Author: Weilin, PANews

On July 19, US President Trump officially signed the Genius Stablecoin Regulatory Act, establishing the first federal-level stablecoin regulatory framework in the United States. This is also the first cryptocurrency-related bill to become legislation in the United States.

According to Fortune, the amendment regarding the conflict of interest in the Trump family's crypto project, which was previously controversial, was not passed, and the relevant provisions were not reflected in the final version of the bill.

At the same time, a crypto lawyer pointed out that the GENIUS Act provides incentives for stablecoin issuers to seek banking licenses. The passage of the bill has brought unprecedented new signals to the US crypto industry and has also triggered extensive discussions on future stablecoin issuers and market competition.

The Genius Act was officially signed into law, with multiple crypto founders present

In the crypto industry, the regulation of stablecoins has always been an unresolved issue. As the first federal regulatory framework for stablecoins in U.S. history, the GENIUS Act provides a clearer regulatory direction for the U.S. market and fulfills Trump’s crypto promise when he was running for president to win over voters.

On July 18 local time, US President Trump said at the bill signing ceremony: "This afternoon, we took a decisive step to consolidate the United States' dominance in the global financial and encryption technology fields. We will sign the landmark GENIUS Act into law."

Trump added: "They (members of the Biden administration) have come a long way since the Biden administration, when they had no idea what you were talking about and half of them were arrested for no reason." Trump also said that the signing was a "huge endorsement" of the encryption industry.

Trump also greeted the crypto industry executives present, including Tether CEO Paolo Ardoino and Coinbase CEO Brian Armstrong. Several leading crypto company founders and executives also attended the signing ceremony, such as Circle founder Jeremy Allaire, Anchorage Digital CEO Nathan McCauley, Coinbase Chief Legal Officer Paul Grewal and Coinbase Chief Policy Officer Faryar Shirzad.

In a promotional video released by the White House, David Sacks, the White House AI and encryption director, said, "The bill will update the outdated payment infrastructure with a revolutionary new payment system and will expand the dollar's global dominance."

The Genius Act establishes a federal regulatory framework for stablecoins, requiring that stablecoins must be fully backed by U.S. dollars or similar liquid assets, requiring issuers with a market value of more than $50 billion to undergo annual audits, and establishing guidelines for the issuance of stablecoins by foreign entities.

On Thursday, local time, the GENIUS Act passed the U.S. House of Representatives with 308 votes in favor and 122 votes against. The bill has already passed the Senate, so it will be sent to Trump for signature after passing the House of Representatives. The process of passing the GENIUS Act, as well as the Clarity Act on the structure of the crypto market and the anti-central bank digital currency (CBDC) bill, encountered some obstacles because some conservative Republican lawmakers voted against it in two procedural votes.

The Genius Act would take effect 18 months after Trump signs it, or 120 days after the “lead federal payments stablecoin regulators” — including the Treasury Department and the Federal Reserve — issue final regulations implementing the bill.

Dual licensing structure allows for interstate regulation and fails to avoid Trump family conflicts of interest

Before the bill was signed, crypto advocates expressed their support on the X platform. Jeremy Allaire posted on the X platform: "Heading to the White House to attend the historic signing ceremony of the GENIUS Act, one of the most transformative legislation in decades. Global financial system, welcome to the Internet!"

Nic Puckrin, founder of Coin Bureau, told the outside world that the GENIUS Act may push stablecoins into the mainstream by enhancing trust in the currency and encouraging more competition in the market.

“Right now, the stablecoin market is effectively a duopoly, almost completely dominated by Circle’s USDC and Tether’s USDT,” Puckrin said. Because the bill would provide a clear path for banks and other entities to issue stablecoins, “we are likely to see a large influx of stablecoins into the market,” he said.

Big banks are preparing to issue their own stablecoins. While they may not all be successful, Puckrin said they will provide consumers with more options to help them find the stablecoin and issuer that best suits their needs.

However, critics of the GENIUS Act argue that it compromises the decentralization of cryptocurrencies and could lead to corruption, such as officials favoring certain stablecoins under the new regulations.

“We need to ensure that government officials are not openly asking people to buy their coins to increase personal or family profits,” said Oregon Senator Jeff Merkley, who opposed the bill, during Senate debate. “Where are those safeguards in this bill? Absolutely not.”

Some critics also say the bill gives too many entities the ability to issue new stablecoins, which could make it more difficult to enforce regulatory standards.

It is worth mentioning that the amendment to avoid Trump's conflict of interest was not passed. Before the GENIUS Act was passed on Thursday local time, some Democrats expressed concerns about World Liberty Financial USD1, which is operated by the Trump family. Maxine Waters, a Democrat on the House Financial Services Committee, raised the issue of potential conflicts of interest on Thursday and conveyed other concerns about foreign issuers.

In addition, Todd Phillips, a professor of banking and administrative law at Georgia State University, pointed out that the new bill would authorize the Office of the Comptroller of the Currency (OCC) to regulate stablecoin issuers nationwide, but the Trump administration has increasingly tended to weaken the independence of regulators, including firing agency heads. "The president has an indirect financial relationship with a stablecoin issuer, which is a very big problem," Phillips said. "This stablecoin issuer may apply for a license from the OCC, and if the OCC does not approve it, the president can fire the monetary supervisor."

He also raised concerns about the structure of the new bill, which creates a dual licensing structure for some stablecoin issuers, allowing them to seek either federal or state regulation, which he said could lead to a “low-standard competition” among different jurisdictions to attract crypto companies.

Banking licenses will be sought after by stablecoin issuers, while DeFi platforms face uncertainty

According to Cointelegraph, Logan Payne, a cryptocurrency lawyer at Winston & Strawn, said that the GENIUS Act provides incentives for stablecoin issuers to seek banking licenses. He said that the stablecoin license established under the GENIUS Act limits the company's activities to "pure stablecoin issuance", but most stablecoin issuers do more than just that.

