Author: Techub selected compilation

Written by Ryan Watkins, Co-founder of Syncracy Capital and former Analyst at Messari

Compiled by: Yangz, Techub News

Critics often cite the financial nihilism that pervades the cryptoeconomy as a reason to argue that the system will eventually collapse under the weight of its overdevelopment. Yet, amid the speculation that fuels this skepticism, we are also seeing some emerging “winners” that are growing over time. In this article, we will explore the contradiction between the “uselessness” and “utility” of the cryptoeconomy and show how they are actually two sides of the same coin.

"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of confidence, it was the epoch of incredulity, it was the season of sunshine, it was the season of darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all ascending to Heaven, we were all descending to Hell." - A Tale of Two Cities, Charles Dickens

Critics often point to the financial nihilism that pervades the cryptoeconomy as evidence of its futility. Despite being 16 years old since Bitcoin was launched and 9 years old since Ethereum, there are still few mainstream use cases that demonstrate their undeniable utility.

Every time we hear stories of users in emerging markets protecting their savings from inflation in their own countries through stablecoins, there always seems to be more users in developed markets pouring their savings into a gamble of various memecoins.

Stablecoins are liberation and destruction; blockchain is the great equalizer and the giant disruptor; the crypto economy is the future of the global financial system and the biggest collective illusion in human history.

These opposing views reveal the high risk that this technology has the potential to change the world, but also the potential for self-destruction due to its over-radical nature. For many, this contradiction has led to skepticism, making people wonder "what does this all mean?" and whether it still makes sense to have a long-term fundamental view on other assets in the crypto economy besides Bitcoin.

However, this contradiction between "uselessness" and "practicality" is not a flaw but a feature, which shows the growing pains that blockchain's revolutionary potential is experiencing.

