Author: @castle_labs

Compiled by: zhouzhou, BlockBeats

Editor's Note: This article introduces multiple DeFi protocols in the HyperEVM ecosystem, including Felix, Mizu Labs, Drip.Trade, HyperSwap, etc., which provide opportunities such as staking, liquidity mining, and airdrop rewards. By participating in these protocols, users can obtain multiple benefits and ecological points, and may receive future token allocations. The HyperEVM ecosystem shows great potential, and the value of early activities is underestimated, giving users who missed the first wave of airdrops a second chance.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

Unless you’ve completely left the crypto scene, you’ve probably noticed it: Hyperliquid is everywhere. It’s one of the few projects that has executed a TGE strategy with pinpoint accuracy, creating a lot of wealth while keeping the entire ecosystem growing.

While most traders focus on the perpetual contract layer, which has indeed found product-market fit and built one of the most active "believers" in the crypto world, the application layer that is expanding around HyperEVM is often overlooked. And the real opportunity lies here.

Castle has covered the core of Hyperliquid in this analysis:

This guide will dive into the emerging mining landscape around HyperEVM, including how it’s evolving, who’s most likely to receive rewards, and how to get in on the action now at an early stage.

What happened and what happens next?

@hyperliquidx's first airdrop in November 2024 was a historic event, distributing 31% of its total token supply to over 90,000 users. The token was issued at $3.20 and rose to a high of $34. The airdrop was worth over $10.5 billion at its peak, making it one of the largest wealth transfers in crypto history.

The opportunity is huge and still in its early stages. HyperEVM is live, the core protocol is running, and various points systems are incentivizing user behavior.

Liquidity across the ecosystem remains thin, and this is often the best time to get the most bang for your buck. Hyperliquid has distributed 31% of the total supply so far, with another 39% still undistributed. At current valuations, this means there is nearly $4 billion in $HYPE that could potentially be distributed to future participants.

And it’s not just about $HYPE itself. Native protocols like @KittenswapHype, @HyperLendx, and @HypurrFi are also running their own points campaigns, which can earn rewards now and have the potential to be superimposed with future ecosystem incentives.

The market has not yet fully reacted. The overall participation is still low, attention is scattered, and few people can make accurate arrangements. If this cycle unfolds according to the logic of the previous cycle, the earliest and most active participants will reap the greatest rewards.

So, who is most likely to benefit next?

From the history and current situation of Hyperliquid, there are several key groups worth paying attention to:

- Perpetual contract traders who maintain stable trading volume and continue to be active

- Users who own Hyperliquid native NFT

- "Protocol farmers" who participate in the HyperEVM protocol (lending, providing liquidity, borrowing, etc.)

