Since its launch in February last year, Pump.fun has quickly attracted users' attention with its unique mechanism and innovative ideas. It currently accounts for more than 70% of the token issuance of the Solana network and contributes more than 56% of decentralized exchange (DEX) activities. In the past 24 hours alone, the platform has issued more than 45,000 tokens, and the cumulative issuance for the whole year has exceeded 5.5 million. Revenue in December reached US$79.94 million, surpassing the performance of mainstream networks such as Tron and Bitcoin.

1. What is Pum p.fun?

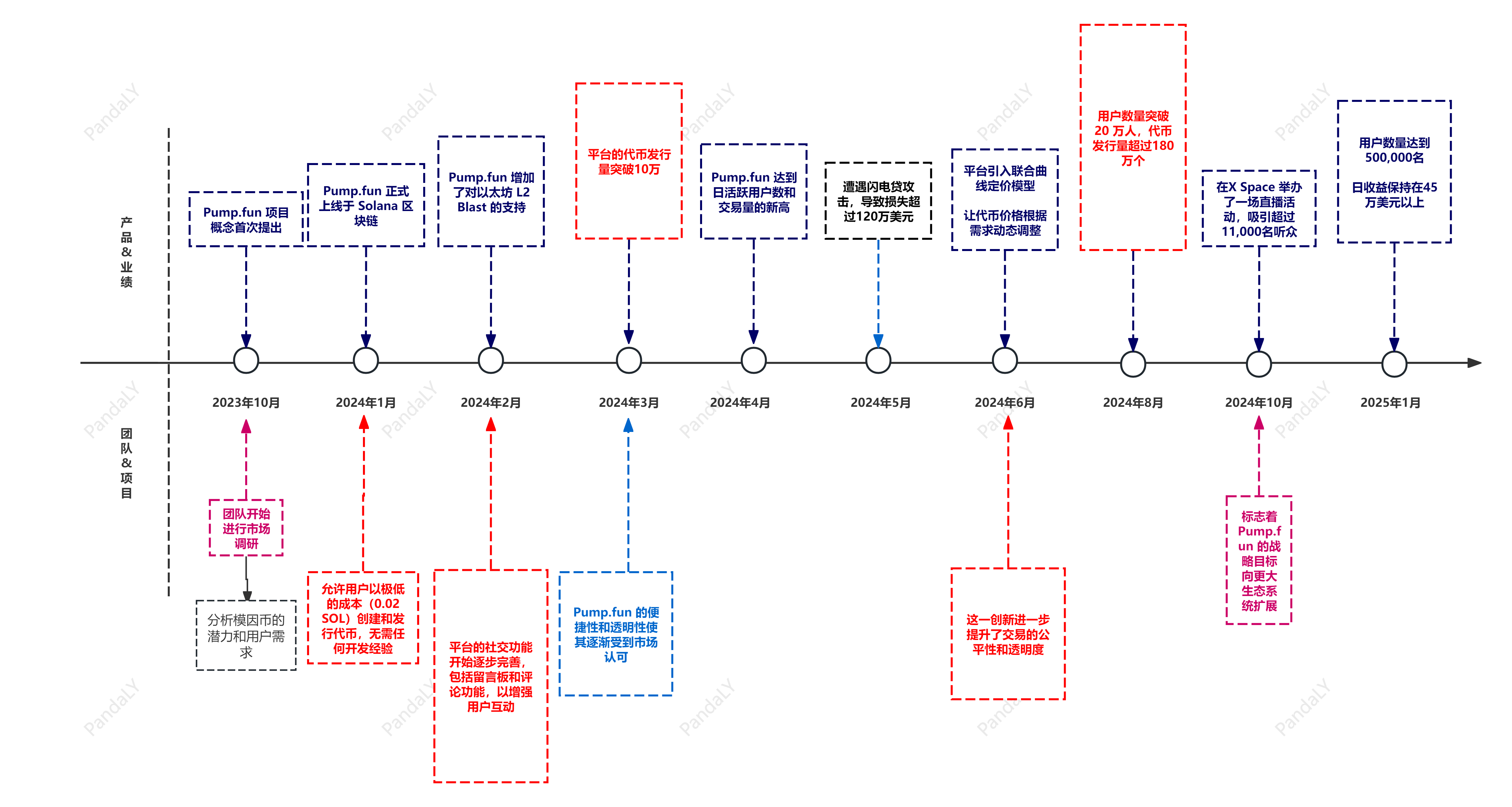

Pump.fun is a Memecoin creation and trading platform based on the Solana blockchain. It is committed to simplifying the token issuance process, lowering the technical threshold, and allowing any user to easily create and trade their own digital assets. With its innovative mechanism design and deep integration of Meme culture, Pump.fun has become an important project in the intersection of DeFi and Meme culture. The figure below shows the creation process and key events of Pump.fun.

2. The reason why Pump.fun became popular

The rise of Pump.fun not only relies on its technological advantages, but also accurately captures the intersection of the Meme market and user needs, filling users' needs for meme currency transactions and interactions.

1) The rise of meme culture

With the development of social media and the Internet, Meme has become a pop culture phenomenon. In this context, speculative Meme coins have quickly become popular, and Pump.fun has seized this trend and provided users with an efficient creation and trading platform.

