This is original|Odaily Planet Daily

Author: Wenser

Recently, after voting, the U.S. Senate officially confirmed Paul Atkins, nominated by Trump, as the chairman of the SEC. Since then, the main government officials during Trump's current term have basically been confirmed, and this group of people will also become key figures influencing the political and economic situation in the United States and even the world, as well as the cryptocurrency market in the next four years.

Therefore, although the major officials of the Trump administration are under the control of the Office of U.S. Government Ethics, their crypto holdings may still become one of the important factors affecting subsequent regulatory policies and the benefits of cryptocurrency projects. Based on this, Odaily Planet Daily will organize the cryptocurrency holdings of major figures in this article for readers' reference.

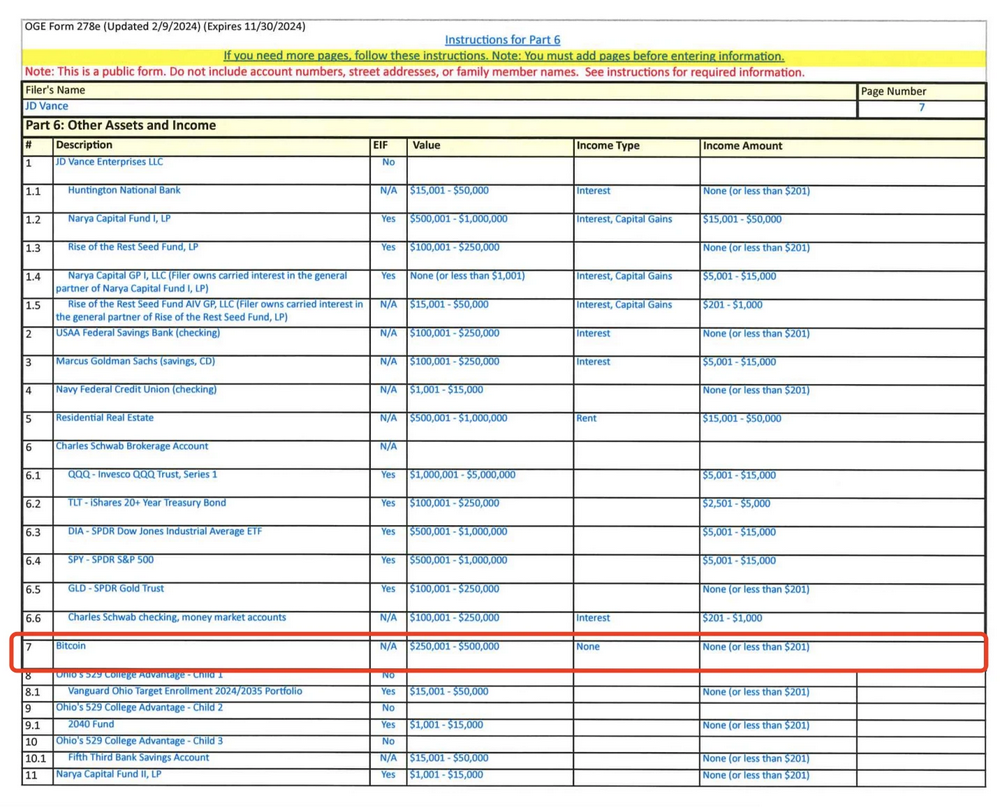

Vice President Vance: Specializing in BTC

As previously reported by Business Insider, the personal financial information of the current US Vice President JD Vance disclosed in August 2024 showed that Vance himself held assets of approximately US$4 million; among them, the relevant crypto assets were approximately US$250,000 to US$500,000, all of which were Bitcoin.

In addition, crypto-asset-related index funds and crypto asset management company funds are also on the list.

Vance Personal Financial Disclosure Information

David Sacks, White House AI and Cryptocurrency Director: He once held BTC, ETH, SOL, BITW, and has now sold all his positions

White House memo documents show that David Sacks, the US director of AI and cryptocurrency affairs, sold more than $200 million in digital asset-related investments through his personal company Craft Ventures before taking office, and about $85 million of income belonged to him personally, including Bitcoin, Ethereum, Solana and Bitwise 10 Crypto Index Fund (BITW), and sold shares in Coinbase (COIN) and Robinhood (HOOD).

In addition, he also withdrew from Multicoin Capital, Blockchain Capital and Bitwise Asset Management related investments, and began to gradually withdraw from holdings in some private digital asset companies. In addition, Sacks still holds interests in some funds under Craft Ventures, which invest in companies such as BitGo and Lightning Labs. These investments are difficult to fully exit due to liquidity restrictions, accounting for less than 3.8% of its total investment assets.

