Author: Yangz, Techub News

When you see a cockroach in your home, there is actually a nest of cockroaches.

Following the ban on market makers for violations in the GoPlus Security and MyShell projects earlier this month, Binance issued another statement yesterday, saying that an investigation found that a market maker in the Movement project was associated with the above market maker and decided to freeze its related earnings to compensate users. Binance said that on December 10 last year, the day after the MOVE token was launched, the market maker sold a total of about 66 million MOVEs, and before being delisted by the platform on March 18 this year, the market maker's final profit reached 38 million USDT.

As soon as the news came out, the industry was in an uproar, and the Movement Foundation also responded immediately, saying that it had cut off all relations with the market maker and promised to use the 38 million USDT recovered from the market maker to repurchase MOVE on Binance. In addition, it stated that the Movement Foundation and Movement Labs were "completely unaware" of the market maker's bad behavior.

Due to the huge amount of profit, in addition to condemning this "worm" behavior, the industry immediately launched an action to track down the malicious market maker. Combined with the various information currently on CT, the biggest suspect of this market maker falls on Web3port, which is the same as the malicious market maker of GoPlus Security and MyShell projects previously disclosed by the community. (CZ once retweeted the disclosure tweet about the market maker Web3Port).

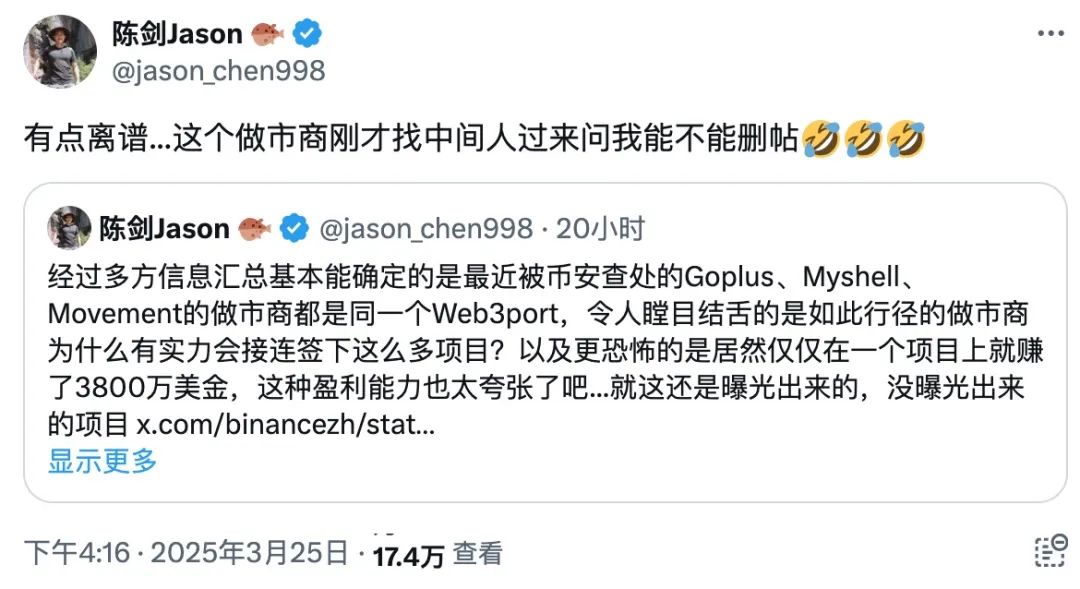

Chen Jian shared that "after summarizing information from multiple sources, it is basically confirmed that the market makers of Goplus, Myshell, and Movement, which were recently investigated by Binance, are all the same Web3port." In addition, he also revealed that the market maker had asked him through an intermediary whether he could delete the post.

Zachxbt also stated that an investor revealed to it that the market maker was Web3port, and suggested that users check the recent tweets retweeted by the market maker to learn about other projects they may be working on.

