Want to invest in Bitcoin but think the current price is too high? Afraid of missing out on the bull market? Binance recently launched the Discount Buy feature, which allows you to set your desired price to buy BTC/ETH using USDT. Even if you don't get it, you'll still earn a profit, making it worth your while!

This product can be thought of as a "limit order with higher capital efficiency." Users use stablecoins like USDT to set a target purchase price and strike price, select an investment period, and a fixed annualized yield. Once the order matures and the conditions are met, the buy is automatically executed. Unlike regular limit orders, this product generates income while the funds are waiting, ensuring investors receive a return regardless of whether the order is ultimately executed.

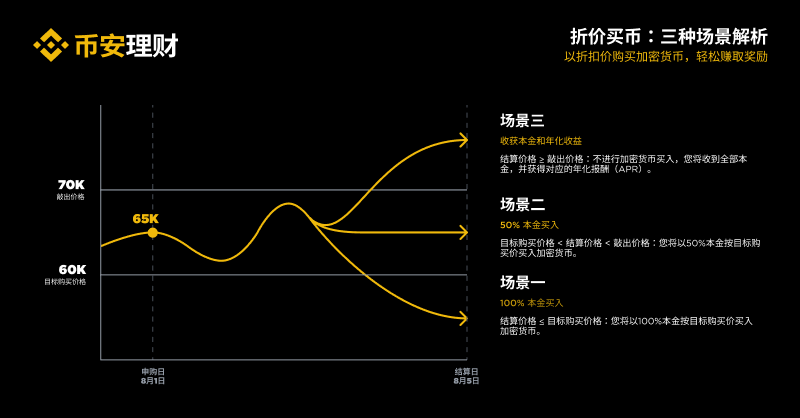

Suppose an investor invests 1,000 USDT and sets a target purchase price of $60,000 for BTC with a strike price of $70,000, a 20% annualized yield, and a 10-day term.

Three possible outcomes on the settlement date:

-If the BTC price is less than or equal to $60,000, all funds will be used to purchase BTC at the set price;

-If the price is between $60,000 and $75,000, 50% of the funds will be used to purchase BTC, and the remaining 50% will be returned;

-If the price is greater than $75,000, the principal will be fully returned, and the annualized return will be calculated as stated above.

The biggest highlight of this feature is that it solves the problem of idle funds in traditional limit orders. In conventional trading, funds placed in limit orders generate no returns, but buying at a discount allows these funds to continue generating value during the waiting period. For investors who are bullish on an asset in the long term but believe the current price is too high, this is undoubtedly a more efficient way to enter the market.

The following is a simple comparison between buying coins at a discount and limit orders:

|

Project |

Buy coins at a discount |

Traditional limit order |

|

Are funds locked? |

Yes, until the product settlement date |

No, you can cancel at any time |

|

Is there any profit if the transaction is not completed? |

Yes, if the transaction is not completed, you can get a fixed annualized return. |

No |

|

Can a partial transaction be completed? |

Yes, you may get half the purchase and half the refund. |

Depends on market liquidity |

|

Applicable scenarios |

Buying a coin at a discount is particularly valuable during periods of sideways or modest gains. Investors setting a target entry point below the current market price not only preserve the opportunity to buy at a low price but also ensure their funds generate returns while waiting. Compared to traditional wealth management products or simply holding onto coins, this structured approach offers a better risk-return balance. Of course, as a structured, high-yield investment product, there are several risks associated with buying at a discount. First, the target price must be based on market forecasts. Second, funds cannot be redeemed before the settlement date. Finally, while the probability of a return is high, the ultimate payout depends on actual market trends, and there's a chance the market could fall further after a successful purchase at a discount. Overall, Binance's discounted buy feature represents an innovative direction for cryptocurrency financial products, combining trading strategies with financial returns. In the current market environment, this tool offers investors more diversified options and helps optimize the overall performance of their portfolios. For investors who prioritize capital efficiency and risk management, it's worthwhile to gain in-depth knowledge and apply it effectively. How do I apply for discounted buys? 1.Log in to your Binance account and go to [Financial Management] > [Advanced Earnings] > [Buy Coins at a Discount];

2.Select from the list of available products. Each product has a preset target purchase price, strike price, annualized rate of return (APR), and settlement date;

3. Enter the amount you want to subscribe to;

4. If you are applying for a discount for the first time, you will be asked to complete a quiz. 5. Please carefully read the Terms and Conditions before applying and confirm that you understand that once your application is successful, your order cannot be modified, canceled, or redeemed until settlement. Share to: Author: 加密攻略 This article represents the views of PANews columnist and does not represent PANews' position or legal liability. The article and opinions do not constitute investment advice Image source: 加密攻略. Please contact the author for removal if there is infringement. Follow PANews official accounts, navigate bull and bear markets together Recommended Reading  Ethereum's turbulent decadeTen years have passed since the creation of Ethereum. Where is the "world computer" headed? This special feature will feature selected articles reviewing Ethereum's turbulent decade of rise, challenges, and breakthroughs.  PAData: Web3 in DataData analysis and visual communication of industry hot spots help users understand the meaning and opportunities behind each data.  Pioneer's View: Crypto Celebrity InterviewsExclusive interviews with crypto celebrities, sharing unique observations and insights  AI Agent: The Journey to Web3 IntelligenceThe AI Agen innovation wave is sweeping the world. How will it take root in Web3? Let’s embark on this intelligent journey together  Memecoin Supercycle: The hype around attention tokenizationFrom joke culture to the trillion-dollar race, Memecoin has become an integral part of the crypto market. In this Memecoin super cycle, how can we seize the opportunity?  Real-time tracking of Bybit attackBybit suffered a security incident, and funds worth $1.44 billion were withdrawn. A North Korean hacker group was accused of being the perpetrator. |