Half devil, half child

The formalist thinking of the 19th century had been based on atomistic individualism;

Globalist thinking in the 20th century has been based on a collectivist liberalism;

The isolationist mindset of the 21st century has been built on a fragmented Westernism.

In 2021, Zhao Changpeng accepted an exclusive interview with "LatePost". In the complex intersection of Binance's de facto world number one and its obscurity in the eyes of the Chinese people, the LatePost team gave the most objective expression of the currency circle and Binance by traditional commercial and financial media to date. The public thus got to know Binance and Zhao Changpeng. Then I left ByteDance and started wandering in Web3 until today.

When it comes to Zhao Changpeng, the biggest difference is the contrast with Sun Yuchen. If Sun Ge is increasingly anthropomorphic with Bao Erye, Li Xiaolai and Xue Manzi as the background, then Zhao Changpeng's comparison objects should be Coinbase's Armstrong and FTX's SBF. However, Sun Ge and Zhao Changpeng are not the same as Satoshi Nakamoto and Vitalik, that is, it is difficult to say that Zhao Changpeng believes in the ideology behind the blockchain - decentralization is just a technical representation, but in fact it is neoliberalism and anarchism.

Just like the title of the 21st edition, "Dialogue with Binance's Changpeng Zhao: In the Middle Ground of Cryptocurrency", Changpeng Zhao himself is between decentralization and centralization, between CEX and DEX, and between the East and the West. If you are asked about your life's achievements, Bloomberg OK Binance, your final destination may be the Middle East, or it may be He Yi.

Let us indulge in a night of possibility.

Life Arbitrage

Individualism is not the mainstream today, and nationalism and deglobalization have gradually recovered after 2018.

But individualism is precisely the spiritual banner of immigrants from old Europe to the New World, and the only choice for the poor at the bottom to restart their lives. The Chinese immigration wave that began after the 1980s is its spiritual sequel. Different from those who went to Southeast Asia for survival, the Chinese laborers who were trafficked in the late Qing Dynasty went to the United States to study physics in Europe starting with the Tsung-Dao Lee Scholarship in 1979. This was the tone of the times for the intellectual class at that time, just like today's CS in Ivy League schools with undergraduate and master degrees in the United States.

Zhao Changpeng's father was a grain of sand in the context of the great era. After the classic three-part story of rightist - sent down to the countryside - returning to the city, he entered UBC's geophysics doctoral program. In 1989, 12-year-old Zhao Changpeng began living in Vancouver and was one of the earliest students to stay in the city.

At this time, the richest Chinese man who would be worth nearly $100 billion in the future was experiencing the hardships of life in a fast food restaurant.

Image caption: CZ wealth changes Image source: Bloomberg Billionaires Index

The not-so-good 20th century came to a quick end. World War I and World War II shaped the Western order centered on the United States, and the victory in the Cold War shaped the world order centered on the United States. However, all of this was based on the sharp contrast between the collective freedom of the West and the lack of freedom in the non-West and the Third World.

Zhao Changpeng ultimately chose to comply with American regulations, perhaps driven by his childhood memories that as long as he paid the price of becoming part of the West, he would naturally have freedom.

Just like that, after 6 years in Vancouver, a country that was not rich in material but rich in spirit, he entered McGill University in 1995, first studying biology and then transferring to computer science. The mental state of a person around the age of 18 is extremely active, which may be the source of Zhao Changpeng's great interest in the DeSci paradigm dominated by biotechnology today.

In 1997, 20-year-old Zhao Changpeng came to the Tokyo Stock Exchange and started an unremarkable summer development internship, but the same choice as the billionaire appeared - to follow Bill Gates, drop out of school, and go all in on Code.

If the university is good, go to it; if the development is interesting, go for it. It must be said that Zhao Changpeng did a good job. Four years later, in 2001, he joined Bloomberg to develop trading software. In 2005, Zhao Changpeng, then 28 years old, resigned from Bloomberg and, under the influence of the gradual return of Chinese entrepreneurs, naturally chose to move to Shanghai.