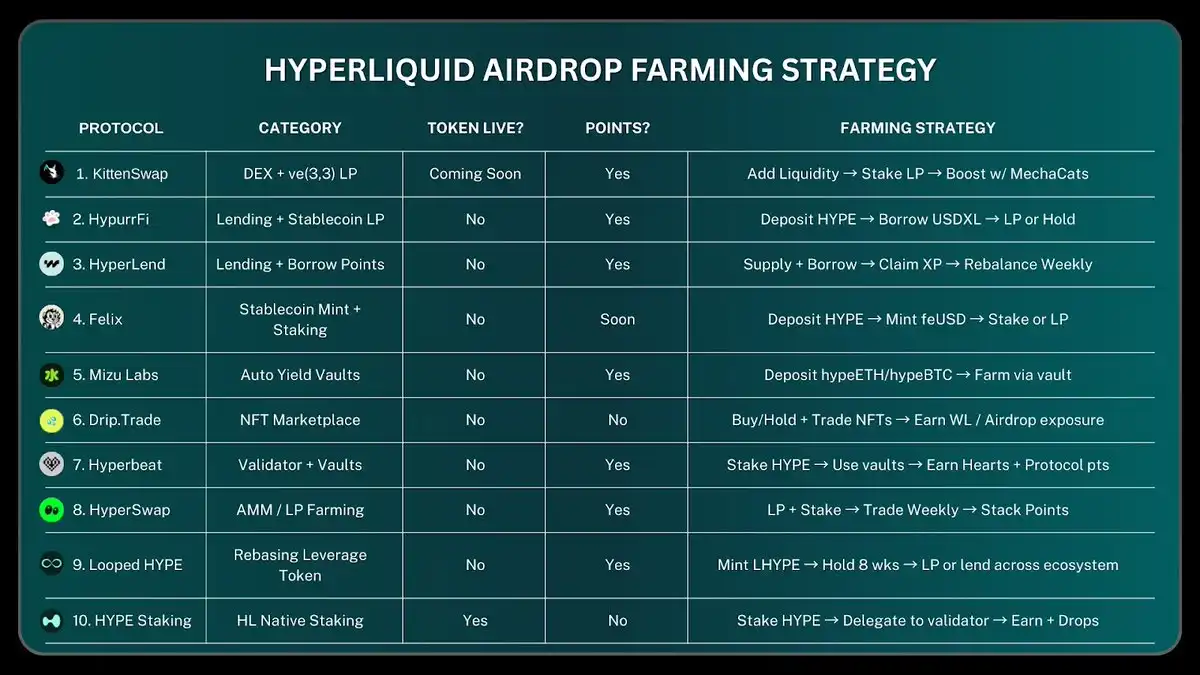

With all that in mind, here are the 10 most noteworthy mining opportunities in the Hyperliquid ecosystem right now.

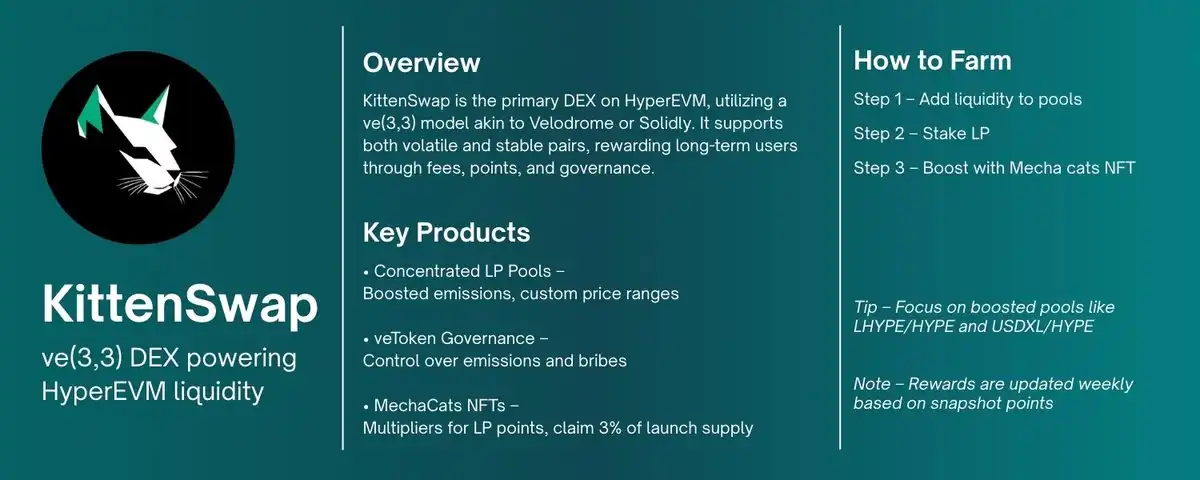

1.KittenSwap – ve(3,3) model DEX for HyperEVM - @kittenswaphype

KittenSwap is the main DeX on HyperEVM, using a ve(3,3) model similar to Velodrome and Solidly. It supports stablecoin and volatile token trading pairs, and rewards long-term users through fee dividends, points programs, and governance mechanisms.

As the DEX with the largest trading volume and TVL in the ecosystem, KittenSwap is the core hub of HyperEVM liquidity. Many new protocols will choose to launch tokens or create stablecoin trading pairs here.

KittenSwap recently launched centralized liquidity pools, allowing custom price ranges and temporarily increasing the point multiplier rewards. Some trading pairs currently receive up to 20x point rewards (such as LHYPE/HYPE and USDXL/HYPE), while the multipliers for standard pools have been reduced. This indicates that the protocol will be more inclined to support centralized liquidity in the future.