“Almost every issuer of a stablecoin currently in the U.S. under U.S. law is engaging in activities that are outside the scope of that license,” Payne said. Even if an issuer obtains a license approved under the GENIUS Act, Payne said they would still need to obtain a state-level money transmission license to operate nationwide.

This creates an incentive for stablecoin issuers to apply for state trust bank charters, as Circle and Ripple have done, “which would allow them to engage in stablecoin issuance and a broader range of activities without having to obtain licenses from state to state,” he said.

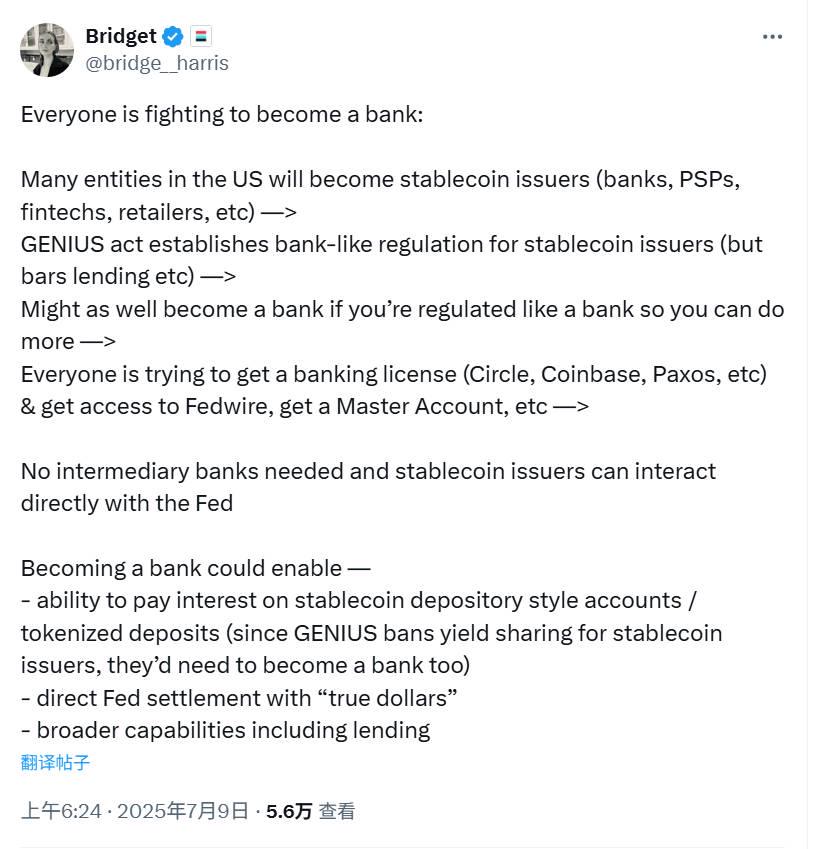

Bridget Harris, investment manager at Founders Fund, holds a similar view. Bridget wrote on the X platform, "Everyone is vying to become a bank: Many entities in the United States will become stablecoin issuers (banks, payment service providers, fintech companies, retailers, etc.). The GENIUS Act establishes bank-like regulation for stablecoin issuers (but prohibits lending, etc.). Since they are regulated like banks, they might as well become banks directly, so that they can do more. Everyone is vying to obtain a banking license (Circle, Coinbase, Paxos, etc.) and obtain access to the Federal Clearing System (Fedwire), master accounts, etc. There is no need for an intermediary bank, and stablecoin issuers can interact directly with the Federal Reserve.

She said that issuers applying to establish banks could bring the following benefits: the ability to pay interest on stablecoin deposit accounts/tokenized deposits (since the GENIUS Act prohibits stablecoin issuers from sharing profits, they would also need to become banks to do so); direct settlement with "real dollars" at the Federal Reserve; and broader capabilities including lending.

A controversial part of the bill for some crypto users is that it prohibits stablecoin issuers — whether foreign or regulated under U.S. law — from providing interest or returns to holders and users.

Yield provision is one of the marketing methods used by stablecoins to attract users. Some stablecoins natively provide yield to holders, while others, such as Circle's USDC (USDC), reward users who hold stablecoins on exchanges such as Coinbase and Kraken. "There will be more legislation and regulation to fill some gaps in the coming years to meet the challenges of DeFi," said Payne, the lawyer mentioned above. One of them is the CLARITY Act, a bill that classifies digital assets and stipulates relevant regulatory agencies. The bill was passed by the House of Representatives and sent to the Senate on Thursday local time.

Payne also analyzed the exemptions for foreign stablecoin issuers. Within three years after the bill is signed, any stablecoin that is not from an approved issuer will be prohibited from being offered in the United States. In addition, foreign-issued stablecoins will also be prohibited from being offered in the United States unless the issuer of the stablecoin is able and willing to comply with the legal requirements of the bill.

The bill provides some exemptions for foreign stablecoin issuers, including if the Treasury Department determines that their country of origin has a comparable regulatory framework. If this is the case, the foreign issuer can serve the U.S. market by registering with the Office of the Comptroller of the Currency (OCC), successfully obtaining approval, receiving a response within 30 days, and holding sufficient reserves at U.S. financial institutions to cover its U.S. customers.

In general, the signing of the GENIUS Act marks a new historical stage for US stablecoin regulation. Although the bill has sparked controversy in some aspects, especially the potential conflict of interest of the Trump family, it may also provide arbitrage space for future stablecoin issuers. As the regulatory environment changes, PANews will continue to pay attention to subsequent developments.

Related reading: