Author: Kyle

Review: 0xmiddle

Source: Content Guild - News

Originally published on: PermaDAO

Original link: https://permadao.notion.site/AO-1a127607c439800dbbd7ebc401cfbfc1?pvs=4

Basic information of tokens

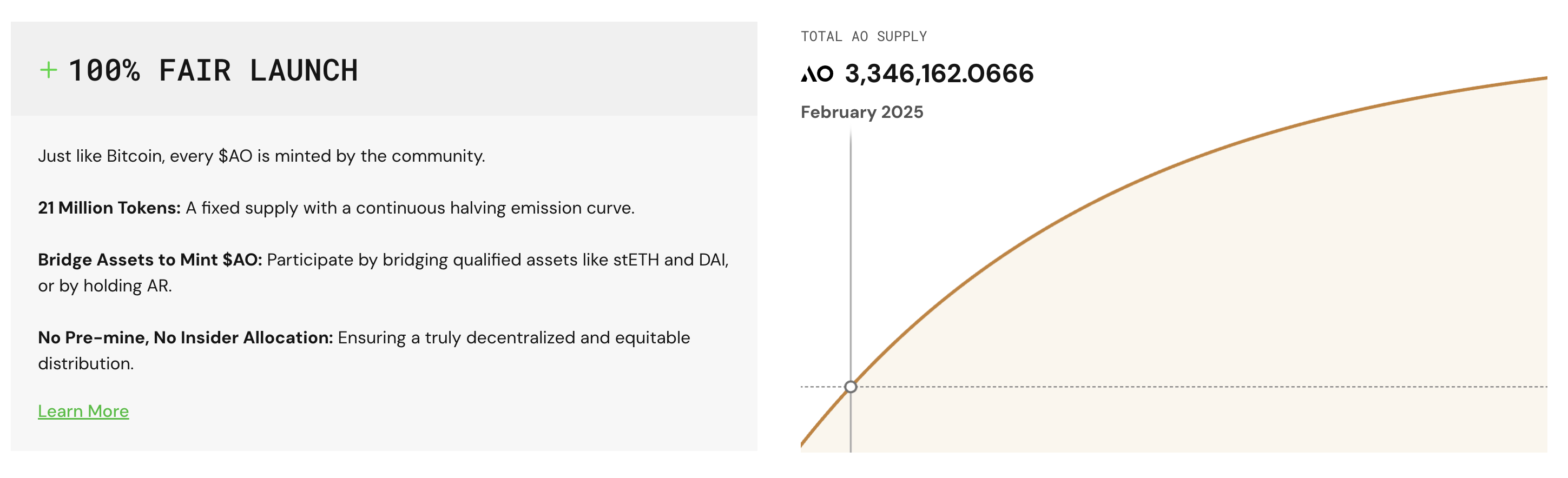

$AO is the native token of the AO network and has officially started trading with the launch of the AO mainnet on February 9, 2025. It follows a 100% fair issuance model with no pre-mining, pre-sale or pre-allocation. It is mainly used to reward contributors, pay for computing services, and stimulate ecological development.

Source: ao.arweave.net

Source: ao.arweave.net

The $AO economic model combines the Bitcoin-style halving mechanism with dynamic minting rules, minting every 5 minutes and controlling inflation decay through "smooth halving".

- Contract address: 0syT13r0s0tgPmIed95bJnuSqaD29HQNN8D3ElLSrsc

- Total supply: 21 million

- Circulation: 3,346,162 pieces, accounting for about 15.9% of the total (statistical time is February 22, 2025)

