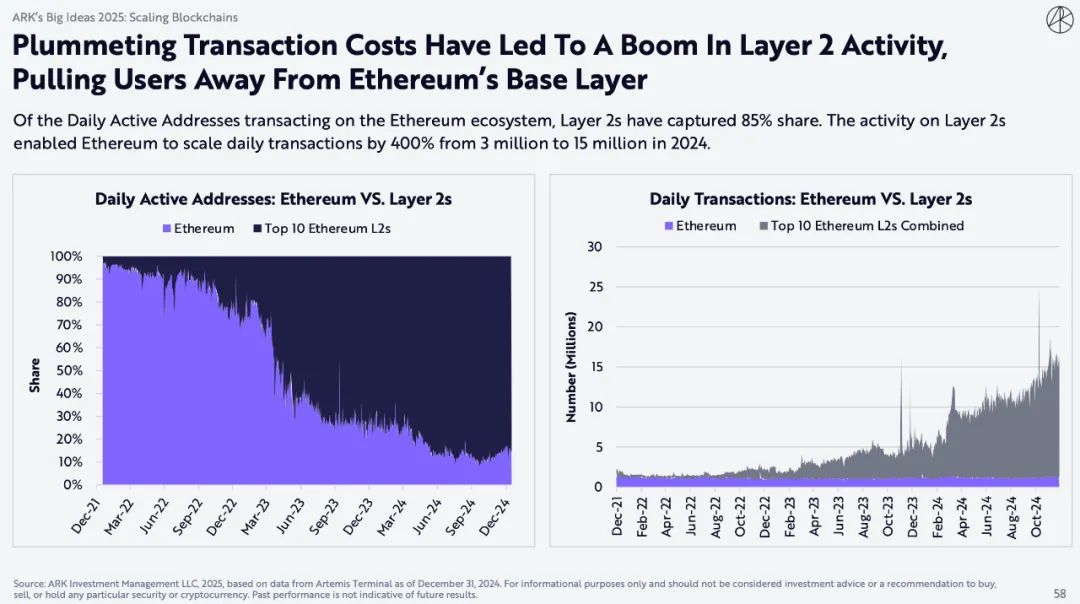

Falling transaction costs lead to a surge in Layer 2 activity, pulling users away from Ethereum’s base layer

Layer 2 accounts for 85% of daily active addresses transacting in the Ethereum ecosystem. Activity on Layer 2 drives Ethereum’s daily transaction volume from 3 million to 15 million by 2024, a 400% increase.

