MUBARAK has just reached 150M (it has reached 200M at the time of posting), and many communities are particularly Fomo, and even more so single-coin A7/A8. Many users are late to this "event-based" pull. What does this indicate? Let's use three indicators to take everyone back to the data before today to see what impact this wave of operations has on the BNB ecosystem.

Important timeline

- On March 13, Binance announced that it had received a $2 billion investment from the UAE sovereign fund MGX; the official posted a tweet on X with a picture of a "tycoon" wearing a Middle Eastern headscarf, and CZ retweeted the tweet with the caption "Mubarak"

- On March 14, CZ then retweeted a related tweet from a community member named “0x5c...46f6”; CZ posted on Binance Square that he was “going to meet a friend this weekend.”

- On March 15, Binance Alpha launched Mubarak. The next day, CZ spent 1 BNB each to buy TST and Mubarak, and posted on Binance Square, "Doing some testing over the weekend." This series of operations pushed the hype of Mubarak to a climax.

- On March 16, CZ tweeted, "Considering changing a new avatar; Mubarak won the $4.4 million permanent liquidity pool support provided by Binance

Now we officially enter the analysis phase:

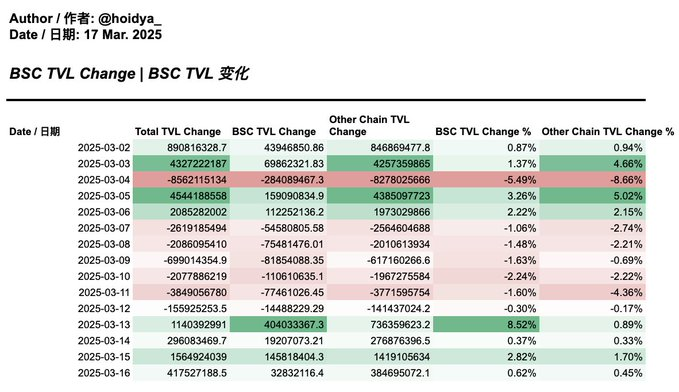

1/TVL

Judging from TVL, the main liquidity of BNB Chain began to flow in on March 13, which may be mainly affected by the investment information of MGX.

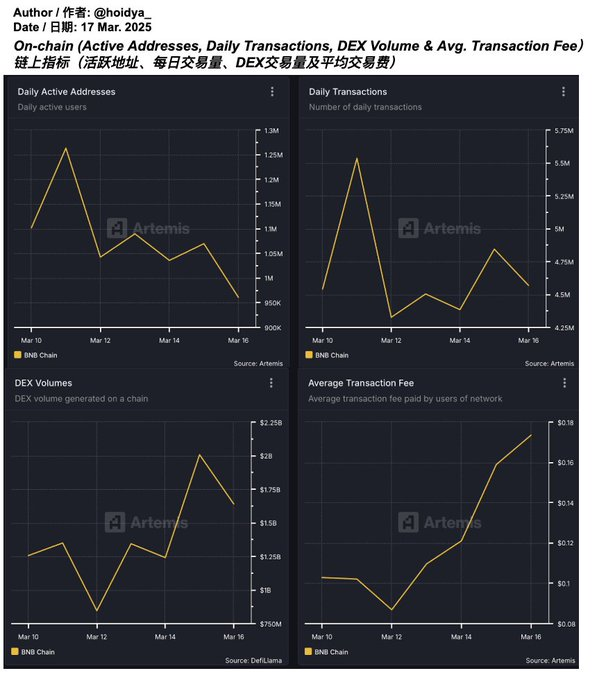

2/On-chain indicators

- Daily active addresses: No increase in users due to MGX investment information, 500k new addresses were added on the 13th and 15th respectively

- Daily trading volume: After a sharp drop on the 11th, the trading volume rose slightly to 4.8 million on the 15th.

