Original article: Hassan Shittu , cryptonews

Compiled by: Yuliya, PANews

Hungary has suddenly turned to criminal crackdown on unauthorized crypto activities, becoming one of the most aggressive countries in the European Union, turning everyday crypto trading into a potential legal minefield. Under the latest legal provisions, crypto trading on unlicensed trading platforms can face up to 8 years in prison. The new regulations have forced several large fintech companies to suspend services, affecting millions of users.

The new rules, which came into effect on July 1, have sent shockwaves through the financial technology industry, with industry insiders warning that they could lead to a massive withdrawal of funds and legal confusion for investors.

Hungary criminalizes unauthorized crypto trading with up to 8 years in prison

According to Hungary’s latest revised Criminal Code , two new crimes have been added: “abuse of crypto assets” and “providing unauthorized crypto asset exchange services”.

Under the new law, anyone who trades cryptocurrencies on an unlicensed platform can be sentenced to up to two years in prison. If the transaction amount exceeds 50 million Hungarian forints (about $140,000), the sentence can be up to three years; if the transaction amount exceeds 500 million forints, the sentence will be extended to five years.

In addition, the law provides for the harshest penalties, up to eight years in prison, for service providers that operate without a government-approved license. The sweeping reform caught businesses and investors off guard.

According to local media Telex, approximately 500,000 Hungarians invest in crypto assets using legally declared income, but under the new regulatory framework, many of these users may face criminal charges for past or ongoing crypto activities.

“Ordinary users are effectively at risk of being sued simply for managing their investments as usual,” a Telex source said.

“This law was implemented without any compliance guidance being issued, and no one knew how to follow it.”

It is worth noting that the Hungarian Financial Supervisory Authority (SZTFH) has 60 days to develop enforcement and compliance mechanisms, but the current legal environment remains unclear.

The new law also requires that all crypto transactions — whether exchanging tokens for fiat or other tokens — must be audited by an authorized “verifier” and produce a certificate of compliance. Transactions without this certificate of compliance will be considered legally invalid, and participating in such transactions may trigger criminal penalties.

Although the law provides for exemptions for transactions below certain thresholds, there are currently no clear criteria for the exemptions.

Revolut suspends crypto business in Hungary as new law makes compliance path unclear

