Author: Frank, PANews

Recently, the crypto market has ushered in a rare period of general rise. Since June 22, Bitcoin has fallen back to below $100,000, which once caused panic in the market. But then, the market ushered in a new round of sharp rise after the correction. From a sensory point of view, this round of general rise is no longer limited to a few mainstream tokens such as BTC, SOL, and ETH. Many tokens that have not recovered for a long time have also performed well in this round of rise.

From the perspective of data, is the entire market really ushering in the altcoin season or is it just another illusion? PANews conducted an overall analysis of the data of 403 spot trading pairs on Binance, hoping to find the real pulse of the market.

Data description: This study is based on the USDT spot trading pair of Binance Exchange, combined with the basic information such as token classification and market value provided by Coingecko, and includes a total of 403 valid tokens for analysis. The time range is from June 22 to July 15, 2025. The increase or decrease is calculated based on the starting price (opening price on June 22) and the ending price (closing price on July 15) of this time period.

Nearly 95% of tokens saw an increase, with an average increase of 30%

Overall, the general rise is well deserved. Among the 403 tokens counted, 382 tokens were in an upward state during this period, accounting for about 94.8%. The average increase of all tokens was 30.38%, and the median increase or decrease was 25.92%. Compared with the rebound in April, it can be clearly seen that the recent rebound momentum is stronger.

Among the rising tokens, 7 tokens have increased by more than 100%, with the highest increase reaching 335%. There are 34 tokens with an increase between 50% and 100%, accounting for about 8.4%. And more tokens have increased by less than 50%, accounting for about 84.6%. From this point of view, this round of rising market is a relatively rare general rise, and it seems to have some "copycat season" feeling. It is worth mentioning that during this period, BTC's increase was 15.31%, and 307 tokens increased by more than this value. In other words, the vast majority of tokens finally outperformed BTC in the recent rebound.

Of course, there are also 20 tokens that performed poorly and developed independent downward trends amid the general rally.