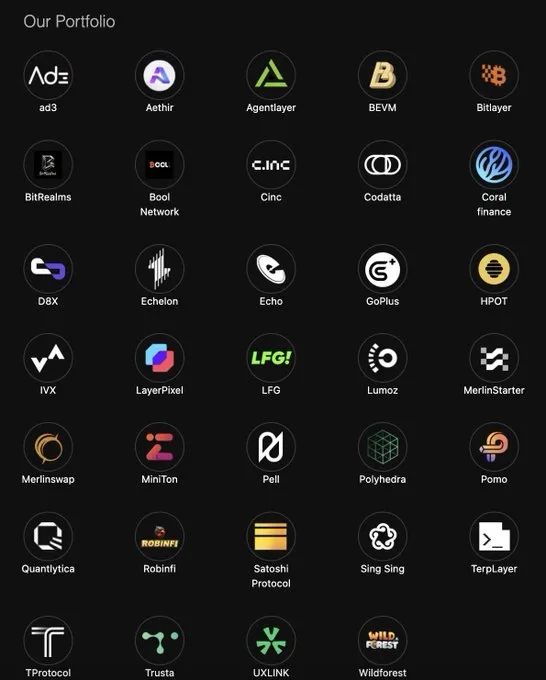

Of course, some netizens have already posted the projects handled by Web3port (as shown below). According to Web3port's 2024 annual summary report, the Web3port Foundation invested in 46 projects last year, with a total investment of approximately US$35 million, covering multiple tracks such as Infra, DeFi, and AI. Web3Port Labs helped accelerate 78 projects last year and assisted 83 projects in financing, with a total financing amount of approximately US$120 million.

After basically identifying the suspected market maker as Web3port, netizens also dug deep into the background and "bad" behavior of this market maker.

The disclosure tweet about Web3Port that was previously forwarded by CZ showed that the predecessor of Web3Port was Spark Digital Capital, and the core figure was May Liu (Piaopiao). Initially, Spark Digital Capital operated in the name of VC, but actually relied on market outsourcing and FA business to let VC invest in projects, and obtain free tokens by itself. After the industry's internal circulation in 2021 and 2022 caused the project party to be unwilling to give tokens for free, Spark Digital Capital turned to the incubator model and established Web3Port, which mainly provides project packaging and VC docking services, and charges 1-3% of tokens. Since it is impossible to realize cash by incubator alone, Spark Digital Capital also established the market maker Whisper, which creates a delivery window for the free tokens in its hands in the name of market making.

@agintender said that the rumor he heard was that "Web3port's predecessor was Icport, which was an accelerator that previously focused on the Dfinity (ICP) ecosystem, and later changed its focus for some well-known reasons." In 2022, Web3port helped project parties obtain VC investment through the "bootcamp" model and participated in hackathons in large ecosystems, and then changed tracks according to the market rhythm, and finally helped the project go public. In addition, he also revealed that the Particle network launched on Binance last night was also incubated by Web3port in the early days.

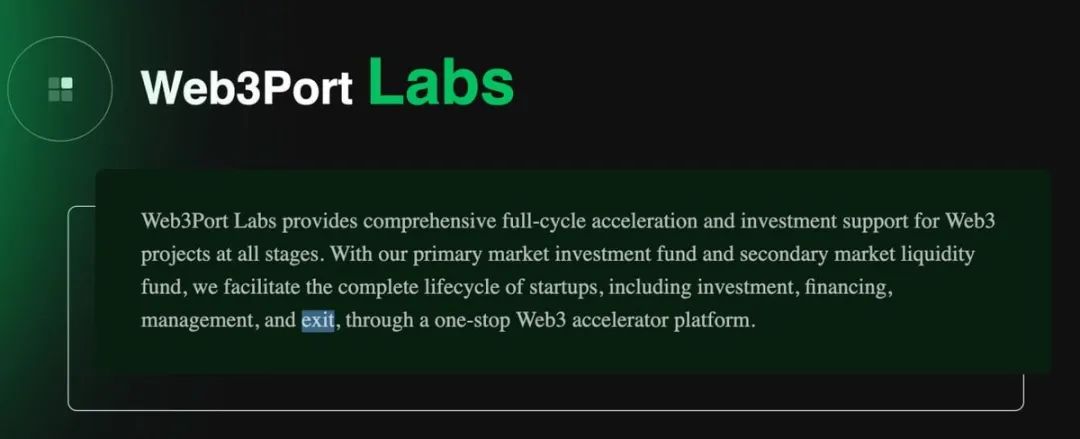

In addition to investigating Web3port’s background, netizens also discovered the glaring word “exit” in the introduction of Web3port Labs’ official website, which reads, “Web3port Labs provides comprehensive full-cycle acceleration and investment support for Web3 projects at all stages. Through our primary market investment fund and secondary market liquidity fund, we use a one-stop Web3 accelerator platform to facilitate the entire life cycle of startups, including investment, financing, management and ‘exit’.”

In addition, @0xVeryBigOrange used the experience of his friend's project to illustrate the "eating style" of Web3port. He said that in January this year, the BD of Web3port took the initiative to contact the project and emphasized that they were only willing to be "active market makers" rather than "passive market makers." @0xVeryBigOrange explained, "The so-called 'active market makers' actually use the project's coins to dump the market, then buy them back at a low price, and then return them to the project. Their logic is that the market-making coins must fall first!"

