Among the many BTCfi projects, Avalon Finance is building a path that can truly release liquidity and generate profits for Bitcoin.

The financialization of BTC is the key to the final value release

Bitcoin has always been the strongest consensus asset since its birth, but its biggest weakness is: incomposability.

BTC's market value exceeds the sum of all other crypto assets, but it is still dormant on the chain like "digital gold" and has no circulation efficiency. The BTCfi model represented by Avalon is the way to introduce Bitcoin into DeFi and activate its dormant value.

BTC Collateralized Lending: A Safe Solution to Unlock Liquidity

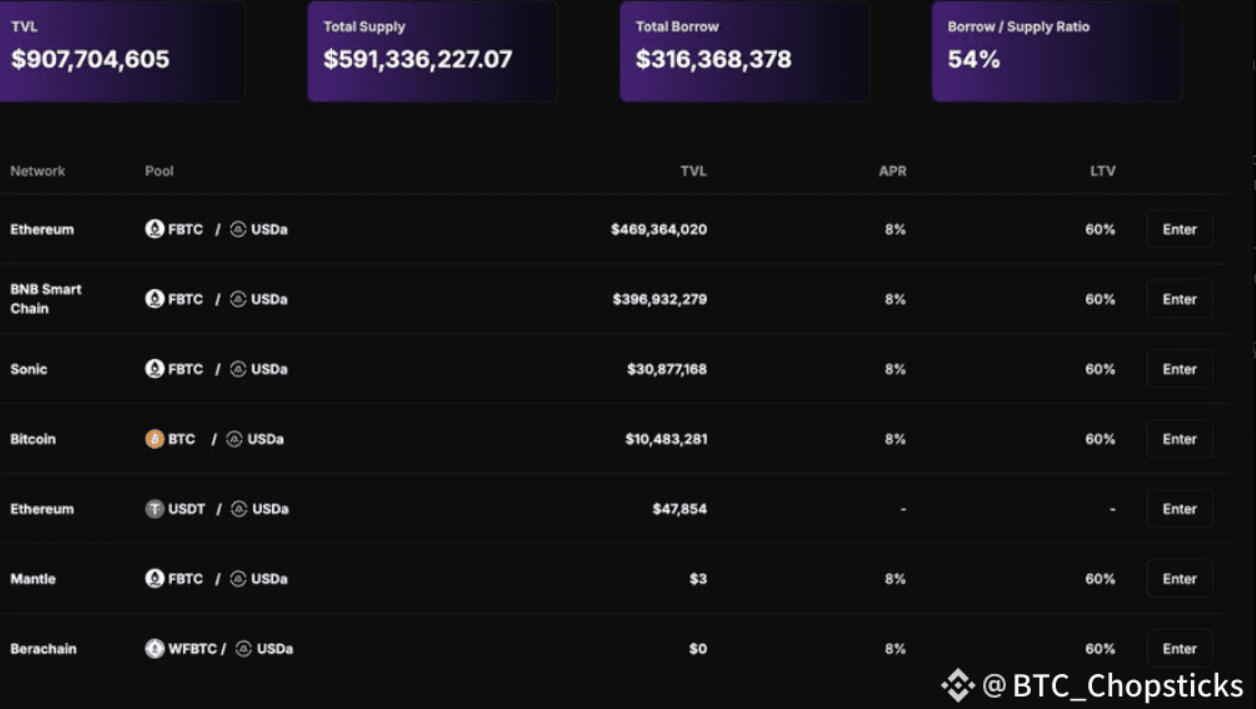

The Bitcoin mortgage loan mechanism launched by Avalon Labs is gradually becoming a mainstream way to obtain funds:

Fixed rate: 8%

Get liquidity without selling BTC

The platform provides intelligent risk control management, and users only need to manage the mortgage rate

