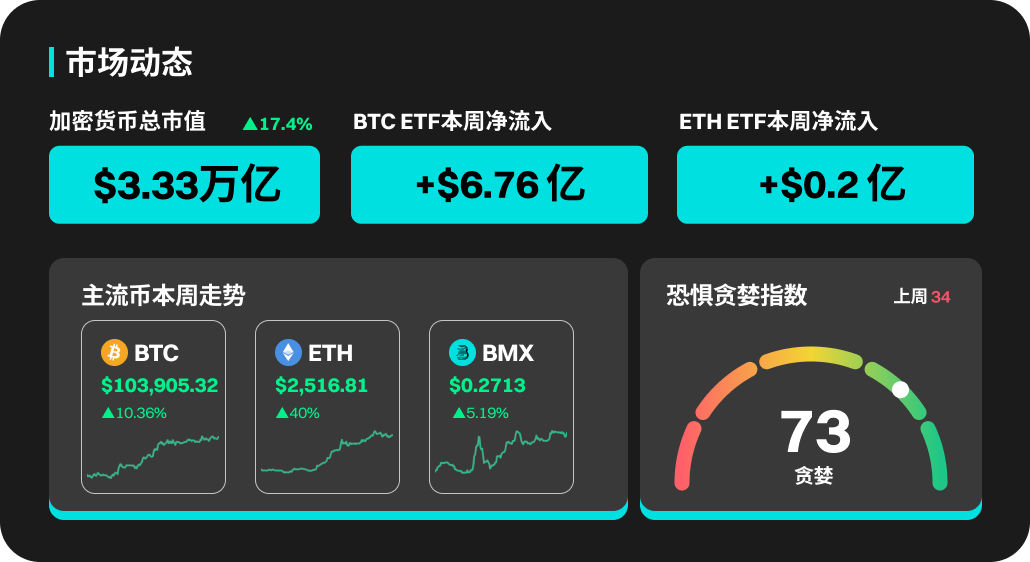

Crypto market dynamics this week

Last week, BTC ETF had a net inflow of $920 million, achieving three consecutive weeks of net inflows. The inflows in the first two weeks were $3.03 billion and $1.81 billion respectively. The continuous inflows indicate optimism in the future. In the past week, BTC reached a high of $105,000, and BTC is expected to hit a record high in May. In the past week, the market greed and panic index continued to rise, and market sentiment entered the greed stage.

Last week, the ETH ETF had a net outflow of $38 million, but ETH rose sharply from the $1,800 range to $2,600, and even rose by 25% in a single day. The ETH/BTC exchange rate rose sharply, temporarily reporting 0.024; at the same time, ETH's market share also rebounded sharply from around 7% to 9%. Judging from the inflow and outflow of funds in the ETF, the rise of ETH in the past week has little to do with the ETF; some communities even believe that the current rise of ETH is only because various indicators are at historical bottoms, and it may be just a short-term rebound.

This week's popular coins

In terms of popular currencies, MOODENG, GOAT, PNUT, PI and KAITO all performed well. MOODENG's price rose by 566.53% this week, with the highest price of 0.2889 USDT, and its current market value is 260 million US dollars. GOAT's price rose by 212.9%, with the highest price of 0.2503 USDT, and PNUT's price rose by 167.6%.

US market and hot news

U.S. stocks had mixed performances, with the S&P 500 down 0.8%, the Dow Jones Industrial Average down 1.2%, and the Nasdaq down 1.5%, mainly affected by tariff uncertainty and mixed earnings reports. Market volatility continued, with tariff exemptions sparking a brief rebound, but U.S.-China trade tensions and stricter chip export restrictions hitting technology stocks hard. Intel's disappointing earnings report dragged down the Nasdaq, while Tesla's strong quarterly results provided some support for the S&P 500.

Monday: Fed Governor Kugler and others delivered speeches;

Tuesday: US April CPI data;

Thursday: U.S. initial jobless claims for the week; U.S. PPI data for April; 2027 FOMC voting member, San Francisco Fed President Daly participates in a fireside chat; Fed Chairman Powell gives an opening speech at an event; the Fed holds the second Thomas Laubach Research Conference;

Friday: U.S. one-year inflation rate forecast for May;

Saturday: Fed’s Barkin and Daly delivered speeches;

Popular sections and projects unlocked

Meme coins such as MOODENG, GOAT, and CHILLGUY have all surged. In the rebound, market funds prefer the popular meme coins in full circulation; MOODENG surged by more than 130% in a day, leading the rise of all altcoins in the market. In the past week, the token has risen by more than 6 times, and it is also the best performing meme coin in the market during the same period. In the past week, many mainstream trading platforms announced the listing of MOODENG, which stimulated the demand for token purchases;

PIPPIN, SWARMS, GRIFFAIN and other AI agent tokens have risen, and the star tokens of the AI agent track have risen significantly from the bottom of the price, indicating that AI agent is still one of the tracks that market funds pay the most attention to; but the tokens of the AI agent sector are still far from the historical highs, which also shows that the market has doubts about the current AI agent projects, and perhaps there will be new AI agent projects.

APT will unlock approximately 11.31 million tokens at 8:00 on May 12, worth approximately US$58.47 million;

Avalanche plans to unlock approximately 9.54 million AVAX tokens on May 17, 2025, accounting for approximately 2.49% of the total supply, which is worth approximately $329 million at current prices. These tokens will be distributed to the team, foundation, strategic partners, etc. In addition, approximately 1.13 million AVAX (approximately $38.81 million) will be distributed through airdrops;

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including earnings) are highly speculative in nature and involve substantial risk of loss. Past, hypothetical or simulated performance is not necessarily indicative of future results.

The value of digital currencies may go up or down, and there may be significant risks in buying, selling, holding or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment objectives, financial situation and risk tolerance. BitMart does not provide any investment, legal or tax advice.