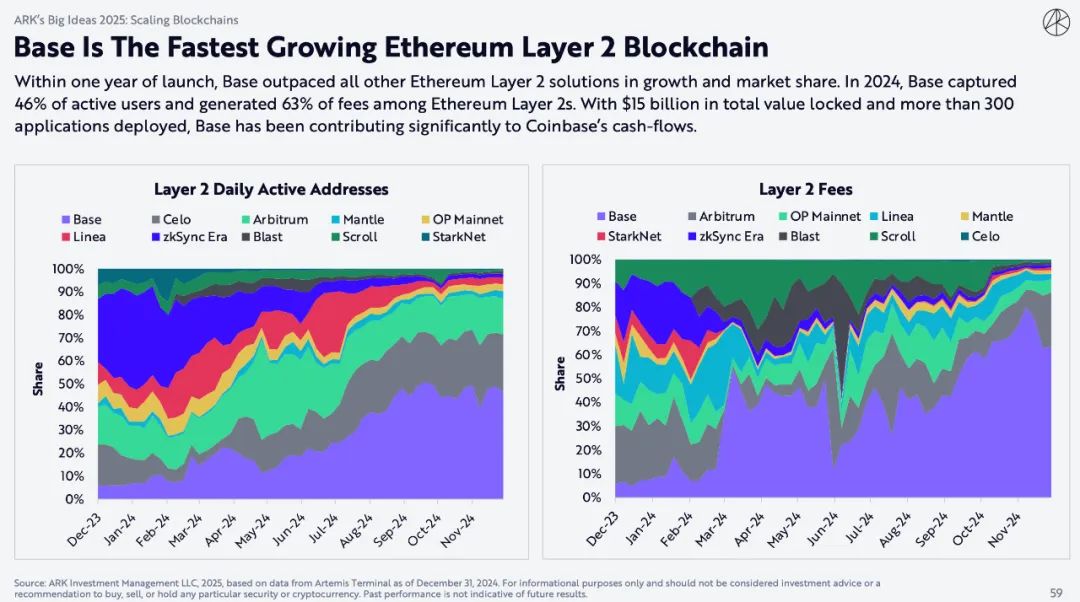

Base is the fastest growing Ethereum layer 2 blockchain

Within a year of launch, Base surpassed all other Ethereum Layer 2 solutions in growth and market share. In 2024, Base captured 46% of active users and generated 63% of fees in Ethereum Layer 2. With $15 billion in total locked value and over 300 applications deployed, Base has made a significant contribution to Coinbase's cash flow.

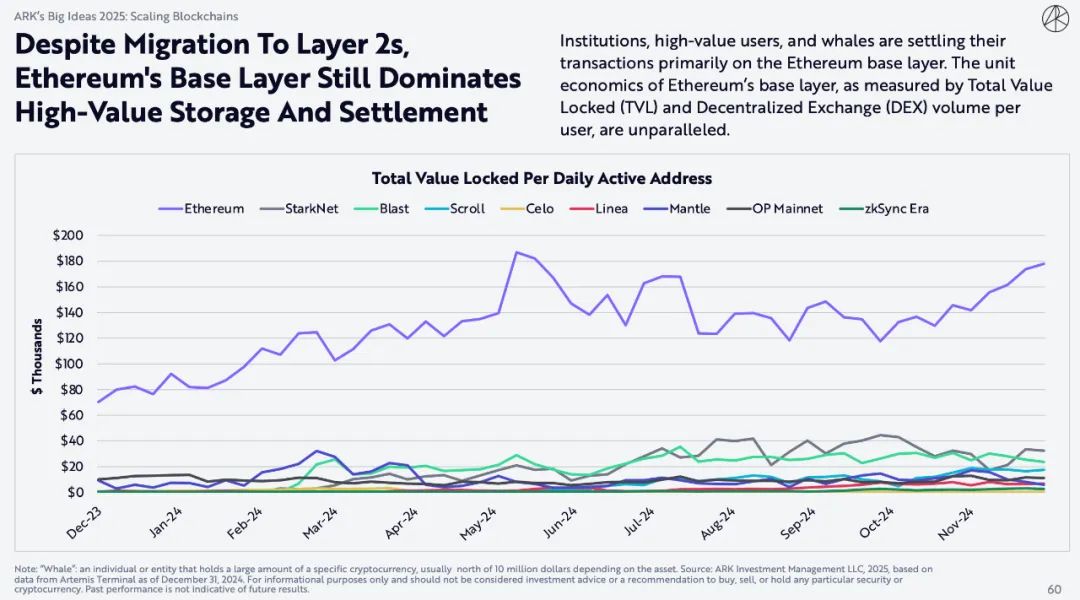

Despite the migration to Layer 2, Ethereum’s base layer still dominates high-value storage and settlement

Institutions, high-value users, and whales primarily settle trades on the Ethereum base layer. The unit economics of the Ethereum base layer are unparalleled, measured by total value locked (TVL) and decentralized exchange (DEX) volume per user.