The above information was also confirmed and responded by David Sacks himself. Multicoin Capital Managing Partner Kyle Samani and Bitwise CEO Hunter Horsley also made corresponding explanations.

SEC Chairman Paul Atkins: Indirect holdings of BTC

According to the speculation published by crypto KOL @0x_Todd, it is preliminarily estimated that Paul Atkins' crypto-related assets are about 2-6 million US dollars. The Off The Chain Capital fund he invested in adopts a Bitcoin strategy (focusing on low-priced Bitcoin investment opportunities, such as Mt. Gox's debt, Bitcoin mining machines, Bitcoin leverage, etc.), and therefore indirectly holds Bitcoin.

In addition, it also holds shares in the encryption company Securitize and Anchorage Digital, the only encryption bank in the United States, with assets worth approximately US$250,000 to US$500,000.

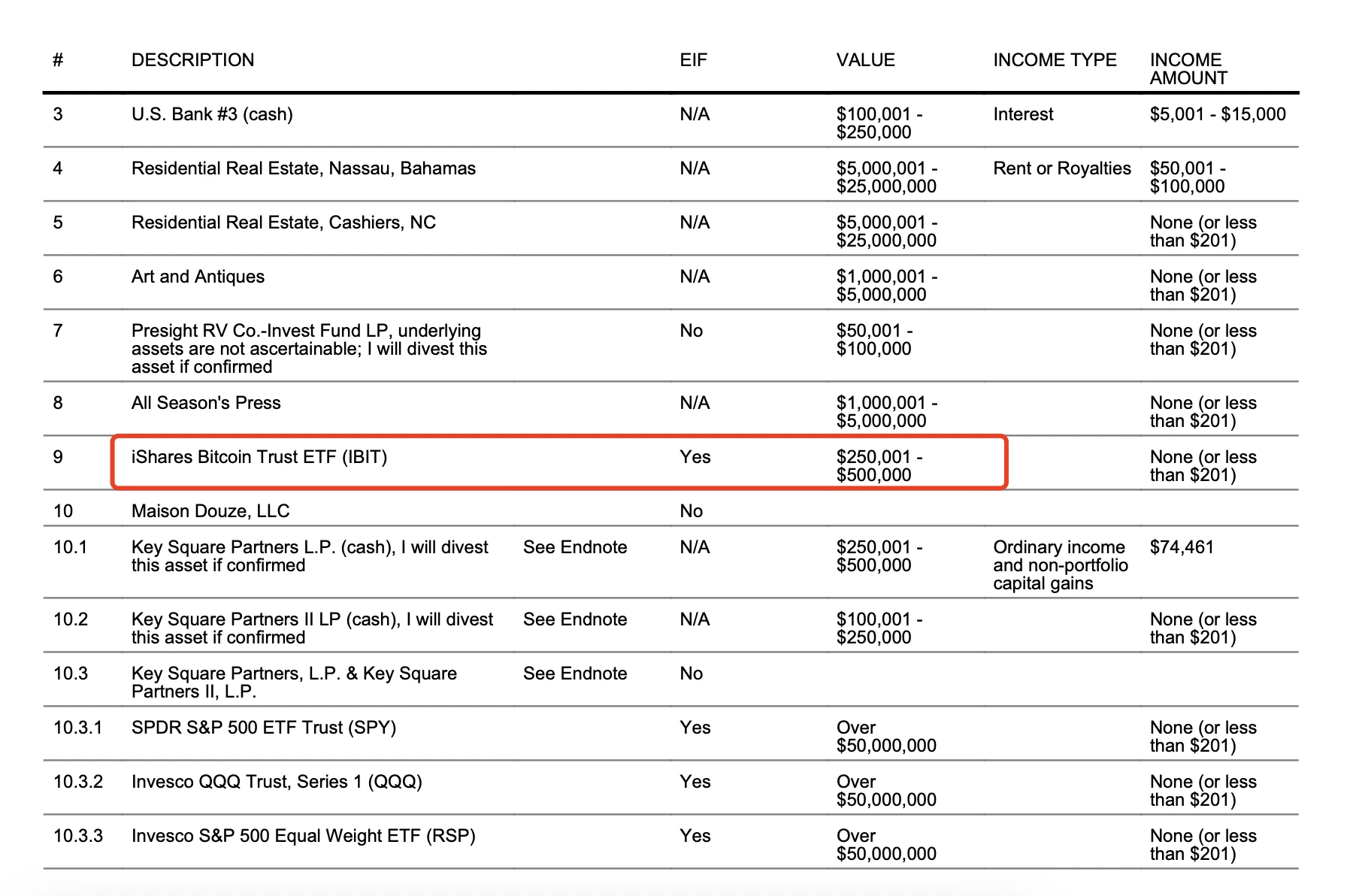

U.S. Treasury Secretary Scott Bessent: Holding IBIT

Personal property documents disclosed by U.S. Treasury Secretary Scott Bessent in August 2024 showed that his total financial assets were approximately US$521 million.

