Whether you admit it or not, from the perspective of applications, the current crypto world is not fundamentally different from the crypto world 5 or even 10 years ago. Of course, the scale is bound to continue to increase, and Defi is also the biggest highlight, but in the final analysis, only currency applications are the most popular in the crypto market, in addition to Bitcoin, there are stablecoins.

Although both are out of the circle, their paths are very different. Bitcoin has convinced people with its growth, drawing a jaw-dropping 100-fold growth curve, successfully making the world justify its reputation, and is the main representative of decentralized currency. However, if measured from the perspective of practicality rather than value, stablecoins are the only cryptographic examples that have truly achieved large-scale adoption on a global scale.

To date, the global stablecoin market value has reached 243.8 billion US dollars. According to panel data provided by Visa, in the past 12 months, the total transaction volume of stablecoins has reached 33.4 trillion US dollars, the total number of transactions has reached an astonishing 5.8 billion times, and the total number of active unique addresses has reached 250 million.

The high frequency and large scale of use show that the application demand and application logic of stablecoins are basically mature, but from the perspective of supervision, stablecoins are still in the running-in stage. In recent years, the global supervision of stablecoins has been continuously improved. Just today, the U.S. Senate voted to pass the "Guiding and Promoting National Innovation in Stablecoins in the United States Act" (also known as the GENIUS Act), clearing the way for global stablecoin supervision.

01. Stablecoins are developing rapidly, with a prominent head effect

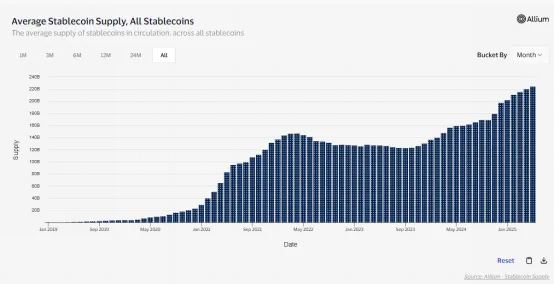

Stablecoins, as the name implies, are crypto assets that provide value stability by being linked to underlying assets such as fiat currencies, precious metals, commodities or asset portfolios. The main goal is to eliminate the volatility that is unique to many cryptocurrencies and provide users with reliable settlement, value storage and investment tools. As a value scale in the crypto market, every expansion of stablecoins reflects the growth of the industry. In 2017, the total circulation of stablecoins worldwide was less than $1 billion, but now it is close to $250 billion, and the global crypto market has also grown from less than $1 trillion to $3 trillion, moving from a small marginal market to the mainstream.

Judging from recent data, this round of bull market can be regarded as a bull market for stablecoins. After the FTX incident, the global stablecoin supply once returned from 190 billion to 120 billion US dollars, but then the stablecoin supply grew steadily and continued to grow within 18 months. Correspondingly, BTC climbed from the bottom of 17,500 US dollars to above 100,000 US dollars again. The reason is that the liquidity of this round of bull market comes from external institutions, and after external institutions intervene, they usually choose stablecoins as the medium, so it shows the characteristics of increased external liquidity and increased stablecoin scale.

Today, the types of stablecoins are diverse and complex. From the control center, centralized stablecoins and decentralized stablecoins can be distinguished. From the fiat currency type, they can be divided into US dollar stablecoins and non-US dollar stablecoins. They can even be divided into interest-bearing stablecoins and non-interest-bearing stablecoins based on whether they are interest-bearing or not. From the collateral, they can be subdivided into US debt, US dollars or digital asset collateral stablecoins, covering a wide range. Unlike other use cases, although the market has begun to see interest-bearing or rebate stablecoins, due to the stable value of the currency, stablecoins are essentially core pricing tools, not used for speculation, and are mostly not restricted by official institutions. They can be adopted globally, which also lays the foundation for stablecoins to become global currencies.