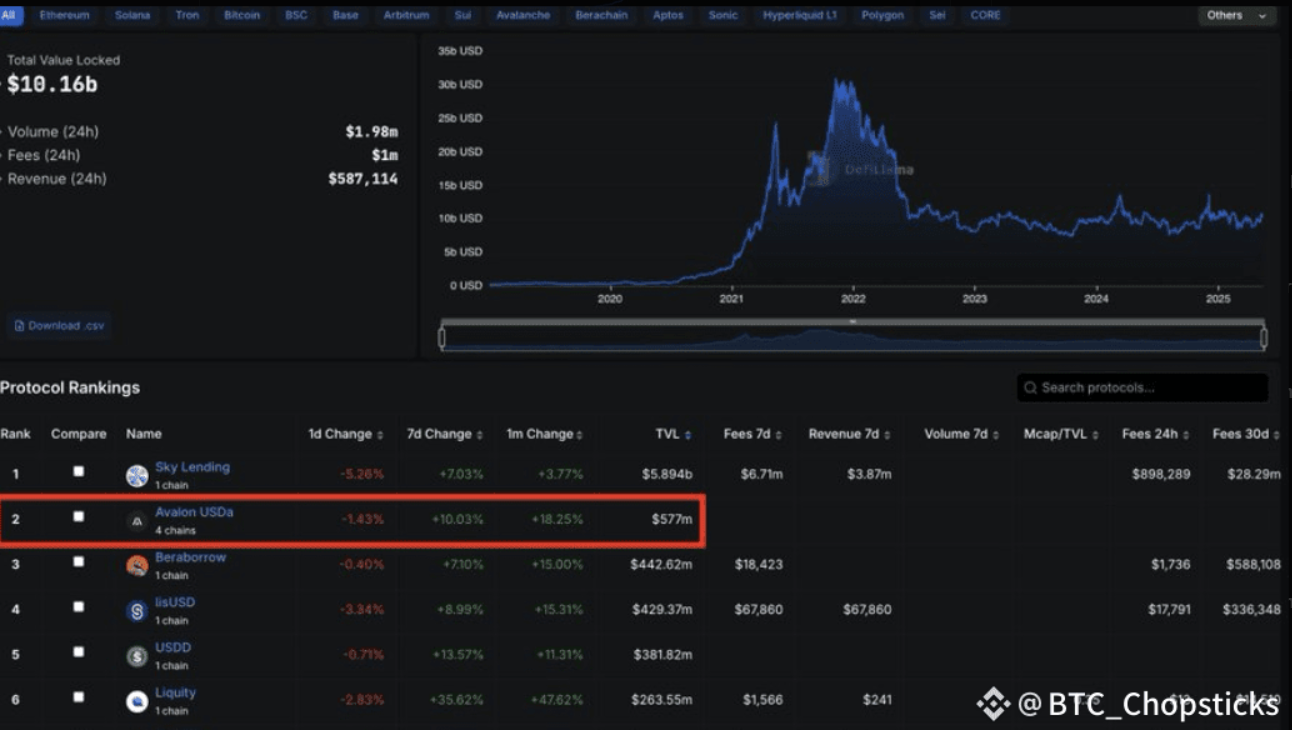

After most BTCfi projects disappeared, Avalon continued to develop steadily and is one of the few players worth observing in the long term.

Stablecoin $USDa: Stability, value-added, CeDeFi combination model

Avalon’s CeDeFi stablecoin $USDa is one of the core innovations:

Backed by BTC as excess collateral

Providing 5% annualized return, taking into account both stability and gain

Provide a stable liquidity pool for DeFi users and support a variety of lending structures

Compared with general high-volatility yield products, $USDa is highly institutional and risk-resistant.

A true “real world benefits” aggregator

Avalon is not only a provider of on-chain yield products, but also one of the first pioneers to introduce real-world yield (RWA) into the BTC ecosystem:

Connecting BTC collateral assets to BlackRock’s $2.4B BUIDL fund

Introducing the “verifiable real-world asset return” structure to achieve CeDeFi portfolio returns

For long-term funds/DAO treasury/institutional investors, this is the most ideal BTC application path

This is the first time that BTC is not just “held” but has become the underlying collateral asset for building the global digital financial system.

Community-driven: Ultra-high APY + Multiple Incentive Mechanisms

Avalon's rise is not only due to its mechanism, but also due to its emphasis on the community:

$AVL staking APY up to 170%+

Cooperate with Pulsar App to get airdrop rewards up to 50,000 $AVL

We have launched community airdrops, test rewards and other activities many times to continuously activate user loyalty

For projects that find a balance between CeFi and DeFi, community stickiness is often the decisive factor.

Future Outlook: Long-termists who stick to the Bitcoin narrative

When most BTCfi projects returned to zero during the bull-bear transition, Avalon completed the roadmap update, strengthened product design, and continued to release cooperation news.

$AVL price reacts positively to roadmap update

Multiple rounds of marketing activities to stimulate market attention

It has become one of the few projects in the BTC ecosystem that can "cross cycles"

We are still in the early stages of BTCfi, but Avalon is already well positioned for the long haul.

Conclusion:

If you miss out on Avalon, you will miss out on the financial revolution of BTC value release

When we talk about the future of Bitcoin, we should not only focus on whether its price reaches a new high, but also think about: How can BTC become a truly global financial cornerstone asset?

Avalon Finance provides the answer to this question through BTC collateral, stablecoins, RWA integration, CeDeFi structure design and other dimensions.

✅ If you firmly believe that Bitcoin will exist for a long time

✅ If you are looking for products with more risk resistance and structural returns

✅ If you want to participate in the early dividends of the BTC financialization wave

Then you should not ignore Avalon. BTCfi is opening a new narrative cycle. And Avalon is likely to be the most important footnote in this cycle.