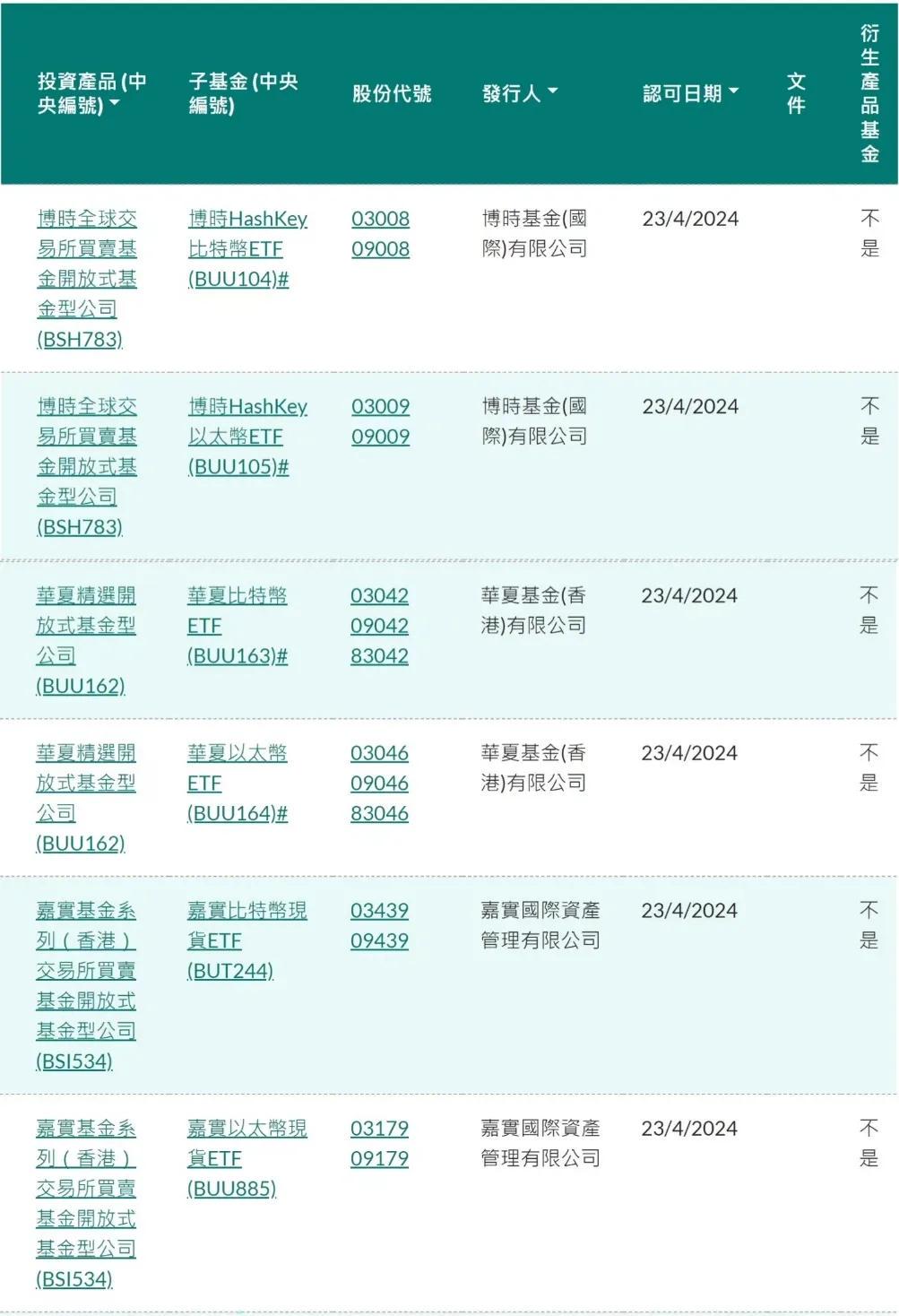

April. Spot Bitcoin and Ethereum ETFs approved

The Hong Kong Securities and Futures Commission’s official website officially announced the list of approved virtual asset spot ETFs, including related products from China Asset Management (Hong Kong), Harvest Global, and Bosera International. This is also the first time such products have been launched in the Asian market, and Ethereum spot ETF products will be the first in the world.

