1. Market observation

Keywords: tariffs, ETH, BTC

US President Trump's reciprocal tariff measures officially took effect today, and the impact of this trade war quickly spread to global financial markets. Ironically, Trump himself was not immune. Since the launch of the comprehensive tariff plan on April 3, his personal net worth has dropped from $4.7 billion to about $4.2 billion, mainly due to the decline of his public and private stocks with the market. In terms of the market, since Trump announced the comprehensive tariffs, global stock markets have evaporated about $10 trillion. The Dow Jones Industrial Average plunged more than 2,000 points from its highs during the session, and the market value of technology giants such as Apple and Microsoft has evaporated more than $5 trillion from their highs. In response, Ken Fisher, founder of Fisher Investments, slammed Trump's tariff policy on social platforms, calling it "stupid, wrong and extreme." It is worth noting that Boujnah, CEO of Euronext, said that some European investors have begun to transfer physical assets such as gold from the United States to Europe in search of a safer haven.

In this round of market turmoil, the cryptocurrency market has shown a unique trend. Although Bitcoin fell to $74,501 on "Black Monday" and hit $74,627 again today, it seems to have formed a potential support level around $74,000. Crypto analyst Eugene and BitMEX co-founder Arthur Hayes both built positions around $75,000, and Hayes predicted that Bitcoin's market value share will climb to 70%. Bernstein analysts pointed out that compared with the historical deep correction of 50% to 70%, the current decline of only 26% shows that Bitcoin is gaining more resilient capital support. In addition, Matrixport analysis pointed out that the US dollar-RMB exchange rate is approaching key technical resistance levels, which may indicate that Bitcoin is about to usher in a new round of rapid rise. Standard Chartered Bank even predicted that the price of Ripple's XRP token may rise to $12.50 before Trump leaves office.

In terms of regulation, the situation is becoming increasingly complicated. In order to comply with Trump's executive order on digital assets, the U.S. Department of Justice announced the dissolution of a department dedicated to cryptocurrency-related investigations. According to Fortune magazine, the U.S. Chamber of Commerce is considering suing the Trump administration to stop the new tariffs that will take effect on Wednesday, and other groups may also join the lawsuit. U.S. Treasury Secretary Bessant said that discussions are currently underway on which regions to prioritize tariff agreements with, but White House officials have confirmed that tariff exemptions will not be implemented in the near future, and reports say that more than 50 countries (regions) have come forward to seek negotiations.

At the macroeconomic level, the situation is becoming increasingly serious. Former U.S. Treasury Secretary Summers warned that Trump's tariff policy could lead to a recession in the U.S. economy, with about 2 million Americans expected to lose their jobs and each family facing a loss of at least $5,000 in income. Goldman Sachs' strategy team warned that the current stock market sell-off could evolve into a longer-lasting cyclical bear market. The U.S. bond market suffered a sharp sell-off, with the 10-year Treasury yield soaring to 4.503% and the 30-year yield breaking through 5.010%. Wall Street bigwigs, including Bill Ackman, Daniel Loeb and Jim Chanos, collectively warned that Trump's latest tariff policy had serious calculation errors and quadrupled the tariff levels of other countries. However, Fisher offered a relatively optimistic view, believing that the market may have overreacted, and cited the example that the stock market also experienced a similar adjustment in 1998, and still achieved a 26% return rate that year.

2. Key data (as of 13:30 HKT on April 9)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $76,492.96 (-18.12% year-to-date), daily spot volume $52.41 billion

Ethereum: $1,454.83 (-56.28% year-to-date), with a daily spot volume of $27.709 billion

Fear and corruption index: 18 (extreme fear)

Average GAS: BTC 0.51 sat/vB, ETH 0.38 Gwei

Market share: BTC 62.5%, ETH 7.2%

Upbit 24-hour trading volume ranking: XRP, AERGO, BTC, ETH, AQT

24-hour BTC long-short ratio: 1.0004

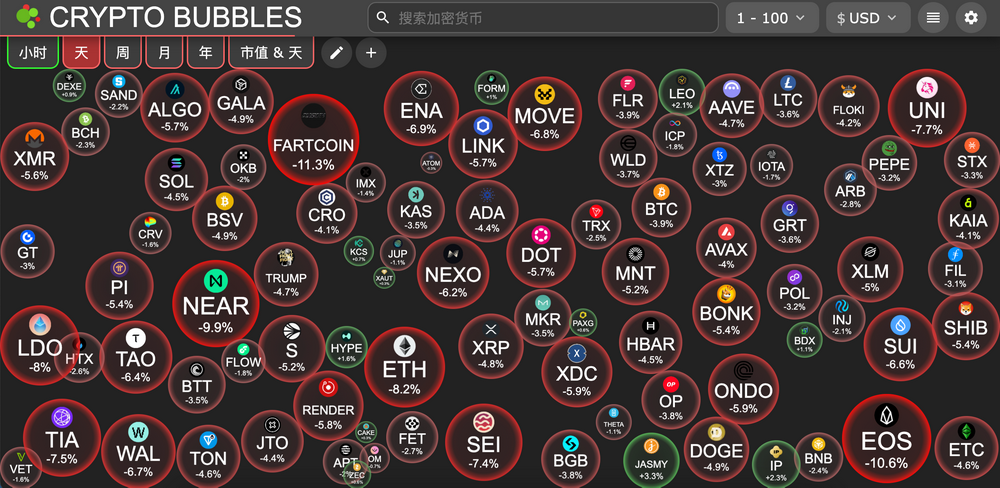

Sector ups and downs: The crypto market fell across the board, with the Meme sector down 5.58% and the AI sector down 5.55%.

24-hour liquidation data: A total of 137,588 people were liquidated worldwide, with a total liquidation amount of US$412 million, including BTC liquidation of US$141 million and ETH liquidation of US$112 million.

BTC medium and long-term trend channel: upper channel line ($82688.70), lower channel line ($81051.30)

ETH medium and long-term trend channel: upper channel line ($1774.39), lower channel line ($1739.26)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 4 EST)

Bitcoin ETF: -$326 million

Ethereum ETF: -$3.29 million

4. Today’s Outlook

Movement (MOVE) unlocks 50 million tokens, worth approximately $20.9 million

US SEC to decide whether to approve BlackRock Ethereum ETF options trading

U.S. Senate holds procedural "end of debate" vote on SEC Chairman nominee Paul Atkins

The Federal Reserve released the minutes of its March monetary policy meeting

U.S. March unadjusted CPI annual rate (April 10, 20:30)

Actual: To be announced / Previous value: 2.8% / Expected: 2.6%

Number of initial jobless claims in the United States for the week ending April 5 (10,000 people) (20:30, April 10)

- Actual: To be announced / Previous value: 21.9 / Expected: 22.3

The biggest increases in the top 500 by market value today : ARDR up 73.38%, FORTH up 36.70%, GAS up 31.30%, RFC up 29.01%, SOS up 18.83%.

5. Hot News

A whale that was long ETH in a cycle sold 5,094 ETH again, with a cumulative loss of $40 million

The probability of the Federal Reserve cutting interest rates by 25 basis points in May is 45.2%.

Standard Chartered: XRP could reach $12.5 before the end of Trump’s presidency

Glassnode: Bitcoin has stabilized near $74,000, and the decline may slow down slightly in the future