Mining strategy

Add liquidity to high-yield pools - focus on pools with high multiples, such as PURR/HYPE, LHYPE/HYPE, and USDXL. Avoid pools with high total locked volume and diluted rewards.

Stake LP tokens to earn points - After adding liquidity, stake LP tokens on KittenSwap to earn points. Points are updated weekly and determine your allocation share in future token issuance.

Increase your earnings with MechaCats NFTs - Hold MechaCats NFTs to get bonus points:

1–9 NFTs = 1.25x

100–199 = 1.4 times

500 or more = 1.5 times

MechaCats holders will also be guaranteed a 3% share of the veKITTEN supply when the token goes live.

2. HypurrFi – Margin Lending and Stablecoin Yields - @hypurrfi

@HypurrFi is a leveraged lending platform on HyperEVM and the issuer of the native over-collateralized stablecoin USDXL. Users can borrow USDXL by pledging $HYPE or stHYPE while continuing to receive interest income on the collateralized assets.

The protocol will invest its revenue into a tokenized U.S. Treasury reserve to enhance the long-term stability and asset backing of USDXL.

Mining strategy

Deposit $HYPE → Borrow USDXL

The simplest way to mine: retain exposure to HYPE while freeing up USDXL for other income opportunities.

Add the borrowed USDXL to the liquidity pool

It can be paired with HYPE, LHYPE or feUSD on KittenSwap or HyperSwap to obtain high-multiple points rewards.

Hold or lend USDXL

Simply holding or lending USDXL may also earn you future rewards from the protocol or ecosystem.

According to HypurrFi, early users usually get the best rewards, even if the points are not displayed at the time. The platform tracks user behavior in the background, including actions such as borrowing, adding liquidity or transferring USDXL, which may participate in multiple incentive activities.

The points system is now live and updated regularly, making it one of the easiest mining strategies to operate on HyperEVM.

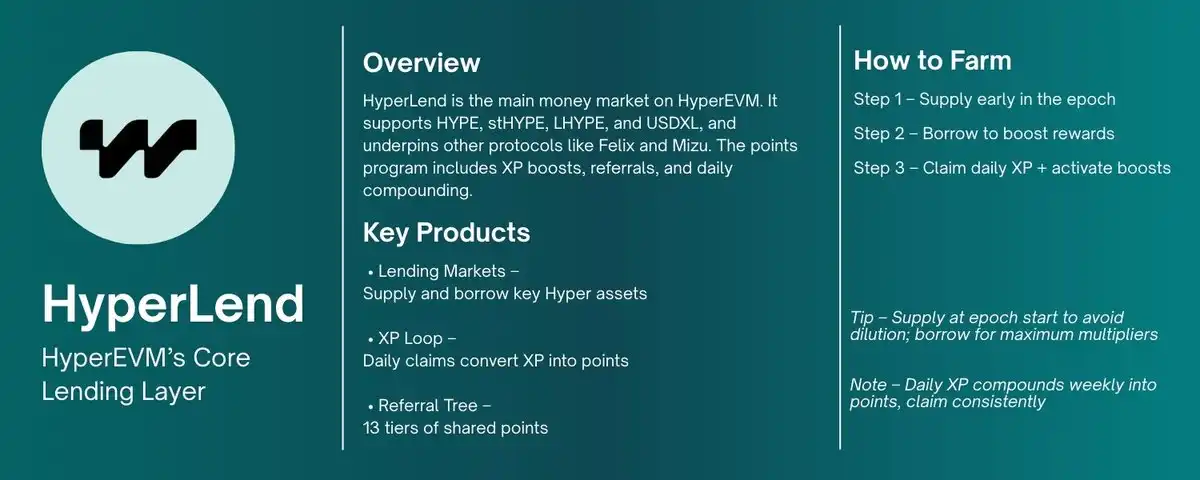

3. HyperLend – Lending infrastructure, points system now live - @hyperlendx

@HyperLendx is the main lending protocol on HyperEVM, supporting core assets such as HYPE, stHYPE, LHYPE and USDXL. It is not only an independent money market, but also provides liquidity foundation for other protocols including @Harmonixfi, @Mizulabs and @Felixprotocol throughout the entire ecosystem.

Public Points is scheduled to go live on April 7, 2025, with weekly rewards and an XP-based compounding system.