After years of experience in trading systems, we turned it into an entrepreneurial direction and founded Fusion Systems. In short, this is a SaaS system that provides high-frequency trading. Please remember that this is actually the origin of Binance, which is to provide the best trading services.

And then nothing happened. Everything calmed down. It was obvious that Changpeng Zhao was not the son of this era. This was the era of Robin Li, Ma Huateng and Jack Ma, the highlight of Copy to China, the era when Alipay was still weak, and the Chinese had not yet created a large number of middle-class people with the accumulation of real estate and the Internet.

The lack of speculators means that ordinary individuals and high-frequency trading obviously cannot be connected, while SaaS systems, 2B and 2G are the mainstream. I think it was during this period that Zhao Changpeng left behind memories of Shanghai and China that required alcohol to survive, but everything was just mentioned to the point, without directly pointing out any complaints about China, just like what he does now with TST, without calling for orders, just rubbing the concept.

Things went on like this until the building collapsed. After he turned 35, Zhao Changpeng, who had become a boss and owned a house in Shanghai, began to gradually evolve into CZ, and met He Yi, the other half of Binance, and made the transition from arbitrage to long-term building of Binance.

By the way, during this period, Zhao Changpeng experienced his first and only "marriage" in his life, and Xu Mingxing once had doubts about his personal resume. True and false are also the norm in life, so just treat everything as true.

Isomers

How do you evaluate Zhao Changpeng's life before he was 35? It is certain that there is no Sun Ge who can make a living. Unlike Sun Yuchen's leap-forward growth, Zhao Changpeng is more like a natural excellence that has accumulated a solid foundation. From his excessive emphasis on opportunities rather than education and wealth, and from the resilience honed by the rolling waves of the times, all he needs now is an industry, a partner and an opportunity.

With experience in Canada and Tokyo, I bought a house as a sea turtle and broke away from the entrepreneurial life of ordinary cattle and horses. With the double buff of China and the Internet, after the massive real estate release in 2008, the financial boom era of P2P and blockchain is coming to us from 2013 to 2018.

Occidentalism existed for a long time from the beginning of this century to before the Sino-US reconciliation on Xiaohongshu. Everything material and spiritual related to the West has a halo. Reviewing the "self-orientalization" in the crypto narrative, whether good or bad, the world will always be more tolerant of them, but this is not always the case. The Binance night run in 2017 and the collapse of FTX in 2022, both the East and the West are eliminating all elements of the old era.

In 2013, during a late-night card game, Li Qiyuan introduced Bitcoin to Zhao Changpeng. It is hard to understand why he would sell his house for $1 million to go all in on Bitcoin. A more reliable guess is that he saw an entrepreneurial opportunity in trading. The image of selling his house to go all in, like King Chen Sheng in the belly of a fish, the stone man in the Yellow River, and the red light at the birth of Zhu Yuanzhang, is a supplement to the mythological history after success. You can just take a look at it.