In comparison, his crypto assets only include the Bitcoin spot ETF IBIT, and the asset size is approximately US$250,000 to US$500,000, accounting for less than 0.1% of his personal assets.

In addition, its investment portfolio also includes cryptocurrency-related assets such as SPDR S&P 500 Trust Fund (SPY), Invesco QQQ Trust Fund (QQQ), etc., with a value of more than US$100 million.

Sources of Position Information

U.S. Commerce Secretary Howard Lutnick: Holds 5% of Tether shares and some BTC

According to financial disclosure documents released by the U.S. Office of Federal Ethics (OGE), current U.S. Secretary of Commerce Howard Lutnick disclosed his crypto assets and related investments in a report submitted on January 24, 2025.

Previously, he had made it clear that he holds Bitcoin and regards it as a global freely traded asset "like gold"; Cantor Fitzgerald under his name is the main partner of stablecoin issuer Tether and manages approximately US$39 billion in US Treasury bonds. According to previous news, Lutnick plans to hand over the company's Tether business relationship to his son Brandon Lutnick.

In addition, Cantor Fitzgerald reportedly holds a 5% stake in Tether, valued at approximately $600 million; Cantor Fitzgerald also planned to launch a Bitcoin financing business last year to provide Bitcoin investors with leverage support of up to $2 billion in initial funds.

DOGE Department Head Musk: BTC and DOGE

As a "star player" in Trump's current administration, Musk's crypto holdings have always been the focus of market attention.

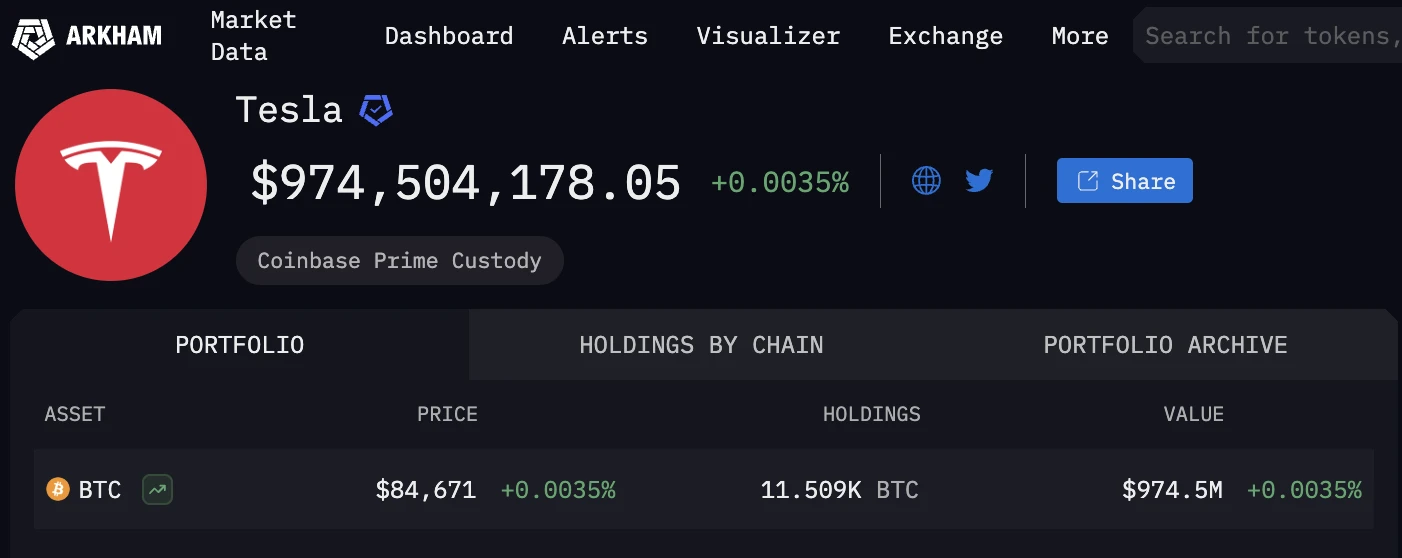

According to data from the Arkham platform, on March 7, Musk's company Tesla's Bitcoin holdings increased to 11,509 BTC, which is about 1,789 BTC more than the 9,720 BTC balance reported in the previous financial report.

Last November, DogeDesigner, a Dogecoin UI designer who frequently interacts with Musk, shared an audio clip of Musk on the X platform, in which Musk said, "I still hold a lot of Dogecoin, and SpaceX still holds Bitcoin."

Tesla BTC holdings information