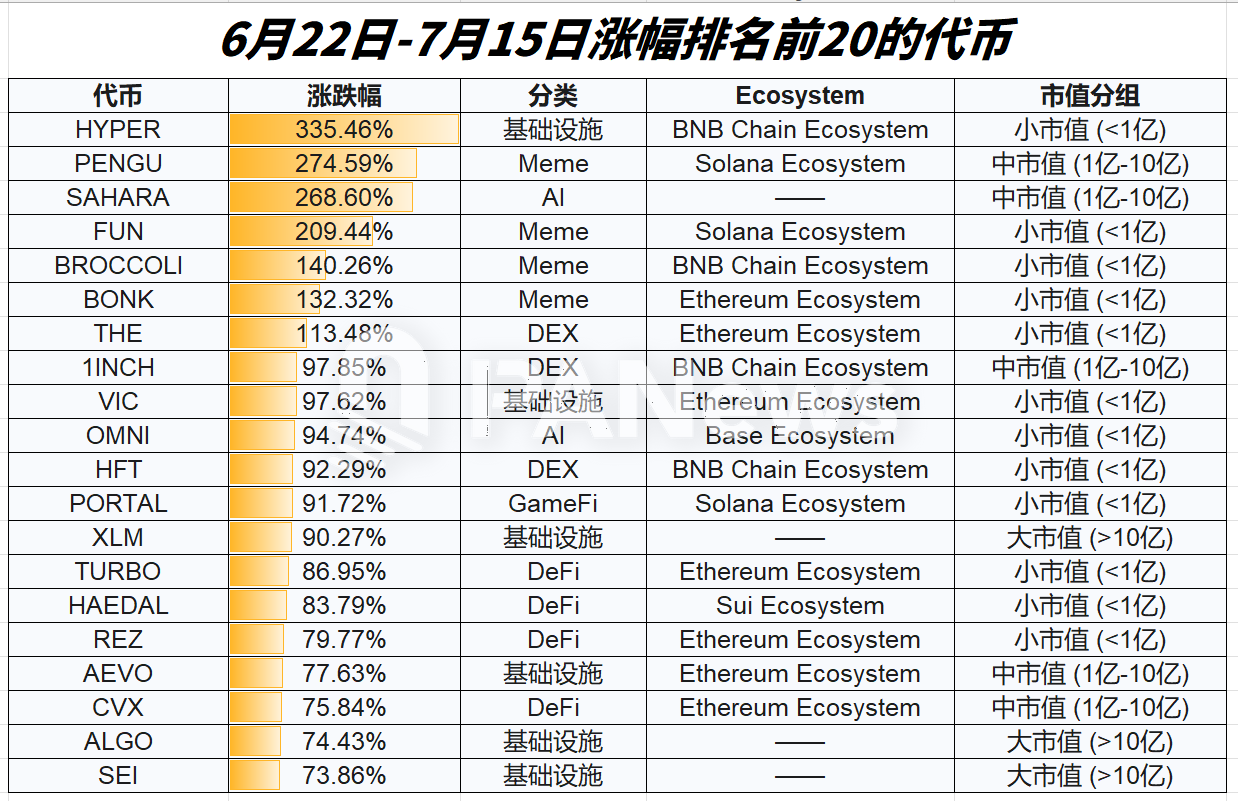

Among the top 20 tokens with the highest growth rates, there are several characteristics.

Market capitalization range: mainly concentrated in the small market capitalization (<100 million) or medium market capitalization (100 million-1 billion) categories. There are only 3 tokens with a market capitalization of more than 1 billion US dollars.

In terms of categories: the top rankings are more related to MEME, AI, and DeFi. In addition, 4 infrastructure tokens have entered the top 20.

Ecosystem classification: The ecosystems with the largest growth are mainly concentrated in the three public chains of Ethereum, BSC, and Solana.

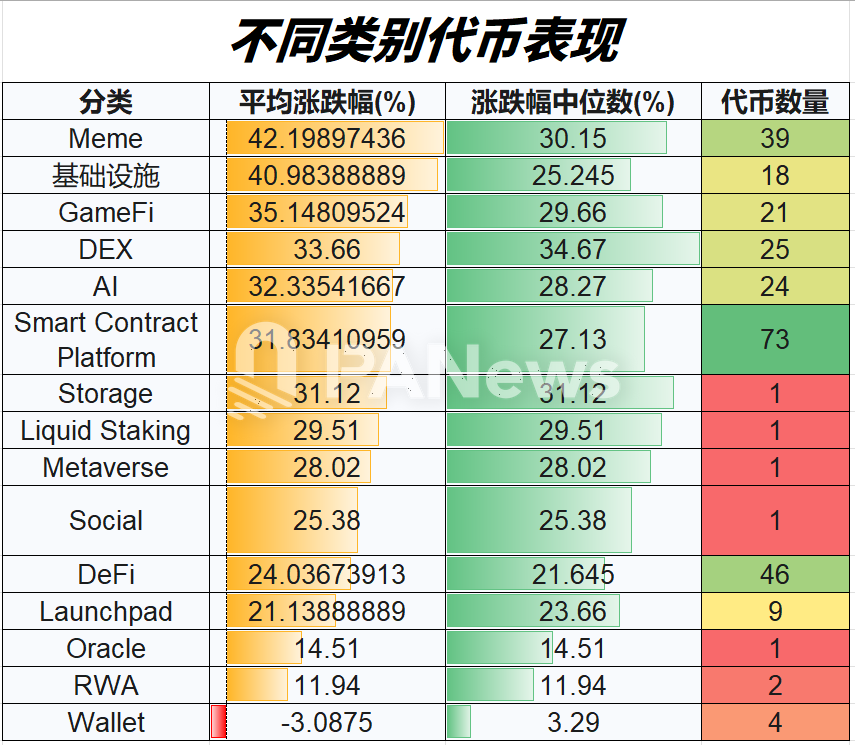

MEME leads the way, GameFi unexpectedly rises

From the perspective of overall track performance, MEME is indeed the best performing track. The average increase reached 42.2%, followed by the infrastructure category, with an average increase of 40.98%. Surprisingly, GameFi-related tokens also performed well in this round of gains, with an average increase of 35.15%. Next are DEX, AI, and smart contract platforms. The RWA-classified tokens, which have always attracted much attention, have a relatively flat increase of only 11.94%, while the average increase of the four selected tokens related to wallets is -3.09%.