Democratizing wealth in the digital age

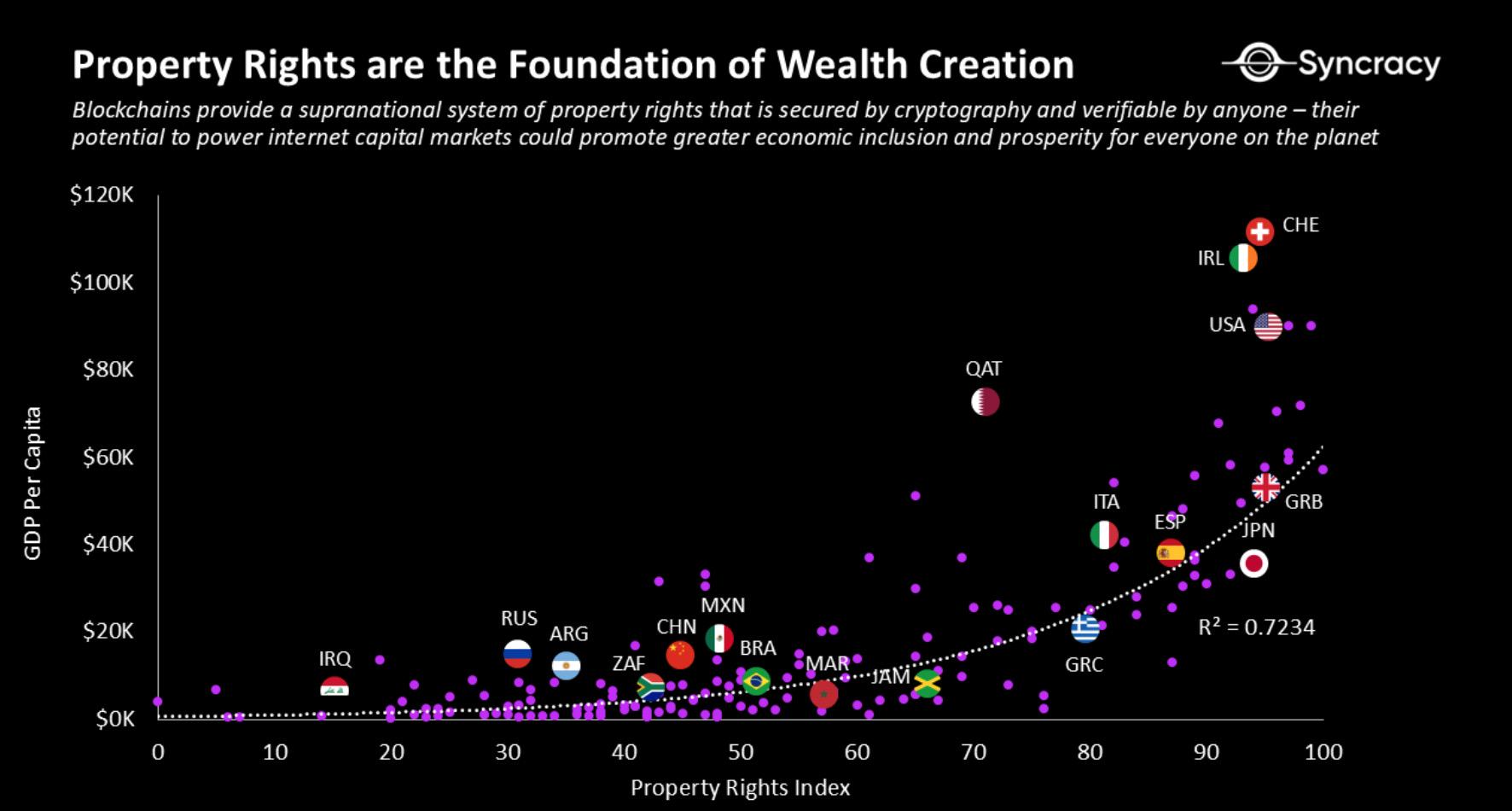

In a world of growing inequality between countries, blockchain technology has the potential to democratize wealth for billions of people. To understand this, you first need to understand the concept of blockchain as a new type of institution that enables users to conduct transactions and enforce contractual relationships without middlemen. Blockchain achieves this through a supranational system of property rights that is secured by cryptography and can be verified by anyone. It is a subtle but powerful tool that can be used to level the economic playing field.

Blockchains rely on the cloud to run, and their only physical presence is the thousands of computers distributed around the world, which collectively maintain the integrity of the network. Together, these computers create the Internet-native infrastructure for the market, which is the best mechanism so far to achieve the "perfect information" required for efficient resource allocation.

Property Rights Index; Data source: The Global Economy, International Monetary Fund

The significance of this change is best captured by Ronald Coase’s seminal 1937 paper, “The Nature of the Firm.” Coase argued that firms exist because the costs of finding information, negotiating agreements, and enforcing contracts in the marketplace exceed the efficiencies of outsourcing.

Blockchain fundamentally changes this. By enabling automated execution through cryptography, blockchains can make information universally available and reduce reliance on intermediaries, drastically reducing transaction costs, especially when combined with complementary internet-era technologies such as search engines and “gig economy” platforms. As transaction costs fall, the need for large, hierarchical companies diminishes, paving the way for blockchain-based global market structures that can maximize economic production, improve market efficiency, and lay the foundation for entirely new markets.

