1. Market observation

Keywords: MAGIC, ETH, BTC

Trump made a statement on the social platform this morning saying that "those who own gold make the rules". Spot gold may be affected by his remarks and continued to rise after opening today, breaking through $3,380/ounce for the first time. The New York gold futures reported $3,375.9/ounce. The gold prices of many gold jewelry brands also rose, approaching 1,040 yuan/gram. At the same time, in the field of encrypted assets, TreasureDAO officially transformed into the AI agent companion track after announcing the end of game operations and Treasure Chain a few days ago. It will be integrated with the SMOL series in the early stage. Its ecological token MAGIC rose more than 2 times over the weekend.

Recently, the price of Bitcoin fluctuated between $83,000 and $86,000. Both the bulls and the bears failed to fully control the market trend. Although Bitcoin held the support level of $83,000, the bulls still failed to recover the key moving average. Failure to hold this level may trigger a new round of selling, and even push the price below $80,000. Greeks.live macro researcher Adam pointed out that the key price of BTC is in the $66,000-67,000 area, and many traders believe that this area is the concentrated area of short-term stop loss. 21Shares and economist Timothy Peterson both predict that the price of Bitcoin is expected to reach around $138,000 by the end of 2025, while Robert Kiyosaki, author of "Rich Dad Poor Dad", believes that Bitcoin will reach $180,000-200,000 in 2025. At the same time, Swiss bank Sygnum pointed out that with the improvement of digital asset supervision and the increase in user participation, altcoins are expected to rebound in the second quarter of 2025. Macroeconomist Lyn Alden is relatively cautious and lowered his Bitcoin price forecast, predicting that the Bitcoin price will be above $85,000 in 2025, and believes that "massive liquidity unlocking" may be the catalyst that Bitcoin needs.

Rick Wurster, the new CEO of Charles Schwab, revealed that the company plans to launch direct spot cryptocurrency trading services within the next 12 months. He said that as the regulatory environment continues to improve, cryptocurrency trading services will become an "inevitable choice" for every large brokerage firm. According to statistics, 9 altcoins and 4 meme tokens have submitted spot ETF applications, among which SOL and XRP are the most popular, with 6 and 10 institutions applying respectively. Among the altcoins that have submitted spot ETF applications, SOL, XRP, LTC, ADA and SUI are called "American coins", while AVAX, APT, MOVE and TRX belong to WLFI's investment portfolio.

On the macro level, the US dollar index fell below the 99 mark for the first time since April 2022, down 0.57% on the day. Tony Pasquariello, head of Goldman Sachs' hedge fund business, analyzed in his latest report that global capital flows are becoming the focus of market attention, and gave three major logics for the sharp decline of the US dollar: the US dollar is overvalued by about 20%; US "exceptionalism" is threatened by tariff policies, and tariffs will put tremendous pressure on US corporate profits and household purchasing power; the current situation is more like Brexit than the first trade war, and it is a confrontation between the United States and the world, making the foreign exchange market the focus. Goldman Sachs also pointed out that the amount of unhedged US dollar overweight in the United States after the global financial crisis reached 2.2 trillion US dollars, and these overweights will take time to unwind. At present, it is mainly investors in the eurozone who are selling US stocks, while other regions are still steadily buying US assets.

2. Key data (as of 12:00 HKT on April 21)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $87,144.42 (-6.8% year-to-date), daily spot volume $22.899 billion

Ethereum: $1,633.91 (-50.91% year-to-date), with a daily spot volume of $9.543 billion

Fear and corruption index: 39 (panic)