- DEX transaction volume: transaction volume increased by ~500m on the 13th and ~750m on the 15th

- Transaction Fees: Transaction fees have continued to rise since the 12th, from 0.1 to 0.18

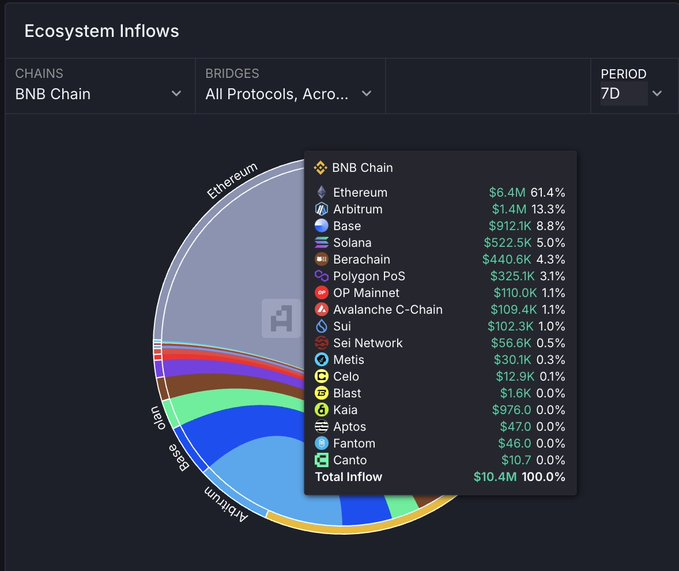

3/7d cross-chain liquidity source

Recently, 7d liquidity mainly comes from Ethereum, accounting for 61%. Solana only has 5%.

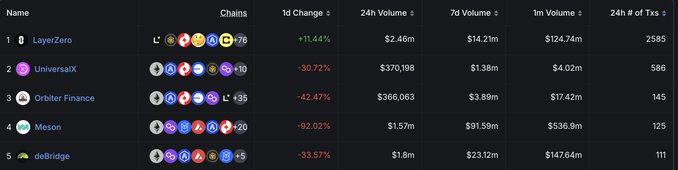

4/Cross-chain transaction volume

Cross-chain transaction volume in the past 24 hours:

- LayerZero 2585 tx large transaction

- UniversalX 586 tx small transaction

- Orbiter Finance 145 tx small transaction

- Meson 125 tx large transaction

- deBridge 111 tx large transaction

It can be seen that LayerZero, meson, and deBridge mainly solve large transactions, while Orbiter Finance & UniversalX focus on small transactions. However, the transaction volume of UniversalX is higher than that of Orbiter Finance.

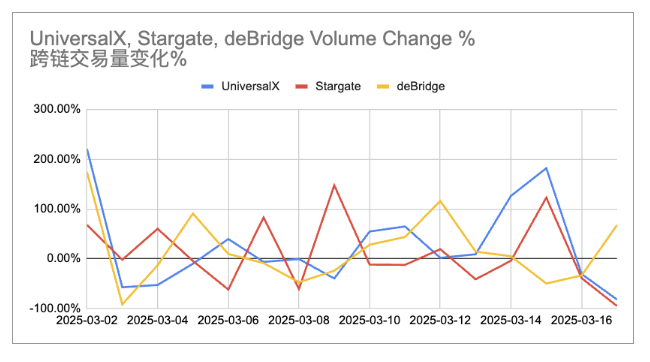

5/Change in cross-chain transaction volume%

It can be seen that UniversalX has obviously increased its trading volume due to the BSC Meme wave last weekend, while Stargate and deBridge have relatively lower incremental changes.

6/Conclusion

Fomo caused by the rise of MUBARAK has increased the liquidity of the BNB Chain ecosystem. The DEX transaction volume and average transaction fee have also reached a new high in a week. However, the core user group has not increased sharply, and even showed a downward trend compared with 7 days ago. This may mean that the on-chain DEX ecological transactions have become more active, but this still does not allow BSC to gain more users.

From the perspective of liquidity sources, the main source is the EVM ecosystem, and there is not much liquidity from Solana. This may also explain why BSC has no incremental users - the liquidity of a large number of meme users is still in Solana.

From the perspective of cross-chain sources, this type of "event-based" outbreak opportunity may not be able to efficiently solve the demand for instant coin purchases if it is only through mainstream cross-chain bridges, so it is not surprising that users use cross-chain bridges + aggregated trading platforms such as UniversalX. In fact, the transaction volume increment is indeed higher than other cross-chain bridges without "coin purchase application scenarios".

The data should be updated in a few days to verify my ideas. Mainly, I think BSC will have other event opportunities.