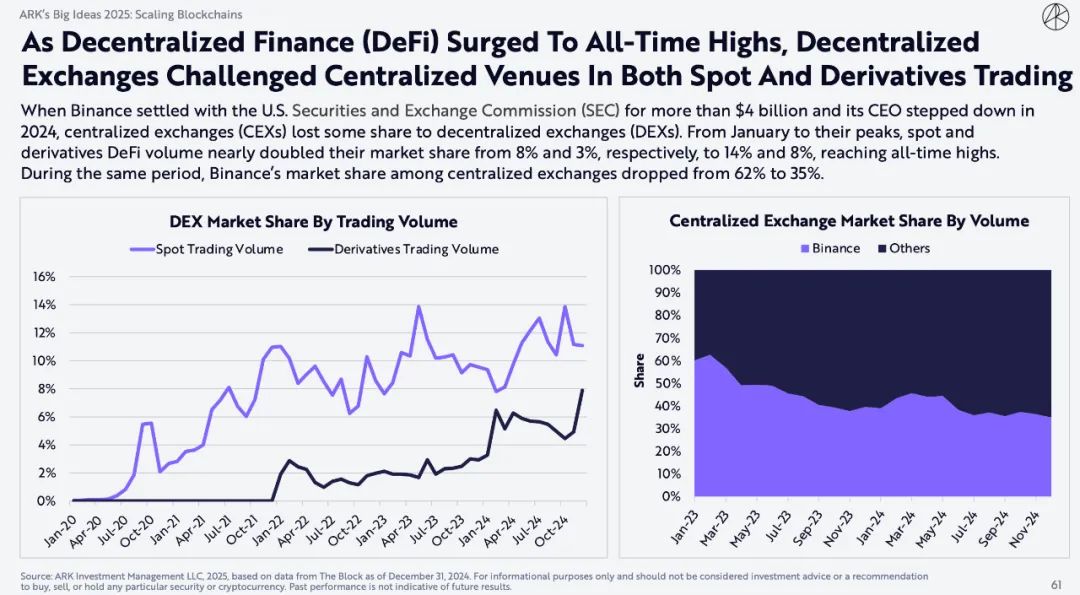

As DeFi surges to all-time highs, DEXs challenge CEXs in spot and derivatives trading

When Binance reached a settlement of more than $4 billion with the U.S. Securities and Exchange Commission (SEC) and its CEO stepped down in 2024, centralized exchanges (CEX) lost some share to decentralized exchanges (DEX). From January to the peak, spot and derivatives DeFi trading volumes almost doubled, with market share increasing from 8% and 3% to 14% and 8%, respectively, setting new all-time highs. During the same period, Binance's market share among centralized exchanges fell from 62% to 35%.

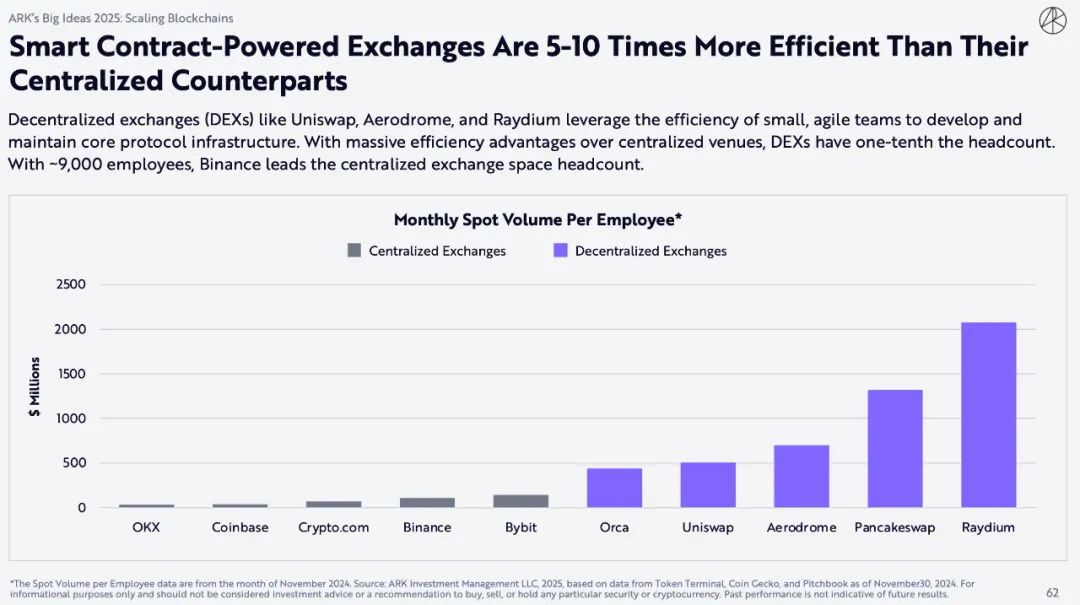

Smart contract-driven exchanges are 5-10 times more efficient than centralized exchanges

Decentralized exchanges (DEXs) such as Uniswap, Aerodrome, and Raydium use the efficiency of small, agile teams to develop and maintain core protocol infrastructure. DEXs have a huge efficiency advantage over centralized exchanges, with only one-tenth the number of employees. With approximately 9,000 employees, Binance leads the field of centralized exchanges in terms of the number of employees.