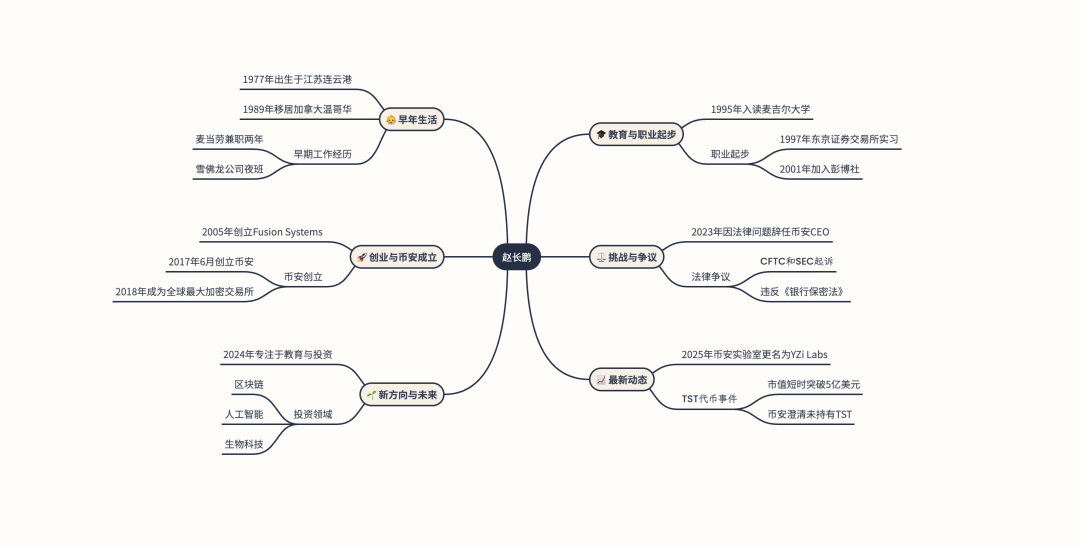

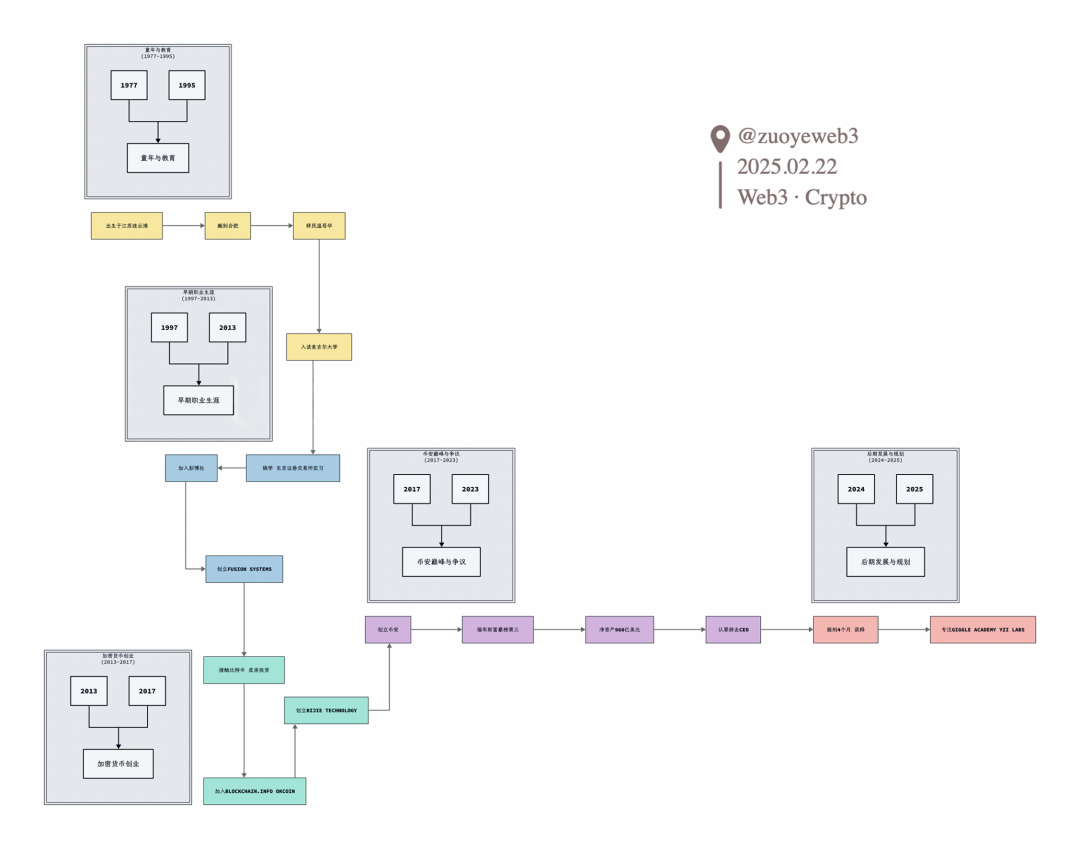

Image caption: Zhao Changpeng's life block Image source: @zuoyeweb3

Zhao Changpeng then left Fusion Systems and joined Blockchain info. Just like what Ripple meant to Sun Ge, Zhao Changpeng joined the game as a technician.