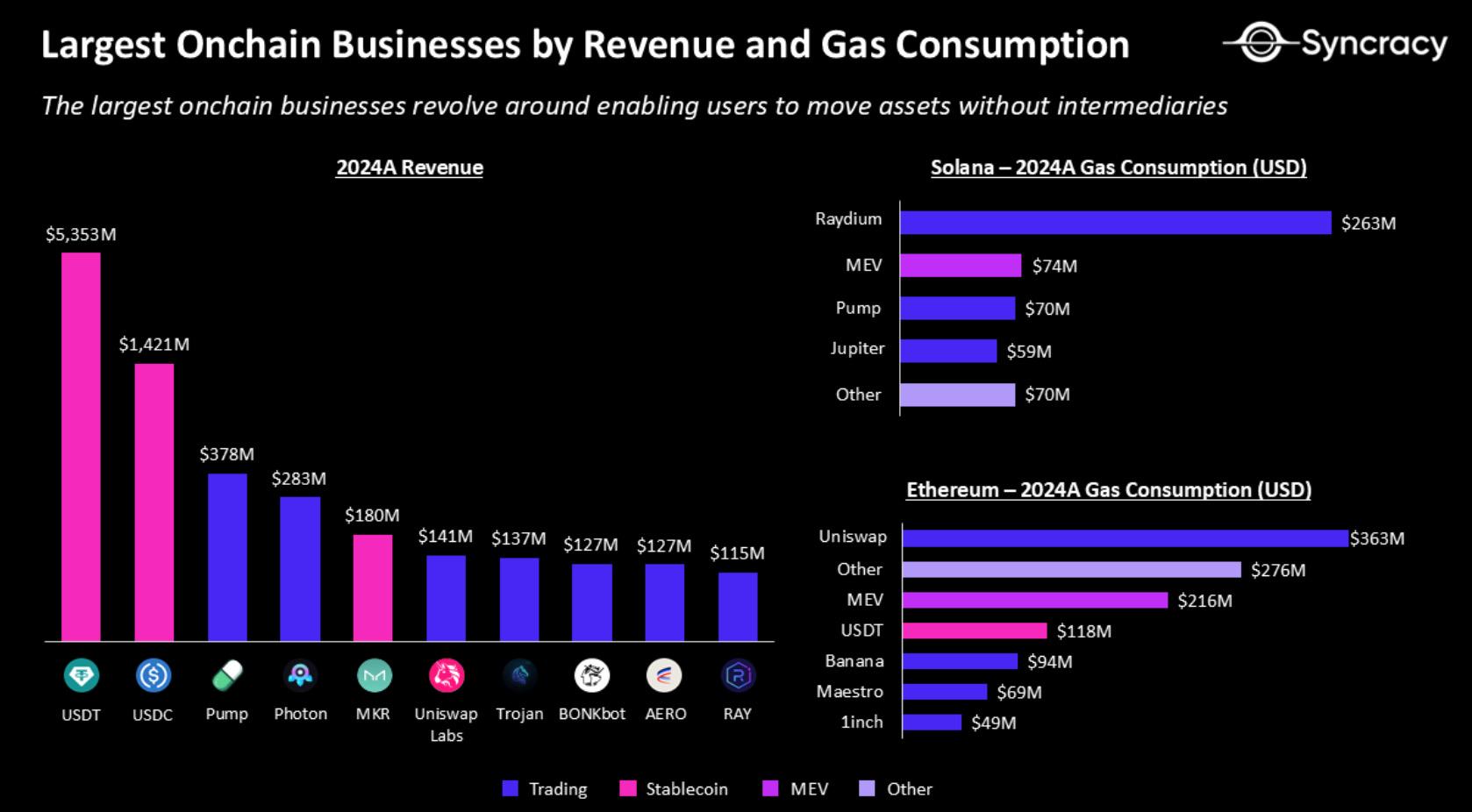

The largest on-chain "business" by revenue and gas consumption in 2024; data source: DeFiLlama, Artemis, Top Ledger

The crypto economy has already demonstrated these advantages. Stablecoins promote economic growth and financial inclusion by providing cheap, reliable money to users around the world; global exchanges and lending platforms create more efficient markets and democratize access to capital markets; DePIN creates entirely new markets that enable users to coordinate and monetize disparate physical and digital resources. All of these use cases operate extremely efficiently, with software-like profit margins, while blockchain automatically handles much of the back-end infrastructure and settlement activities. Large financial institutions and enterprises are slowly recognizing this potential, with many either launching products directly on the blockchain or integrating blockchain-based projects as the back-end infrastructure of existing products.

So why are some still skeptical about the crypto economy?