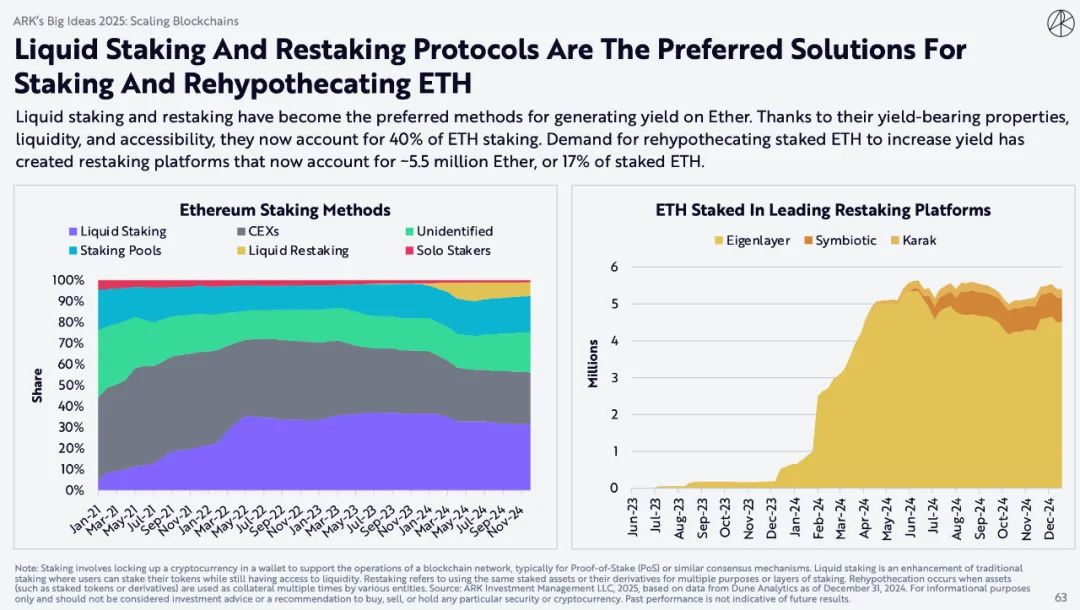

Liquidity staking and re-staking protocols are the preferred solution for staking and re-staking ETH

Liquid staking and re-staking have become the preferred method of generating Ether yield. Due to their yielding properties, liquidity, and accessibility, they now account for 40% of ETH staked. The demand to re-stake ETH to increase yield has given rise to re-staking platforms, which now account for ~5.5M of staked Ether, or 17% of staked ETH.

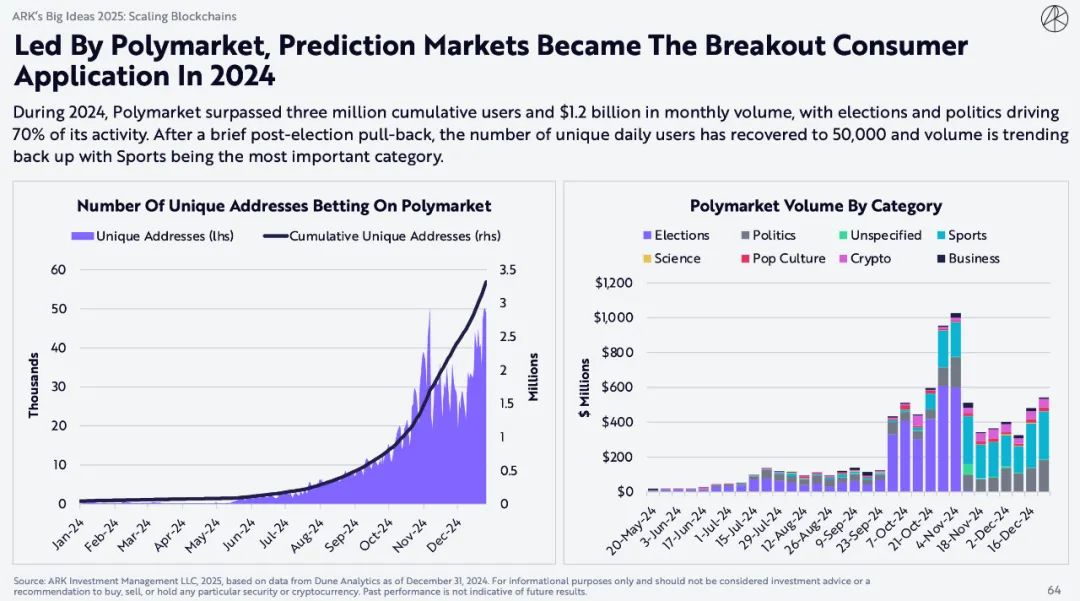

Led by Polymarket, prediction markets become the breakthrough consumer application of 2024