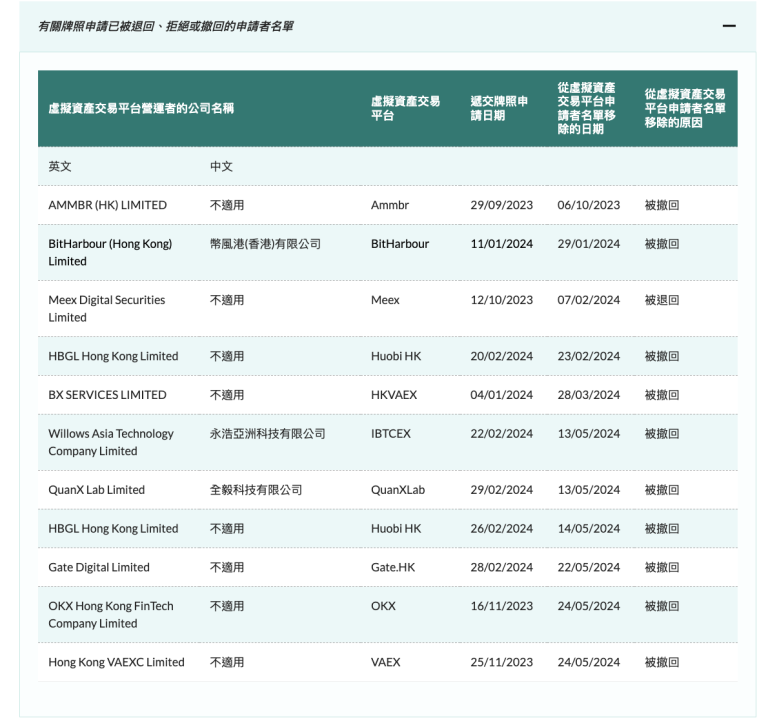

June : License application controversy

On May 31, 2023, the SFC issued the VATP License Manual and the Circular on Transitional Arrangements for the Licensing System, requiring virtual asset exchanges operating in Hong Kong at that time to obtain a license issued by the regulatory authorities by the end of the one-year transition period.

By the end of May 2024, many platforms had actively submitted license applications. However, some mainstream trading platforms such as OKX, Huobi HK, and Gate HK withdrew their applications for compliance licensing in Hong Kong, which once caused confusion among everyone about the prospects of Hong Kong's virtual asset market.

July. JD.com enters Hong Kong stablecoin market

On July 18, 2024, the Hong Kong Monetary Authority (HKMA) released the list of participants in the stablecoin regulatory sandbox, with JD.com, Yuanbi and Standard Chartered becoming the first batch of participating companies.

On July 24, JD CoinChain Technology (Hong Kong) announced that it will issue a cryptocurrency stablecoin anchored 1:1 with the Hong Kong dollar in Hong Kong. As a subsidiary of JD Technology Group, JD CoinChain is the only potential stablecoin issuer under JD. The stablecoin is issued based on the public chain, and the reserves are composed of highly liquid and reliable assets, which are deposited in independent accounts of licensed financial institutions, and the integrity of the reserves is verified through regular disclosure and audit reports. JD said it will cooperate with global regulators and comply with relevant laws and regulatory standards.

August. The Hong Kong Monetary Authority launched the Ensemble project sandbox to support the development of the tokenized market

On August 28, 2024, the Hong Kong Monetary Authority (HKMA) launched the Ensemble Project Sandbox to promote the application of tokenization technology in the financial field. The first phase of the trial covers four major themes: fixed income and investment funds, liquidity management, green finance and trade supply chain financing.

The HKMA has completed the construction of the sandbox and is working with banks to prepare for cross-bank payment and currency settlement experiments. The SFC will work with the HKMA to promote the development of the tokenized asset market, enhance Hong Kong's innovative position in the global financial market, and plan to cooperate with international institutions to promote the development of global tokenization technology.