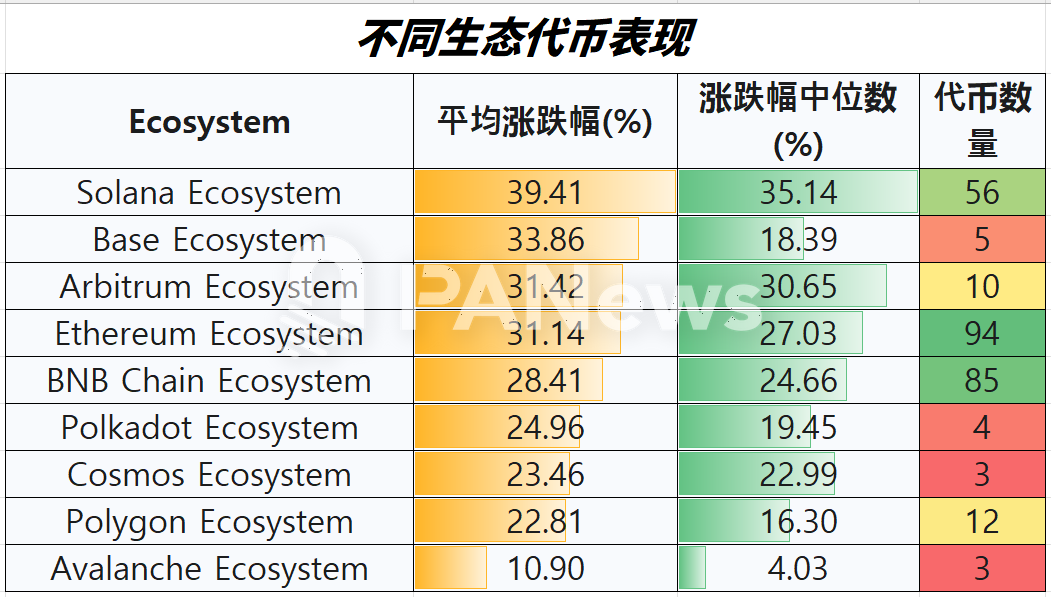

Solana, Base, Arbitrum, Ethereum and other ecosystems performed best

In terms of ecology, Solana ecology leads all public chains with a 39.41% increase. Base ecology tokens also ranked second with a 33.86% increase. Next are Arbitrum (31.42%), Ethereum (31.14%), and BSC (28.41%). Avalanche ecology-related tokens still performed generally, with an average increase of only 10.86%.