The superposition of practicality and uselessness

The creation of a decentralized infrastructure for transactions and contract execution inevitably leads to unlimited experimentation. The momentum for this experimentation is also extremely strong, as the potential user base of blockchain includes billions of Internet users around the world. Even world leaders are issuing their own currencies. The lure of opportunity has led to the rapid proliferation of new assets and financial protocols, including both revolutionary innovations and outright scams.

While these attempts may seem frivolous, it’s not too different from what happened during the dot-com bubble , when companies often went public with little more than a domain name. In contrast, the crypto economy amplifies this dynamic to an extreme, providing internet-scale capital markets to anyone. This has provided an unprecedented arena for innovation and speculation, ultimately accelerating the pace of discovery and adoption. After all, speculation attracts new users and provides much-needed stress testing for the system before trillions of dollars of future value enter the blockchain space.

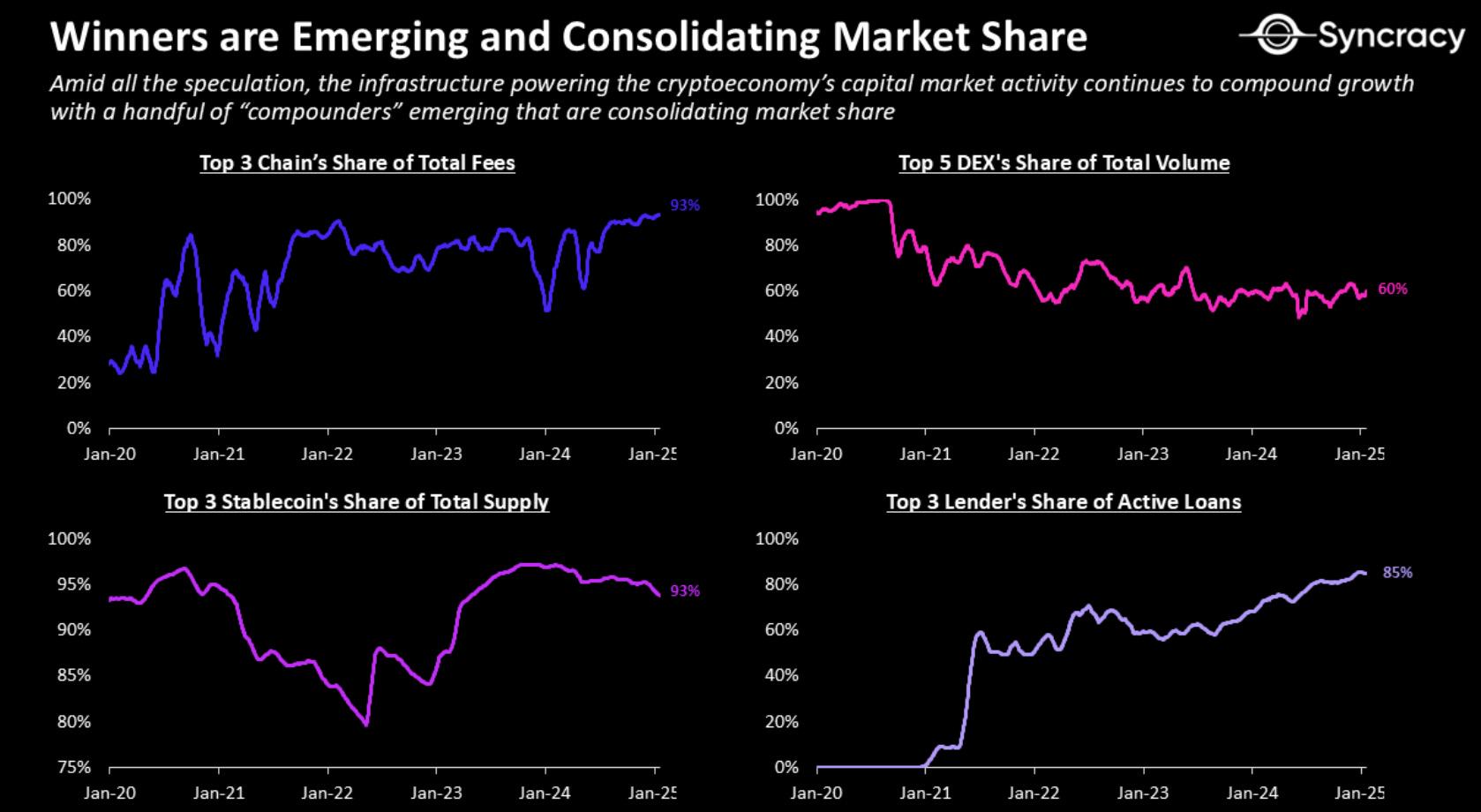

“Winners” are emerging and consolidating market share; data source: DeFiLlama, Artemis, Token Terminal

However, amid all the speculation, a handful of “winners” have begun to emerge. Many projects are driving speculative activity in the capital markets that grabs the headlines and compounds behind the scenes. These “winners” are the rare “compounders” that are consolidating market share, expanding their capabilities, and increasingly serving non-speculative use cases over time. These projects will ultimately provide the backbone for the crypto economy to mature and scale globally.