In terms of coverage, in addition to mainstream regions such as Europe, America, Japan and South Korea, emerging markets such as Brazil, India, Indonesia, Nigeria and Turkey, especially those with weak financial infrastructure and deep inflation, have begun to use stablecoins for daily transactions. According to a report released by Visa last year, the most popular use of stablecoins in non-cryptocurrency is currency substitution (69%), followed by payment of goods and services (39%) and cross-border payments (39%).

It is clear that stablecoins have begun to get rid of the label of crypto investment and become an important entry point for the integration of the crypto market and the global economy. In this context, the development pattern of global stablecoins has also attracted much attention. In terms of market share, the US dollar stablecoin occupies 99% of the stablecoin market, which also makes stablecoins jokingly called "US dollar branches."

In terms of details, due to the scale effect of the currency itself, the strong will always be strong, and the top is prominent, which is the key feature of the stablecoin field. Centralized stablecoins dominate one side, and USDT has become the absolute leader, with a market share of US$152 billion, accounting for 62.29% of the total market. The second is USDC, with a market size of about US$60.3 billion, accounting for 24.71%. These two alone account for more than 80% of the total market, which shows the degree of centralization. The third is USDe, which has broken through the siege with a unique mechanism and high yield. Strictly speaking, it is a semi-centralized stablecoin with a current market size of US$4.9 billion. Since Terra, algorithmic stablecoins have declined. In the stablecoin ranking, only the decentralized stablecoin in the Sky ecosystem is still at the forefront, with USDS of about US$3.5 billion. In view of the diversion effect, DAI is only US$4.5 billion. In terms of public chains, Ethereum occupies an absolute dominant position, with a market share of up to 50%, followed by Tron (31.36%), Solana (4.85%) and BSC (4.15%).

From a business perspective, the issuance of stablecoins is a harmless business. Large-scale issuance can make the marginal cost of the issuing institution infinitely close to zero. The direct exchange of digital currency for cash allows the issuer to make a lot of money in risk-free returns. Take Tether, the issuer of USDT, as an example. According to its 2024 full-year revenue report, it achieved a net profit of US$13.7 billion in a year, and the group's net assets soared to US$20 billion. The company's team is only 165 people, and the employee efficiency per square meter is amazing. Such high returns have attracted major institutions to join. In recent years, traditional financial institutions such as Visa and Paypal have been actively deploying this sector, and Internet companies are also ready to move. In addition to Meta overseas, JD.com in China also hopes to get a share of the pie in Hong Kong. At present, the Trump family project WLFI is also launching the stablecoin USD1, which was soft-launched on April 12. It has rapidly expanded and integrated more than 10 protocols or applications.

02. Regulatory adjustments are accelerating, and the US Senate passes the GENIUS Act

Institutions rushed to the beachhead, and regulation came as expected. So far, looking around the world, including the United States, the European Union, Singapore, Dubai, and Hong Kong, have begun or have already improved legislation around the stablecoin framework. The United States, the center of cryptocurrencies, is undoubtedly the most eye-catching region in the world.

From the perspective of US regulation alone, stablecoins have gone through a complete process from highly uncertain to certain. Before 2025, the US Congress had not issued any special regulations for stablecoins and cryptocurrencies. In the existing regulations, the SEC, CFTC and OCC have all defined stablecoins in order to gain dominance in this emerging sector. The US Financial Crimes Enforcement Agency uses the licensing system as a tool to regulate entities engaged in the issuance and trading of cryptocurrencies, while the SEC relies on the Securities Exchange Act to accuse some stablecoins (such as BUSD and USDC) of being securities. The commodity theory of the CFTC focuses on the anti-fraud and anti-market manipulation of stablecoins. The complex regulatory nesting not only makes it difficult to define the subject control, but also shows a diversified trend in the state-level stablecoin regulatory environment under the US administrative system. There are currency dealer licenses under state law. For example, New York has an independent cryptocurrency license.

It is clear that the regulation of stablecoins before 2025 is quite fragmented, and there is even regulatory chaos caused by the struggle between regulatory agencies, which has brought high uncertainty and compliance difficulties to the stablecoin industry. But now, with Trump taking office, the regulation of stablecoins has also been accelerated.