- Current price: $40.7

- Market capitalization: $136 million

- FDV (fully diluted valuation): $850 million

$AO Price Performance

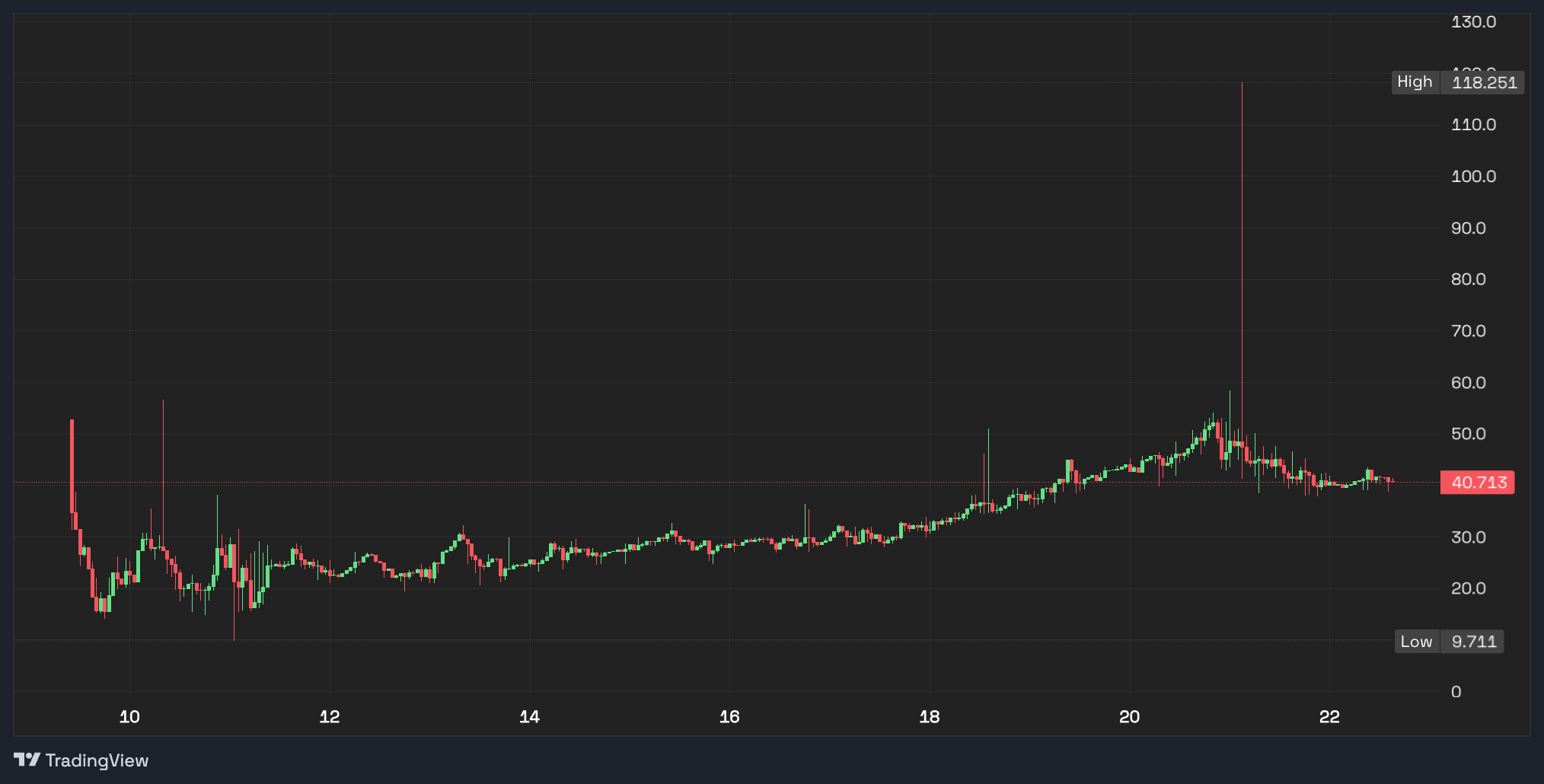

$AO Token 1-Hour K-line Chart

Source: Permaswap

Statistical time: February 22

Since $AO started supporting trading on February 9, it has shown a downward trend at the opening. The price fluctuated in a narrow range of 20-30 US dollars from February 10 to 18. Then, from February 18, the price broke through the fluctuation range and reached a maximum of 54 US dollars, with a weekly increase of 180%, showing strong buying momentum. After that, the market began to pull back, and the price fell back to the support level of 40.7 US dollars. During this period, there was an instantaneous pin at 58/118 US dollars, reflecting the intensification of the market's long-short game. The current price is 40.7 US dollars, the circulating market value is 136 million US dollars, and the FDV is 850 million US dollars.

$AO Volume Performance

| Platform Name | Platform Type | Transaction Type | TVL | 24H Trading Volume (USDT) | Total transaction amount (USDT) |

|---|---|---|---|---|---|

| Permaswap | DEX | Spot Trading | 5.3M | 803K | 18M |

| Botega | DEX | Spot Trading | 2M | 348K | 6.3M |

| MEXC | CEX | Pre-Market Trading | - | 4.8K | 227K |

| Lbank | CEX | Pre-Market Trading | - | 1.9M | 21.5M |

The table shows the $AO trading volume data as of February 22, 2025, from the perspective of DEX and CEX:

- In terms of DEX : Permaswap has a total locked asset value (TVL) of $5.3 million, a 24-hour trading volume of $803,000, and a total historical trading volume of $18 million; Botega supports a daily trading volume of $348,000 with a TVL of $2 million, and a cumulative trading volume of $6.3 million. Together, the two form the core liquidity pool of the DEX ecosystem, with Permaswap accounting for 74% of the market share.

- In terms of CEX : centralized trading platforms showed significant differentiation. Lbank became the platform with the most outstanding data performance with a 24-hour trading volume of US$1.9 million and a historical total trading volume of US$21.5 million. Its daily trading volume was much higher than that of MEXC (24-hour trading volume of US$4,800 and total trading volume of US$227,000).

It should be noted that the $AO trading market on Lbank and MEXC is currently in the pre-market trading stage, which only supports trading but cannot be recharged or withdrawn. Trading and mainnet assets are temporarily isolated. This is because the AO mainnet has just been launched and the exchange needs time to complete the docking with the mainnet. This situation may cause a large deviation in prices, and the trading volume may not fully reflect the real market situation. For traders, DEX may be more able to reflect the actual value of $AO assets at present. It is recommended to make a comprehensive judgment based on DEX data.

Summarize

At present, the price of $AO on CEX may be distorted, and transactions on DEX are not yet fully active, and execution often freezes. This is mainly because the performance of the AO mainnet still needs to be optimized, and a large number of traders have not yet entered the market. The future price trend of $AO will depend on the performance level of the mainnet ecology, the progress of liquidity, and the market's consensus assessment of the value of FDV and the circulating market value ratio (currently 6.25 times).