Hong Kong pushes forward with stablecoin regulation as digital assets grow

Key points:

Paul Chan announced stablecoin regulations and digital asset trading data.

It has a significant impact on digital currency trading volume.

Hong Kong will strengthen its leadership in the cryptocurrency market.

Hong Kong’s financial landscape is set to change as new stablecoin regulations come into effect on August 1, 2025. Financial Secretary Paul Chan Mo-po revealed that digital assets have driven significant transaction volumes at local banks, totaling HK$17.2 billion last year.

The regulation introduces a licensing regime for stablecoin activities, aiming to attract global issuers and enhance market liquidity.

Hong Kong Stablecoin Regulation to Take Effect in 2025

Financial Secretary Paul Chan announced that Hong Kong’s new stablecoin regulations will take effect on August 1, 2025. Last year, Hong Kong banks’ digital asset trading volume exceeded HK$17.2 billion. In his article titled “Accelerating Development, Seeking Progress in Stability,” Chan stressed that the move is aimed at boosting financial institutions.

With the introduction of this regulation , stablecoin issuers can anchor multiple fiat currencies, not just the Hong Kong dollar. This flexibility is expected to increase liquidity and enhance Hong Kong's attractiveness as a financial center. The regulation provides a structured environment that paves the way for sustainable growth.

Hong Kong Financial Secretary Paul Chan Mo-po emphasized the potential of digital asset development. He said: "Accelerated advancement and steady progress", highlighting the catalytic effect of digital asset development on local financial institutions.

Hong Kong’s strategic positioning in digital finance

Did you know? Hong Kong has been a leader in digital asset innovation, setting a global precedent with its comprehensive virtual asset trading platform license since 2020.

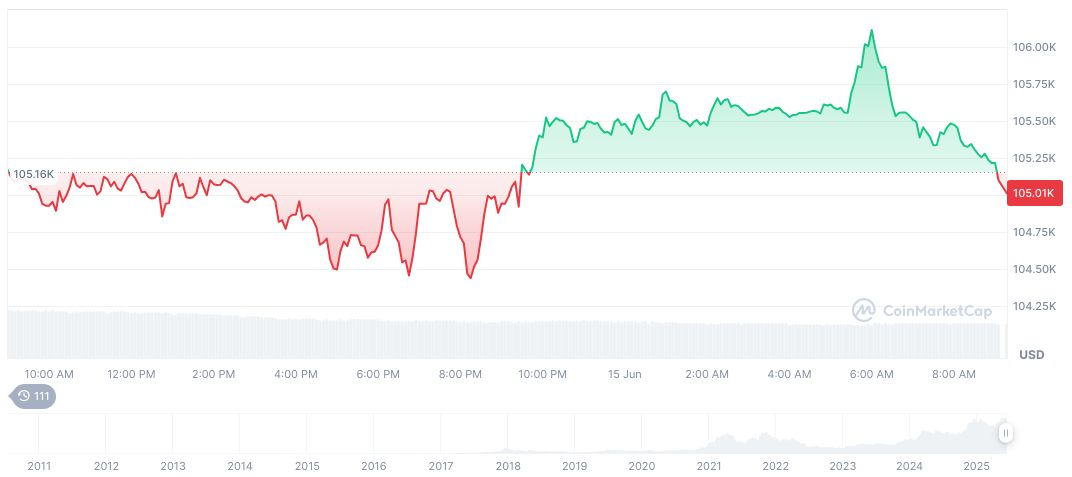

Bitcoin (BTC) remains a significant player in Hong Kong’s cryptocurrency market, with its price at $105,894.24 according to CoinMarketCap. BTC has a market cap of $2.10 trillion, accounting for 63.74% of the market. Its 24-hour trading volume is $38.2 billion, up 10.86% year-on-year, showing strong market interest and trading activity.

Bitcoin (BTC), daily chart, CoinMarketCap screenshot, 02:14 UTC, June 16, 2025. Source: CoinMarketCap