As early as February this year, Bryan Steil, Chairman of the U.S. House of Representatives Digital Assets Subcommittee, and French Hill, Chairman of the Financial Services Committee, submitted a draft of the Stablecoin Transparency and Accountability Promoting the Ledger Economy Act of 2025 (STABLE). In the same month, Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis jointly proposed the Guidance and Establishment of a U.S. Stablecoin National Innovation Act in the Senate.

The simultaneous introduction of the two bills is not a surprise, but a forward-looking action supported by the top level. At the first crypto summit held by the White House in March this year, Trump expressed his interest in stablecoins. He not only said that this would become a "promising" growth model, but also expressed his hope that Congress would submit relevant legislation to the President's office before the August recess, sending a clear signal.

On March 17, the Senate Banking Committee passed the GENIUS Act with a bipartisan support rate of 18 votes in favor and 6 votes against, and formally submitted the bill to the Senate. On March 26, the STABLE Act successfully submitted a revised version, and was passed by the House Financial Services Committee on April 3 and submitted to the House for a full vote.

Although both are stablecoin bills, they have slightly different focuses. STABLE prioritizes unified federal control, while GENIUS emphasizes building a dual-regulation management system that runs parallel to the state and federal levels. STABLE limits issuance qualifications to insured depository institutions and non-bank institutions approved by the federal government, while GENIUS allows more types of issuers to open access. Both require 1:1 reserve support and monthly disclosure, but STABLE is more stringent, requiring the Federal Deposit Insurance Corporation (FDIC) to provide insurance, and also imposes a two-year ban on algorithmic stablecoins, while GENIUS allows exploration of algorithmic stablecoin mechanisms under certain conditions. In addition, the GENIUS Act supports stablecoins to provide interest or income to holders, but the STABLE Act explicitly prohibits interest payments.

In practice, both bills have faced questions from many parties. State governments oppose the federal government's regulatory priority for STABLE, and some industry insiders are dissatisfied with the harsh terms. GENIUS has mainly attracted discussions on compliance costs, believing that the dual-track system will increase compliance costs and that the bill focuses too much on the US domestic market and ignores the usage needs of third world countries.

At present, the GENIUS Act is progressing faster than STABLE. On May 9, the GENIUS Act failed in a Senate vote with 48 votes in favor and 49 votes against. The reason was that the Democrats demanded to strengthen anti-corruption clauses and prohibit executive branch members from holding cryptocurrencies, and bluntly said that Trump was corrupt in cryptocurrencies, but the Republicans did not give in. In response to this incident, the US Treasury Secretary tweeted that US lawmakers were doing nothing and expressed dissatisfaction with the decision.

Shortly afterwards, the GENIUS Act passed its second round of review. In the updated version, the regulatory mechanism was divided by scale, that is, stablecoins with assets exceeding 10 billion are regulated by the federal government, and stablecoins with a market value of less than 10 billion are self-regulated by the states. At the same time, it clearly separated from the insurance credit and government credit of the United States, reduced systemic risks, and added restrictions on the participation of technology companies in stablecoins. Although the updated bill still did not touch on the ethical standards questioned by the Democrats, there was still progress in the protection of investors and existing mechanisms. Against this background, some Democrats successfully switched sides. On the evening of the 19th, the U.S. Senate passed the procedural motion of the GENIUS Act with 66 votes in favor and 32 votes against, clearing the way for final legislation. The next step will be to enter the Senate's plenary debate and amendment process, and the subsequent process is to submit the bill to the House of Representatives for deliberation, but considering that the threshold for passage in the House of Representatives is relatively low, the possibility that the bill will eventually be submitted to the President's Office for signature and become final legislation is very high.

