Written by: 0xResearcher

While the market is still boiling over the hype of meme coins and ETFs, some traditional financial players with a longer-term vision have quietly turned to another direction: infrastructure with stronger performance, higher compliance, and smoother cross-chain. What they want is not "short-term stimulus", but the underlying system that can really run the next generation of finance. And Sei is becoming a popular choice in their eyes.

A closer look reveals that its most prominent feature is that it retains the technical advantages of crypto-native technology while actively embracing the regulatory framework. It does not pursue short-term popularity, but instead focuses on solving the two most difficult problems of blockchain implementation - performance bottlenecks and compliance thresholds. This "slow is fast" development philosophy may be the most needed quality for the industry to move from speculation to practical use.

Performance innovation: from "seconds" to "milliseconds"

While most blockchains are still dealing with the problem of "hundreds of transactions per second", Sei has taken speed to another dimension: more than 12,500 transactions per second (TPS) can be processed, and the final confirmation time is only 400 milliseconds. In comparison, the confirmation time of the Ethereum mainnet is 470 times that of Solana, which is known as "lightning fast", is 22% slower.

Moreover, Sei is fully compatible with the development tools of the Ethereum ecosystem, such as Hardhat and Foundry, so developers can get started "painlessly", greatly reducing migration and development costs.

Compliance design, born for institutions

When institutions begin to truly participate in blockchain, the focus of the issue shifts from "whether it can be used" to "whether it is trustworthy". In this regard, Sei significantly reduces the risk of being captured by MEV in large transactions by introducing a "deterministic gas fee" model, and also improves the predictability of overall transaction costs. Coupled with high-performance RPC nodes with nanosecond response and audited memory pool architecture, these have greatly enhanced the friendliness of the on-chain system to institutional users.

At the same time, its compliance capabilities are not just verbal promises. For example, a new entity in the ecosystem recently established a compliance operation structure in the United States and launched a $65 million fund to support the DeSci (decentralized scientific research) project, which in itself conveys its long-term investment and attention to compliance.

ETF endorsement: a key signal of market confidence

In addition to a solid foundation in technology and compliance, Sei has also achieved key breakthroughs in asset financialization. Recently, Canary submitted the first ETF based on Sei pledged assets in the United States, which is not only an important milestone for Sei, but also a recognition of the quality of its underlying assets by the entire industry.

It should be emphasized that not all blockchain projects have the conditions to launch a pledged asset ETF. Therefore, Sei’s inclusion in the ETF product itself represents a strong market endorsement. Against the backdrop of the current market sentiment gradually warming up, such progress is very likely to become a key variable in boosting the confidence of the community and institutions.

Cross-chain liquidity aggregation: breaking down barriers between chains

To solve the problem of liquidity fragmentation, Sei cooperates with cross-chain protocols such as Wormhole and Axelar to achieve seamless connection with mainstream blockchains such as Ethereum and Cosmos. Users can interact freely between protocols on different chains without complicated bridging operations.

In addition, Seu has worked with Circle to develop a compliant cross-chain USDC channel to ensure the safe circulation of stablecoins between different chains. To incentivize liquidity providers, a $50 million Liquidity Guidance Fund (LBF) was established to support cross-chain transactions and asset management.

Rapid expansion of the ecosystem: from DeFi to gaming

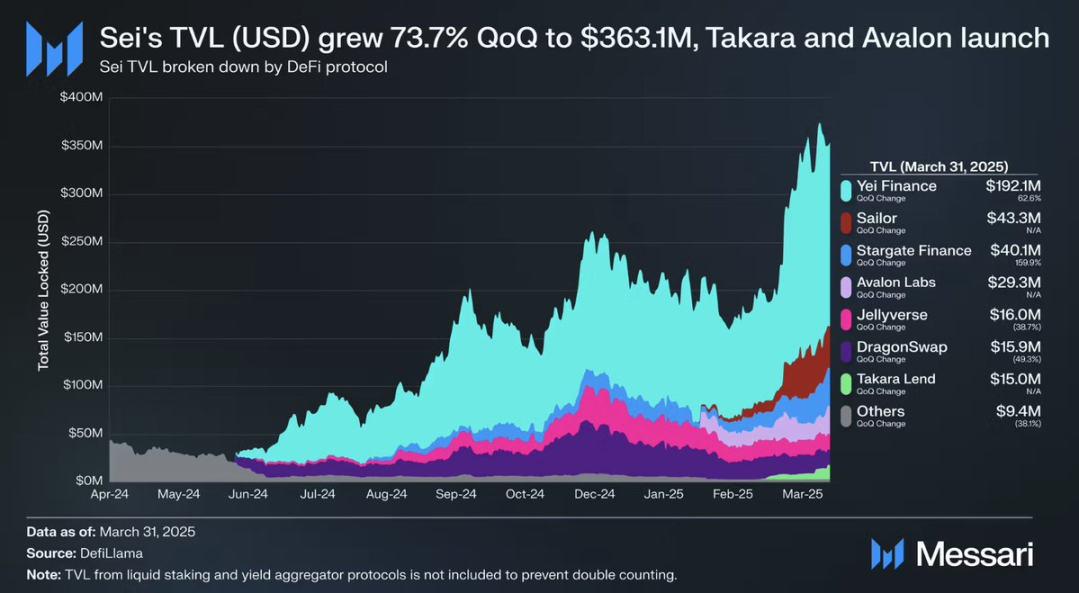

Since mid-2024, Sei's ecosystem has grown rapidly, attracting more than 150 projects to deploy on the mainnet, with 400,000 daily active addresses and more than 6.5 million total users. In the first quarter of 2025, the total locked value (TVL) increased by 73.7% to $363 million, and the stablecoin market capitalization hit an all-time high of $178 million.

It is particularly worth mentioning that the gaming sector has become the main driver of growth. The average daily game-related transaction volume reached 354,000, a year-on-year increase of 79.8%. For example, World of Dypians, a multiplayer online role-playing game similar to World of Warcraft, has achieved significant user growth on these platforms.

In addition, a $10 million Creator Fund and a $250,000 Street Team program were launched to support the development of NFT and social projects and encourage global creators to participate in the construction of the ecosystem.

The starting point of a new phase: Giga upgrade and future blueprint

Although the current data is already amazing, Sei's ambitions are clearly not limited to this. The Giga upgrade, which is scheduled to be launched in 2025, will introduce a new EVM client, and the performance improvement is expected to reach 50 times the current level. This not only means a qualitative change in processing power, but also symbolizes another leap towards the goal of "universal infrastructure."

From infrastructure to ecological prosperity, to institutional design and technological evolution, Sei has completed the path that traditional projects take five years to explore in less than two years. It is not the loudest voice in the market, but it may be the most determined force in building the next blockchain era.

Towards a decentralized future

Sei's technological upgrade is not only a leap in performance, but also an important step in its global strategic layout. By establishing a legal and compliant operating entity in the United States, it provides a solid foundation for global expansion. With the continuous growth of the ecosystem and the continuous improvement of technical performance, it is leading blockchain technology towards a truly decentralized future.

In this process, Sei not only provides developers with a powerful technical platform, but also brings a more efficient and secure blockchain application experience to global users. With the continuous advancement of technology, it is expected to become a bridge connecting Web2 and Web3, leading the development of the next generation of the Internet.