Will parallel roads intersect?

For the foreseeable future, Syncracy believes that the best way to articulate the fundamental thesis of the crypto economy is to find assets that are both robust and capture the inherent speculative momentum of the Internet capital markets. This is not a profound statement, because in practice, it just means embracing fast-growing projects that people actually use. For now, this also means doing more trading volume, such as monetizing speculation on the chain directly through asset issuers or market platforms (such as exchanges), or investing in its underlying infrastructure, such as L1. These L1s not only monetize speculation, but also provide a flexible valuation framework because they are often priced as currency-like assets.

In fact, long speculation via infrastructure (fast-growing projects that people actually use) has been the common denominator for many of the biggest winners in this cycle. Solana offers best-in-class performance that makes the on-chain trading experience similar to traditional retail trading platforms (such as Robinhood); Phantom creates an Apple-like user-friendly experience with a special focus on mobile apps, allowing users to speculate anywhere, anytime in an unprecedented way; Pump.fun compresses the cost, effort, and resources required to launch a new token; Hyperliquid gives on-chain traders the feeling of using a centralized exchange, but at a lower cost, with fewer barriers and restrictions; Virtuals and ai16z (Eliza) allow anyone to launch an AI agent with an associated token and wallet; Telegram bots and token discovery tools (such as Photon and DexScreener) bring light to the on-chain economy and make it easily accessible from familiar applications. The list goes on.

