JPMorgan Chase analyzes the performance of leading cryptocurrencies in April

- Bitcoin outperformed gold over the past year

- Bitcoin’s outlook continues to improve

This is a sharp turnaround from the decline of Bitcoin when it was hovering around $80,000 a few months ago. JPMorgan Chase found that Bitcoin prices continued to strengthen in April, and the rise in May was even more rapid.

The market had suffered a heavy blow in the previous few weeks - US President Trump's announcement of a comprehensive increase in tariffs triggered panic about a global trade war, causing widespread pressure on international markets.

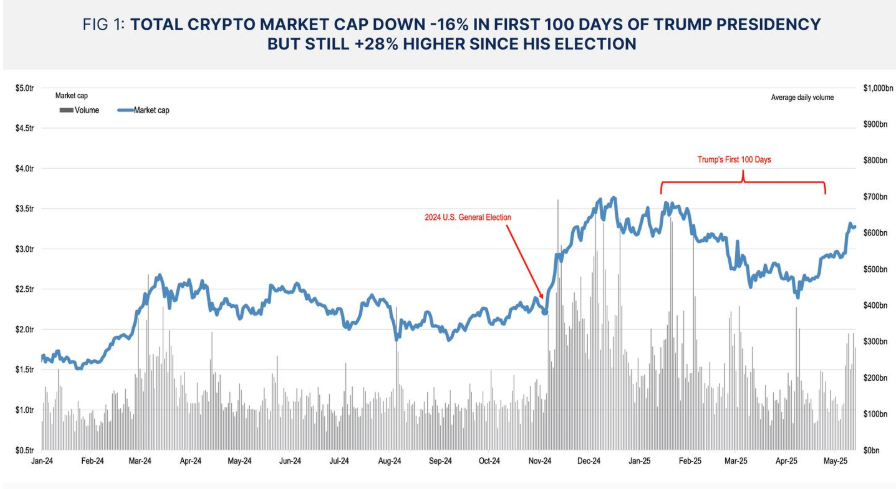

JPMorgan Chase pointed out in a report on May 14 that although Trump advocated pro-cryptocurrency policies, he failed to boost cryptocurrency prices or achieve regulatory reforms during his first 100 days in office.

But pessimism has faded as Trump has backed down on trade and as more signs of global cryptocurrency adoption emerge at the corporate and national levels.

"Bitcoin's bull case fundamentals have never been stronger," David Marcus, a former PayPal executive and well-known Bitcoin supporter, tweeted on May 10. "Fasten your seat belts."

The top cryptocurrency has gained 10% since May and is now trading at $103,500.

JPMorgan Chase outlines its recovery trajectory in six charts.

Bitcoin’s revaluation

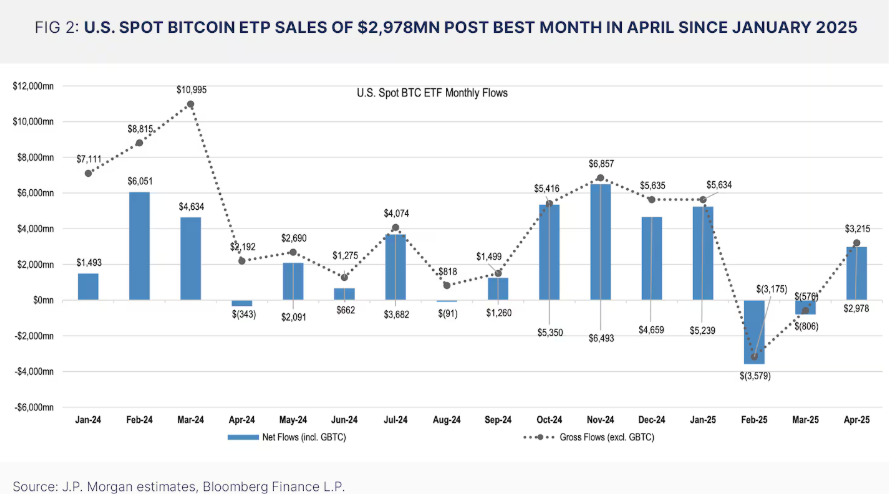

The sharp sell-off at the beginning of the year has now reversed, with inflows into exchange-traded products including Bitcoin ETFs issued by BlackRock and Fidelity turning positive, posting their best monthly performance since January.

Total Crypto Market Capitalization Jumps to $2.9tr (+10% MoM) at End of April, but Volumes Remain Muted this Month. Source: JPMorgan.

JPMorgan Chase pointed out that BlackRock's IBIT was undoubtedly the biggest winner in April. The fund accounted for 84% of the total inflows of Bitcoin ETFs, with an overall amount of US$3 billion in April.

US Spot Bitcoin ETP Sales of $2,978mn Post Best Month in April Since January 2025. Source: JPMorgan

Dune Analytics data shows that the Bitcoin ETF market is currently dominated by BlackRock IBIT, with a market share of 52%.

According to DefiLlama statistics, the Bitcoin ETF has attracted a total of US$96 billion in funds since its launch in 2024. In comparison, the Ethereum ETF has only US$5 billion in assets under management.

Bitcoin value "regains lost ground"

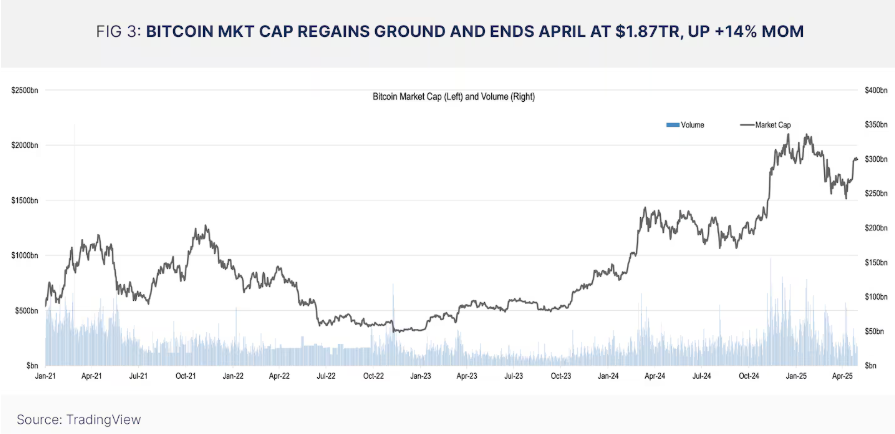

The market in April was dominated by the turmoil of Trump's tariffs, and the market was once volatile until the recent suspension of tariffs and the reaching of an agreement pushed prices back up.

The tech-heavy Nasdaq, to which bitcoin has historically correlated, spent much of April about 15% below its level on Trump’s inauguration day in January.

As Bitcoin now breaks through the $100,000 mark, the Nasdaq has also recovered in sync. JPMorgan Chase pointed out that Bitcoin's gains for the month "mostly concentrated in the last week."

Bitcoin Mkt Cap Regains Ground and Ends April at $1.87tr, Up +14% MoM. Source: JPMorgan.