Points are related to borrowing, daily active behavior and social recommendations, and are automatically displayed in the wallet dashboard without the need to claim them manually.

Mining strategy

Deposit assets early

Deposit assets like HYPE, LHYPE or USDXL as soon as a new cycle begins.

The protocol has a TVL cap, and the later you enter, the more your points will drop.

Borrowing to increase score weight

Lending and borrowing operations can increase the reward weight, which is helpful even for small positions.

Stablecoins can be borrowed using HYPE or LHYPE as collateral while retaining spot exposure.

·Start XP daily cycle

You can claim XP daily when you have ≥100 points and deposited assets ≥$50.

XP will compound over the week and eventually convert into additional points.

Activate all available bonuses

Testnet participants will receive a permanent points multiplier bonus.

Users who hold @HypioHL NFTs will receive additional points (NFTs with HyperLend features will receive higher bonuses).

The social recommendation system opens 13 levels of invitation relationships, and extra points are obtained based on the performance of the inviter.

·Overlay benefits of other protocols

USDXL or LHYPE borrowed from HyperLend can be added to @KittenSwaphype or @HypurrFi to stack multi-protocol points. You can also deposit the newly launched uBTC to earn HyperLend points and get rewards from HyperUnit.

HyperLend is a "deploy and observe" strategy that requires low-frequency operation once it is set up. The main tasks are to master the entry time, collect XP every day, and occasionally adjust the position according to the reward changes.

4. Felix Protocol - Stablecoin Income + Liquidation Mining - @felixprotocol

@Felixprotocol is the first native stablecoin protocol on HyperEVM. Users can mint feUSD by pledging HYPE. It provides two main income paths: staking feUSD into a stable pool to obtain liquidation rewards, or using feUSD in various liquidity pools to earn extra points.

As a basic module of DeFi, the Felix protocol helps users achieve leverage, take risks, and transfer funds between lending protocols and DEX. Its points program will be officially launched on April 13, 2025 at 12:00 PM UTC.

Mining strategy

Mortgage HYPE → mint feUSD

feUSD is an over-collateralized stablecoin designed for use across the ecosystem.

Pledge feUSD to the stable pool

These pools are used to support the liquidation mechanism.

When the collateralized position is liquidated, participants can obtain HYPE at a discount and share part of the protocol profits.

Add liquidity on KittenSwap or HyperSwap

For example, trading pairs such as feUSD/USDXL and feUSD/HYPE usually enjoy bonus points from the cooperative ecosystem.

Focus on multi-protocol integration

Felix is integrated with HyperLend and available in the Mizu Automated Yield Vault.

Using feUSD across multiple protocols has the potential to unlock overlapping incentives.

Felix is a clean strategy to put idle HYPE to work, allowing users to simultaneously enjoy multiple revenue paths including protocol rewards, liquidation dividends, and ecological points distribution.

5. Mizu Labs – Automated HyperEVM Mining Tools

@MizuLabs is a yield aggregator in the HyperEVM ecosystem, focusing on automated mining. It provides hypeETH and hypeBTC vaults (these two are liquidity packaging tokens after bridging ETH and BTC), and deploys these assets to high-yield protocols such as HyperLend, HypurrFi, Felix, Harmonix, etc.

This protocol is ideal for users who want to participate in HyperEVM mining but don’t want to frequently rotate funds or manually track points. Mizu helps users automatically optimize their earnings, accumulate points, and consolidate rewards through a unified treasury.

Mining strategy

Deposit ETH or BTC → Get hypeETH or hypeBTC

Mizu provides a guided bridging and wrapping process, where native assets must first be converted to hypeETH/hypeBTC before they can enter the vault.

Deposit hypeETH or hypeBTC into Mizu Vault

After depositing, Mizu will automatically deploy assets to multiple protocols to maximize returns and points acquisition.

Earn stacking rewards

The Mizu vault can enjoy rewards from up to eight protocols at the same time, including Hyperbeat, Harmonix, HypurrFi, Timeswap, and HyperLend. Royco Markets has also reserved 1–2% of the distribution quota of various tokens for Mizu users.

Mizu is a passive mining strategy suitable for ETH/BTC holders. It can easily access HyperEVM and superimpose profits from multiple protocols without frequent operations.