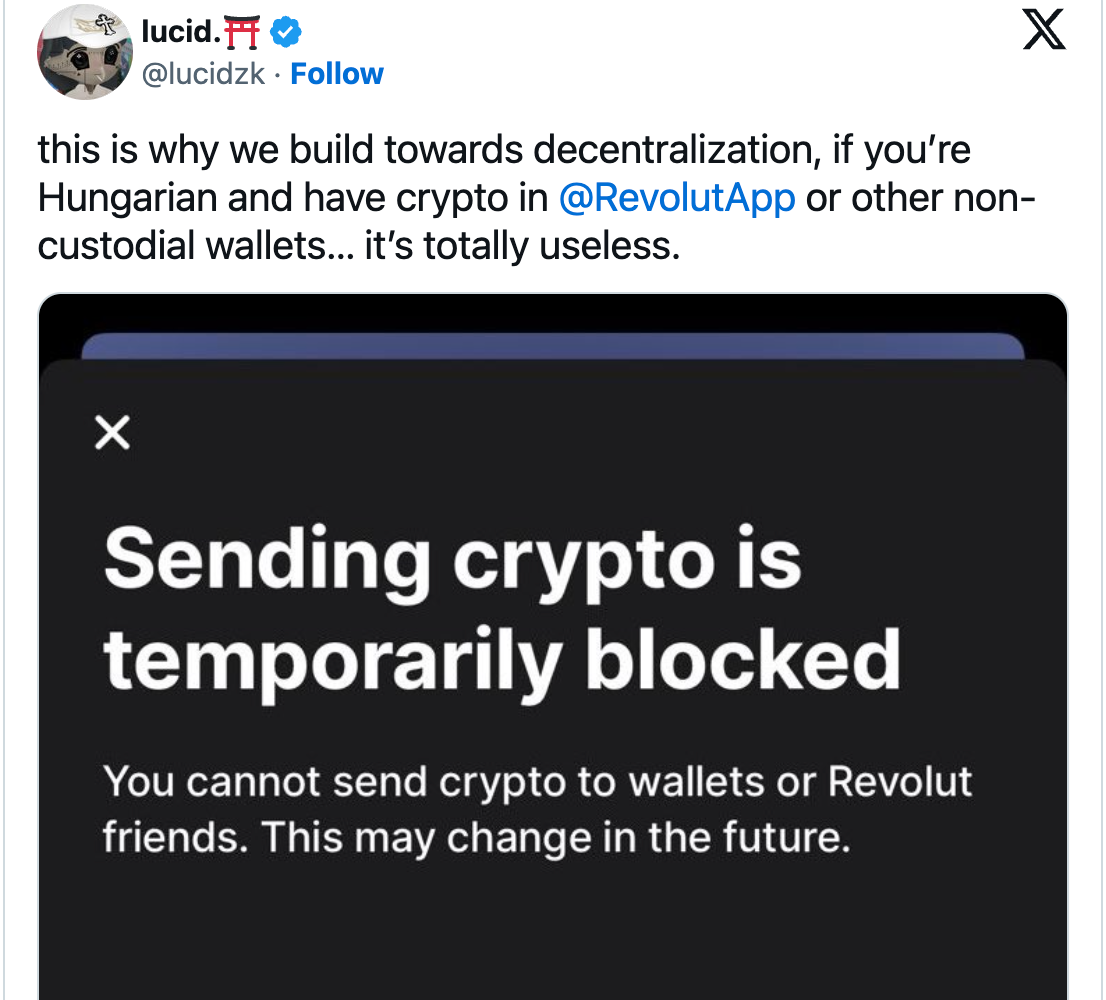

Legal uncertainty has already caused major market players to withdraw from Hungary. On July 9, London-based neobank Revolut announced that it would suspend all cryptocurrency services “until further notice.” Revolut has more than 2 million users in Hungary.

Users can still transfer existing crypto assets to external wallets, but purchase, top-up and pledge services have been completely frozen. Revolut said the suspension of operations was to ensure full compliance with Hungarian domestic law and the EU's new crypto regulatory framework MiCA.

Revolut is currently applying for MiCA authorization through its EU entity, but the additional local license required by the Hungarian central bank makes the process more complicated. As of July 7, Revolut has also completely frozen crypto asset balances and even closed the token sale function.

Revolut stressed that the move was temporary, adding that it was “working hard to resume service as soon as possible once there is greater clarity on the regulatory path”.

Hungary deviates from EU’s unified crypto regulation path

The timing of Hungary’s crackdown on crypto trading is particularly special, as the EU’s MiCA regulatory framework also came into effect on July 1. MiCA aims to establish a unified legal framework for the crypto market across the EU, and several member states have chosen to delay implementation to ensure a smooth transition. However, Hungary has gone against this path of harmonization.

An analyst told Forbes: "It is hard to understand why Hungary has implemented such strict regulations when the EU has just established unified standards. This will create huge legal uncertainty and hit fintech innovation."

Still, the crackdown on crypto trading appears to be part of a broader policy trend in Hungary. The government has also introduced rules limiting foreign ownership of companies and a law that would transfer some of citizens’ donations to the state.

Critics say the policies mainly affect more educated voters in cities, a demographic that generally does not support the ruling Fidesz party.

While enforcement actions against global exchanges such as Coinbase or Binance are considered unlikely, businesses registered in Hungary and local users are now facing legal risks. This leads to a paradox - foreign platforms may continue to provide services to Hungarian customers with little to no consequences, while local companies may be prosecuted.

However, the Hungarian central bank further exacerbated the restrictive atmosphere by announcing on July 3 that it would exclude cryptocurrencies from official reserves, citing the volatility of crypto assets and unclear regulations.

“The stability and reliability of reserve assets must be prioritized,” the central bank said, while reiterating its preference for traditional assets such as gold and fiat currencies.