1. Market observation

Keywords: LLJEFFY, ETH, BTC

As China announced a cut in the reserve requirement ratio and interest rate and confirmed economic and trade talks with the United States, the market's risk appetite has rebounded significantly. Pan Gongsheng, governor of the People's Bank of China, announced this morning that the deposit reserve ratio of financial institutions would be reduced by 0.5 percentage points, while the policy interest rate would be reduced by 0.1 percentage points to 1.4%, and the housing provident fund interest rate would be reduced by 0.25 percentage points. This decision, together with the news that the Chinese Ministry of Foreign Affairs announced that Vice Premier He Lifeng would hold economic and trade talks with US Treasury Secretary Benson during his visit to Switzerland from May 9 to 12, boosted market sentiment. Asian stock markets generally rose, and futures prices such as iron ore and steel rose. At the same time, the global market is focusing on the interest rate decision that the Federal Reserve will announce at 2 a.m. tomorrow. According to CME's "Fed Watch" data, despite Trump's continued pressure for a rate cut, the market expects the Federal Reserve to maintain interest rates unchanged in May with a probability of 96.9%, and the possibility of a rate cut is only 3.1%. Goldman Sachs analyst Jan Hatzius' team pointed out that the Federal Reserve has set a higher threshold for interest rate cuts. Policymakers need to see more convincing evidence of an economic slowdown before taking action, especially hard data showing a clear weakening of the job market, such as rising unemployment and weak wage growth.

At the same time, Bitcoin has made a breakthrough at the policy level. New Hampshire officially signed the HB 302 bill, becoming the first state in the United States to pass "Strategic Bitcoin Reserve" legislation, authorizing the state treasurer to purchase Bitcoin or digital assets with a market value of more than US$500 billion, with a maximum holding limit of 5% of the total reserve funds. In the UK, although Emma Reynolds, the Economic Secretary of the Treasury, made it clear that the UK would not follow the United States in establishing a national cryptocurrency reserve, she tended to incorporate crypto assets into the existing financial regulatory framework and follow the "same risk, same regulation" principle.

Bitcoin has been fluctuating for two weeks. Glassnode analyzed that Bitcoin may face significant selling pressure when it approaches $99,000. FxPro analyst Alex Kuptsikevich further pointed out that the current key support levels of BTC are $92,500 and $89,000, and the market has returned to the key resistance zone from December to February. If it falls below $90,000, it will have a greater impact on the technical and psychological levels and may fall below the 200-day moving average. In a recent interview, Binance founder CZ predicted that Bitcoin may be between $500,000 and $1 million in this cycle, and is optimistic about the combination of blockchain with AI, scientific research and other fields. In addition, Futu Securities announced new progress. The official website shows that ordinary users can now recharge BTC and ETH to Futu accounts through personal wallets, with the minimum recharge amount of 0.0002 BTC and 0.001 ETH respectively. This move will further promote the integration of traditional finance and crypto assets.

The MEME market has been abuzz with the death of Zerebro co-founder Jeffy Yu in the past two days. The market value of its related token LLJEFFY once rose to $31 million, but has now fallen back to $5.7 million. From 1:48 p.m. on May 4, LLJEFFY development wallets and multiple associated addresses began to frequently trade and destroy tokens. Today, it was confirmed that Jeffy Yu faked his death. With the truth revealed, this market-disturbing event may come to an end.

2. Key data (as of 12:00 HKT on May 7)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $96,523.49 (+3.21% YTD), daily spot volume $29.36 billion

Ethereum: $1,827.47 (-45.11% YTD), with daily spot volume of $13.78 billion

Fear of Greed Index: 67 (Greed)