6. Drip.Trade – Native NFT Marketplace + Future Airdrop Potential

@drip__trade is the main NFT marketplace on HyperEVM, hosting local collections related to points bonus, airdrops and whitelisting such as @HypioHL, MechaCats, @HypersonHL, etc. Most NFT projects on HyperEVM will launch here or use Drip for secondary liquidity trading.

Although no official token has been launched yet, the site already has a “Rewards” tab, and multiple series have hinted that active users and holders will receive future airdrops.

Mining strategy

Buy and hold key series

Starting with Hypios (HyperLend for multipliers), MechaCats (KittenSwap for multiplier rewards and 3% of $KITTEN supply), and Hypers (Drip’s flagship project). These series have historically received whitelisted positions and token allocations from partner protocols.

Stay active

Trades, listings, and delistings are performed regularly, as market activity may affect future airdrop qualifications.

7. Hyperbeat - @0xhyperbeat

@0xHyperBeat, as a validator and ecosystem fund, focuses on staking, earnings, and long-term docking with Hyperliquid. Through vault deployment, it provides users with exposure to multiple projects and through Hearts (points) rewards, it may lead to future token distribution.

HyperBeat simplifies the mining process for entering the HyperEVM early protocol as a way to not rotate funds as frequently.

Mining strategy

· Validator who stakes HYPE and HyperBeat

Hearts accumulate over time, providing rewards based on weekly snapshots.

Deposit to the vault via Royco Markets

Select one of the following options:

HyperETH vault for ETH → exposed to 15+ partner protocol tokens

HyperBTC Vault for BTC

HyperUSD vault for stablecoins (over $11M TVL)

Earn stacking rewards

With a single deposit, you can earn Hearts and points from partner protocols such as HyperLend, HypurrFi, Harmonix, Timeswap, Silhouette, and more.

No active mining required

Funds are automatically routed and rewards are automatically tracked as new protocols are added.

Hyperbeat is a passive mining method that combines validator staking and multi-protocol vaults, allowing users to mine on HyperEVM with just one setup.

8. HyperSwap – Low slippage DEX, deep ecosystem integration @hyperswapx

@HyperSwapX, a low-slippage AMM on HyperEVM, is positioned as a lightweight and streamlined alternative to KittenSwap, optimizing fast execution, low TVL mining, and ecosystem partner activities.

The protocol's active points plan is to distribute 2.5 million points in 5 weeks (500,000 per week), which are allocated through usage, LP provision and integration with more than 20 partner protocols. The weekly snapshot time is every Sunday at 10 PM PST.

Mining strategy

Provide liquidity and stake LP tokens

Provide liquidity on HyperSwap and stake LP tokens directly. Points are distributed based on the size, duration, and trading volume of the pool. The longer the stake, the greater the share you get.

Regular transactions

Trade on HyperSwap weekly, especially in partner token pools, to earn activity-based points.

Mining the Ecological Pond

Certain trading pairs offer additional rewards: USDXL, feUSD, KEI, LHYPE, stHYPE, uBTC/uETH. Providing liquidity to these pools will earn points on both HyperSwap and partner protocols.

Stack bonuses by holding

Users who hold assets such as Hypio NFTs, Buddy Tokens, CatCabal, PiP, etc. can earn points every week if they are active on HyperSwap.

Recommendation System

Invite new users and earn 10% of the points they generate through their transactions and LP provision.

HyperSwap is very suitable for small LPs and cross-protocol farmers. Due to its reward mechanism based only on usage, there is no NFT or veToken mechanism, which keeps it simple and scalable.

