Author: Berachain

Compiled by: TechFlow

It's finally here.

After two years of waiting, Berachain’s Mainnet launch happened last Thursday, and Beras has been cooking. There’s a lot going on, and it’s hard to get a comprehensive overview of what’s happening on any chain — but this post will give you a comprehensive overview of almost everything you can do on Berachain right now.

Berachain itself needs no introduction, but its consensus mechanism, Proof-of-Liquidity (PoL), is at the heart of Berachain's economic innovation. Initially, when the idea of this new consensus mechanism was proposed, Berachain was just a community, not an L1. But now the situation is very different. After attracting more than $3 billion in deposits through the Boyco program, Berachain has officially launched, started producing blocks, and attracted a large number of dApps and users.

This blog usually focuses on the fundamentals of Berachain and explores its future potential, but this time we will start from a practical perspective and explore the actual ecology on the chain. Let’s get started!

Explore Berachain’s DeFi Ecosystem

First, let’s start with an overview of Berachain’s DeFi ecosystem. Most of the functionality of this ecosystem relies on assets deposited through Boyco, and the dApp team is also working hard to launch new strategies and on-chain features.

According to DefiLlama, Berachain’s total value locked (TVL) is slightly over $1.9 billion, but this does not include all Boyco assets. Captain Jack Bearow wrote an excellent summary of the Boyco market operation and where these assets are going, which you can read here.

Let’s briefly explain how Boyco works, and then we’ll get into the mainnet dynamics.

A total of 12 applications and over 20 asset issuers were selected for the Boyco program. Boyco assets were divided into three categories: primary assets, third-party assets, and hybrid assets. Depending on the asset class, different multiples and terms were applied, and teams submitted application scripts describing where these assets will be used after the mainnet is launched.

From the TVL data of Berachain, it is not only evenly distributed among dApps, but also very healthy among pools, assets and strategies. Next, we will list some activities on the chain and highlight some specific strategies and pools to show their possibilities.

Starting with BeraHub, we can see how the PoL magic works.

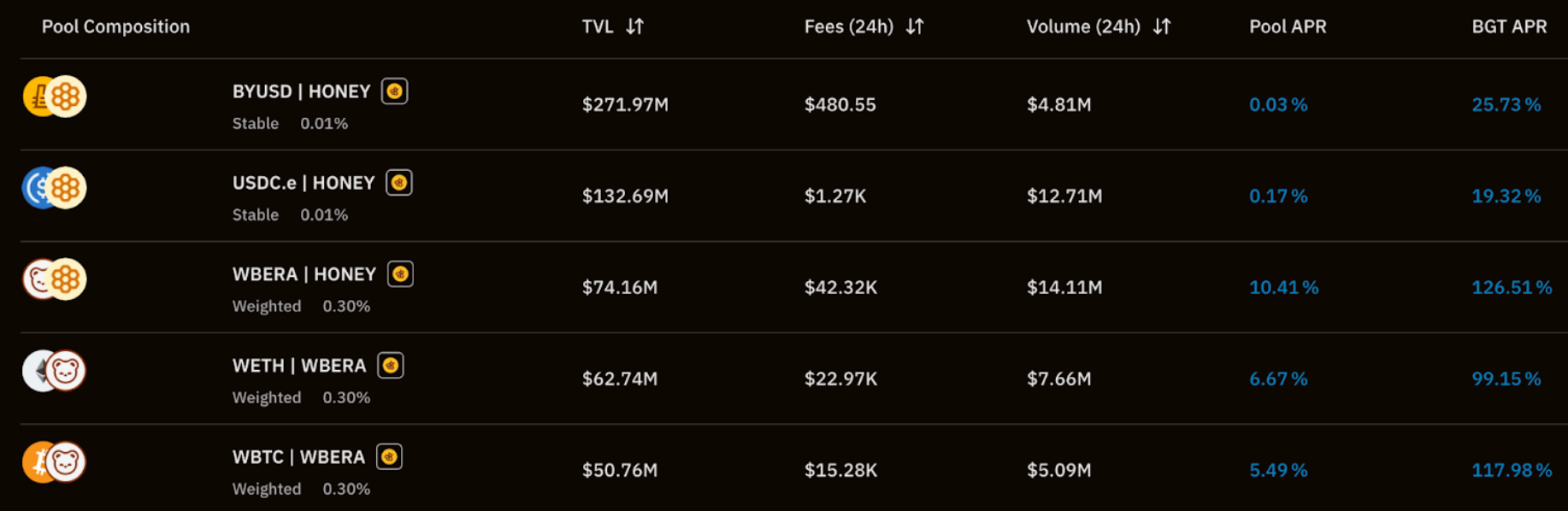

Once you open the site, you’ll see a few different tabs, but let’s start with the pools. The top five TVL pools allow you to deposit HONEY or WBERA, with paired assets including BYUSD, USDC.e, WETH, and WBTC, depending on your risk appetite.