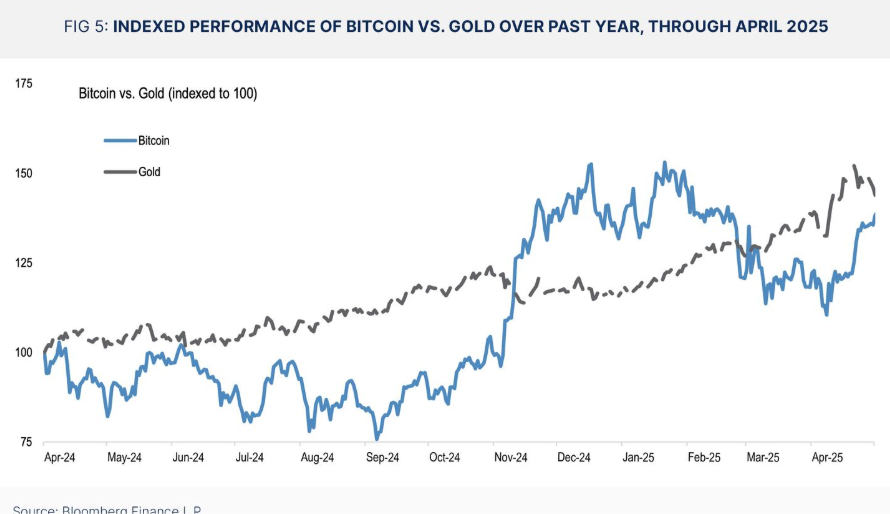

The battle with gold

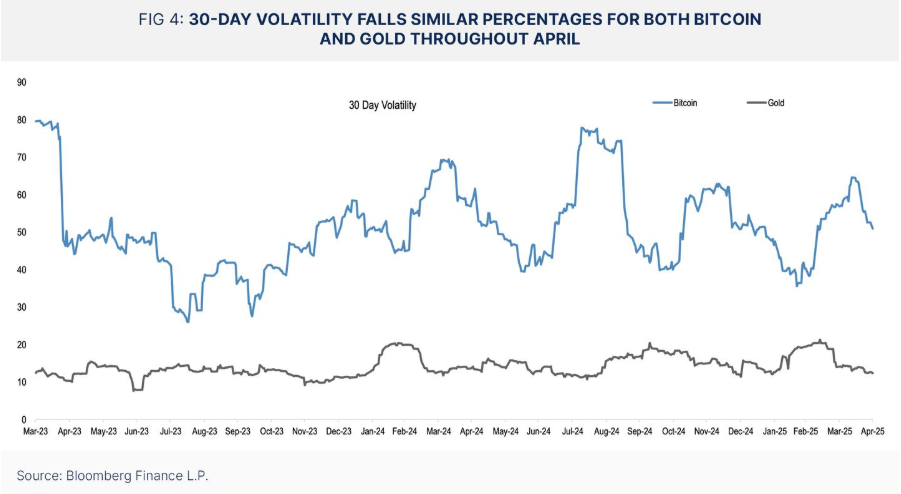

BlackRock CEO Larry Fink has touted Bitcoin's potential as a safe-haven asset similar to gold.

But JPMorgan research found that potential has not yet been realized.

At the same time, Bitcoin volatility continues to decline. According to CoinGlass data, JPMorgan Chase pointed out that the 30-day volatility of Bitcoin and gold has shown a synchronous downward trend.

30-Day Volatility Falls Similar Percentages for both Bitcoin and Gold Throughout April. Source: JPMorgan.

In a normalized comparison (one that sets the value of two or more assets equal at the beginning of a particular period to compare performance, as shown in the chart below), Bitcoin was up 15% as of the end of March, while gold was up 5%.

Indexed Performance of Bitcoin vs. Gold Over Past Year, Through April 2025. Source: JPMorgan.

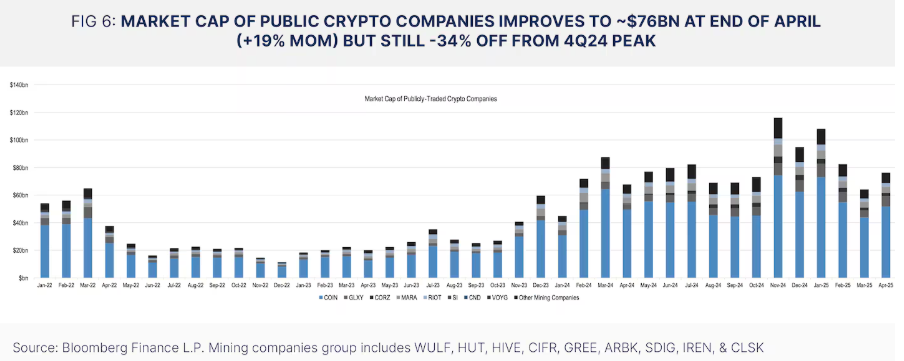

Cryptocurrency stocks surge

The total market capitalization of listed crypto companies has shrunk 34% to $76 billion at the end of April from an all-time high of nearly $120 billion after the November 2024 election.

April brought a ray of hope, with total market capitalization increasing by 19% month-on-month.

JPMorgan Chase pointed out that Galaxy Digital, which announced plans to go public in the United States in April, became the biggest winner in market value growth that month, with an increase of 45%.

This week, there was news that Coinbase will be included in the S&P 500 index from May 19. The news pushed its stock price up 16%, and according to JPMorgan Chase data, the company's total market value increased by 18% month-on-month.

Market Cap of Public Crypto Companies Improves to ~$76bn at End of April (+19% MoM) but Still -34% Off from 4Q24 Peak. Source: JPMorgan.