October. Wong Tin-yau becomes Chairman of the Hong Kong Securities and Futures Commission

The Chief Executive of the Hong Kong Special Administrative Region has appointed Dr. Wong Tin-yau as Chairman of the Securities and Futures Commission of Hong Kong in accordance with the Securities and Futures Ordinance for a term of three years, from October 20, 2024 to October 19, 2027.

"We must seize opportunities and embrace challenges to foster a sustainable and vibrant capital market that protects the interests of investors while promoting economic growth, improving corporate governance and stimulating innovation," he said.

Hong Kong's third virtual asset exchange approved

On October 4, 2024, the Hong Kong Securities and Futures Commission updated the list of virtual asset trading platforms (VATP) and issued Type 1 (securities trading) and Type 7 (automated trading) licenses to the Hong Kong Virtual Asset Exchange (HKVAX), in compliance with the requirements of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

HKVAX provides over-the-counter trading, trading platforms and custody services, focusing on security tokens (STO) and real asset tokenization (RWA), and promoting the development of Hong Kong's fintech ecosystem. The CEO said that STO and RWA will increase asset liquidity and create more financing and investment opportunities. The company is also building a strong infrastructure to support its own and partner businesses, and plans to provide end-to-end solutions covering tokenization, issuance, trading and custody, and jointly build a digital asset alliance with strategic partners to improve industry standards.

November. HKEX officially launches virtual asset index series on November 15, 2024

The virtual asset index series provides transparent and reliable benchmark prices for Bitcoin and Ethereum in the Asian time zone, supporting Hong Kong's position as Asia's leading digital asset hub. The index series will address price differences between virtual assets on global exchanges and provide investors with a unified reference price.

This series will comply with the EU Benchmark Regulation (BMR) and will be jointly managed by a UK-registered management body and CCData. The launch of the HKEX is in response to the Hong Kong government's policy to promote the development of virtual assets, aiming to promote the development of Hong Kong's financial technology and provide investors with important benchmark tools to help the healthy development of the virtual asset market.