The past is just a life experience, not a burden that is difficult to unload. By withdrawing from entrepreneurship to learn new and unfamiliar fields, Zhao Changpeng once again changed the trajectory of his life and continued to wander between various companies.

The real key was that Zhao Changpeng met He Yi, and CZ was born.

In 2014, the two co-founders of Binance officially met. At He Yi's enthusiastic invitation, Zhao Changpeng resigned and joined the then OKex, now OKX, as the technical director. At that time, Reddit became his main battlefield for speaking, enthusiastically promoting everything about OKX and cryptocurrency. Of course, it is not known whether being addicted to social media would affect development.

In 2015, CZ left OKX to start his own business. There are too many personal emotions between CZ and Xu Mingxing, Binance and OKX, which is not as interesting as business competition. I will not take a closer look.

Subsequently, Bijie was established. Strictly speaking, Bijie contributed to the first bubble in China's crypto industry, because it was another SaaS company that sold "white label" systems for exchanges. The subsequent battle among thousands of exchanges essentially contributed profits to these SaaS white label companies in vain.

This should be the real point of Zhao Changpeng's wealth growth, rather than his previous all-in BTC and entrepreneurship.

“The most dynamic and successful companies are those that stand on the edge of chaos and are not constrained by order.”

Unlike Binance, which is well known in the crypto industry and originated in 2017, the crypto exchange business and the stamp and coin business are the two major pillars after the establishment of Bitmain. The latter is even a thicker one. The stamp and coin (stamps, coins, phone cards) trading platform, using objects familiar to crypto users as metaphors, is close to the mixture of physical NFTs, tulips and tokens, which will certainly not last long.

As a result, in January 2017, one of Bijie's legs was broken, and the stamp, coin and card exchanges almost disappeared in August. But at the same time, cryptocurrencies took the opportunity to grow. At this time, CZ had two paths. The first was to do 2C, but he had hardly ever worked in an exchange; the second was to continue to do 2B, but his imagination was far less than that of an exchange's SaaS platform.

He needed someone, someone who could win the battle of a thousand schools.

After leaving OKX, He Yi joined Yizhibo and signed the popular Song Joong-ki. We have to admit that, whether it is praise or criticism, He Yi is one of the best CMOs in China in this era, not limited to the crypto industry.

Binance was founded in June 2017. Things have changed over time. In July, He Yi joined CZ’s company. Things became increasingly urgent. After 9/4, Binance moved from Alibaba Cloud to AWS, and CZ moved back to Tokyo from China, just as Sun did.

In the United States, Armstrong's Coinbase has gradually grown into a towering tree, but it is obvious that the purchasing power of the Chinese people has been demonstrated for the first time. Binance's offshore mechanism is more flexible, and the dual routes of China and foreign countries have created the wonder of becoming the world's number one in 165 days.

In 2018, CZ entered the Forbes Crypto Rich List with a maximum net worth of $2 billion, which is about 2% of the 2021 Bloomberg Billionaires Index of $96 billion.

From 2017 to 2021, two bull markets have enabled Binance and CZ personally to achieve an unparalleled crypto career. They are no longer faced with hasty legal battles with investment institutions or the embarrassment of being unable to sell the legendary platform coins.

Looking at the history of the development of disruptive technologies, the leaders in a field have never been able to continue to dominate on the platform of the next era.