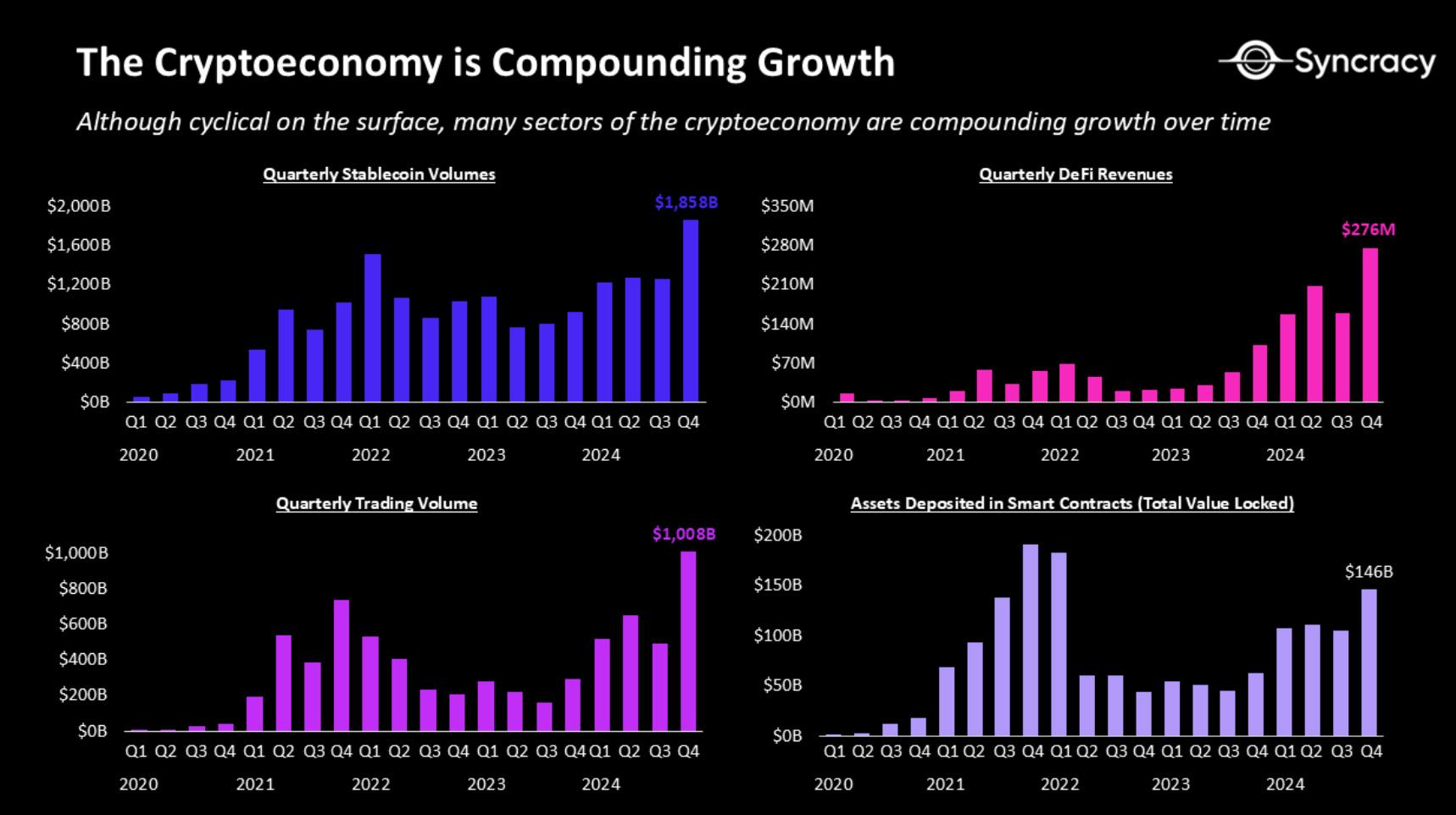

The crypto economy is growing at a compound rate; data source: DeFiLlama, Artemis

Eventually, we will move beyond this model of relying on speculative projects to attract super high attention and traffic, especially after more institutional investors enter this asset class. At the same time, there are many less speculative but promising projects in DeFi and DePIN, which are steadily rising along the "Slope of Enlightenment" ( the fourth stage in Gartner's technology maturity curve: the technological advantages begin to gradually emerge and are more widely understood ). These projects have shown early signs of product-market fit and fundamental improvement. While these assets may take time to achieve valuation growth, they also urgently need a clear regulatory framework to drive them into the mainstream. Although some tracks (such as stablecoins) have pointed the way forward for the industry and confidently entered the deployment stage of the life cycle, given the current complex crypto-economic activities, bystanders can still find many counterexamples and interpret them according to their own biases.

Nonetheless, from an investment perspective, our immediate goal is to cultivate long-term players and take advantage of the two sides of the crypto economy, increasingly serving real, non-speculative use cases while leveraging speculative energy to drive financial change. Such assets can achieve compound returns over time, rather than being caught in the vortex of "rotational play" like other more narrative-driven assets in the crypto economy. These assets will ultimately lead the world's transition to on-chain, as the speculation they drive attracts new users and provides much-needed stress testing before trillions of dollars worth of activity enters the blockchain space in the coming years.

In fact, uselessness and practicality are like two sides of a coin.