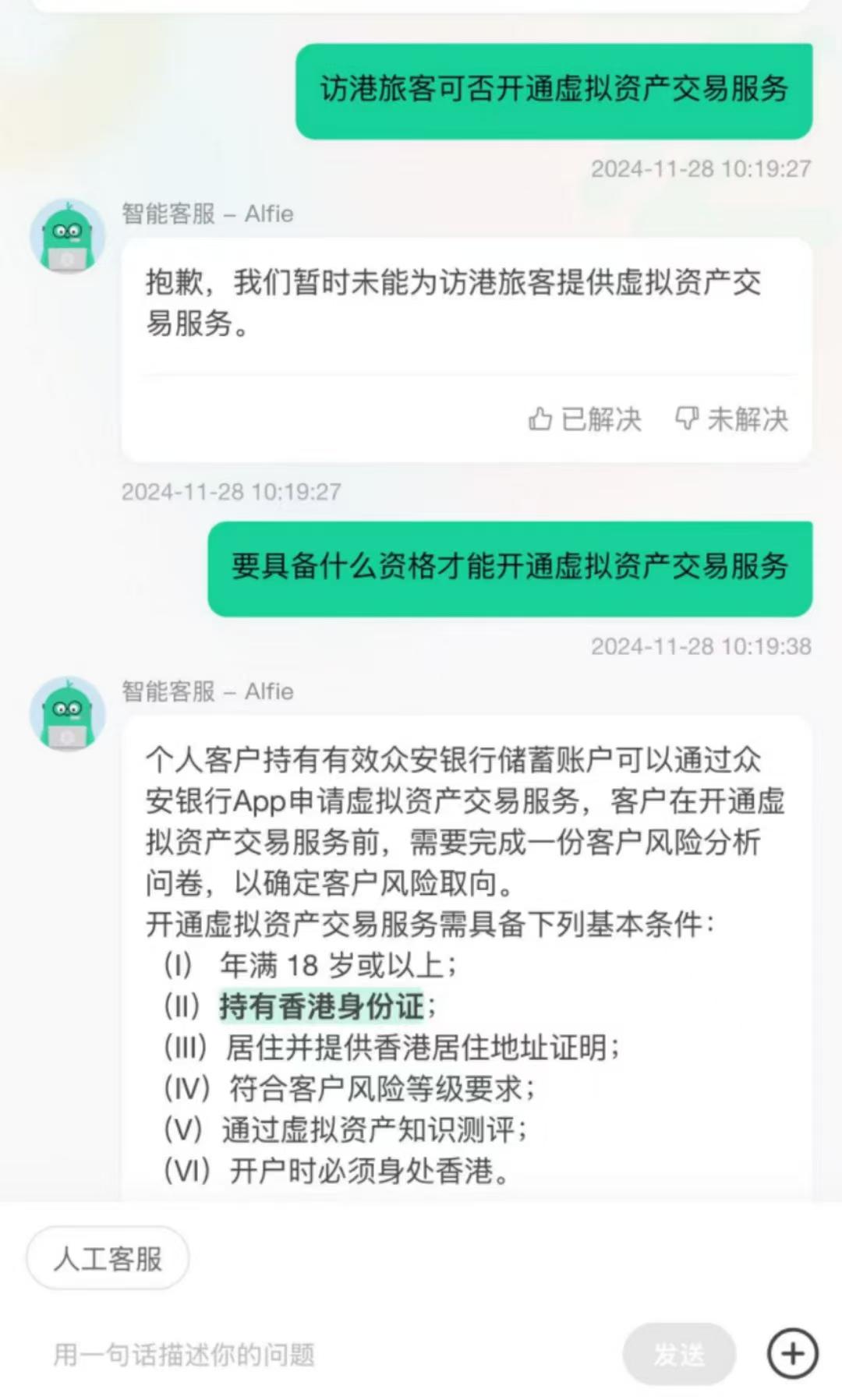

ZhongAn Bank launches cryptocurrency trading service

On November 25, Hong Kong digital bank ZA Bank announced that it has become the first bank in Asia to provide cryptocurrency trading services to retail users, supporting Bitcoin and Ethereum transactions. Users can use Hong Kong dollars and US dollars to trade through the ZA Bank App, with a minimum transaction amount of US$70 or HK$600. New users are exempt from commissions for the first three months. This service is limited to Hong Kong ID card holders.

December. The Stablecoin Draft Bill was released

The Stablecoin Bill was submitted to the Legislative Council for its first reading on December 18. The bill stipulates that the issuance of legal currency stablecoins, Hong Kong dollar stablecoins or the promotion of stablecoins to the public requires a license. Regulatory priorities include the sound management of reserve assets, the protection of redemption rights of coin holders, and the fight against money laundering.

Four new licensed exchanges

On December 18, the Hong Kong Securities and Futures Commission announced that the Hong Kong Securities and Futures Commission has recently issued licenses to four virtual asset trading platforms, increasing the number of licensed virtual asset trading platforms in Hong Kong to seven. These four platforms include Cloud Account Greater Bay Area Technology (Hong Kong), DFX Labs, Hong Kong Digital Asset Trading Group and Thousand Whales Technology. These platforms will obtain licenses through a fast-track licensing process. At the same time, the Securities and Futures Commission is accelerating the approval process for virtual asset platforms and has developed a clear licensing process roadmap. It plans to set up an advisory group in early 2025 to strengthen supervision of virtual asset platforms.

Hong Kong Legislative Council member Wu Jiezhuang proposed the launch of "Digital Pass"

On December 31, Hong Kong Legislative Council member Wu Jiezhuang proposed the launch of "Digital Pass", allowing mainland investors to buy and sell Hong Kong-approved digital assets through special channels to promote financial connectivity between the mainland and Hong Kong and promote financial innovation and the development of new quality productivity.

Wu Jiezhuang pointed out that although cryptocurrency trading is prohibited in the mainland, cryptocurrency trading in Hong Kong is legal under the "one country, two systems" framework and may provide opportunities for mainland residents to invest in Hong Kong virtual assets. He believes that whether such investment is allowed will depend on changes in the international situation, and the mainland may adjust relevant policies in a timely manner according to development needs.