2) A low-threshold platform that everyone can participate in

The traditional token issuance process is complicated and expensive, but Pump.fun has greatly simplified this process. Users only need to pay a fee of about 0.02 SOL to quickly create tokens. The operation is simple, allowing users without a technical background to easily enter the Meme ecosystem.

3) Solana Ecosystem:

Solana is known for its high throughput and low transaction fees, making it the blockchain of choice for many emerging projects. Pump.fun leverages Solana's technical advantages to provide users with a fast and efficient transaction experience.

4) Combination of DeFi and Meme

The booming DeFi market has led to the emergence of more and more innovative projects. Pump.fun combines meme culture with DeFi, providing users with more opportunities to participate and enhancing the project's appeal.

Three: Pump.fun Technical Highlights

The operating mechanism of the Pump.fun platform includes two trading methods: internal and external.

Pump.fun's internal disk mechanism - Introducing the Bonding Curve model

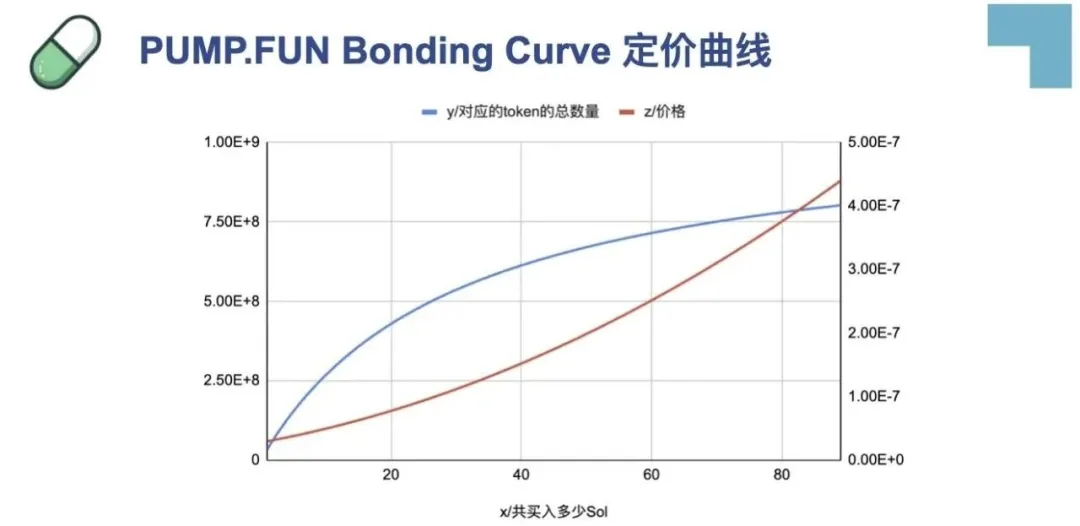

Within Pump.fun, when the amount of funds is small, the tokens will be traded on the platform's own trading market. At this time, users can buy and sell directly within the platform without transferring to an external platform. The price of internal transactions is volatile, and with Pump.fun's unique mechanism, the price will gradually increase when users make subsequent purchases, but this is not linear, but a curve called a Bonding Curve.