This is what SBF thinks. FTX is in its heyday in 2022, and its American background also makes FTX stand out. Temasek and the Middle East sovereign wealth fund, as well as Silicon Valley and Wall Street, are all extremely optimistic about SBF, who adheres to effective altruism, has parents who are Stanford law professors, and is an old American with a passion for the Stars and Stripes. In contrast, there is Binance, which is globally independent, CZ, who is on the wall, and He Yi, who is not good at English. No matter how you look at it, FTX is bound to win.

The two giants fought, but the result was that each killed one thousand enemies and lost eight hundred of their own. FTX went bankrupt in 2022 due to misappropriation of user assets and insolvency. SBF went to jail after playing the game. CZ was sued by the United States in March 2023. After a long legal battle, he resigned as CEO, went to jail, no longer managed Binance, and was fined more than 4 billion.

The verdict will be announced in April 2024 and he will be released from prison at the end of September. The charges are the anti-money laundering provisions that everyone is familiar with.

In short, after paying the fine and serving the jail term, you can successfully get a second spring on the shore. The fine is bombarded! How high is the price of Binance landing?

Zhao Changpeng, 47, is already the father of three children, and He Yi is also the mother of three children. After wandering for half a lifetime, he finally found his place - a billionaire in the UAE.

Zhao Changpeng returns, will BNB be revived?

In 2024, CZ appeared in Dubai and made a fresh start at the 2024 Binance Blockchain Week, announcing his focus on the Giggle education platform to serve the K12 population in impoverished areas around the world, followed by making good investments, mainly in blockchain, biotech, and AI.

Whether Rome conquered the world with military force, Greece conquered the world with the power of ideas, or the three religions conquered the world with the power of emotions, it is all the same.

The key is how to conquer the world. CZ gave his own answer, which is to revitalize the BNB ecosystem. Whether it is investment or public chain, it must be empowered around BNB. CZ announced his holdings, 98% of which are BNB. It seems that the 1 million BTC may be true, but there is only 1 million.

Now it seems that it is mainly driven by the dual-wheel drive of BNB Chain and YZi after the name change of Binance Labs. It empowers BNB Chain with Meme and AI Agent, invests in Vana as a consultant, and educates global P young people, and incidentally studies longevity-oriented DeSci with Vitalik.

I have always believed that the crypto industry is a content creative industry. It is rare to see that after a company becomes big, Ma Huateng chatting with QQ users or interns sending private messages to Ma Huateng can become hot searches. Bureaucracy is a standard feature of modern society, regardless of capital or society, or of the East or the West.

However, in the crypto industry, endless creativity is transformed into DAG/BFT/ZK/FHE/AI Agent, monetized in the form of tokens, NFTs, and Memes. They are born and die quickly, waiting for more "lively" people to appear and lead the trend for three to five years.

It must be admitted that before CZ and Armstrong, Crypto transactions had been subject to traditional technological hedonism and were just toys for a few geeks to entertain themselves. It was after CZ's Binance that cryptocurrency expanded to its current scale. He may not be the creator, but he is definitely an accelerator.

However, the more successful a person is, the harder it is to find the meaning of his existence. The reason may be that success isolates people from the real society.

We see that CZ, who can't use a wallet or play memes, is a sequela of success, which is a bit like the old money style. He is not in the same class as ordinary crypto users. His preference for money life, in general, is to preserve the barbarian temperament, but shrewdness, or management ability, replaces the physical harm that the barbarians loved earlier.

Image caption: CZ's Timeline Image source: @zuoyeweb3

CZ's cleverness lies in "using the West to oppose encryption and using encryption to fight the West", using decentralization as bait, and ultimately completing his own wealth accumulation with CEX, leaving OKX's $500 million fine in the wind.

According to Bloomberg, CZ personally holds 90% of Binance shares. At a time when rumors are circulating that he will sell part of his shares, this will actually turn his shares into real cash flow, which may be more beneficial to BNB's family, but these are the feelings of outsiders.

Don’t worry about BNB. P will be a friend of the cycle, not a friend of old money. In the face of the new cycle, the volatile market will quickly wipe out the experience advantage of old money, which is also the charm of Web3.