These liquidity provision (LP) certificate tokens can be used for staking in reward vaults, which is the main way to earn BGT rewards on Berachain. There are currently five reward vaults - corresponding to the five liquidity pools - that have been whitelisted and opened for deposits, and each vault has a different BGT capture rate and annualized rate of return (APR).

As of this writing, Kodiak’s TVL has exceeded $690 million — so where does all this money come from? And how can LP users take advantage of Kodiak’s infrastructure?

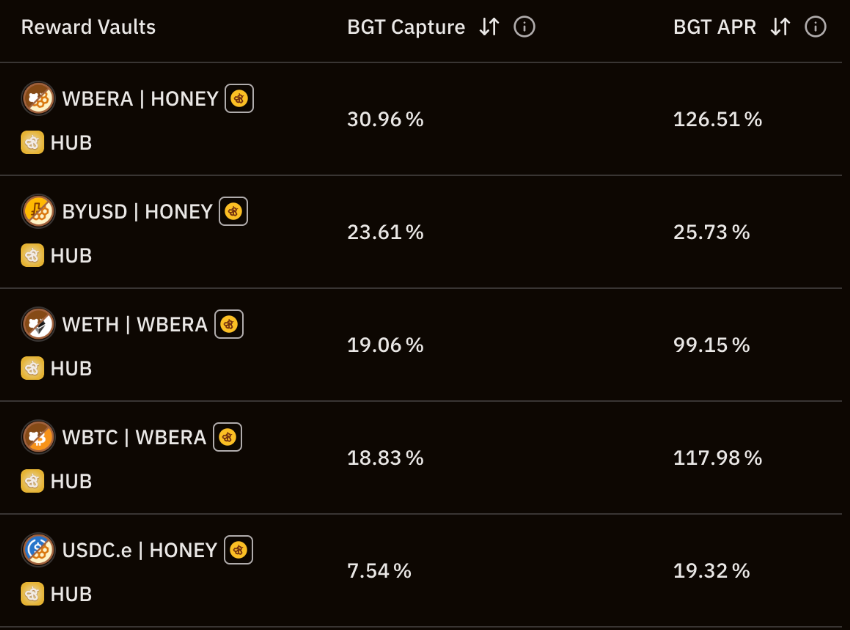

If we look at the top ten liquidity pools by TVL, we can see that Kodiak has fairly deep liquidity in multiple trading pairs that are spread across the three asset classes mentioned earlier. Of these trading pairs, WETH pairings occupy three of the top five, with the rest including STONE, WBTC, HONEY, and beraETH.

Over $375 million in WETH has been deposited in the Boyco program, most of which has now been deployed on the Berachain mainnet.

Kodiak not only offers rewards for depositing more standardized assets, but also launched "sweetened islands", a product designed for BERA/HONEY, BERA/WETH and YEET/BERA pairings, with annualized yields currently in the triple digits. Whatever your needs, Kodiak can meet them, with assets growing to over $1.1 billion and continuing to launch new features and farms, such as "sweetened islands" for WBTC/BERA, integration with Zapper, and the continued launch of new tokens for the Berachain ecosystem.

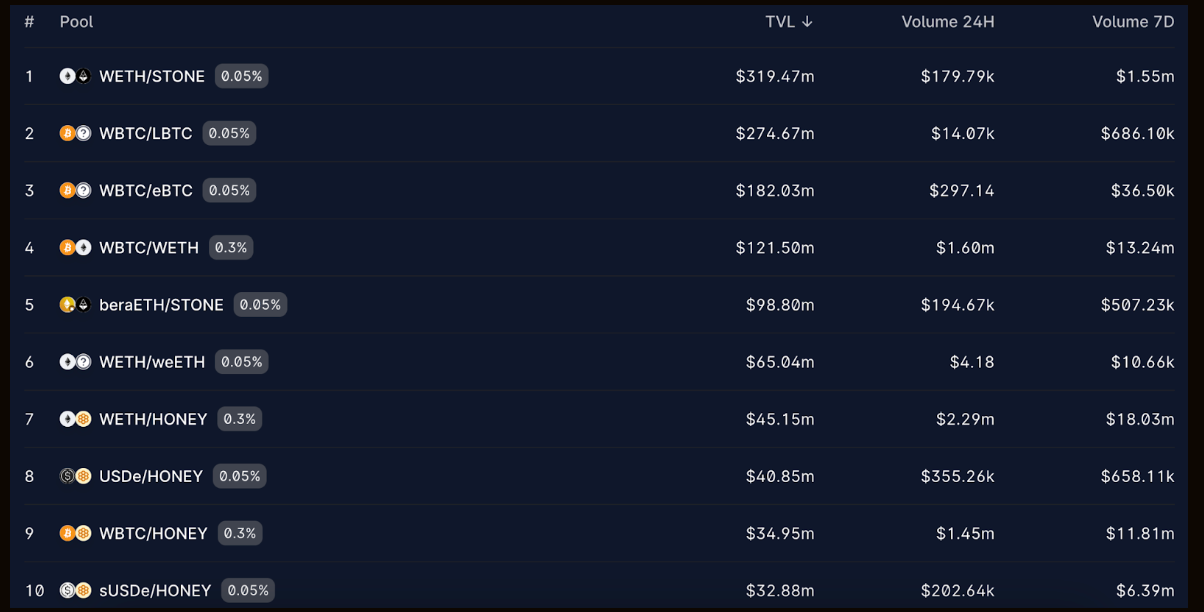

D2 Finance currently offers several unique strategies for Berachain, such as Hyperbera.usdc, Hyperbera.Weeth, Kodiak++, Dgnberaland, and Hyperbera. At the time of writing, the protocol has a TVL of over $10 million and has been working hard to provide differentiated products that leverage the broader Berachain ecosystem.

D2 recently wrote about their ideas around Berachain and Pol, but the team wants to put tokenized derivative strategies on Berachain that not only offer attractive yields but also benefit from the reflective and incentive structure of Pol. If you want to passively farm BGT rewards through a range of actively managed strategies, D2 may be the perfect destination for you.

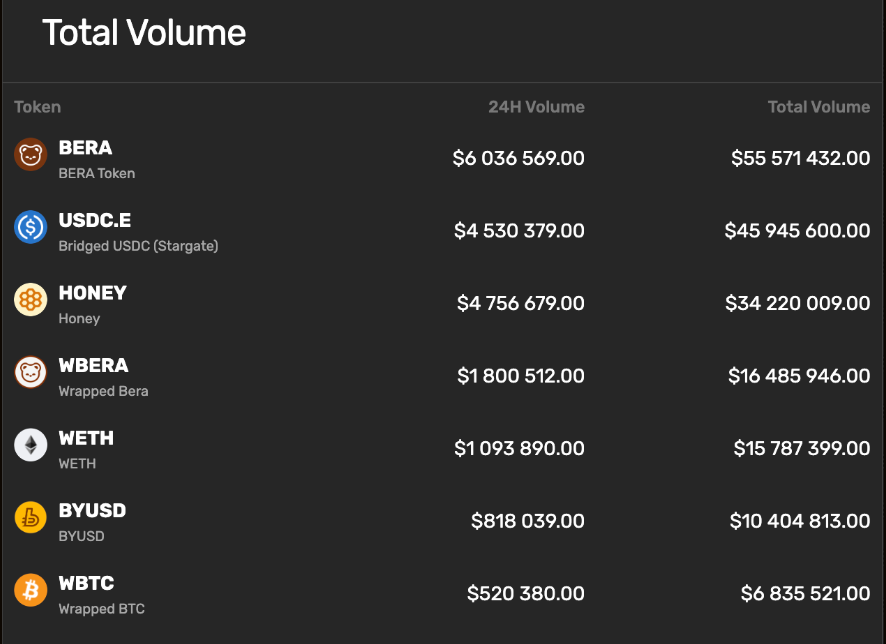

Ooga Booga is a native liquidity aggregator that has completed nearly $200 million in trading volume since its launch. These trading volumes come from a variety of tokens, mainly including BERA, HONEY and USDC.e.