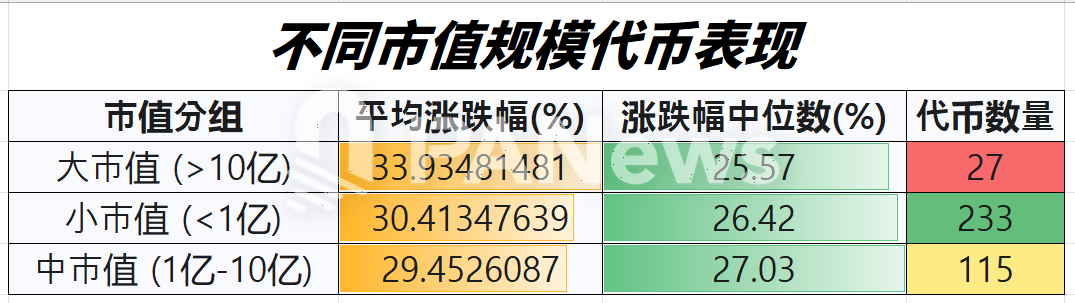

Under the general rising market, the correlation with market value is low

In terms of market capitalization classification, the difference between large and small market capitalizations is not obvious. The average increase of large market capitalization tokens with a market capitalization of more than 1 billion US dollars is 33.93%, the average increase of small market capitalization tokens (< 100 million US dollars) is 30.41%, and the average increase of tokens between 100 million and 1 billion US dollars is 29.45%. However, from the perspective of sample quantity, the number of tokens with small and medium market capitalizations is still the absolute main force, with a total of 348 tokens in this range, and from the current analysis results, this rise has indeed achieved a general rise, which has little to do with the size of the market capitalization.

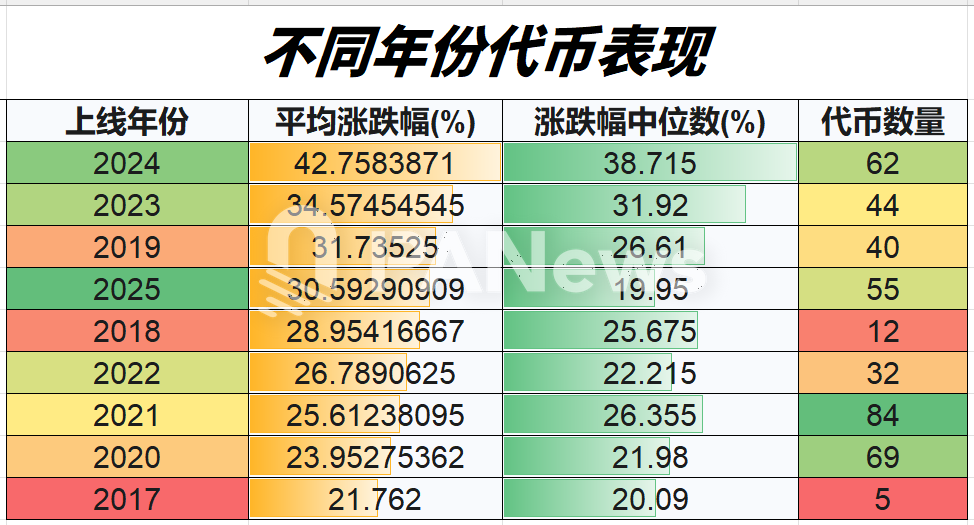

The best performing coins of 2024, and the forgotten coins of 2017?

Judging from the time when the tokens were launched, the tokens launched in 2024 performed best in this round of increases, with an average increase of 42.76%. The second was in 2023, with an average increase of 34.57%. In addition, the tokens launched in 2019, 2025, and 2018 also rose relatively high. On the contrary, the tokens launched in 2017 and 2021-2022 rose slightly less in this round of increases. Combined with the previous analysis of the increase in April, the tokens launched in 2017 also performed at the bottom, which may explain some problems. Those early projects are gradually losing market attention.

Alt season still a ways off, only 7 tokens surpass 2024 highs

Is the altcoin season really here? First of all, the overall performance of altcoins in 2024 is not a typical surge, but it has a certain increase driven by the rise of mainstream tokens such as Bitcoin. Observe the market from June 22 to July 15. PANews found that during this period, only 7 tokens created a price high higher than the highest price in 2024. The remaining 341 (there is no data for tokens launched in 2025) all failed to exceed the previous high. Another heartbreaking reality is that there are still 38 tokens whose highest points in this round of rise are 90% away from the highest point in 2024, which means that these tokens need to rise 10 times again to return to the previous high. There are 146 tokens that differ from the 2024 high by more than 80%, and 302 tokens that differ from the 2024 high by more than 50%. This means that the vast majority of tokens must at least double again to return to the price level in 2024 and create a new high.

From this perspective, it seems that the potential of the copycat season is huge, but I don’t know whether this round of rise is just a flash in the pan or the first sound of the horn?