Bonding Curve is a mathematical model that is widely used in cryptoeconomics, especially in the fields of token economy and automated market makers (AMM). Its main function is to determine the price and supply of tokens through algorithms. Here are some key features of the bonding curve:

1: The bonding curve defines the relationship between the price of a token and its supply. Typically, this curve is designed so that as the supply of tokens increases, the token price also increases.

2: This design is intended to incentivize early investors who can buy when the token supply is low (price is low) and reap potential gains as the market expands.

Pump.fun's external disk mechanism

When the token market value reaches $69,000, Pump.fun will automatically inject $12,000 worth of liquidity into the decentralized exchange Raydium and destroy some of the tokens in circulation. This mechanism is designed to ensure market liquidity while preparing for subsequent external transactions.

The external trading adopts the automatic market making (AMM) mechanism, and Pump.fun will automatically inject liquidity. This mechanism effectively protects user assets from malicious manipulation and enhances the security of the platform by designing a security strategy to prevent liquidity from being withdrawn.

IV. Potential risks and hidden dangers

Although Pump.fun has reduced various risks through technological and mechanism innovation, some potential issues still need attention:

*Smart contract vulnerabilities

Since Pump.fun relies on smart contracts to perform token creation and transactions, any vulnerabilities in the code may be exploited by hackers, resulting in loss of funds or failure of contract functions. Once deployed, smart contracts are difficult to modify, so ensuring the security of the contract code is crucial.

*Liquidity risk

Although the platform has adopted a liquidity protection mechanism, there may still be illiquidity when the market fluctuates violently. This may cause users to be forced to bear losses when they cannot trade at a reasonable price.

* Market manipulation risk

Due to the high speculative nature of the memecoin market, there may be traders who use their influence to manipulate the market through false information or joint transactions (such as "pump and dump" behavior), causing other investors to suffer losses.

Be cautious if you see any of the following signs:

Developer dumps: Developers (project creators) may sell their assets before Raydium migrates, causing a significant price drop. This behavior may be difficult to detect because it looks similar to normal trading activity.

Pump.fun Bundle: The developer artificially inflated the price through multiple wallets and then dumped all assets before they reached Raydium. Keep an eye out for top holders who suddenly have a large number of new wallets.

Large Buyers and Dumping: Developers may create the appearance of large buyers to attract new investors, only to dump the tokens shortly afterwards. Be cautious with tokens where a single holder controls more than 10% of the supply.

*Decentralized exchange reliance

There are potential risks in Pump.fun's interaction with third-party decentralized exchanges, such as Raydium. Any potential security vulnerabilities or governance vulnerabilities may affect Pump.fun's liquidity and the security of user assets.

*User data and asset security

If the platform fails to properly protect the user's personal information and account security, it may be attacked by hackers, resulting in user data leakage or fund theft. On May 16 last year, pump.fun was attacked. The attacker was able to participate in the meme coins released by the platform indefinitely through a loophole, resulting in a loss of 1.9 million US dollars. The DEXX incident some time ago is also a warning of security issues. The platform must strengthen the security protection of user information and funds.

Conclusion

The rapid rise of Pump.fun represents the huge potential of the combination of DeFi and Meme culture. With its mechanism design and technological innovation, it has become a core project in the Solana ecosystem. However, challenges such as technical security, liquidity and market manipulation still need to be addressed. In the future, whether Pump.fun can consolidate its advantages while solving potential risks will determine its long-term competitiveness in the crypto market.