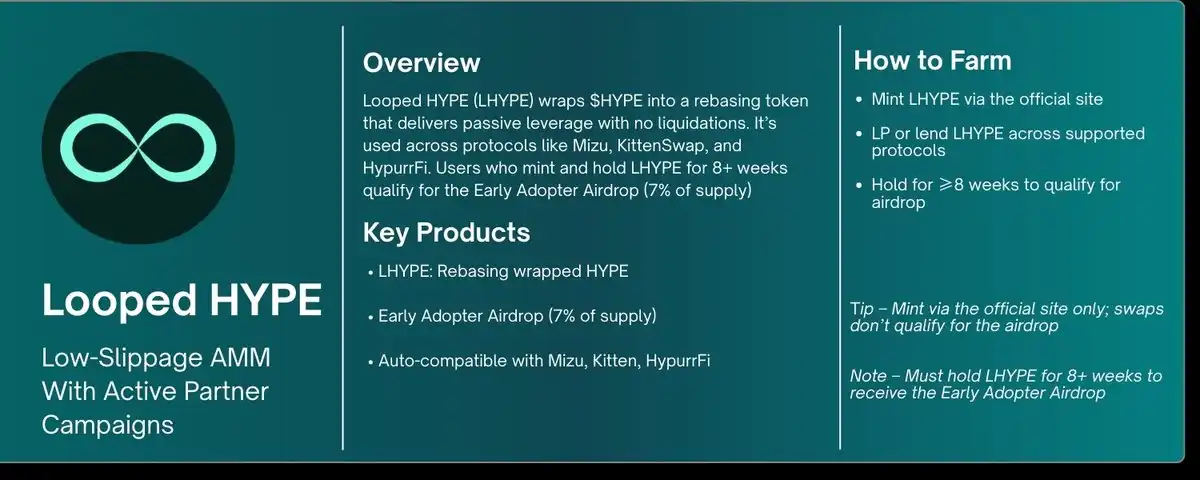

9. Looped HYPE - @looped_hype

@Looped_HYPE wraps $HYPE into LHYPE, a rebasing token designed to enable passive leverage, no liquidation, and no fee tracking. It earns enhanced staking returns and integrates with top protocols on HyperEVM. Looped HYPE also launched a structured early user program that allocates 7% of its total token supply to users who mint and hold LHYPE, supporting use in DeFi positions.

Mining strategy

Mint LHYPE on the official website and avoid exchanges. Only direct minters or those using through supported integrations are eligible for the early user program.

Participate in Phase 2 (already launched)

Quota: 3% of total token supply

Limit: 2M HYPE

Hold LHYPE for ≥8 weeks

Hold LHYPE in: native wallets, AMM pools (KittenSwap, HyperSwap, Laminar), or lending protocols (Felix, Timeswap).

Providing LHYPE liquidity in the ecosystem

@KittenswapHype pool offers 20x multiplier rewards. HyperSwap includes LHYPE in its points program. Holding LHYPE also counts towards activities from Mizu, Harmonix, and HypurrFi.

No active management required

Once deployed to DeFi, LHYPE will continue to rebasing and automatically mine across layers.

$HYPE Staking

Staking $HYPE on Hyperliquid is a low-effort way to earn yield and potentially qualify for future airdrops from Hyperliquid and its partnership agreements. Validators like HypurrCollective x Nansen have secured multiple airdrops for their stakers, including:

SENT(SENTIIENTAI)-2120K allocated

TIME(TIMESWAP)-0.5 100K

These airdrops are usually distributed in tiers based on the staked amount.

Staking Strategy

Visit the Hyperliquid staking page

Transfer $HYPE from the spot account to the staking account

Delegating to a validator (e.g. HypurrCollective x Nansen)

Get staking rewards and unlock airdrop qualifications

If you are not actively mining, this is the easiest way to stay involved and earn rewards for holding.

Conclusion and Thoughts

This article covers the existing and relevant core protocols in the Hyperliquid ecosystem, but is far from covering everything that is going on. There are dozens of new protocols being built on the HyperEVM right now, many showing potential and others finding their niche. Due to space limitations, we have focused on those with active rewards and meaningful progress. But the momentum is spreading quickly.

The most profitable airdrops tend not to announce themselves loudly. Hyperliquid has demonstrated its commitment to early users with one of the largest token distributions of its kind.

Now, the entire ecosystem around HyperEVM looks likely to follow a similar trajectory.

There is good reason to assert that current early activity in the HyperEVM ecosystem is currently significantly undervalued relative to future potential. The protocols mentioned in this article represent core infrastructure that could become a significant DeFi environment, and early participants are likely to receive large token allocations.

For those who missed out on the first Hyperliquid airdrop, the emerging ecosystem offers a rare second chance, this time with more clarity about which activities matter most.