In addition to trading volume, Ooga Booga is constantly listing new tokens and allowing users to trade assets on multiple DEXs, providing a simple user experience while continuously launching new partnerships and integrations.

In addition to trading volume, Ooga Booga is constantly listing new tokens and allowing users to trade assets on multiple DEXs, providing a simple user experience while continuously launching new partnerships and integrations.

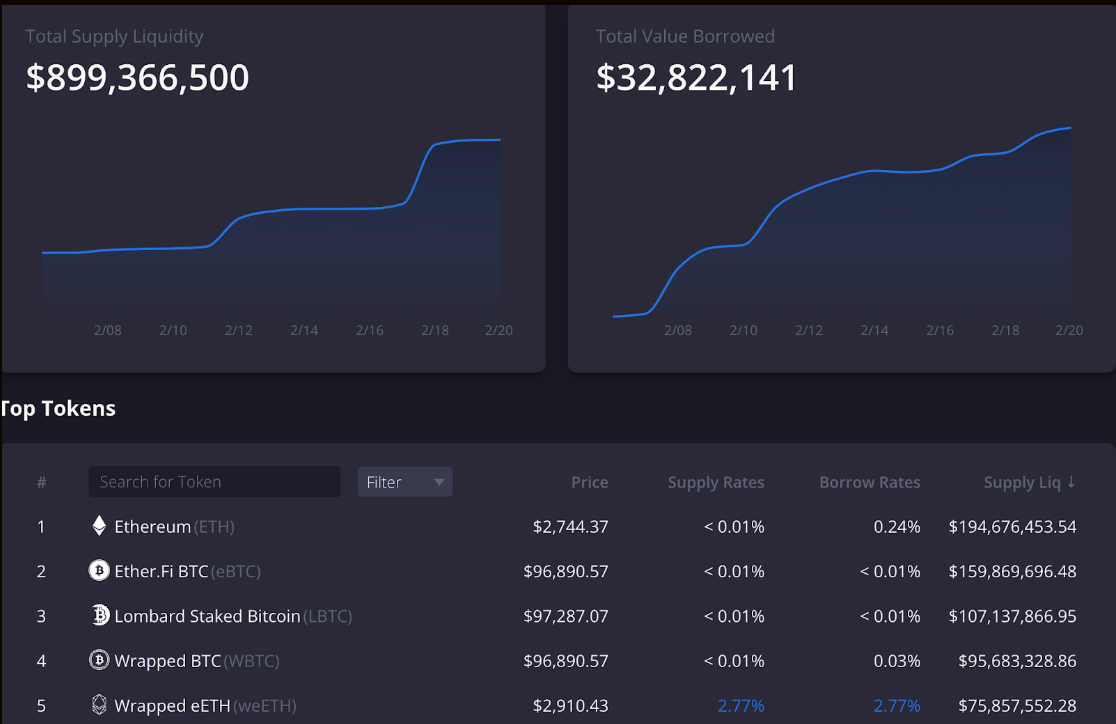

The Dolomite protocol has attracted nearly $1 billion in assets to the platform, of which over $32 million has been loaned out. Dolomite is building a money market and margin trading protocol to serve Berachain and users who want to make the most of their assets.

For users who want to stake BGT or BERA, Infrared is key.

The platform is a user-friendly liquidity staking solution focused on PoL. Infrared has attracted more than 180 million BERA, through which users can stake BERA and receive iBERA, a liquidity token (ERC-20) backed by BERA 1:1. The deposited BERA tokens are staked through Infrared's validator network, and users can receive staking rewards without any action.

A major advantage of liquid staking tokens is not only the easy staking yield, but also its additional capital efficiency. In the Berachain ecosystem, you can use iBERA to provide liquidity, borrow, or serve as collateral without giving up staking rewards. Infrared will also launch iBGT, a liquid variant of its BGT for users who want to maximize PoL rewards, more information can be read here.