In 2024, Polymarket has more than 3 million users and a monthly trading volume of $1.2 billion, with 70% of activity related to elections and politics. After a brief decline after the election, the number of daily unique users has recovered to 50,000, and trading volume is on the rise, with sports being the most important category.

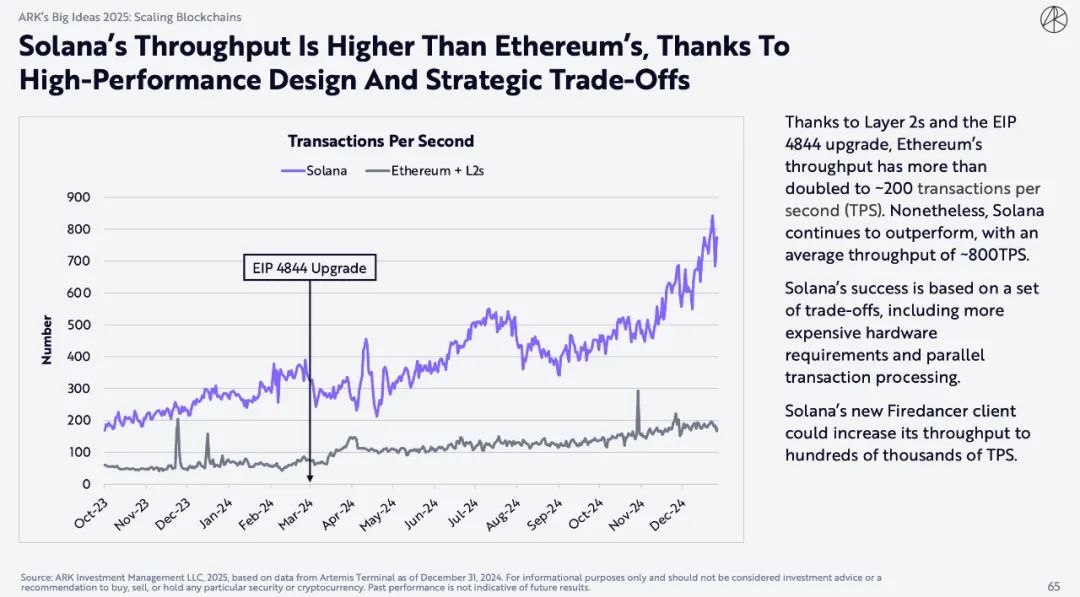

Solana has higher throughput than Ethereum thanks to its high-performance design and strategic trade-offs

Ethereum’s throughput has more than doubled to around 200 transactions per second (TPS) thanks to Layer 2 and EIP 4844 upgrades. Still, Solana is performing well, with an average throughput of around 800 TPS.

Solana’s success is based on a series of trade-offs, including more expensive hardware requirements and parallel transaction processing. Solana’s new Firedancer client can increase its throughput to hundreds of thousands of TPS.