It should be noted that the above information about Web3port and its predecessor is currently just speculation. Putting this topic aside, many community users questioned the rationality of putting all the responsibility on the market maker, believing that this is actually a "collusion" between the project and the market maker.

@0xcryptowizard said bluntly that it was illogical for the market maker to earn $38 million directly, and it must have been shipped for the Move team. @cryptobraveHQ said, "I got information from four parties (exchanges, actual market makers, market makers who took the blame, and multiple project parties), and a certain Port market maker was indeed blamed." He said that market makers are the top predators in the industry, standing at the top of the pyramid, it is very easy to make money. Web3Port broke into the market maker track last year, moved the cake, and was targeted by other market makers, "Exchanges and project parties also need to take the blame."

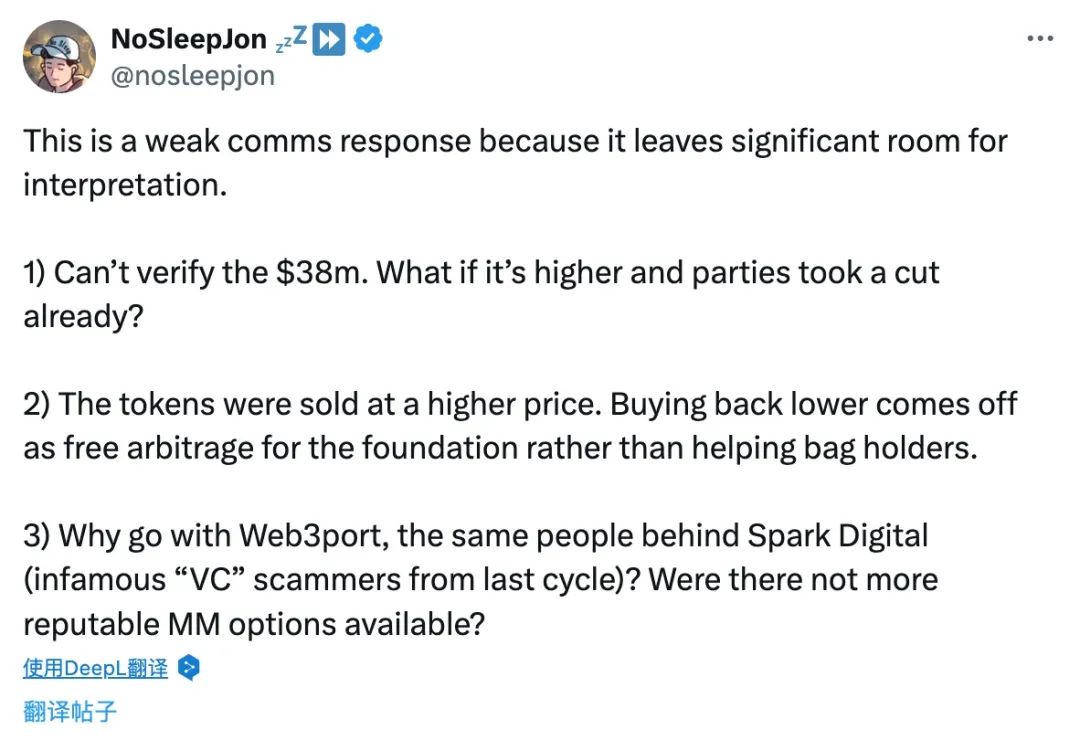

In addition, Zachxbt said that if Movement’s statement was for transparency, why didn’t it name the market maker? @nosleepjon also believed that Movement’s response was “too weak and there are still many things that are not explained clearly.” He said that the profit amount of $38 million has not yet been confirmed, “If the amount is higher and the parties have already distributed dividends, how should it be handled?” In addition, he mentioned that “tokens are sold at high prices but repurchased at low prices, which is actually free arbitrage for the foundation, rather than helping holders.” Of course, he also pointed out the connection between Web3port and Spark Digital, and questioned why the last round of notorious “VC” scammers were chosen as market makers.

At the same time, a screenshot of @YunkaizZ's Moments revealed the connection between Movement and Dovey Wan, the founding partner of Primitive Ventures. The agency shared in an article last December that "In 2023, the Primitive Ventures team initially decided to give up investing in Movement, but this decision was eventually rejected by Dovey Wan and prompted the team to re-examine the plan." Given Dovey Wan's reputation in the circle, many users began to question the truth behind this investment.

When you see a cockroach at home, there is actually a nest of cockroaches. The question now is, how many shameful transactions are still hidden under the table in the industry? Perhaps there is a lot of money deposited in the circle, but if this kind of business that eats people without spitting out bones continues to exist, who dares to invest in altcoins? How can the all-round altcoin bull market be started and how can it be sustained?