Average GAS: BTC 1.55 sat/vB, ETH 0.33 Gwei

Market share: BTC 63.1%, ETH 7.2%

Upbit 24-hour trading volume ranking: AERGO, LOOM, XRP, WCT, BTC

24-hour BTC long-short ratio: 1.096

Sector gains and losses: AI sector rose 3.98%, GameFi sector rose 1.71%

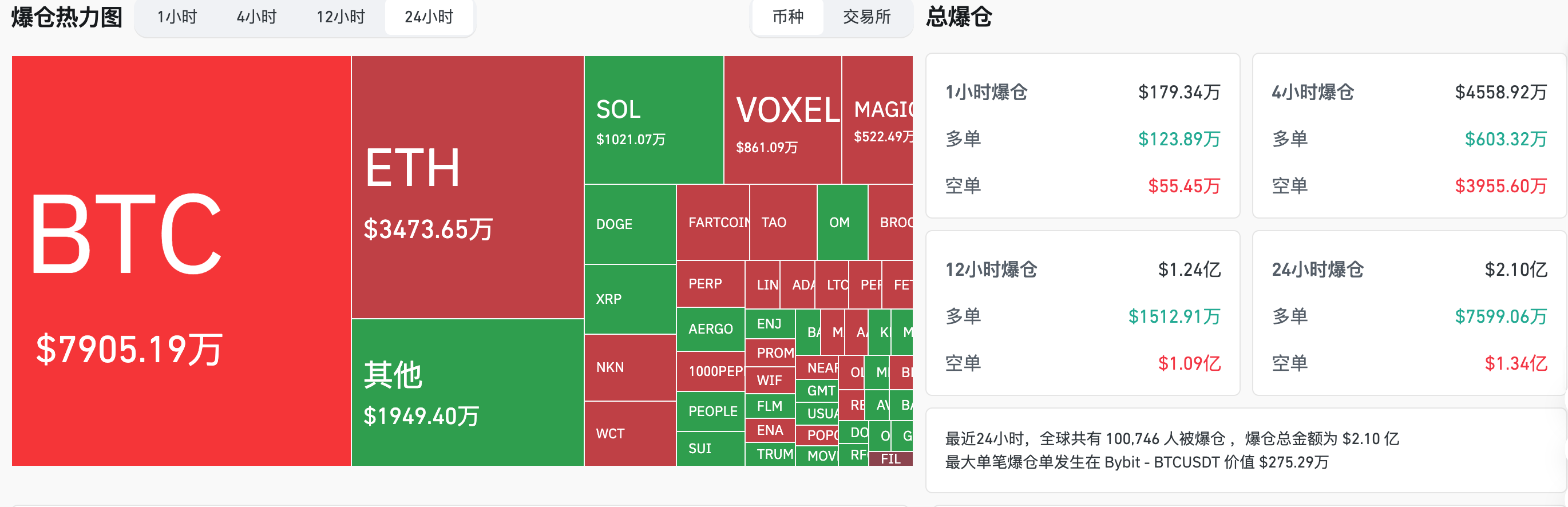

24-hour liquidation data: A total of 69,616 people were liquidated worldwide, with a total liquidation amount of US$210 million, including BTC liquidation of US$79.05 million, ETH liquidation of US$34.73 million, and SOL liquidation of US$10.21 million

BTC medium and long-term trend channel: upper channel line ($84690.59), lower channel line ($83013.55)

ETH medium and long-term trend channel: upper channel line ($1634.94), lower channel line ($1602.57)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (April 14 to April 17 EST)

Bitcoin ETF: $15.85 million

Ethereum ETF: -$32.17 million

4. Today’s Outlook

Pectra client is expected to be released today, adding EIP-7702 delegation status to JSON-RPC

Coinbase has applied to the CFTC to launch XRP futures, which is expected to be launched today

Kraken will launch BNB spot trading pairs at 10:00 PM on April 22

Bittensor (TAO) will unlock 210,000 tokens on April 21, worth about $47.7 million

Scroll (SCR) will unlock 40 million tokens on April 22, worth about $111 million

SPACE ID (ID) will unlock approximately 12.65 million tokens on April 22, accounting for 2.94% of the current circulation and worth approximately US$2.4 million.

The biggest increases in the top 500 stocks by market value today: MAGIC up 40.66%, AURORA up 33.33%, ENJ up 31.11%, GFI up 20.30%, and SOS up 19.42%.

5. Hot News

Macro outlook this week: The Federal Reserve’s “verbal storm” is coming, is Powell’s chair unstable?

Metaplanet purchased another 330 BTC, bringing its total holdings to 4,855

Raydium LaunchLab created 3,761 tokens in 5 days, with a graduation rate of only 1.12%

Bitcoin price hits $84,600 on Easter 2025, highest in nearly 17 years

The retail dominance index on Binance is 89.6%, while on Coinbase Prime it is only 18.3%.

Bitcoin mining difficulty increased by 1.42% to 123.23 T, setting a new record high