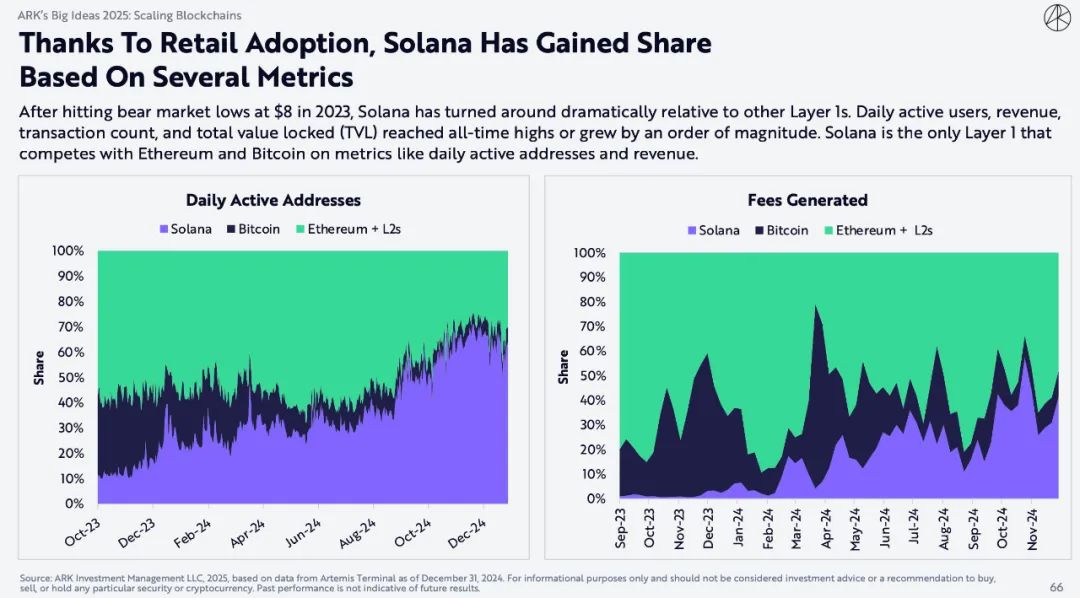

Solana gains market share across multiple metrics due to strong retail adoption

After hitting a bear market low of $8 in 2023, Solana has seen a dramatic turnaround relative to other Layer 1s. Daily active users, revenue, number of transactions, and total locked value (TVL) have all hit new all-time highs or increased by an order of magnitude. Solana is the only Layer 1 that competes with Ethereum and Bitcoin on metrics like daily active addresses and revenue.

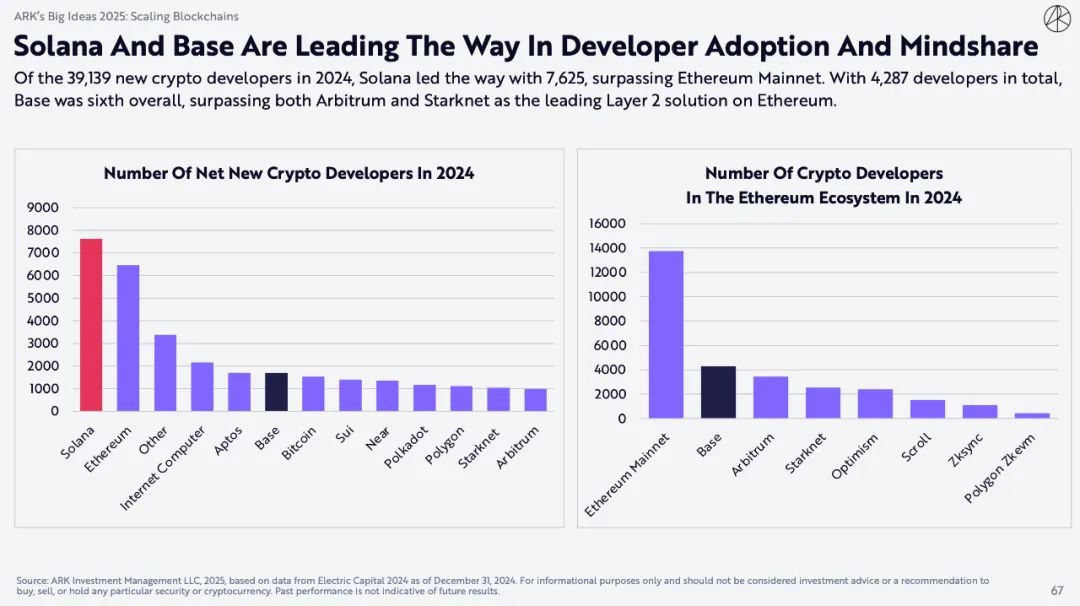

Solana and Base Lead in Developer Adoption and Market Share

Solana leads with 7,625 developers, surpassing the Ethereum mainnet, out of the 39,139 new crypto developers added in 2024. Base ranks sixth with 4,287 developers, surpassing Arbitrum and Starknet to become the leading Layer 2 solution on Ethereum.