The passage of this bill is undoubtedly an important milestone in the history of crypto assets in the United States. It will fill the regulatory gap of stablecoins in the United States, clarify the regulatory subjects and rules, further promote the vigorous development of the stablecoin industry in the United States, and once again contribute to the mainstreaming of the crypto industry. From the perspective of the United States itself, after the promulgation of the regulations, the benefits of the deep penetration of the US dollar based on stablecoins will be more prominent, and the trend of the crypto market becoming a subsidiary of the US dollar will continue to strengthen, providing a core driver for the construction of centralized and decentralized hegemony of the US dollar. It is worth noting that no matter what kind of bill, it requires stablecoin holders to hold US Treasury bonds, US dollars, etc., which also creates new and continuous purchasing demand for US bonds.

03. Outside the United States, global stablecoin regulation has taken shape

There will be clear stablecoin regulation in 2025, which is enough to show that stablecoin regulation in the United States is not at the forefront. In fact, long before the United States, the European Union launched the Markets in Crypto-Assets (MiCA) Act, which provides a comprehensive regulatory framework for all crypto assets, including stablecoins. In terms of stablecoins, MiCA divides them into asset-referenced tokens and electronic currency tokens, and also prohibits algorithmic stablecoins. It requires stablecoin issuers, especially those with a certain market size, to maintain a 1:1 capital reserve, comply with transparency rules, and complete registration with EU regulators. At the same time, the European Insurance and Occupational Pensions Authority (EIOPA) recommends that insurance companies holding crypto assets (including stablecoins) be subject to regulatory requirements.

Strict capital management systems are implemented, requiring insurance companies to set aside 100% capital adequacy ratio for such asset holdings and to treat them as zero-value assets in solvency calculations.

Outside the EU, Hong Kong is also a leader in stablecoin regulation. On December 6, 2024, the Hong Kong government published the Stablecoin Bill in the Gazette and submitted it to the Hong Kong Legislative Council for first reading on December 18. According to the latest news, the plan will resume the second reading debate at the Legislative Council meeting on May 21. Hong Kong has shown a cautious and inclusive attitude towards stablecoin legislation, and also adopts a licensing system for management, clarifying that issuers must be established in Hong Kong, have sufficient financial resources and liquid assets, and pay a share capital of not less than HK$25 million. It is necessary to ensure that reserve assets are separated from other reserve asset portfolios, and specify that the market value of the reserve asset portfolio must be at least equal to the face value of the unredeemed and still circulating stablecoins at any time, that is, 1:1 reserves. Earlier in July last year, the Hong Kong Monetary Authority announced the list of participants in the "Sandbox" of stablecoin issuers, including JD Coin Chain Technology (Hong Kong) Co., Ltd., Yuancoin Innovation Technology Co., Ltd., Standard Chartered Bank (Hong Kong) Co., Ltd., Anmi Group Co., Ltd., and Hong Kong Telecom Co., Ltd.

In addition to the above-mentioned regions, Singapore and Dubai have also been involved in stablecoin regulation. Singapore released a stablecoin regulatory framework in 2023, while Dubai listed stablecoins in the Payment Token Services Regulations.

Overall, there are limited differences in global stablecoin regulation, and latecomers show obvious signs of absorbing the experience of the former. Global regulators focus on licensing and supervising issuers, and have made clear provisions on issuance reserves, risk isolation, anti-money laundering and counter-terrorism. The differences are mainly reflected in the permitted categories of stablecoins, issuer restrictions, and localized anti-money laundering compliance.

However, the major regions of the world have successively introduced stablecoin regulation, which is enough to reflect that the role of stablecoins in the global financial market is moving from being ignored to being a hundred schools of thought. Stablecoins have gradually become an important part of the global currency market. In addition to further enhancing the voice of the crypto market, they have also added a strong touch to the killer applications in the crypto field. On the other hand, third world countries can also use stablecoins for 24-hour global settlement, which is a true realization of Satoshi Nakamoto’s original vision - free electronic cash.

Life is full of ups and downs. After a hundred years of cryptocurrencies, how many of the claimed valuable applications will still survive the test of time? From the current perspective, at least stablecoins and Bitcoin still have their meaning of existence.