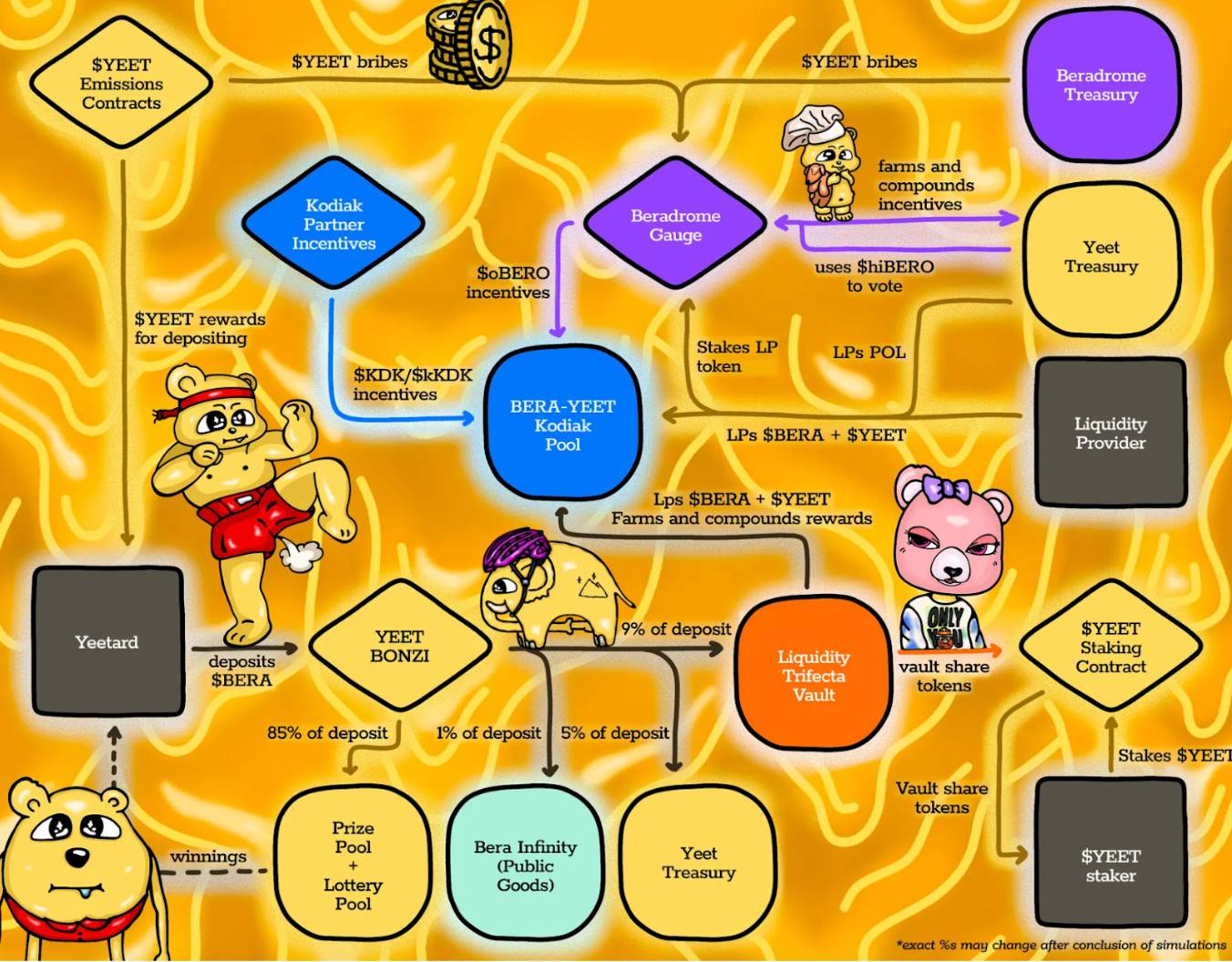

If you want maximum exposure to the Berachain ecosystem, you can deposit it in Yeet’s liquidity Trifecta Vault (described in detail here).

A TL;DR introduction is that Yeet has partnered with Beradrome and Kodiak to release a very user-friendly automatic yield product that allows depositors to receive mining yields and add them back to the Yeet/Bera LP position.

Instead of having to manually provide liquidity, stake voucher tokens to Beradrome, and route them through Kodiak’s YEET/BERA “sweet islands,” users can now do all of this directly through Yeet without having to go through the cumbersome steps. If you wish, you can even withdraw LP voucher tokens from the liquidity trifecta vault for other uses. The choice is yours.

Beradrome was officially launched on February 9th, with the goal of becoming the preferred liquidity market for any yield-bearing asset on Berachain. Although its structure is quite complex (you can see a detailed description in their documentation), this has not stopped community users from depositing assets and starting the "flywheel effect".