Average GAS: BTC 1 sat/vB, ETH 0.44 Gwei

Market share: BTC 64.2%, ETH 7.4%

Upbit 24-hour trading volume ranking: LAYER, XRP, BTC, MOVE, LOOM

24-hour BTC long-short ratio: 1.0517

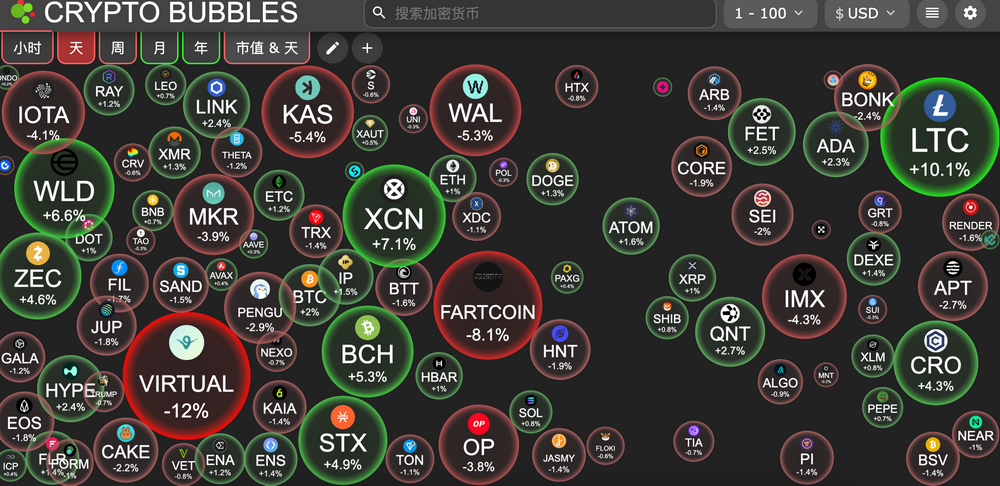

Sector gains and losses: NFT sector fell 2.96%, GameFi sector fell 2.83%

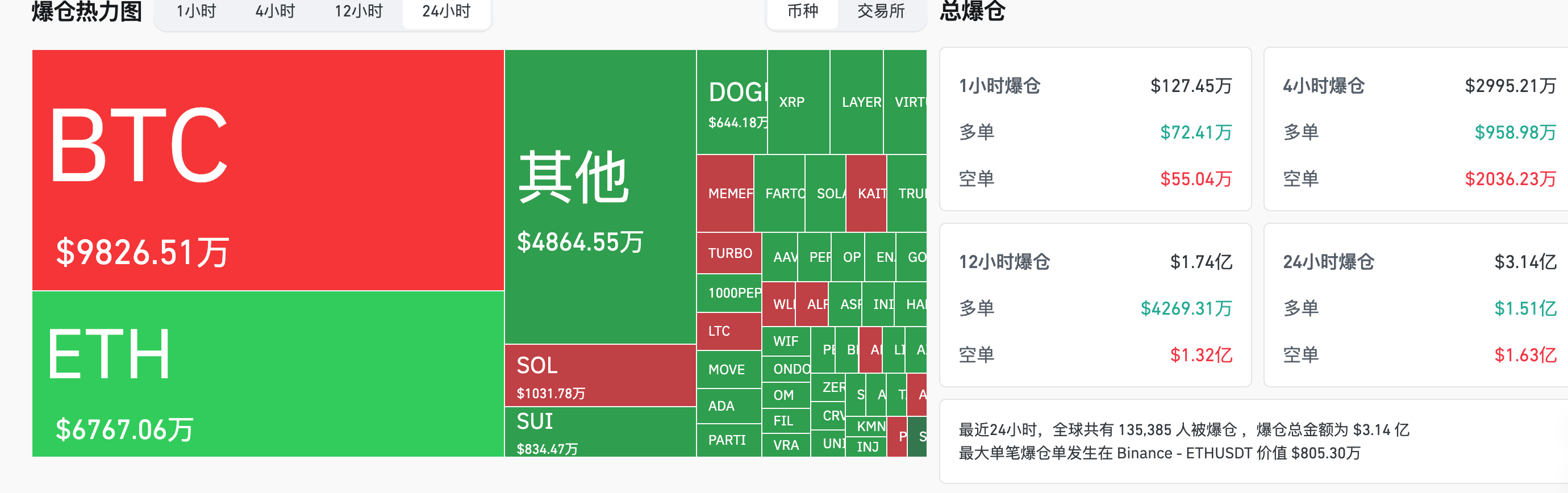

24-hour liquidation data: A total of 1,135,385 people were liquidated worldwide, with a total liquidation amount of US$314 million, including BTC liquidation of US$98.26 million, ETH liquidation of US$67.67 million, and SOL liquidation of US$10.31 million

BTC medium- and long-term trend channel: upper channel line ($95,261.41), lower channel line ($93,375.05)

ETH medium and long-term trend channel: upper channel line ($1811.27), lower channel line ($1775.40)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of May 6)

Bitcoin ETF: -$85.63 million

Ethereum ETF: -$17.87 million

4. Today’s Outlook

Binance Alpha to Launch Obol Collective (OBOL) Trading on May 7

Jito (JTO) will unlock 11.3 million tokens on May 7, worth approximately $20.4 million

Ethereum Name Service (ENS) will unlock 1.45 million tokens on May 8, worth about $26.2 million

US Federal Reserve interest rate decision (upper limit) until May 7 (May 8 2:00)

Actual: To be announced / Previous value: 4.5% / Expected: 4.5%

Bank of England interest rate decision on May 8 (May 8, 19:00)

Actual: To be announced / Previous value: 4.5% / Expected: 4.25%

Number of initial jobless claims in the United States as of May 3 (10,000 people) (May 8, 20:30)

Actual: To be announced / Previous value: 24.1 / Expected: 23.1

The biggest gains among the top 500 by market value today: KAITO up 31.81%, BAN up 21.75%, SYRUP up 15.93%, REX up 13.63%, and SHFL up 12.34%.

5. Hot News

US senators propose MEME bill to ban president and congress members from issuing Meme coins

Trump family project WLFI transfers more than $4.5 million in assets to an unknown wallet

New Hampshire becomes first state in the U.S. to pass “strategic bitcoin reserve” legislation

Doodles announced that $DOOD will be listed on Solana and launch a 13% airdrop plan

China's central bank cuts interest rates and reserve requirement ratio

sns.sol announces SNS token economics: airdrop accounts for 40%

Standard Chartered Bank: BNB price may reach $2,775 by the end of 2028

Conflux will destroy 76 million CFX and pledge 500 million CFX

SOL Strategies, a listed company, announced the purchase of 122,524 SOL

Haedal launches buyback program to use protocol revenue directly to reward veHAEDAL stakers

Binance to List Maple Finance (SYRUP) and Kamino Finance (KMNO) and Add Seed Tags

Two new wallets withdraw 83,000 SOL from Kraken and use it for staking, worth $11.97 million

The creator of the meme coin Trump has earned over $320 million in fees so far

Florida Strategic Bitcoin Reserve Bill Withdrawn, Withdrawing from State Crypto Legislation Race