The architecture of Beradrome is inspired by observing the Solidly model and trying to optimize it. With the underlying operation of PoL, Beradrome is able to build deeper liquidity through reward vaults and revenue tokens. If this dApp continues to grow, users will be more motivated to participate in BERO, hiBERO and oBERO, thereby taking advantage of the advantages of Beradrome and PoL at the same time.

Last but not least, Smilee Finance launched gBERA, a unique liquidity staking token designed to automatically rebase and accumulate rewards through Berachain validators. Unlike other liquidity staking tokens such as iBERA, gBERA is unique in that it automates the reward claiming process and re-rolls rewards into BERA without any additional actions from users. The team plans to launch more integration features in the coming weeks, allowing users to wrap gBERA and use it in various applications in the ecosystem.

GameFi, SocialFi and MemeFi on Berachain

If DeFi isn’t your thing, that’s okay.

Berachain is not just another DeFi chain, its ecosystem has shown considerable diversity even just one week after its mainnet launch.

Maybe you just want to bridge to Berachain and take a break, avoiding dApps for a while while you plan your next move. If so, check out bera.tv. The team describes it as "the first cross-dimensional AI-generated TV show" that airs only on Berachain. If you like watching two AI bear news anchors talk about various topics, you've come to the right place.

Want to bet, but aren’t interested in sports? Over/Under is now live on mainnet, allowing you to bet on the outcomes of live video games in real time, and even set up parlays. Streaming has become one of the most popular ways to reach an audience, and the numbers don’t lie — last year, more than 7 million unique streamers used Twitch, with an average concurrent audience of 2 million.

If cryptocurrencies hope to break out of their niche and start attracting more users, catering to their interests is an important path to potential success. Over/Under hopes to become the go-to hub for streamers and speculators, and only on Berachain.

Memeswap aims to be a top destination for memecoin traders, providing an experience similar to pump dot fun, but designed specifically for the Berachain community. If you want to take advantage of the growing activity on the chain but don’t want to buy tokens directly, you can stake your BERA through Memeswap and provide leasing liquidity for new token issuances, thereby earning a yield.

For users who wish to actually trade tokens, they can use Memeswap to track new token deployments, recent bindings, and other details to stay up to date. Memeswap has completed over 370,000 BERA trading volume and has integrated with Infrared, Ooga Booga, and other teams to provide a seamless experience for all types of traders.

Shogun is building a platform to make it easier for users to get on-chain through gun.fun. Users can transfer assets from any chain to Berachain with just one click. The team went live on February 11th, and even though Berachain is an EVM equivalent chain, Shogun allows anyone to send assets from a non-EVM chain to Berachain.

Honey Chat is a native Berachain social networking application that aims to redefine social dynamics through on-chain mechanisms. Once users sign up and connect their existing X accounts, they gain access to a network where social reputation truly matters and governance is through tokens.

Advancing Proof of Liquidity (PoL)

Speaking of which, we can talk about PoL, even though it has not yet been officially launched.

Rather than waiting for PoL to activate, it’s better to proactively think about how PoL integrates with existing on-chain liquidity and how you can leverage it. Whether you switch between different dApps based on the reward program or choose to be loyal to one or two dApps, it’s valuable to think about these issues in advance.

As mentioned earlier, there are only five whitelist bounty vaults at the moment - what happens once more protocols start applying for the whitelisting process? The current BGT capture rate distribution is still relatively even, but this situation will most likely not last long. For more information on how the bounty vaults actually work, you can check out the documentation.

Berachain’s token economics is designed to promote a healthy balance between on-chain behaviors, separating gas tokens and governance tokens for good reasons. Instead of releasing 10% of the BERA supply each year, users and dApps can earn BGT, which has completely different unit dynamics and game theory.

Just to briefly mention, there are already some opportunities on the chain, such as Infrared's iBGT, which currently provides a good annualized rate of return (even stablecoin returns).

When PoL activates and goes live, those who made the early efforts will be rewarded for their patience and diligence, while others will need to catch up and understand why Berachain is so different from PoS chains.

At this point, this post should have given you enough to think about and act on, but there is still a lot that is not covered. If you want to stay up to date with the latest developments on Berachain, you can start with the Foundation’s X Account and Ecosystem Page, which will be updated as more teams go live on the mainnet.

Thanks for reading, Beras.